Get 14653 Form

Key takeaways

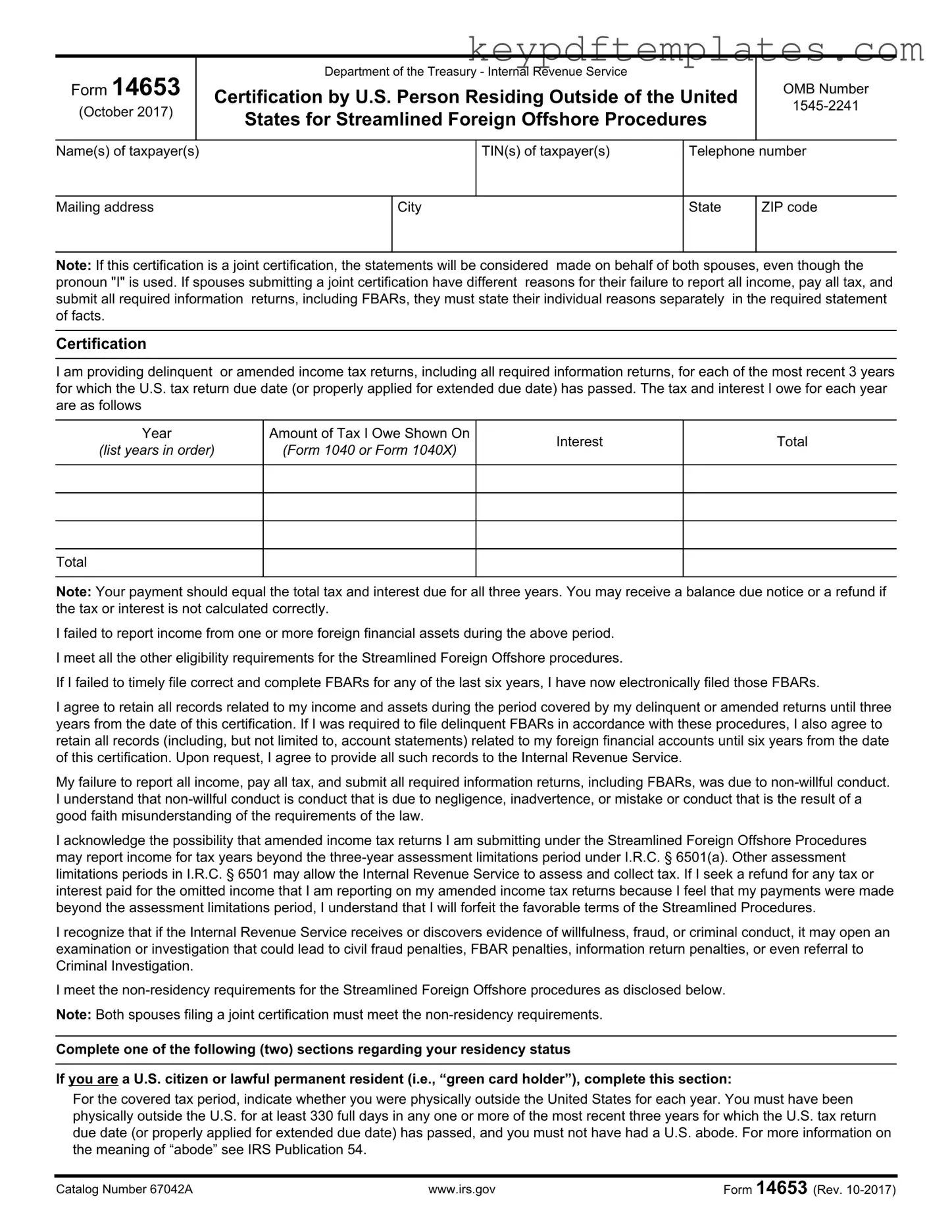

Filling out Form 14653 is an important step for U.S. persons residing outside the United States who wish to participate in the Streamlined Foreign Offshore Procedures. Here are key takeaways to consider:

- Eligibility Requirements: Ensure you meet all eligibility criteria for the Streamlined Foreign Offshore Procedures before submitting the form.

- Joint Certification: If filing jointly, both spouses must meet the non-residency requirements. Individual reasons for failure to report must be stated separately.

- Amended Returns: You must provide delinquent or amended income tax returns for the most recent three years for which the due date has passed.

- Payment Accuracy: Calculate the total tax and interest owed accurately. Incorrect calculations can lead to balance due notices or refunds.

- Non-Willful Conduct: Clearly state that your failure to report income was due to non-willful conduct, which includes negligence or misunderstanding of the law.

- Record Retention: Retain all records related to your income and assets for three years from the date of certification, or six years for FBAR-related records.

- Residency Status: Confirm that you were physically outside the U.S. for at least 330 full days in one or more of the last three years.

- Narrative Statement: Provide a detailed narrative explaining your failure to report income, including personal and financial background.

- Professional Advice: If you relied on a professional advisor, include their contact information and a summary of the advice received.

- Penalties for False Information: Understand that providing false information can lead to penalties, and ensure that all statements are true and complete.

Completing this form correctly is crucial for your compliance with U.S. tax laws. Take your time to ensure all information is accurate and complete.

Similar forms

Form 14653 is specifically designed for U.S. persons residing outside the United States who are looking to participate in the Streamlined Foreign Offshore Procedures. There are several other forms that share similarities with Form 14653 in terms of purpose and content. Here are five such forms:

- Form 1040: This is the standard individual income tax return form used by U.S. taxpayers. Like Form 14653, it requires taxpayers to report their income, deductions, and credits. Both forms aim to ensure compliance with U.S. tax laws, although Form 1040 is for general tax reporting while Form 14653 is for specific streamlined procedures.

- Form 1040X: This form is used to amend a previously filed Form 1040. Similar to Form 14653, it allows taxpayers to correct errors or omissions in their tax returns. Both forms require detailed information about the taxpayer’s financial situation and reasons for any discrepancies.

- FBAR (FinCEN Form 114): The Foreign Bank Account Report is required for U.S. citizens and residents with foreign financial accounts exceeding certain thresholds. Both Form 14653 and the FBAR focus on reporting foreign financial assets, emphasizing the importance of compliance for U.S. persons living abroad.

- Hold Harmless Agreement: For activities involving potential liabilities, refer to the essential Hold Harmless Agreement form to protect yourself from unforeseen claims.

- Form 8938: This form is used to report specified foreign financial assets. Like Form 14653, it targets U.S. taxpayers with foreign financial interests, ensuring that they disclose all necessary information to the IRS. Both forms play a critical role in preventing tax evasion and ensuring transparency.

- Form 8854: This form is used by expatriates to report their status and any tax obligations upon relinquishing U.S. citizenship. Similar to Form 14653, it requires detailed financial disclosures and is aimed at ensuring compliance with U.S. tax laws, particularly for those who may have previously lived abroad.

Misconceptions

-

Misconception 1: The 14653 form is only for individuals who have willfully evaded taxes.

This form is designed specifically for U.S. persons residing outside the United States who have not reported all income or submitted required information returns due to non-willful conduct. Many believe that only those who intentionally hide income can use this form, but that is not the case. Non-willful conduct can include negligence or misunderstanding of tax obligations.

-

Misconception 2: Submitting the 14653 form guarantees immunity from penalties.

While the form provides a pathway for penalty relief under the Streamlined Foreign Offshore Procedures, it does not guarantee immunity. If the IRS discovers evidence of willfulness or fraud, it may still pursue penalties. The form's intention is to encourage compliance, not to shield individuals from scrutiny.

-

Misconception 3: All foreign financial accounts must be reported on the 14653 form.

Individuals must report income from foreign financial accounts, but not every account needs to be detailed on the form itself. Instead, the form requires a narrative statement explaining the failure to report income and the source of funds in foreign accounts. This allows for a more comprehensive understanding of the taxpayer's situation.

-

Misconception 4: The 14653 form is a one-time submission with no further obligations.

Upon submitting the 14653 form, individuals must retain all records related to their income and assets for specified periods. This includes records for the three years covered by their amended returns and six years for FBARs. The IRS may request these records, and failure to provide them can lead to complications in the future.

More PDF Templates

Lyft Inspection Form 2023 - Inspect the suspension for any signs of wear or damage.

Understanding the necessary paperwork is vital for anyone undergoing a divorce in Georgia, and the Georgia Divorce form plays a central role in this process. For comprehensive guidance on this important document, you can visit Georgia PDF, which offers insights into residency requirements, custody arrangements, and more to ensure you complete the form accurately and efficiently.

Why Would a Court Case Be Continued - A way to ask the court for more time to prepare.

Form Specs

| Fact Name | Fact Description |

|---|---|

| Form Title | Certification by U.S. Person Residing Outside of the United States for Streamlined Foreign Offshore Procedures |

| Governing Law | Internal Revenue Code Sections 6501 and 7701 |

| Eligibility Criteria | Taxpayers must meet specific requirements, including non-willful conduct and residency status. |

| Submission Requirement | Taxpayers must provide delinquent or amended returns for the last three years. |

| FBAR Filing | Taxpayers must electronically file any delinquent FBARs for the last six years. |

| Record Retention | Records related to income and assets must be retained for three years from the date of certification. |

| Joint Certification | If filing jointly, both spouses must meet the non-residency requirement and provide separate reasons if applicable. |

| Penalty Relief | Submissions lacking a narrative statement of facts will be considered incomplete and ineligible for penalty relief. |

Documents used along the form

The Form 14653 is a crucial document for U.S. persons residing outside the United States who wish to participate in the Streamlined Foreign Offshore Procedures. Alongside this form, several other documents are commonly required to ensure compliance with IRS regulations. Below is a list of these documents, each accompanied by a brief description.

- Form 1040: This is the U.S. Individual Income Tax Return form that taxpayers must file annually. It reports income, deductions, and credits, determining the taxpayer's overall tax liability.

- Form 1040X: This is an amended U.S. Individual Income Tax Return form. It is used to correct errors on a previously filed Form 1040, such as changes in filing status, income, or deductions.

- FBAR (FinCEN Form 114): The Foreign Bank Account Report is required for U.S. persons with financial interests in or signature authority over foreign financial accounts exceeding $10,000 at any time during the calendar year.

- Form 8938: This form is used to report specified foreign financial assets. It is part of the IRS requirements for certain taxpayers who hold foreign assets above a specified threshold.

- Statement of Facts: This narrative statement explains the reasons for failing to report all income and submit required returns. It should include personal and financial background relevant to the non-compliance.

- Texas Resale Certificate 01 339: This certificate is essential for businesses in Texas buying goods for resale, allowing tax-free purchases. Ensure you understand how to properly fill out the form to comply with Texas tax laws. More information can be found at https://txtemplate.com/texas-resale-certificate-01-339-pdf-template.

- Computation of Substantial Presence Test: For non-U.S. citizens or residents, this document shows the number of days present in the U.S. over a specified period to determine residency status for tax purposes.

- Proof of Non-Residency: This may include documents such as visas, passports, or other evidence demonstrating the taxpayer's physical presence outside the U.S. for the required duration.

These documents collectively support the submission of Form 14653 and facilitate the IRS's assessment of eligibility for the Streamlined Foreign Offshore Procedures. Properly completing and submitting these forms can help mitigate potential penalties for non-compliance with U.S. tax obligations.