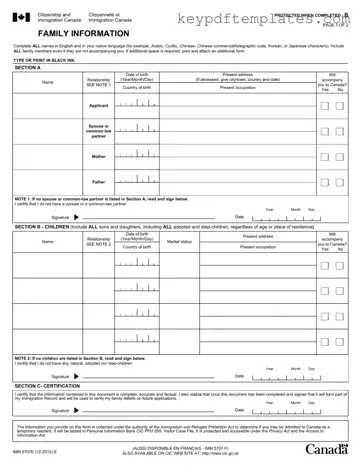

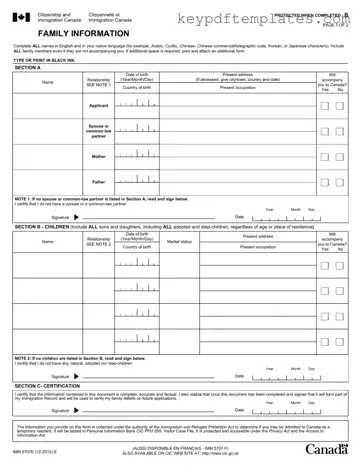

The IMM 5707 form, also known as the Family Information form, is a crucial document required for individuals applying for a Temporary Resident Visa to Canada. This form collects essential details about the applicant's family members, ensuring that all relevant...

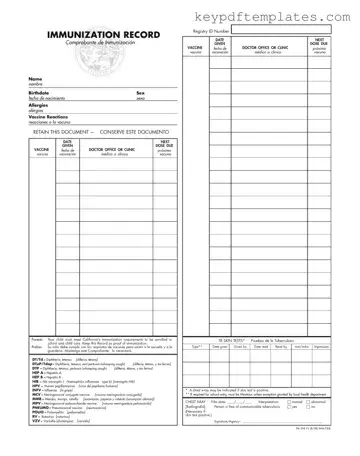

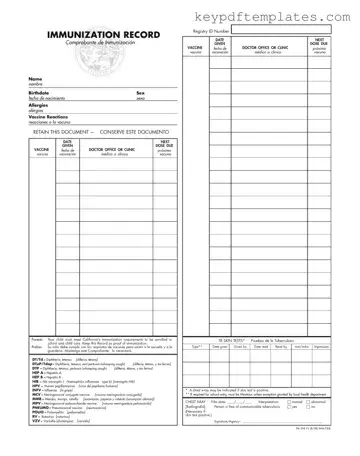

The Immunization Record form is an essential document that tracks an individual's vaccination history, ensuring that they meet the necessary health requirements for school and childcare enrollment. This form not only includes personal details such as name and birthdate but...

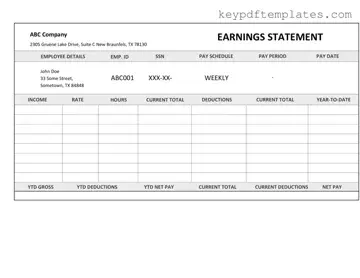

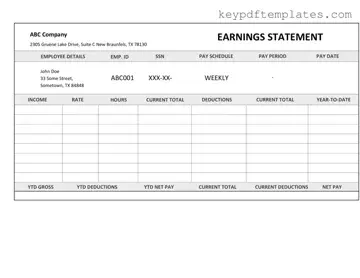

The Independent Contractor Pay Stub form is a document that outlines the payment details provided to independent contractors for their services. This form serves as a record of earnings, deductions, and any applicable taxes, ensuring transparency in the payment process....

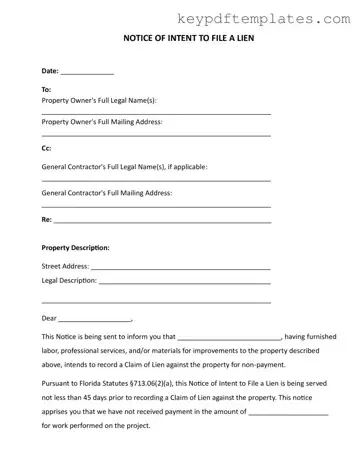

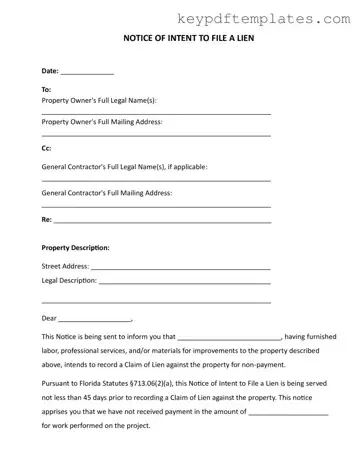

The Intent To Lien Florida form is a legal document that notifies property owners of an impending claim against their property due to non-payment for services rendered. This notice serves as a warning, allowing property owners to address outstanding payments...

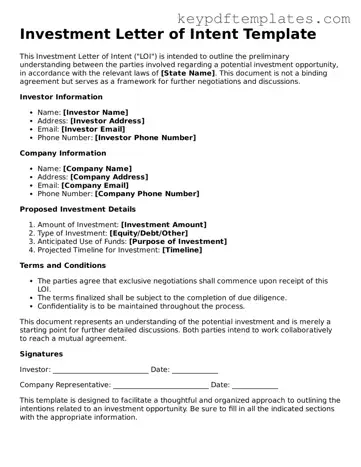

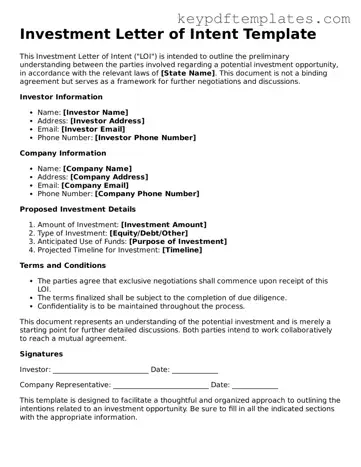

An Investment Letter of Intent form is a document that outlines the preliminary terms and conditions of a potential investment. This form serves as a starting point for negotiations between investors and companies seeking funding. By clarifying intentions, it helps...

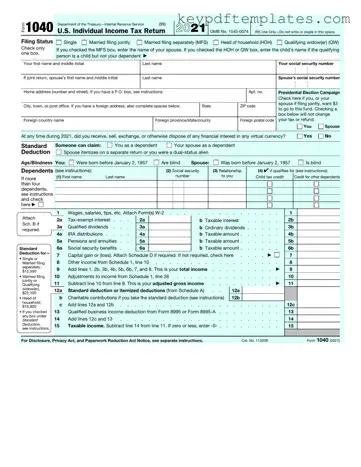

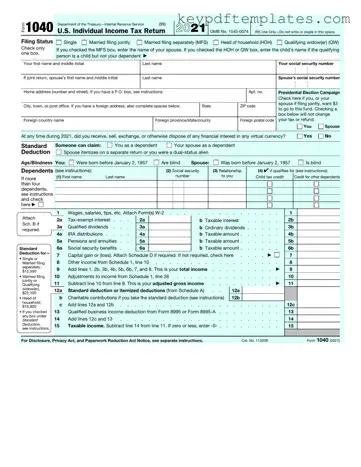

The IRS 1040 form is the standard federal income tax form used by individuals to report their income and calculate their tax liability. This form allows taxpayers to detail their income sources, claim deductions, and determine any credits for which...

The IRS 1095-A form is a document that provides important information about health insurance coverage obtained through the Health Insurance Marketplace. This form is essential for taxpayers who need to report their health insurance status when filing their federal income...

The IRS 1099-MISC form is a tax document used to report various types of income received by individuals and businesses that are not classified as wages. This form serves as a crucial tool for ensuring that all income is accurately...

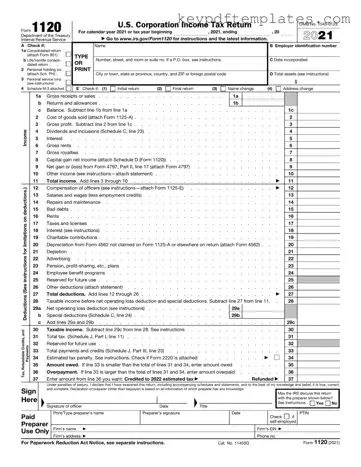

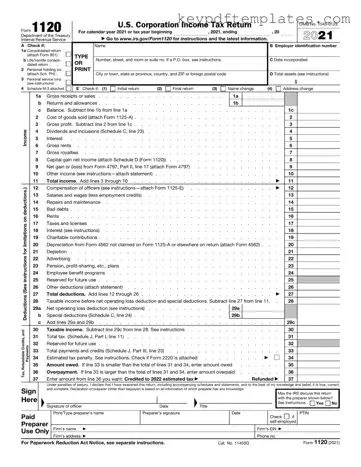

The IRS 1120 form is a tax return used by corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service. This form is essential for C corporations, as it helps determine their tax liability. Understanding...

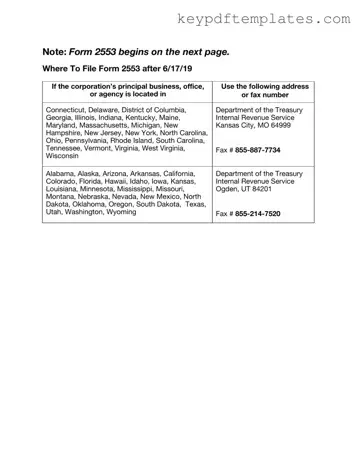

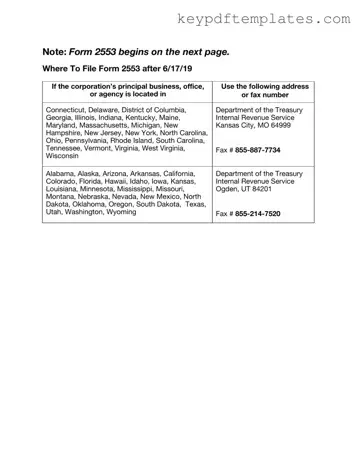

The IRS Form 2553 is a document used by small businesses to elect S corporation status for tax purposes. By filing this form, eligible entities can enjoy the benefits of pass-through taxation, which can lead to potential tax savings. Understanding...

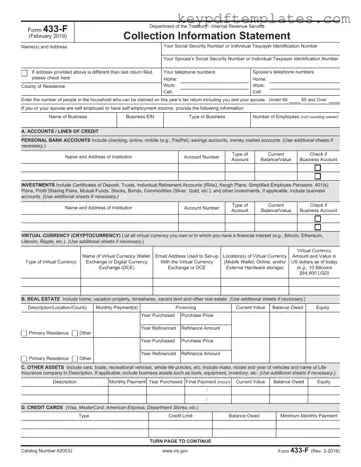

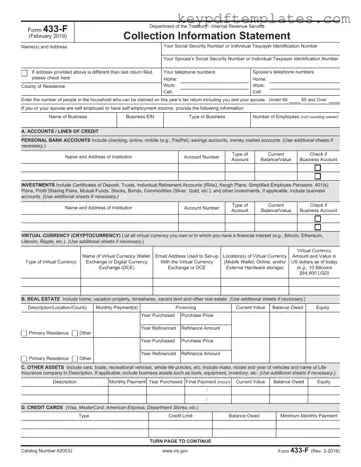

The IRS 433-F form is a financial statement used by individuals to provide the Internal Revenue Service with a detailed overview of their financial situation. This form is essential for those seeking to negotiate a payment plan or settle tax...

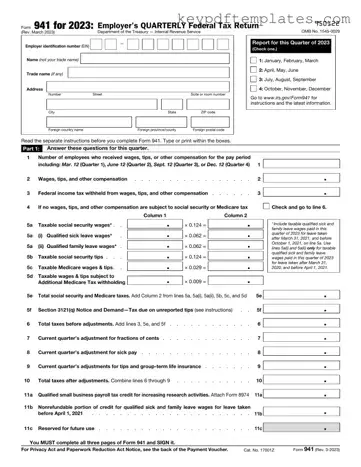

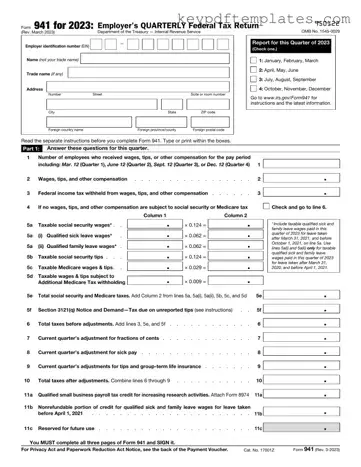

The IRS Form 941 is a quarterly tax form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Understanding this form is crucial for businesses to ensure compliance with federal tax laws....