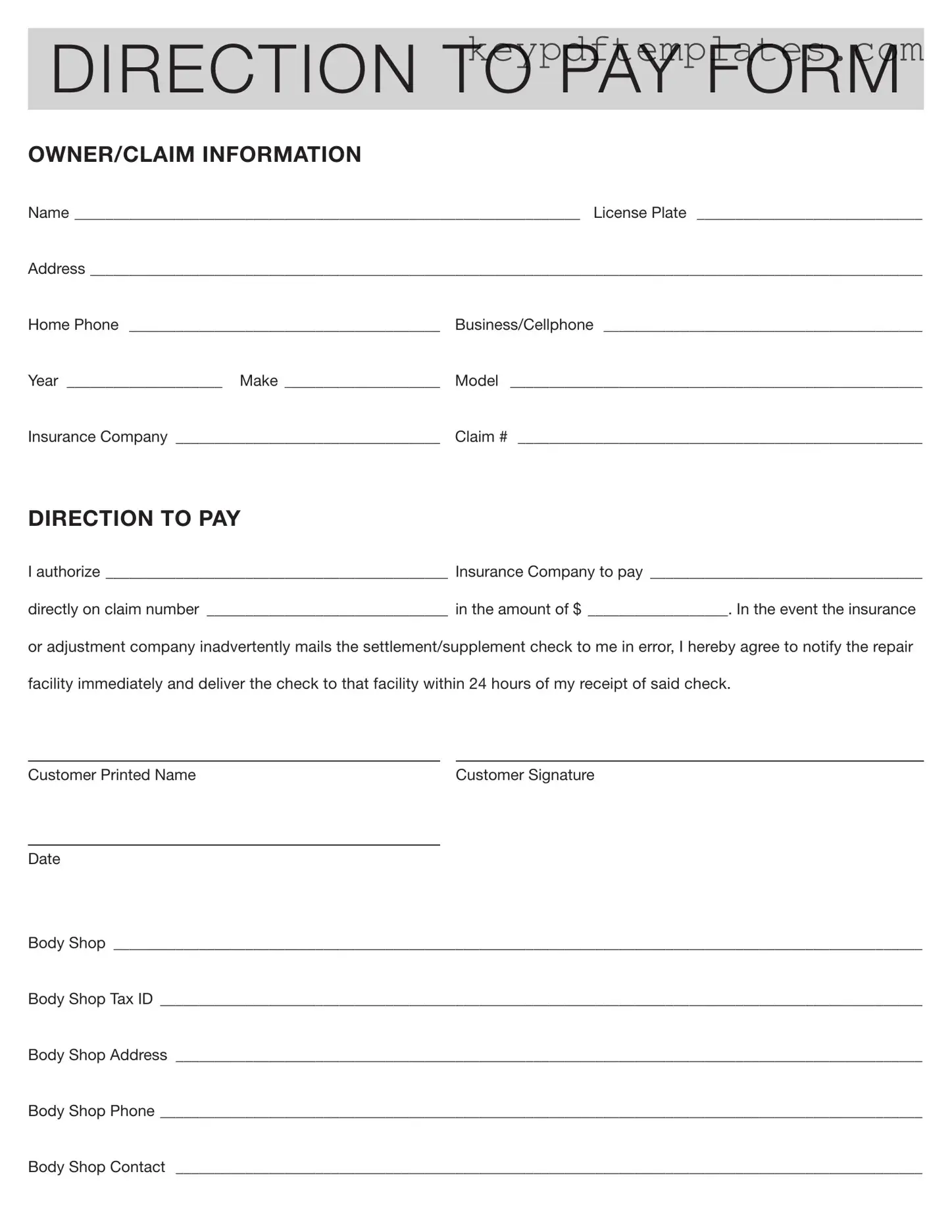

Get Authorization And Direction Pay Form

Key takeaways

Filling out the Authorization and Direction Pay form correctly is essential for a smooth claims process. Here are some key takeaways to keep in mind:

- Complete All Sections: Ensure every section of the form is filled out accurately, including your name, address, and contact information.

- Insurance Company Details: Clearly state the name of your insurance company and the claim number. This helps avoid any confusion.

- Payment Authorization: Specify the amount you authorize the insurance company to pay. Double-check this figure for accuracy.

- Timely Notification: If you receive a check by mistake, notify the repair facility within 24 hours to avoid delays.

- Body Shop Information: Provide complete details about the body shop, including their tax ID and contact information.

- Signature Required: Don’t forget to sign and date the form. Your signature confirms your authorization.

- Keep Copies: Always keep a copy of the completed form for your records. This can be helpful for future reference.

- Check for Errors: Review the form for any mistakes before submitting it. Small errors can cause big delays.

- Follow Up: After submission, follow up with both the insurance company and the body shop to ensure everything is processed correctly.

By adhering to these guidelines, you can help facilitate a smoother claims process and ensure that payments are directed where they need to go.

Similar forms

The Authorization and Direction Pay form shares similarities with several other documents commonly used in insurance and financial transactions. Each of these documents serves a specific purpose in facilitating payments and authorizations. Below are six documents that are comparable to the Authorization and Direction Pay form:

- Power of Attorney: This document allows one person to act on behalf of another in legal or financial matters. Like the Authorization and Direction Pay form, it grants authority to manage transactions, ensuring that the designated person can make decisions regarding payments.

- Insurance Assignment of Benefits Form: This form authorizes an insurance company to pay benefits directly to a service provider. Similar to the Direction to Pay form, it directs payments to a third party, streamlining the process for the claimant and service provider.

- Direct Deposit Authorization Form: This document permits an employer or organization to deposit funds directly into an individual's bank account. Both forms facilitate the transfer of funds but in different contexts—one for insurance claims and the other for regular payments.

- Claim Release Form: This form is used to release an insurance company from liability after a claim has been settled. It often accompanies payment authorization, ensuring that the claimant acknowledges receipt of payment, similar to the agreement in the Direction to Pay form.

- Payment Authorization Form: This document allows a business or individual to charge a specified amount to a customer's credit or debit card. Both forms require explicit consent for payment, emphasizing the importance of authorization in financial transactions.

- Power of Attorney for a Child: This legal document allows a parent or guardian to delegate authority to another person for making decisions on behalf of their child, which can be crucial in situations such as temporary relocations or emergencies. To learn more about this form, visit Florida PDF Forms.

- Service Agreement: This contract outlines the terms of service between a provider and a client. It may include payment terms and conditions, similar to the Direction to Pay form, which specifies the payment arrangement between the insurance company and the repair facility.

Misconceptions

Misconceptions about the Authorization and Direction Pay form can lead to confusion and errors in processing claims. Here are ten common misunderstandings:

- It is only for auto insurance claims. Many believe this form is exclusive to auto insurance. However, it can be used for various types of insurance claims.

- Only the insurance company needs to fill it out. In reality, both the claimant and the insurance company must provide information on the form for it to be valid.

- The form guarantees payment from the insurance company. While it directs payment, it does not guarantee that the insurance company will approve the claim.

- Once signed, the form cannot be changed. Changes can be made, but both parties must agree to any modifications and initial them.

- The claimant must receive the check directly. The purpose of the form is to allow the insurance company to pay the repair facility directly, bypassing the claimant.

- It is unnecessary if a repair shop is involved. Even when a repair shop is handling the claim, this form is crucial for directing payment.

- All insurance companies accept this form. Not all companies recognize this form; it’s essential to check with the specific insurer.

- It can be submitted after repairs are completed. This form should be submitted before repairs begin to ensure payment is directed correctly.

- Only one signature is required. Both the claimant and the representative from the repair facility typically need to sign the form.

- It is a legal contract. While it has legal implications, it is primarily an administrative document for payment direction.

Understanding these misconceptions can help individuals navigate the claims process more effectively and ensure that payments are directed as intended.

More PDF Templates

Free Printable Bill of Lading - This document is essential for smooth operation in supply chain management.

For those looking to correct errors in their property records, utilizing the Texas Affidavit of Correction form is a vital step in ensuring accuracy and clarity in documentation.

Letter Authorizing Child to Travel - Providing accurate details on the form is crucial for its effectiveness.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Authorization and Direction Pay form allows a policyholder to direct their insurance company to pay a repair facility directly for services rendered. |

| Information Required | This form requires detailed information including the owner's name, license plate, address, phone numbers, and specifics about the vehicle and insurance claim. |

| Agreement Clause | The form includes an agreement that the policyholder must notify the repair facility and return any mistakenly sent checks within 24 hours. |

| State-Specific Laws | In states like California, the use of this form is governed by the California Insurance Code, ensuring compliance with local regulations. |

Documents used along the form

When dealing with insurance claims and payments, several forms and documents often accompany the Authorization And Direction Pay form. Each of these documents serves a specific purpose in ensuring a smooth transaction and clear communication between all parties involved. Below is a list of commonly used forms that may be required in conjunction with the Direction to Pay form.

- Proof of Loss Form: This document outlines the details of the loss or damage incurred. It typically includes information about the incident, the property involved, and the estimated costs for repairs or replacement.

- Statement of Fact Texas Form: Completing this form is essential for clarifying vehicle ownership details during transactions. For more information, visit txtemplate.com/statement-of-fact-texas-pdf-template.

- Claim Submission Form: This form is used to formally submit a claim to the insurance company. It provides essential information such as the policy number, details of the incident, and any supporting documentation required for processing the claim.

- Repair Estimate: A detailed estimate from the repair facility outlining the anticipated costs for repairs. This document is crucial for the insurance company to assess the claim and determine the appropriate payout.

- Release of Liability Form: This form is signed by the claimant to release the insurance company from any future claims related to the incident. It is often required before payment can be processed.

- Assignment of Benefits Form: This document allows the insurance company to pay the repair shop directly for services rendered. It streamlines the payment process and ensures that the repair facility receives the funds promptly.

- Insurance Policy Declaration Page: This page provides a summary of the insurance policy, including coverage limits, deductibles, and effective dates. It is essential for verifying coverage when processing claims.

- Identity Verification Document: This may include a driver's license or other government-issued ID to confirm the identity of the claimant. Insurance companies often require this to prevent fraud.

- Incident Report: A report detailing the circumstances surrounding the incident. It may include witness statements, police reports, or photographs that support the claim.

- Subrogation Agreement: This document allows the insurance company to pursue recovery from a third party responsible for the loss. It outlines the rights of the insurer to recoup costs after paying the claim.

Understanding these forms and their purposes can greatly facilitate the claims process. By ensuring that all necessary documentation is in order, individuals can help expedite their claims and receive the compensation they are entitled to in a timely manner.