Get Adp Pay Stub Form

Key takeaways

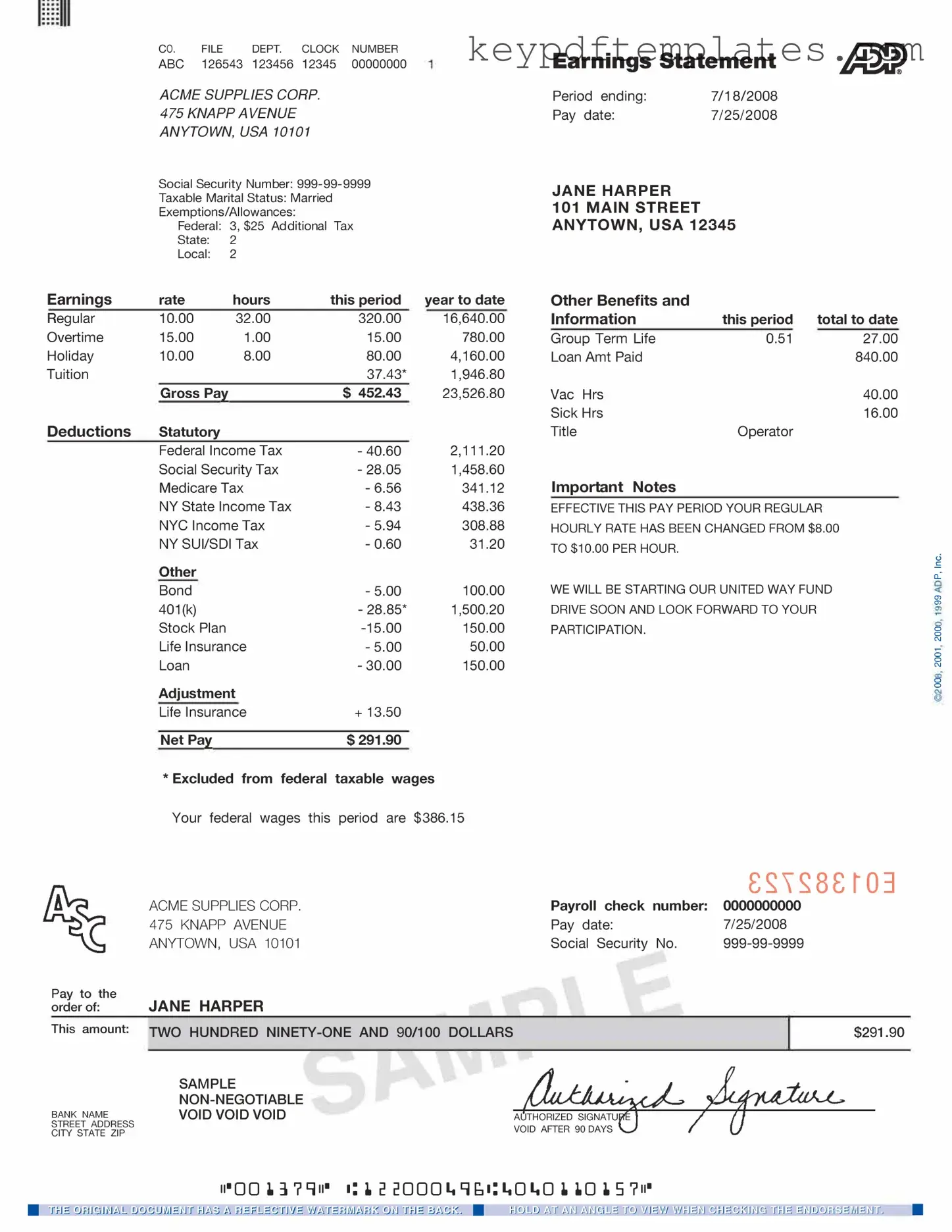

When dealing with the ADP Pay Stub form, it’s essential to understand its components and how to use it effectively. Here are key takeaways to keep in mind:

- Accuracy is Crucial: Ensure all information is filled out correctly. Mistakes can lead to incorrect pay or tax issues.

- Review Regularly: Check your pay stub each pay period. This helps you catch any discrepancies early.

- Understand Deductions: Familiarize yourself with various deductions. Knowing what is taken out of your paycheck is important for financial planning.

- Keep Records: Store your pay stubs safely. They are important for tax filings and verifying income.

- Use for Budgeting: Pay stubs can assist in budgeting. Knowing your net pay helps you plan your expenses better.

- Seek Help if Needed: If you have questions about your pay stub, don’t hesitate to ask your HR department. Clarity is key.

Similar forms

The ADP Pay Stub form serves as an important financial document for employees, providing a detailed breakdown of earnings and deductions. There are several other documents that share similarities with the ADP Pay Stub, each serving a unique purpose while providing essential information regarding compensation and tax withholdings. Below is a list of ten documents that are similar to the ADP Pay Stub form:

- W-2 Form: This document summarizes an employee's annual wages and the taxes withheld from their paycheck. Like the pay stub, it provides a clear picture of earnings and tax obligations.

- Paycheck: A physical or electronic check issued to employees, detailing gross pay, deductions, and net pay, much like the pay stub.

- Direct Deposit Receipt: This document confirms the transfer of funds to an employee's bank account, often including similar details about earnings and deductions.

- 1099 Form: Used for independent contractors, this form reports income received throughout the year, similar to how a pay stub reports earnings for employees.

- Payroll Summary Report: This report provides an overview of payroll expenses for a specific period, including total wages and deductions, akin to the information found on a pay stub.

- Employee Earnings Statement: Often provided by employers, this statement includes detailed information about an employee's earnings for a specific pay period, paralleling the pay stub's function.

- Residential Lease Agreement: Important for landlords and tenants, a California Residential Lease Agreement outlines key terms and responsibilities for renting property. For further details, you can refer to Top Forms Online.

- Tax Withholding Estimator: While not a pay stub, this tool helps employees understand their tax withholdings based on their earnings, similar to the deductions listed on a pay stub.

- Benefit Statement: This document outlines an employee's benefits and contributions, including health insurance and retirement plans, which may also appear on a pay stub.

- Time Sheet: A record of hours worked by an employee, which is often used to calculate the pay reflected on the pay stub, making it an essential document in the payroll process.

- Commission Statement: For employees earning commissions, this statement details commission earnings and deductions, similar to the breakdown found on a pay stub.

Each of these documents plays a vital role in understanding an individual's financial situation and tax responsibilities. They provide transparency and clarity regarding earnings and deductions, much like the ADP Pay Stub form.

Misconceptions

-

Misconception 1: The ADP pay stub only shows gross pay.

This is not true. The ADP pay stub provides detailed information including gross pay, deductions, and net pay. Employees can see how much they earned before deductions and what they take home after taxes and other withholdings.

-

Misconception 2: Pay stubs are only relevant for employees who are paid hourly.

In fact, both hourly and salaried employees receive pay stubs. Regardless of how employees are compensated, the pay stub is a crucial document for understanding earnings and deductions.

-

Misconception 3: Pay stubs are not necessary for tax purposes.

This is incorrect. Pay stubs serve as important documentation for tax filings. They provide a record of income and deductions that can be useful when preparing taxes or applying for loans.

-

Misconception 4: All deductions on a pay stub are mandatory.

While some deductions, such as federal taxes, are required, others, like retirement contributions or health insurance premiums, may be optional. Employees should review their pay stubs to understand which deductions apply to them.

-

Misconception 5: Pay stubs are the same across all employers.

This is not accurate. Each employer may have a different format for their pay stubs, and the information included can vary. Employees should familiarize themselves with their specific pay stub layout and details.

-

Misconception 6: Employees can only access their pay stubs through paper copies.

Many employers now offer electronic access to pay stubs. Employees can often view and download their pay stubs online, making it easier to keep track of their earnings and deductions.

-

Misconception 7: Pay stubs are not important for personal financial management.

This is a misunderstanding. Pay stubs provide essential information for budgeting and financial planning. By reviewing their pay stubs, employees can gain insights into their earnings and expenses, which can help in making informed financial decisions.

More PDF Templates

Download Dvla D1 Form - Know that applications that are incomplete may be returned for correction.

For those involved in outdoor activities, understanding the significance of a comprehensive Release of Liability form is vital to safeguard against potential claims. This legal document ensures that participants are informed of risks while agreeing to absolve providers of future responsibilities. To learn more about this important document, visit the following link: comprehensive Release of Liability documentation.

Puppy Health Record - Record the name of the parasite control product for reference.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings and deductions for each pay period. |

| Components | The pay stub typically includes gross pay, net pay, taxes withheld, and other deductions such as health insurance or retirement contributions. |

| State-Specific Regulations | In some states, employers are required to provide pay stubs under specific labor laws. For example, California Labor Code Section 226 mandates itemized wage statements. |

| Access | Employees can often access their pay stubs electronically through an online portal provided by ADP, making it convenient to review past and current pay information. |

Documents used along the form

When managing payroll and employee compensation, several important documents complement the ADP Pay Stub form. Each of these documents serves a specific purpose, ensuring that both employers and employees have a clear understanding of earnings, deductions, and tax obligations. Below is a list of commonly used forms and documents that often accompany the ADP Pay Stub.

- W-2 Form: This form summarizes an employee's annual wages and the taxes withheld from their paycheck. Employers must provide this document to employees by the end of January each year.

- W-4 Form: Employees complete this form to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from each paycheck.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their pay directly into their bank account, providing convenience and security.

- Payroll Register: A detailed report that lists all employees' earnings, deductions, and net pay for a specific pay period. It serves as a record for payroll processing and auditing.

- Time Sheets: These documents track the hours worked by employees, including regular hours, overtime, and leave taken. They are essential for accurate payroll calculations.

- Employee Benefits Summary: This document outlines the benefits available to employees, such as health insurance, retirement plans, and paid time off, helping employees understand their total compensation package.

- Pay Period Calendar: A calendar that outlines the specific pay periods for employees, including start and end dates. This helps employees know when to expect their paychecks.

- FedEx Release Form: This form allows customers to designate a specific location for package delivery in their absence, ensuring safe delivery without requiring a signature. For more details, refer to the Fedex Release form.

- State Tax Withholding Form: Some states require a specific form for state income tax withholding. Employees must complete this form to ensure the correct amount is withheld for state taxes.

- Expense Reimbursement Form: Employees use this form to request reimbursement for work-related expenses. It includes details about the expenses incurred and requires supporting documentation.

Understanding these documents is crucial for both employers and employees. They ensure transparency in the payroll process and help maintain compliance with tax regulations. By keeping these forms organized and accessible, everyone involved can navigate payroll matters with confidence and clarity.