Get Auto Insurance Card Form

Key takeaways

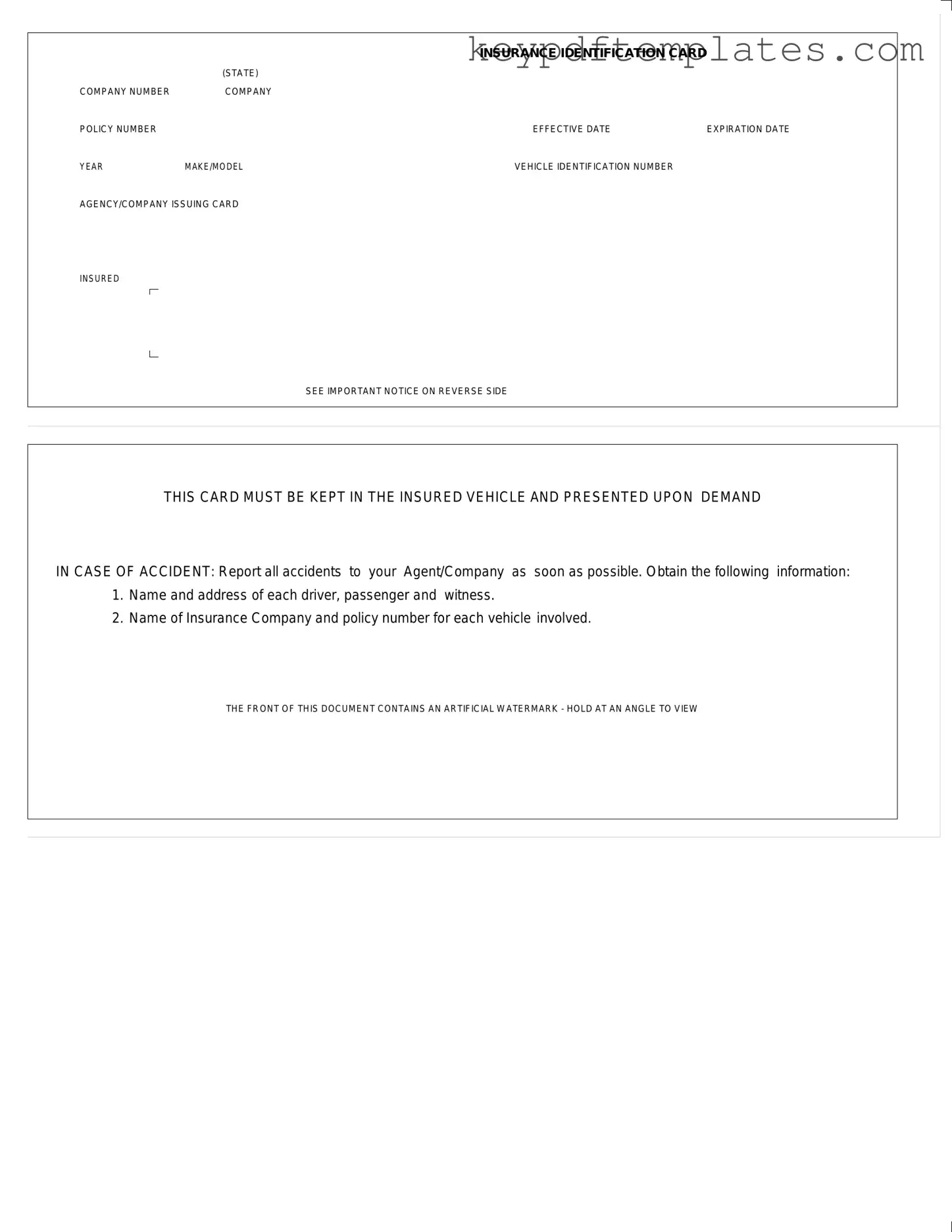

When filling out and using the Auto Insurance Card form, it is essential to understand its components and requirements. Here are some key takeaways:

- Keep it Accessible: Always store the Auto Insurance Card in your vehicle. This ensures that it is readily available when needed.

- Provide Accurate Information: Ensure that all fields, such as the company number, policy number, and vehicle identification number, are filled out correctly.

- Understand the Dates: Pay close attention to the effective and expiration dates of your policy. This information is crucial for maintaining valid coverage.

- Report Accidents Promptly: If an accident occurs, report it to your insurance agent or company as soon as possible. Timely reporting can help facilitate the claims process.

- Gather Necessary Details: In the event of an accident, collect names and addresses of drivers, passengers, and witnesses. Also, note the insurance information for all vehicles involved.

- Recognize the Watermark: The front of the card includes an artificial watermark. Hold the card at an angle to view it clearly, as this may be necessary for verification purposes.

- Review Important Notices: Always read the important notice on the reverse side of the card. It contains additional information that may be beneficial in various situations.

Similar forms

-

Health Insurance Card: Similar to the Auto Insurance Card, the health insurance card contains essential information such as the policy number, effective dates, and the issuing company. It serves as proof of insurance coverage and must be presented during medical visits.

-

Identification Card (ID): An ID card provides personal identification details, including the holder's name, address, and date of birth. Like the Auto Insurance Card, it is often required to be carried and presented upon request.

-

Vehicle Registration Card: This document includes information about the vehicle, such as the make, model, and Vehicle Identification Number (VIN). It is similar in that it must be kept in the vehicle and presented when requested by law enforcement.

-

Driver's License: A driver's license verifies an individual's ability to operate a vehicle. It includes personal information and must be carried at all times, similar to the requirement for the Auto Insurance Card.

-

Proof of Insurance Certificate: This document serves as verification of insurance coverage, listing policy details and effective dates. It is often required to be shown during vehicle stops, akin to the Auto Insurance Card.

-

Rental Car Agreement: When renting a vehicle, this agreement outlines the terms and conditions, including insurance coverage. It parallels the Auto Insurance Card by providing necessary information about the vehicle and insurance policy.

-

Homeowners Insurance Policy Declaration Page: This document summarizes the coverage provided by a homeowners insurance policy, including policy numbers and effective dates. It is similar in its purpose to inform the insured of their coverage details.

- Georgia WC-100 Form: This form is integral for initiating workers' compensation mediation, ensuring all parties engage effectively in settling disputes. For detailed information, refer to the Georgia PDF.

-

Business Insurance Certificate: This certificate confirms that a business has insurance coverage. It includes policy numbers and effective dates, much like the Auto Insurance Card, which outlines coverage for a vehicle.

-

Travel Insurance Policy Document: This document details the coverage provided during travel, including policy limits and effective dates. Similar to the Auto Insurance Card, it serves as proof of coverage and must be accessible when needed.

Misconceptions

Understanding auto insurance can be confusing. Here are some common misconceptions about the Auto Insurance Card form that many people have.

- The card is optional to carry in the vehicle. Many believe the insurance card is not necessary. However, it is required to be kept in the vehicle and presented upon demand in case of an accident.

- All information on the card is irrelevant. Some think that the details on the card do not matter. In reality, the company number, policy number, and effective dates are crucial for verifying coverage.

- The card is only needed for accidents. Many assume the card is only necessary during an accident. It is also required for traffic stops or when requested by law enforcement.

- The expiration date is not important. Some ignore the expiration date on the card. This date indicates when the insurance coverage ends, and driving without valid insurance can lead to penalties.

- Only the vehicle owner needs to know the details. Some believe that only the owner should understand the card's information. However, all drivers of the vehicle should be familiar with the insurance details.

- The watermark is just for decoration. Many think the watermark is unimportant. In fact, it serves as a security feature to prevent fraud.

- All insurance companies issue the same type of card. Some assume all insurance cards look alike. Each insurance company has its own format, but all contain essential information.

- Accidents should be reported only if there are injuries. Some believe they only need to report accidents with injuries. However, all accidents should be reported to the insurance company regardless of injury status.

- The card is valid indefinitely once issued. Many think the card remains valid forever. Coverage must be renewed periodically, and the card must be updated to reflect current information.

- It’s okay to present a digital version of the card. Some believe that showing a digital version is sufficient. While many states accept digital cards, it is always best to check local laws to ensure compliance.

By understanding these misconceptions, drivers can ensure they are properly covered and prepared in case of an accident.

More PDF Templates

Acord Application - Acord 50 WM captures pertinent details to tailor coverage options effectively.

In Texas, the Trailer Bill of Sale is essential for protecting both the seller and buyer during the transfer of trailer ownership; you can access a comprehensive template to facilitate this process at txtemplate.com/trailer-bill-of-sale-pdf-template/, ensuring that all legal requirements are met and that the transaction proceeds smoothly.

Employee Status Change Form Template - Notify of status changes impacting employee rights and privileges.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose of the Card | The Auto Insurance Card serves as proof of insurance coverage for the vehicle. It must be kept in the vehicle and presented upon request during traffic stops or accidents. |

| Required Information | Essential details on the card include the company number, policy number, effective date, expiration date, vehicle identification number, and the make/model of the vehicle. |

| Legal Requirement | In many states, including California and New York, it is mandated by law to carry an auto insurance card in the vehicle at all times (California Vehicle Code § 16028, New York Vehicle and Traffic Law § 319). |

| Accident Reporting | In case of an accident, the insured must report the incident to their insurance agent or company immediately and gather relevant information from all parties involved. |

Documents used along the form

When it comes to auto insurance, having the right documents on hand is crucial. Along with your Auto Insurance Card, there are several other forms and documents that can support your insurance needs and ensure you are prepared in case of an accident. Here’s a list of commonly used documents that you might find helpful.

- Insurance Policy Document: This is the official contract between you and your insurance company. It outlines the coverage, terms, and conditions of your auto insurance.

- Claim Form: If you need to file a claim after an accident, this form is essential. It allows you to report the details of the incident and request compensation for damages.

- Accident Report Form: Often provided by law enforcement, this document records the details of an accident. It includes information about the vehicles involved, the location, and any citations issued.

- Proof of Payment: This document shows that your insurance premium has been paid. It can be useful if you need to confirm your coverage status.

- Vehicle Registration: This form proves that you are the legal owner of the vehicle. It is typically issued by your state’s Department of Motor Vehicles (DMV).

- Driver's License: A valid driver’s license is required to operate a vehicle. It serves as identification and proof that you are legally allowed to drive.

- Roadside Assistance Card: If you have roadside assistance as part of your insurance policy, this card provides details on how to access those services when needed.

- Motor Vehicle Power of Attorney: For those needing to delegate vehicle-related tasks, our simple Motor Vehicle Power of Attorney form instructions provide the essential guidance for managing your vehicle transactions effectively.

- Endorsements or Riders: These are additional coverages that can be added to your policy. They modify the original policy to provide extra protection for specific situations.

- Insurance Renewal Notice: This document is sent by your insurance company before your policy expires. It details any changes in coverage or premiums for the upcoming term.

Keeping these documents organized and readily accessible can make a significant difference in managing your auto insurance effectively. Being prepared will help you navigate any situation with confidence and ease.