Get Business Credit Application Form

Key takeaways

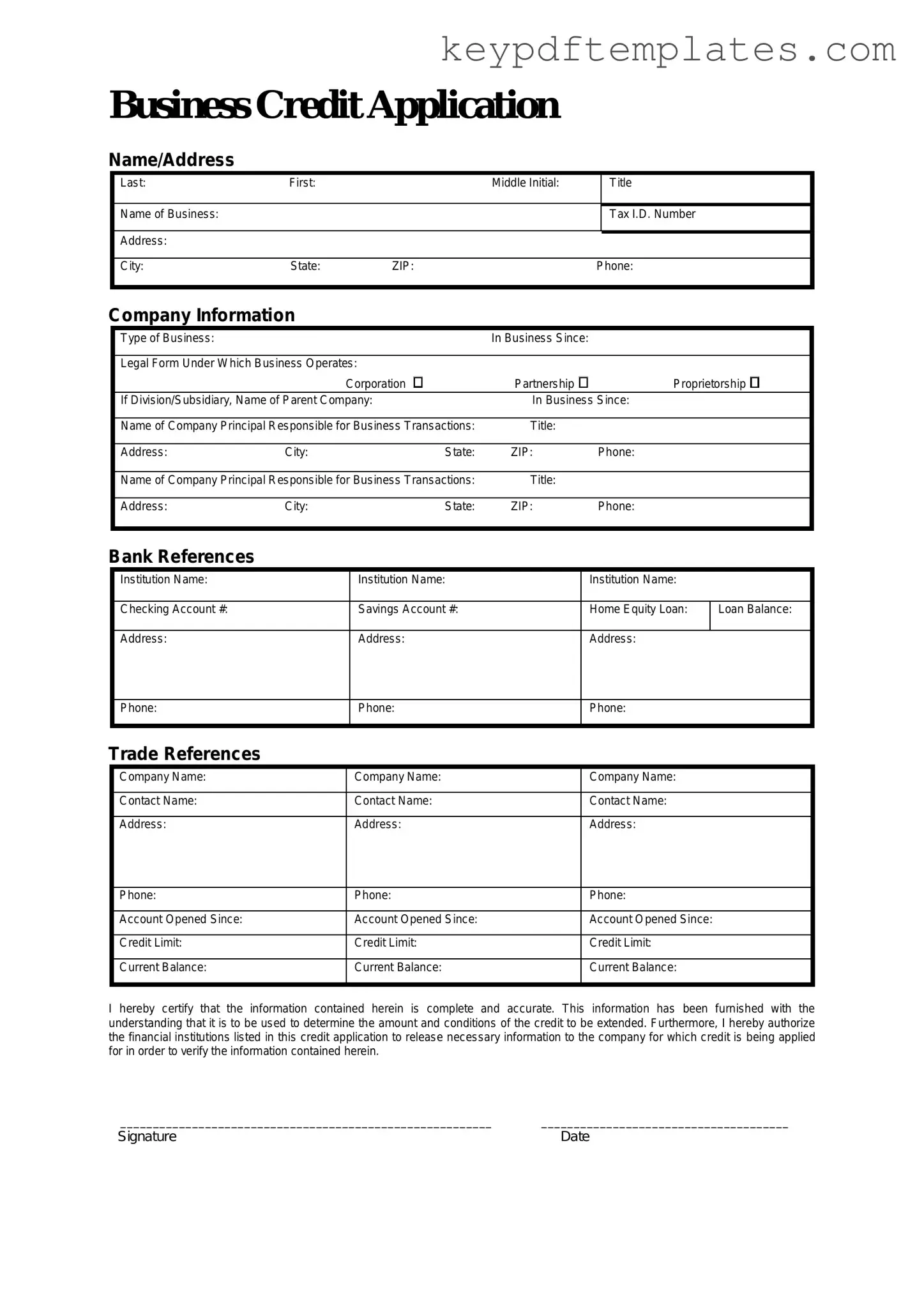

When filling out a Business Credit Application form, it is essential to keep several key points in mind. These takeaways can help ensure that the application process is smooth and efficient.

- Accurate Information: Provide complete and precise information about your business. This includes the legal name, address, and tax identification number. Inaccurate details can lead to delays or denials.

- Financial History: Be prepared to share your business's financial history. This may involve submitting recent financial statements, tax returns, or other relevant documents that demonstrate your creditworthiness.

- Credit References: Include credit references from suppliers or other creditors. These references can help establish your business's credibility and reliability in managing credit.

- Understand Terms: Familiarize yourself with the credit terms being offered. Knowing the interest rates, payment schedules, and any fees associated with the credit can help you make informed decisions.

- Review Before Submission: Always review the application before submitting it. Double-check for any errors or omissions that could affect the outcome of your application.

By following these key takeaways, you can enhance your chances of successfully obtaining business credit. A well-prepared application reflects professionalism and can lead to favorable credit terms.

Similar forms

Loan Application Form: Like the Business Credit Application, a loan application form collects essential information about a business, including financial history and creditworthiness, to assess eligibility for funding.

Vendor Credit Application: This document is used by suppliers to evaluate a business's credit risk. It shares similarities in requiring financial statements and trade references to determine credit limits.

Lease Application: When businesses seek to lease property or equipment, they complete a lease application. This form often asks for similar financial details and business history to assess reliability.

Business Loan Agreement: While this is a contract rather than an application, it follows the same principles by outlining terms based on the financial information provided during the application process.

- Georgia WC-3 Form: As a critical form for workers' compensation claims, the Georgia PDF enables employers or insurers to dispute claims, ensuring proper communication with the State Board of Workers' Compensation.

Partnership Agreement: This document outlines the terms of a business partnership, often requiring similar disclosures about financial stability and creditworthiness to protect all parties involved.

Personal Guarantee Form: Often required alongside business credit applications, this form holds business owners personally liable for debts, reflecting similar concerns about credit risk.

Business Registration Form: While primarily for legal recognition, this form often requests financial information that can impact credit assessments, making it similar in purpose.

Financial Statement: A business financial statement provides a snapshot of financial health, which is crucial for any credit application process, thus aligning closely with the information sought in a credit application.

Trade Reference Form: This document collects references from other businesses that can vouch for a company’s creditworthiness, similar to the verification processes in credit applications.

Credit Report Authorization Form: This form allows lenders to obtain a business's credit report, paralleling the credit assessment process that begins with the Business Credit Application.

Misconceptions

Many business owners encounter the Business Credit Application form but may not fully understand its purpose or requirements. Here are five common misconceptions:

-

It's only for large businesses.

Many believe that only large corporations need to fill out a Business Credit Application. In reality, businesses of all sizes can benefit from establishing credit. Small businesses often need credit to grow and manage cash flow.

-

Completing the form guarantees approval.

Some assume that submitting a Business Credit Application will automatically lead to credit approval. However, lenders evaluate various factors, including credit history and financial stability, before making a decision.

-

It’s a one-time process.

Many think that once they submit the application, they never have to do it again. In truth, businesses may need to update their applications periodically, especially if there are significant changes in their financial situation or structure.

-

Only financial information is required.

Some applicants believe that only financial data matters. While financial information is crucial, lenders also look at business ownership, management experience, and operational details.

-

It’s a lengthy and complicated process.

Many fear that filling out the Business Credit Application is overly complex. While it does require attention to detail, most applications are straightforward and can be completed relatively quickly with the right information at hand.

More PDF Templates

Time Sheets Printable - Follow the guidelines provided when filling out your time card.

Form 6059B Customs Declaration - Travelers should review the current guidelines about what can be brought into the U.S.

For landlords seeking to navigate rental agreements, this valuable resource on the Notice to Quit requirements in Texas can provide essential guidance.

Triple Aaa International License - Complete your application for an Aaa International Driving Permit here.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Business Credit Application form is designed to collect essential information from businesses seeking credit from lenders or suppliers. |

| Required Information | This form typically requires details such as the business name, address, ownership structure, and financial information to assess creditworthiness. |

| State-Specific Regulations | In some states, the application may be governed by laws related to commercial transactions, such as the Uniform Commercial Code (UCC), which provides a framework for credit agreements. |

| Impact on Credit Decisions | Accurate and complete information on the form can significantly influence a lender's decision regarding the approval of credit, impacting the business's financial opportunities. |

Documents used along the form

When applying for business credit, several forms and documents often accompany the Business Credit Application. Each of these documents plays a crucial role in establishing a comprehensive understanding of your business's financial health and creditworthiness. Below is a list of these essential forms and documents.

- Personal Guarantee: This document is a commitment from an individual, usually a business owner, to repay the debt if the business fails to do so. It provides additional security to lenders.

- Business Plan: A detailed plan outlining the business's goals, strategies, and financial projections. This document helps lenders assess the viability and potential growth of the business.

- Financial Statements: These include the balance sheet, income statement, and cash flow statement. They provide a snapshot of the business's financial position and performance over a specific period.

- Tax Returns: Providing personal and business tax returns for the past few years helps lenders verify income and assess the overall financial health of the business.

- Bank Statements: Recent bank statements give lenders insight into the business's cash flow and spending habits. They are often used to assess liquidity and financial stability.

- Bill of Sale for a Trailer: Essential when transferring ownership of a trailer, ensuring all details are documented properly; for more information, refer to the Bill of Sale for a Trailer.

- Trade References: This document lists other businesses or suppliers that the company has worked with, providing insight into payment history and business relationships.

- Business License: A copy of the business license proves that the company is legally registered and compliant with local regulations, which can enhance credibility.

- Articles of Incorporation: For corporations, this document outlines the company's structure and confirms its legal existence. It is essential for establishing ownership and governance.

- Operating Agreement: This is a key document for LLCs that outlines the management structure and operating procedures of the business. It helps clarify roles and responsibilities among members.

Understanding these documents and their purposes can significantly enhance your business's chances of securing credit. Each form provides valuable information that lenders use to evaluate risk and make informed lending decisions. Being prepared with these documents can streamline the application process and improve your business's credibility.