Printable Business Bill of Sale Template

Key takeaways

When filling out and using a Business Bill of Sale form, there are several important points to consider. Below are key takeaways that can help ensure the process is smooth and legally sound.

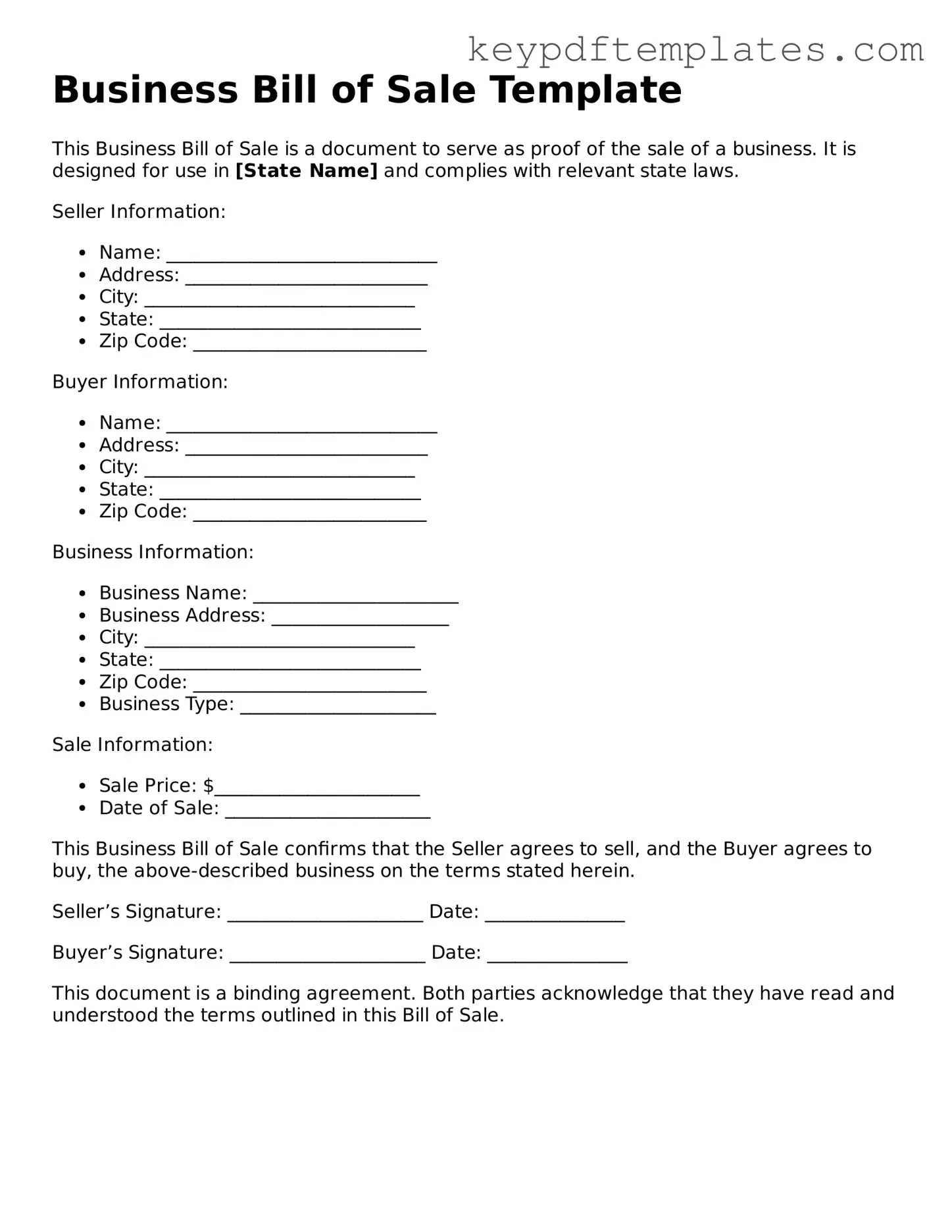

- Identify the Parties: Clearly state the names and addresses of both the buyer and the seller. This establishes who is involved in the transaction.

- Describe the Business: Provide a detailed description of the business being sold. Include relevant information such as the business name, location, and any assets included in the sale.

- Specify the Purchase Price: Clearly indicate the total purchase price of the business. This should be agreed upon by both parties before finalizing the sale.

- Include Payment Terms: Outline the terms of payment. Specify if the payment will be made in full at the time of sale or if there will be installment payments.

- Address Liabilities: Clarify any existing liabilities or debts that the buyer will assume as part of the sale. This protects both parties from future disputes.

- Signatures Required: Ensure that both parties sign and date the form. This formalizes the agreement and makes it legally binding.

Using the Business Bill of Sale form correctly can help prevent misunderstandings and protect the interests of both the buyer and the seller.

Similar forms

- Personal Property Bill of Sale: This document serves a similar purpose by transferring ownership of personal items, such as vehicles or equipment. It provides proof of the transaction and details about the item being sold.

- Real Estate Purchase Agreement: Like the Business Bill of Sale, this agreement outlines the terms of a property sale. It includes details about the buyer, seller, and the property, ensuring that both parties understand their obligations.

- Asset Purchase Agreement: This document is used when one business acquires specific assets from another. It details the assets being sold and the terms of the sale, similar to how a Business Bill of Sale specifies the business assets being transferred.

- Lease Agreement: While primarily used for rental situations, this document can be similar in that it outlines the terms of use for a business property. It clarifies responsibilities and rights, just as a Business Bill of Sale clarifies ownership transfer.

-

Bill of Sale Form: In New York, using a Bill of Sale form is crucial for documenting the transfer of ownership. For more information on this essential document, you can refer to NY PDF Forms.

- Inventory List: This document details the items included in a business sale. It is similar to the Business Bill of Sale in that it provides a comprehensive overview of what is being transferred, ensuring transparency in the transaction.

- Partnership Agreement: This document outlines the terms of a partnership, including ownership stakes and responsibilities. While it serves a different purpose, it shares the common goal of clearly defining the terms of a business arrangement, much like a Business Bill of Sale does for ownership transfer.

Misconceptions

Understanding the Business Bill of Sale form is essential for anyone involved in buying or selling a business. However, several misconceptions can lead to confusion. Here are ten common misunderstandings about this important document.

- A Business Bill of Sale is only for large transactions. Many believe this form is only necessary for significant sales. In reality, it is useful for any business transaction, regardless of size.

- The form is only needed for the sale of tangible assets. While it does cover physical items, it can also be used for intangible assets like goodwill or intellectual property.

- You don’t need a Bill of Sale if there’s a written contract. Even if a detailed contract exists, a Bill of Sale provides additional proof of the transfer of ownership.

- A verbal agreement is sufficient. Relying on verbal agreements can lead to disputes. A written Bill of Sale clearly documents the transaction and protects both parties.

- The form is only necessary for buyers. Sellers also benefit from having a Bill of Sale, as it serves as evidence of the sale and can help avoid future claims.

- It’s a one-size-fits-all document. Each transaction is unique, and the form should be tailored to reflect the specific details of the sale.

- Once signed, the Bill of Sale cannot be changed. While it is a binding document, any changes must be agreed upon by both parties and documented properly.

- It doesn’t need to be notarized. While notarization is not always required, having the document notarized can add an extra layer of authenticity and protection.

- The Bill of Sale is only relevant at the time of sale. It may also be useful later for tax purposes or if disputes arise, making it a valuable record to keep.

- You can use any format for a Bill of Sale. While there is flexibility, using a standard form ensures that all necessary information is included and reduces the risk of errors.

By dispelling these misconceptions, you can approach the sale or purchase of a business with greater confidence and clarity.

Other Business Bill of Sale Types:

Printable Travel Trailer Camper Bill of Sale Template - This form can be a valuable reference if any issues arise after the sale.

When engaging in a motorcycle transaction in Alabama, it's crucial to have the proper documentation to protect both parties involved. The Alabama Motorcycle Bill of Sale form is a legal document that records the sale and transfer of ownership of a motorcycle in Alabama. This form serves as proof of the transaction between the buyer and the seller, including essential details such as the motorcycle's make, model, year, and the parties involved in the sale. For more information, you can access a free template at Motorcycle Bill Of Sale.

Blank Bill of Sale for Car - Helps ensure a clear record of vehicle ownership change.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | A Business Bill of Sale form is used to document the transfer of ownership of a business or its assets from one party to another. This ensures clarity and legal protection for both the buyer and the seller. |

| State-Specific Requirements | Each state may have specific requirements for a Business Bill of Sale. For example, in California, the governing law is found in the California Commercial Code, which outlines the necessary elements for a valid sale. |

| Key Components | The form typically includes details such as the names of the buyer and seller, a description of the business or assets being sold, the purchase price, and the date of the transaction. |

| Legal Implications | Completing a Business Bill of Sale can protect both parties by providing proof of the transaction. It can also be used in disputes to clarify the terms agreed upon during the sale. |

Documents used along the form

When engaging in the sale or transfer of a business, several documents accompany the Business Bill of Sale to ensure a smooth transaction. Each of these documents serves a specific purpose and helps protect the interests of both the buyer and the seller. Below is a list of common forms and documents often used in conjunction with a Business Bill of Sale.

- Asset Purchase Agreement: This document outlines the terms and conditions for the purchase of specific assets of the business, such as equipment, inventory, and intellectual property.

- Non-Disclosure Agreement (NDA): An NDA protects confidential information shared during negotiations. It prevents either party from disclosing sensitive business details to third parties.

- Employment Agreements: If the sale involves retaining employees, these agreements clarify the terms of employment, including roles, responsibilities, and compensation.

- Motor Vehicle Bill of Sale Form: When dealing with vehicle transactions, refer to our comprehensive guide on Motor Vehicle Bill of Sale requirements to ensure all aspects are legally addressed.

- Lease Assignment: If the business operates from a leased location, this document transfers the lease agreement from the seller to the buyer, ensuring the buyer can continue operations without interruption.

- Financial Statements: These documents provide a snapshot of the business's financial health. They typically include balance sheets, income statements, and cash flow statements, which help the buyer assess the value of the business.

- Due Diligence Checklist: This list outlines the necessary steps and documents needed for the buyer to evaluate the business thoroughly. It ensures that all relevant information is reviewed before the sale is finalized.

- Closing Statement: This document summarizes the final terms of the sale, including the purchase price, any adjustments, and the distribution of funds. It serves as a record of the transaction's completion.

Using these documents alongside the Business Bill of Sale can help facilitate a clear and efficient transaction. Each form plays a vital role in safeguarding the interests of all parties involved, ensuring that the sale is conducted fairly and transparently.