Get Broker Price Opinion Form

Key takeaways

Filling out the Broker Price Opinion (BPO) form requires attention to detail and a clear understanding of the property and market conditions. Here are seven key takeaways to keep in mind:

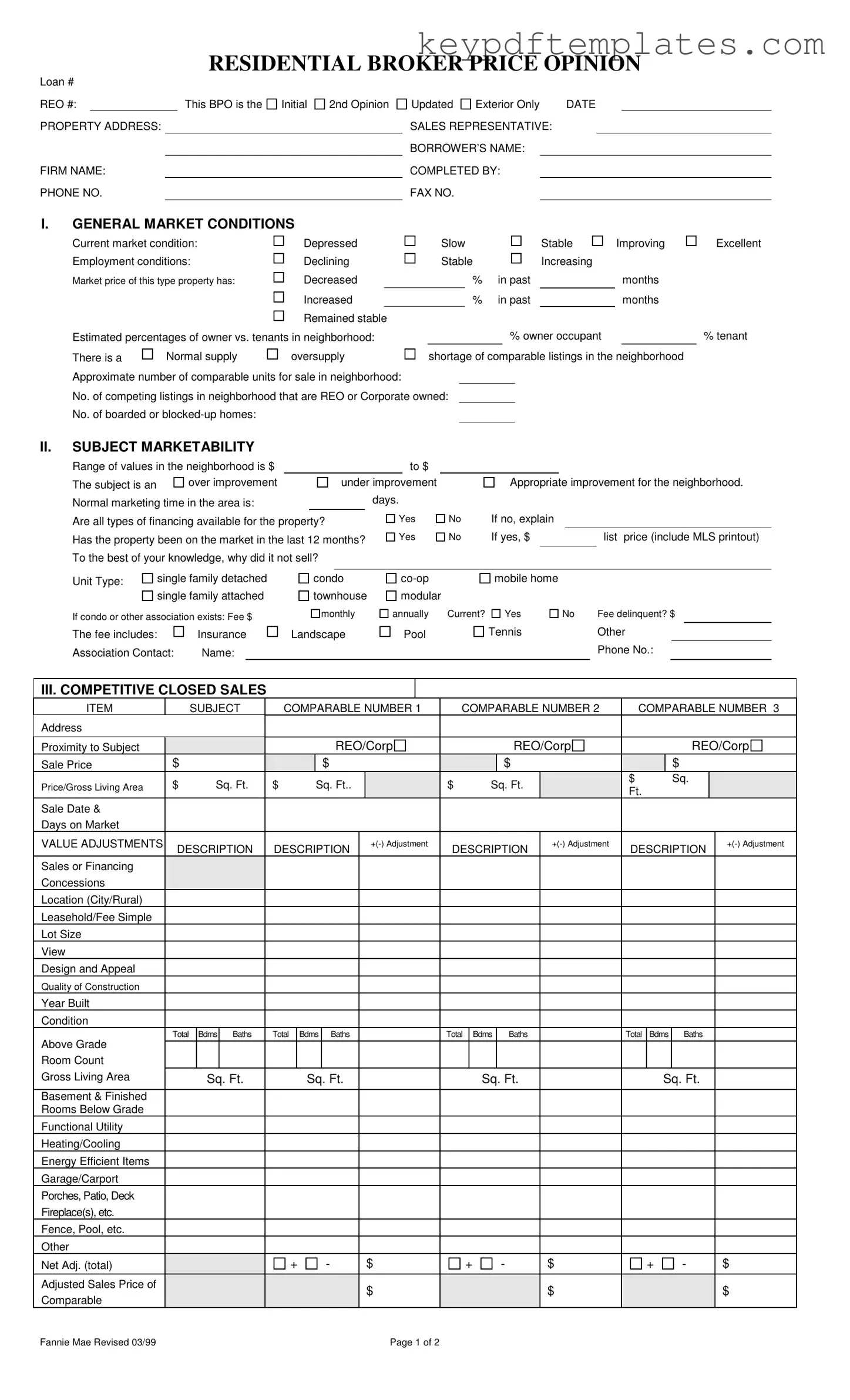

- Accurate Information: Ensure all fields, including property address, loan number, and contact details, are filled out accurately. This establishes a reliable foundation for the assessment.

- Market Conditions: Assess the current market conditions carefully. Indicate whether the market is depressed, stable, or improving, as this impacts the valuation.

- Comparable Sales: Identify and include recent comparable sales. Provide details such as sale price, days on market, and any necessary adjustments to reflect differences.

- Repairs and Improvements: Clearly itemize any repairs needed to bring the property to marketable condition. This helps potential buyers understand what to expect.

- Occupancy Status: Note the occupancy status of the property. Whether occupied or vacant, this can influence buyer interest and pricing strategy.

- Marketing Strategy: Define the marketing strategy, whether it’s as-is or with minimal repairs. This decision should align with the property’s condition and market expectations.

- Comments Section: Use the comments section to highlight any unique features or concerns about the property. This can provide valuable context for potential buyers.

By following these guidelines, the BPO can serve as a powerful tool in determining the property’s market value and facilitating a successful sale.

Similar forms

- Comparative Market Analysis (CMA): A CMA assesses property values based on recent sales of similar homes in the area. Like a Broker Price Opinion, it provides insights into market conditions and helps determine a competitive price for a property.

- Appraisal Report: An appraisal report offers a professional estimate of a property's value. Both documents analyze comparable sales, but appraisals are typically more detailed and conducted by licensed appraisers.

- Affidavit of Gift Form: To ensure the transfer of gifts is properly documented, consider the essential Affidavit of Gift form guidelines for clear legal compliance.

- Listing Agreement: This document outlines the terms under which a property will be listed for sale. Similar to a BPO, it considers market conditions and property value to establish a starting point for pricing.

- Property Condition Report: A property condition report evaluates the physical state of a home. Like a BPO, it may identify necessary repairs that could affect marketability and price.

- Market Analysis Report: This report examines market trends and conditions. It shares similarities with a BPO by providing an overview of the local real estate market, including supply and demand factors.

- Real Estate Investment Analysis: This analysis focuses on the potential return on investment for a property. Both documents assess value and market conditions, but the investment analysis also considers financial metrics.

- Seller’s Disclosure Statement: This document outlines known issues with a property that could affect its value. Like a BPO, it provides insights into the property’s condition and marketability.

- Lease Agreement: A lease agreement details the terms under which a property is rented. Similar to a BPO, it reflects the property's value based on market conditions and comparable rental properties.

- Foreclosure Valuation Report: This report estimates the value of a property in foreclosure. It shares similarities with a BPO by focusing on market conditions and comparable sales to determine a fair value.

- Investment Property Analysis: This document evaluates the financial viability of a property as an investment. Like a BPO, it considers market conditions and comparable properties to assess value and potential returns.

Misconceptions

-

Misconception 1: The Broker Price Opinion (BPO) is the same as an appraisal.

While both documents assess property value, they serve different purposes. An appraisal is a formal evaluation performed by a licensed appraiser, often required for financing. A BPO, on the other hand, is typically conducted by a real estate broker and is less formal. It provides an estimated value based on market conditions and comparable sales.

-

Misconception 2: A BPO is only used for foreclosures.

Although BPOs are frequently utilized in foreclosure situations, they are not limited to that context. Real estate agents and lenders often use BPOs to determine property values for various purposes, including listings, short sales, and market analysis.

-

Misconception 3: The BPO process is quick and does not require much detail.

In reality, a comprehensive BPO involves thorough research and analysis. Brokers must consider various factors, such as market conditions, comparable sales, and property specifics. This detailed approach ensures a more accurate valuation.

-

Misconception 4: A BPO guarantees a specific sale price.

A BPO provides an estimate based on current market conditions but does not guarantee that the property will sell for that amount. Many variables, including buyer interest and market fluctuations, can affect the final sale price.

-

Misconception 5: BPOs can only be completed by licensed appraisers.

This is incorrect. Brokers and agents with sufficient market knowledge can perform BPOs. However, they must adhere to ethical standards and guidelines to ensure their evaluations are credible and reliable.

More PDF Templates

Dr312 - Filing this form can expedite the administration of the estate in Florida.

A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees about the property’s title. This form is often used in situations like transferring property between family members or clearing up title issues. If you're ready to complete your transfer, visit Florida PDF Forms to fill out the form.

Hiv Cmia Test Normal Range - Ensures clients have a clear understanding of what results mean.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Broker Price Opinion (BPO) form is used to estimate the market value of a property based on current market conditions and comparable sales. |

| Components | This form includes sections for general market conditions, subject marketability, competitive closed sales, and marketing strategy. |

| State-Specific Regulations | In California, the BPO is governed by the California Bureau of Real Estate guidelines, which require proper disclosures and adherence to ethical standards. |

| Market Value Estimation | The BPO provides a suggested list price based on the analysis of comparable properties and current market trends. |

Documents used along the form

The Broker Price Opinion (BPO) form serves as a critical tool in real estate transactions, particularly for determining property values. Several other forms and documents often accompany the BPO to provide a comprehensive view of the property and its market. Below is a list of these documents, each playing a unique role in the evaluation and sale process.

- Comparative Market Analysis (CMA): This document assesses the value of a property by comparing it to similar properties that have recently sold in the area. It helps establish a fair market price based on current market trends.

- Property Inspection Report: This report details the condition of the property, highlighting any issues that may affect its value. It includes information about structural integrity, necessary repairs, and overall maintenance.

- Listing Agreement: This is a contract between the property owner and the real estate agent. It outlines the terms of the sale, including the listing price, duration of the agreement, and commission structure.

- Insurance Verification Form: A necessary document for confirming current insurance coverage, ensuring that agents possess adequate protection during property evaluations. For more details, visit txtemplate.com/texas-certificate-insurance-pdf-template/.

- Sales Contract: Once a buyer is found, this legally binding document outlines the terms of the sale, including the purchase price, contingencies, and closing date. It protects both the buyer and seller during the transaction.

- Appraisal Report: Conducted by a licensed appraiser, this report provides an independent assessment of the property's value. It considers various factors, including location, condition, and comparable sales.

- Title Report: This document verifies the legal ownership of the property and identifies any liens, encumbrances, or other claims against it. Ensuring clear title is essential for a successful sale.

- Disclosure Statement: Required by law in many states, this document informs potential buyers of any known issues with the property, such as past repairs, environmental hazards, or neighborhood concerns. Transparency is key in real estate transactions.

Each of these documents complements the Broker Price Opinion form, creating a more complete picture of the property and its marketability. Together, they facilitate informed decision-making for buyers, sellers, and real estate professionals alike.