Get Acord 130 Form

Key takeaways

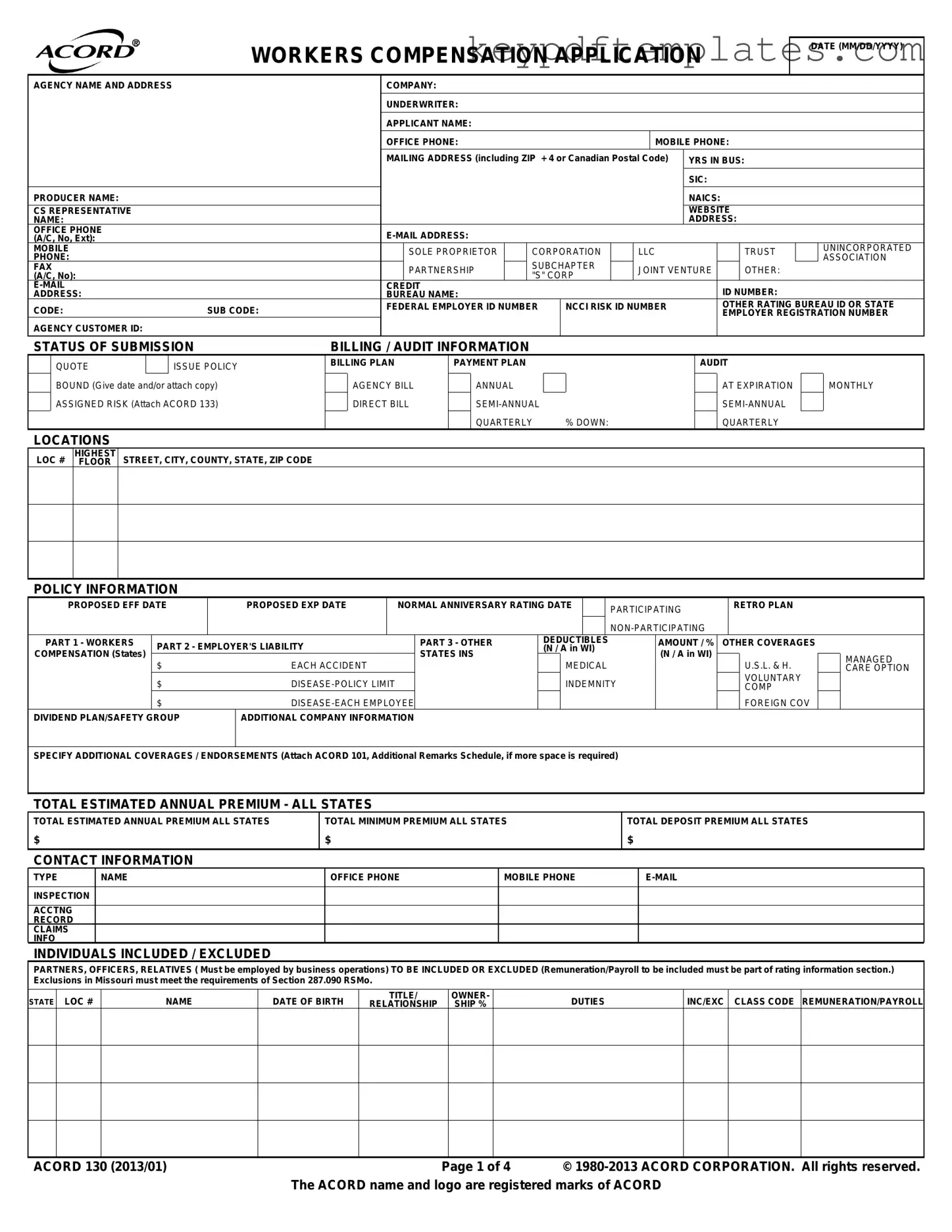

When filling out and using the ACORD 130 form, it is essential to ensure accuracy and completeness. Here are some key takeaways to keep in mind:

- Application Date: Always include the date in MM/DD/YYYY format to establish a clear record of submission.

- Agency Information: Clearly provide the agency name and address. This helps in identifying the responsible party for the application.

- Applicant Details: Ensure the applicant's name, office phone, mobile phone, and mailing address are accurate. This information is vital for communication.

- Business Structure: Indicate the type of business entity (e.g., corporation, LLC, partnership) accurately, as this affects liability and coverage.

- Years in Business: Specify the number of years the business has been operating. This can influence the underwriting process.

- Coverage Information: Fill out the sections regarding proposed effective dates, coverage limits, and any additional coverages or endorsements required.

- Employee Information: Provide detailed information about employees, including their roles and remuneration. This is crucial for calculating premiums.

- Loss History: Include information about past claims and loss history for the last five years. This helps underwriters assess risk.

- General Information: Answer all questions truthfully, especially those regarding hazardous materials, subcontractors, and safety programs.

- Signature Requirement: Ensure that the application is signed by an authorized representative, such as an officer or owner. This validates the application.

Completing the ACORD 130 form accurately is critical for obtaining the appropriate workers' compensation coverage. Take your time to review each section carefully, and do not hesitate to seek assistance if needed.

Similar forms

- ACORD 133: Workers Compensation Coverage Part - This form is used when applying for workers compensation insurance. Like the Acord 130, it gathers information about the applicant's business operations and employee classifications to determine coverage and premiums.

- ACORD 125: Commercial Insurance Application - Similar to the Acord 130, this form collects comprehensive information about a business for various types of commercial insurance, including property and liability coverage. Both forms aim to assess risks and determine appropriate premiums.

- ACORD 27: Certificate of Liability Insurance - While this document serves a different purpose, it still relates to insurance coverage. It provides proof of insurance and details about the coverage, similar to how the Acord 130 outlines coverage needs for workers compensation.

- ACORD 140: Commercial Property Application - This form focuses on property insurance, gathering information about the property and its use. Like the Acord 130, it is designed to assess risk and determine coverage options.

- Bill of Sale: A Georgia Bill of Sale form is a crucial document that ensures both the buyer and seller have a clear understanding of the transaction, providing protection for both parties involved. To simplify the process, you can access the necessary documentation by visiting Georgia PDF.

- ACORD 126: Businessowners Policy Application - This application is for businesses seeking a Businessowners Policy (BOP). It shares similarities with the Acord 130 in terms of gathering business information to evaluate insurance needs and coverage.

- ACORD 151: Commercial General Liability Application - This form is used to apply for general liability insurance. It collects information about the business and its operations, much like the Acord 130 does for workers compensation, to assess risks and coverage requirements.

- ACORD 151: Umbrella Liability Application - This document is for businesses seeking additional liability coverage beyond their primary policies. It parallels the Acord 130 in that both forms aim to provide a complete picture of the business's insurance needs.

Misconceptions

- Misconception 1: The Acord 130 form is only for large businesses.

- Misconception 2: Completing the Acord 130 is optional.

- Misconception 3: The Acord 130 form is only about employee information.

- Misconception 4: The form can be filled out without prior knowledge of workers' compensation.

- Misconception 5: Submitting the Acord 130 guarantees coverage.

- Misconception 6: The Acord 130 form is the same in all states.

- Misconception 7: All businesses must include all employees on the form.

- Misconception 8: The Acord 130 form does not require updates.

- Misconception 9: The Acord 130 form is only for new businesses.

- Misconception 10: The Acord 130 form is too complicated to fill out.

This form is applicable to businesses of all sizes, including small and medium enterprises. It helps ensure that all employers have the necessary workers' compensation coverage.

For many businesses, completing this form is a requirement to obtain workers' compensation insurance. It is essential to ensure compliance with state regulations.

While employee details are crucial, the form also collects information about business operations, coverage needs, and prior insurance history.

Understanding your business's specific needs and risks is important before completing the form. This knowledge helps ensure accurate and comprehensive information is provided.

Filling out the form does not guarantee that insurance will be issued. The insurer will review the information and determine eligibility based on their underwriting criteria.

While the Acord 130 is widely used, specific requirements and additional forms may vary by state. Always check your state’s regulations.

Some employees may be excluded based on specific criteria. It is important to understand which employees need to be reported for accurate coverage.

Changes in business operations, employee counts, or other relevant factors may necessitate updates to the form. Keeping information current is vital.

This form is used for both new and existing businesses seeking to establish or renew their workers' compensation coverage.

While it may seem daunting, the form is designed to be straightforward. Assistance is available if needed, ensuring that all required information is accurately provided.

More PDF Templates

Dekalb County Water New Service Application - It helps the county manage water service requests effectively.

104r - The form stipulates that the degree is based on a minimum four-year program.

For those looking to navigate the eviction process smoothly, utilizing resources like the Florida PDF Forms can provide essential guidance and ensure that the Notice to Quit is completed accurately and in accordance with Florida state law.

Salary Advance Agreement - Access your wages in advance to bridge financial gaps.

Form Specs

| Fact Name | Description |

|---|---|

| Form Purpose | The Acord 130 form is used to apply for workers' compensation insurance, gathering essential information about the applicant and their business operations. |

| Applicable States | This form is utilized in multiple states, each having specific governing laws regarding workers' compensation insurance. |

| Business Structure | The form accommodates various business structures, including sole proprietorships, corporations, LLCs, and partnerships. |

| Submission Details | Applicants must indicate the status of submission, including whether it is bound, quoted, or requires additional documentation. |

| Premium Information | The form requires detailed premium estimates, including total estimated annual premium, minimum premium, and deposit premium for all states. |

| Employee Information | It gathers information about employees, including those to be included or excluded from coverage, as well as their remuneration and relationship to the business. |

| Fraud Warning | The form includes a warning about the consequences of providing false information, which may lead to criminal and civil penalties. |

Documents used along the form

The ACORD 130 form is essential for applying for workers' compensation insurance. It provides necessary information about the applicant's business, including its operations, history, and coverage needs. Several other documents may accompany this form to ensure a comprehensive understanding of the insurance requirements. Below is a list of common forms and documents that are often used alongside the ACORD 130.

- ACORD 133: This form is used for the Assigned Risk Plan, detailing the applicant's eligibility for coverage under this program. It includes information on the business's classification and prior coverage.

- ACORD 101: The Additional Remarks Schedule allows applicants to provide more detailed information or explanations that do not fit in the primary application. This is useful for clarifying unique situations or additional coverage needs.

- Loss Run Report: This document provides a history of claims made by the business over a specified period. Insurers use it to assess risk and determine premium rates.

- Experience Modification Rate (EMR) Worksheet: This worksheet calculates the EMR, which reflects a company's past claims experience compared to industry standards. A lower EMR can lead to reduced premiums.

- State Rating Worksheet: This form collects specific information about the business's operations and employee classifications for each state where coverage is sought. It helps in determining the appropriate rates.

- Employer's Liability Insurance Application: If the applicant seeks additional coverage beyond workers' compensation, this form provides details about the employer's liability insurance needs.

- General Liability Application: This document may be required if the applicant also needs general liability coverage. It outlines the business's operations and any potential liabilities.

- Certificate of Insurance: Often requested by clients or partners, this document verifies that the business has the necessary insurance coverage in place.

- Trailer Bill of Sale Form: When facilitating trailer ownership transfers, reference the essential Trailer Bill of Sale guidance to ensure all transaction details are accurately recorded.

- Claims History Statement: Similar to the Loss Run Report, this statement provides details about past claims, including types, amounts, and outcomes, helping insurers assess risk more accurately.

- Business Description Document: This document elaborates on the nature of the business, its operations, and any special circumstances that may affect insurance coverage.

These documents collectively provide a clearer picture of the business's insurance needs and history. They help insurers make informed decisions regarding coverage and premium rates, ensuring that the applicant receives the appropriate protection for their operations.