Get Alabama Mvt 20 1 Form

Key takeaways

Here are key takeaways about filling out and using the Alabama MVT 20 1 form:

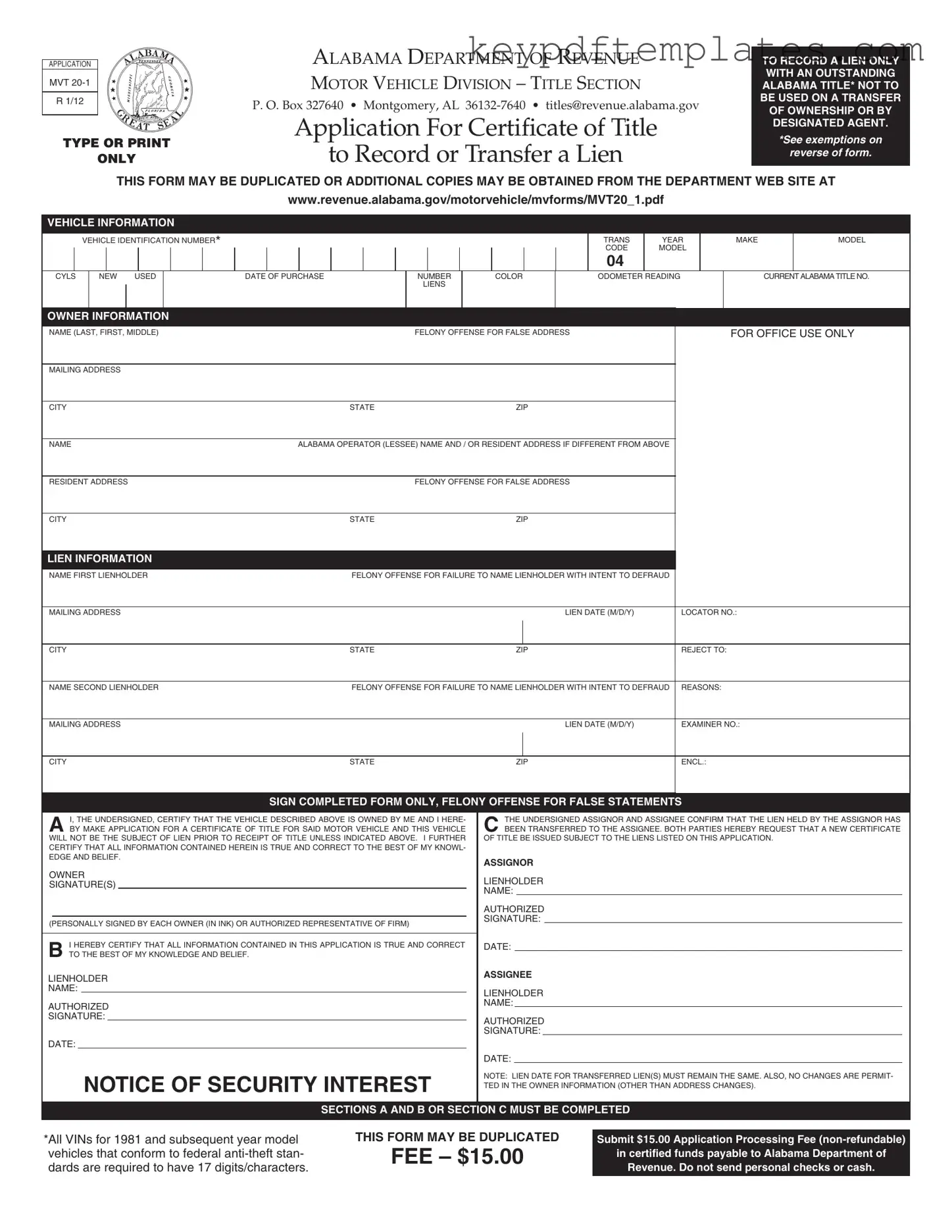

- The form is specifically for recording or transferring a lien on a vehicle with an existing Alabama title.

- It cannot be used for transferring ownership or by designated agents.

- Ensure all vehicle information matches the existing Alabama title, except for the mailing address.

- Provide the Vehicle Identification Number (VIN), which must have 17 characters for vehicles from 1981 and newer.

- Include the current Alabama title with the application, along with a $15 processing fee in certified funds.

- Illegible forms will be returned, so type or print clearly.

- Sections A and B or Section C must be completed for the form to be valid.

- Be aware of exemptions; vehicles older than 35 years or certain trailers may not require a title.

- Submit the completed form to the Alabama Department of Revenue for processing.

- Both the assignor and assignee must sign the form to confirm the lien details.

Similar forms

The Alabama Mvt 20 1 form serves a specific purpose in recording or transferring a lien on a vehicle. Several other documents share similarities with this form, primarily in their function related to vehicle titles and liens. Below is a list of documents that are comparable to the Alabama Mvt 20 1 form:

- MVT 5-1E Form: This form is used by designated agents to record liens. Unlike the Mvt 20 1, which is for lienholders, the MVT 5-1E is specifically designed for agents acting on behalf of owners.

- MVT 5-1 Form: This document is utilized for the transfer of ownership of a vehicle. While the Mvt 20 1 focuses solely on liens, the MVT 5-1 encompasses broader ownership transactions.

- MVT 3-1 Form: This form is for applying for a duplicate title. It shares the purpose of title management but differs as it addresses lost or damaged titles rather than lien recording.

- Hold Harmless Agreement: Utilizing a Hold Harmless Agreement can protect parties from liability in various situations, ensuring that individuals understand the potential risks involved, as outlined at allfloridaforms.com/.

- MVT 4-1 Form: Used for a title application for a newly purchased vehicle, this form is similar in that it initiates title processing but does not involve lien information.

- MVT 1-1 Form: This is the standard application for a certificate of title. Like the Mvt 20 1, it is essential for establishing legal ownership, but it does not pertain to lien recording.

- MVT 7-1 Form: This document is used for recording a lien release. It serves a similar function in the lien process but is focused on removing a lien rather than recording one.

- MVT 8-1 Form: This form is for the application of a salvage title. While it addresses a different aspect of vehicle title management, it is still part of the broader title documentation process.

- MVT 10-1 Form: This document is for transferring a title due to inheritance. It shares the goal of title transfer but is specific to situations involving the deceased’s estate.

- MVT 9-1 Form: This form is for applying for a title for a vehicle purchased from a dealer. It is similar in that it deals with title applications but is tailored for dealer transactions.

Each of these documents plays a vital role in the vehicle title process, ensuring that ownership and lien information is accurately recorded and maintained. Understanding their similarities and distinctions can help individuals navigate vehicle ownership and lien management more effectively.

Misconceptions

Misconceptions about the Alabama Mvt 20 1 form can lead to confusion and errors in the application process. Here are ten common misconceptions along with clarifications:

- This form can be used for transferring ownership. The Mvt 20 1 form is strictly for recording or transferring a lien. It cannot be used for ownership transfers.

- Anyone can file this form. Only lienholders or vehicle owners can submit this form. Designated agents must use a different form.

- The form can be submitted without the current Alabama title. The application must include the current Alabama title to be processed.

- Illegible forms will still be accepted. Forms must be typed or printed clearly; otherwise, they will be returned for correction.

- There is no fee associated with this application. A non-refundable processing fee of $15.00 is required, payable in certified funds.

- All vehicles require a title regardless of their age. Certain vehicles, such as those over 35 years old, may be exempt from titling.

- The lien information can be changed after submission. Once submitted, no changes to the lien information are allowed, except for address updates.

- Only one lienholder can be recorded. The form allows for multiple lienholders to be listed, as long as all required information is provided.

- All vehicles must have a 17-digit VIN. This requirement applies only to vehicles manufactured in 1981 or later. Older vehicles may have different VIN structures.

- Submitting this form guarantees a new title will be issued. A new title will only be issued if the application meets all requirements and is approved.

Understanding these misconceptions can help ensure a smoother application process for those dealing with vehicle liens in Alabama.

More PDF Templates

Pest Control Service Agreement Template - Fill in the customer’s address for accurate service dispatch.

To ensure a clear understanding of rental terms, it is essential for both landlords and tenants to utilize the Florida Residential Lease Agreement form, which delineates their responsibilities and rights when renting property. For your convenience, you can access the necessary form at Florida PDF Forms, helping to facilitate a seamless leasing process.

How Long Does It Take to Get on Section 8 - Late requests may result in termination from the Section 8 program.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | This form is used to apply for a certificate of title to record or transfer a lien on a vehicle with an outstanding Alabama title. |

| Governing Law | The form is governed by Section 32-8-61 of the Code of Alabama 1975, which outlines the requirements for creating a security interest in a vehicle. |

| Application Fee | A non-refundable processing fee of $15.00 is required, payable in certified funds to the Alabama Department of Revenue. |

| Eligibility | This form is not to be used for transferring ownership of a vehicle or by designated agents; they must use form MVT 5-1E instead. |

| Supporting Documents | The application must be accompanied by the current Alabama title for the vehicle and the title fee in certified funds. |

| Exemptions | Vehicles over 35 years old and certain types of trailers are exempt from titling provisions as of January 1, 2012. |

Documents used along the form

The Alabama MVT 20 1 form is essential for recording or transferring a lien on a vehicle with an outstanding Alabama title. However, it is often used in conjunction with several other documents to ensure proper processing and compliance with state regulations. Below are four commonly associated forms that may be required or helpful in the process.

- MVT 5-1E Form: This form is used by designated agents to record liens. It is specifically for situations where the lienholder is not the owner of the vehicle. The MVT 5-1E ensures that the lien is properly recorded and recognized by the Alabama Department of Revenue.

- Texas Bill of Sale Form: When engaging in personal property transactions, utilize the comprehensive Texas bill of sale form resources to ensure all legal requirements are met.

- Current Alabama Title: The existing title of the vehicle must accompany the MVT 20 1 form. This document serves as proof of ownership and provides necessary vehicle information. It is crucial for validating the lien being recorded.

- Power of Attorney (POA): If a lienholder or agent is submitting the MVT 20 1 form on behalf of the vehicle owner, a POA may be required. This document grants the agent the authority to act on the owner’s behalf regarding the title and lien matters.

- Vehicle Bill of Sale: Although not always mandatory, a bill of sale can provide additional evidence of the transaction related to the vehicle. This document outlines the sale details and can clarify ownership transfer, especially in lien situations.

These documents work together to facilitate the accurate recording of liens and ensure compliance with Alabama's motor vehicle regulations. Having the correct forms and supporting documentation is crucial for a smooth process when dealing with vehicle titles and liens.