Printable Business Purchase and Sale Agreement Template

Key takeaways

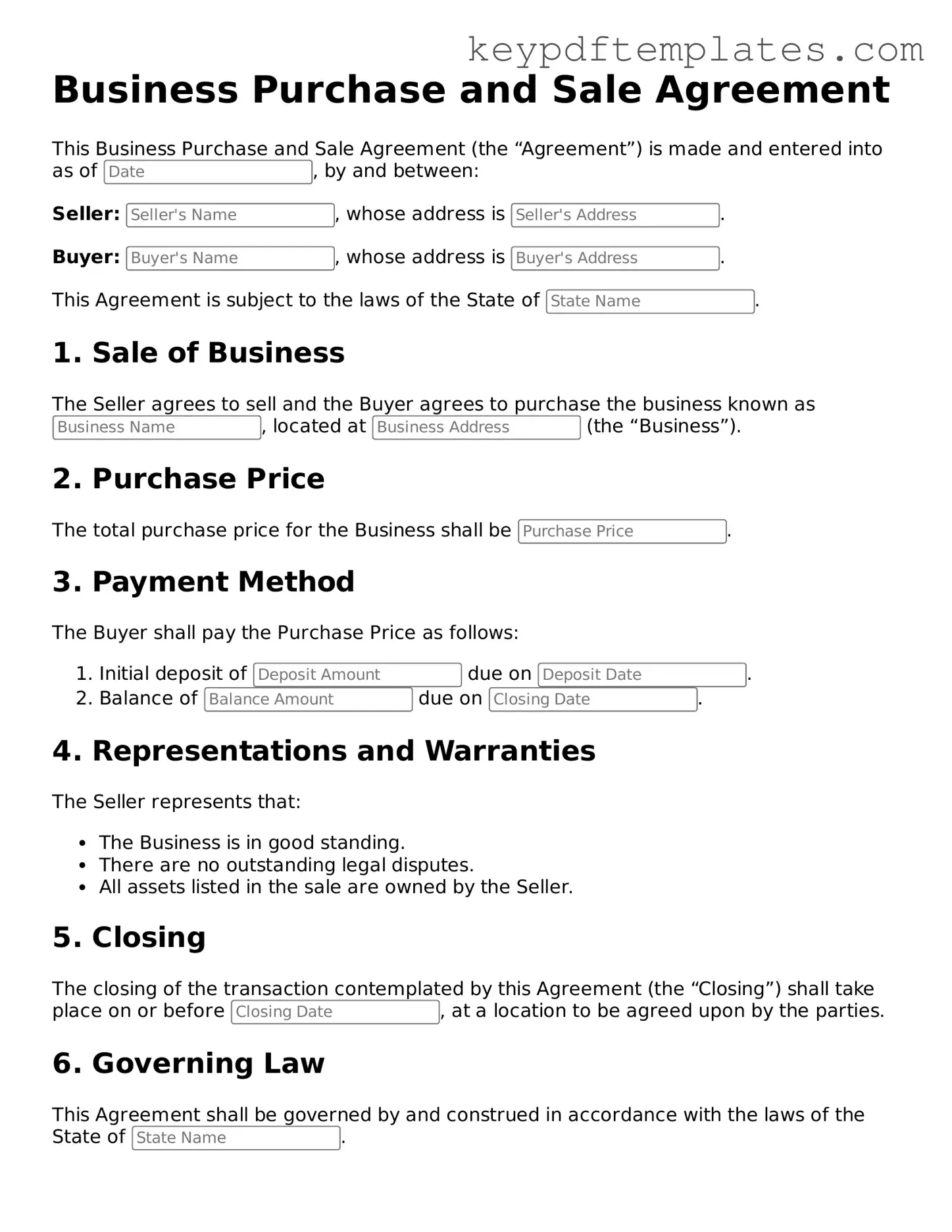

When engaging in the process of buying or selling a business, the Business Purchase and Sale Agreement (BPSA) serves as a crucial document. Below are key takeaways to consider when filling out and utilizing this form:

- Understand the Purpose: The BPSA outlines the terms and conditions of the sale, protecting both parties involved.

- Identify the Parties: Clearly specify the buyer and seller’s legal names and addresses to avoid confusion.

- Define the Business: Provide a detailed description of the business being sold, including assets, liabilities, and any intellectual property.

- Purchase Price: State the total purchase price and the payment terms, including any deposits or financing arrangements.

- Contingencies: Outline any conditions that must be met for the sale to proceed, such as financing approval or inspections.

- Closing Date: Specify the date when the sale will be finalized and ownership will transfer to the buyer.

- Representations and Warranties: Include statements from the seller regarding the business's condition, ensuring the buyer is fully informed.

- Confidentiality: Consider including a clause to protect sensitive information shared during the negotiation process.

- Seek Professional Guidance: Consulting with a lawyer or accountant can provide valuable insights and ensure compliance with relevant laws.

By keeping these takeaways in mind, both buyers and sellers can navigate the complexities of a business transaction more effectively.

Similar forms

- Asset Purchase Agreement: This document outlines the terms for purchasing specific assets of a business rather than the entire business itself. It details what assets are included in the sale and any liabilities that the buyer may assume.

- Stock Purchase Agreement: This agreement is used when a buyer purchases the stock of a corporation. It specifies the shares being sold, the purchase price, and any warranties or representations made by the seller.

- Letter of Intent: A preliminary document that expresses the intention of the buyer to purchase a business. It outlines the basic terms and conditions but is not usually legally binding.

- Confidentiality Agreement: Also known as a non-disclosure agreement, this document protects sensitive information shared during negotiations. It ensures that both parties keep proprietary information confidential.

-

The Georgia WC-100 form is a vital document for initiating mediation in workers' compensation claims, ensuring all parties commit to resolving disputes effectively. For more information, visit Georgia PDF.

- Due Diligence Checklist: This is a list of items and documents the buyer needs to review before finalizing the purchase. It helps ensure that the buyer has all necessary information about the business.

- Operating Agreement: For limited liability companies (LLCs), this document outlines the management structure and operating procedures of the business. It may be relevant in a business sale to clarify how the business will be run post-sale.

- Purchase Agreement for Real Estate: If the business includes real estate, this agreement specifies the terms for purchasing the property. It includes details about the property, price, and any contingencies.

- Bill of Sale: This document serves as proof of the transfer of ownership of tangible assets from the seller to the buyer. It provides a record of the transaction.

- Franchise Agreement: If the business being sold is a franchise, this document outlines the terms of the franchise relationship, including fees, rights, and obligations of both parties.

Misconceptions

Many people have misunderstandings about the Business Purchase and Sale Agreement form. Here are six common misconceptions:

- It is only necessary for large transactions. Many believe that only big businesses need this agreement. However, any business transaction, regardless of size, can benefit from a formal agreement to clarify terms.

- It can be a verbal agreement. Some think that a verbal agreement is sufficient. In reality, a written document is crucial for protecting both parties and ensuring all terms are clear.

- It is a one-size-fits-all document. Many assume that one standard agreement works for all transactions. Each business deal is unique, so it is important to customize the agreement to fit specific circumstances.

- Only lawyers can prepare it. Some people feel that only attorneys can draft this agreement. While legal advice is valuable, many qualified document preparers can assist in creating a comprehensive agreement.

- It covers only the sale price. There is a belief that the agreement only addresses the sale price. In fact, it includes various terms such as payment methods, timelines, and conditions of sale.

- It is not legally binding. Some think that this agreement lacks legal weight. On the contrary, when properly executed, it is enforceable in court, providing legal protection for both parties.

Common Forms

How Many Cells in 96 Well Plate - Manufactured under strict quality controls to ensure reliability.

If you're preparing to sell your vehicle, having the proper documentation is crucial. Ensure your transaction is secure by utilizing a reliable source for your Motor Vehicle Bill of Sale template that outlines everything necessary for both parties involved.

T47 Paralympics - A properly executed T-47 reflects diligence and responsibility on the seller’s part.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions for buying and selling a business. |

| Parties Involved | The agreement typically involves the seller, who is transferring ownership, and the buyer, who is acquiring the business. |

| Asset vs. Stock Sale | The agreement can specify whether the sale involves assets or stock of the business, which affects tax implications. |

| Governing Law | The agreement is governed by state law, which varies by location. For example, in California, the governing law is the California Commercial Code. |

| Purchase Price | The purchase price is clearly stated, including any adjustments or payment terms agreed upon by both parties. |

| Due Diligence | Buyers often have a due diligence period to investigate the business before finalizing the purchase. |

| Representations and Warranties | The seller usually makes representations and warranties regarding the business's condition, financial status, and legal compliance. |

| Closing Date | The agreement specifies a closing date, which is when the ownership officially transfers from the seller to the buyer. |

| Confidentiality | Many agreements include confidentiality clauses to protect sensitive information shared during the sale process. |

| Dispute Resolution | The agreement may outline how disputes will be resolved, whether through mediation, arbitration, or litigation. |

Documents used along the form

When engaging in a business transaction, it is essential to have a comprehensive set of documents to ensure clarity and protection for all parties involved. Below is a list of commonly used forms and documents that often accompany the Business Purchase and Sale Agreement.

- Letter of Intent: This document outlines the preliminary understanding between the buyer and seller regarding the terms of the proposed transaction. It serves as a starting point for negotiations.

- Confidentiality Agreement: Also known as a non-disclosure agreement (NDA), this form protects sensitive information shared during the negotiation process. It ensures that both parties maintain confidentiality.

- Due Diligence Checklist: This is a comprehensive list of items and documents that the buyer needs to review before finalizing the purchase. It helps ensure that all necessary information about the business is considered.

- Asset Purchase Agreement: If the buyer is purchasing specific assets rather than the entire business entity, this document outlines the terms of that transaction, detailing which assets are included.

- Replacement Application: In cases where a business vehicle's registration is lost or damaged, the Texas VTR-60 form is required for obtaining a replacement. For more information, visit https://txtemplate.com/texas-vtr-60-pdf-template/.

- Bill of Sale: This document serves as proof of the transfer of ownership of the business assets from the seller to the buyer. It includes descriptions of the assets being sold.

- Closing Statement: This document summarizes the financial aspects of the transaction at closing. It details the amounts paid, any adjustments, and the final terms agreed upon by both parties.

- Post-Closing Agreement: This agreement may outline any obligations that the seller has after the sale, such as training the new owner or providing ongoing support for a specified period.

Having these documents in place can significantly streamline the business purchase process, providing clarity and reducing the potential for disputes. Each document plays a vital role in ensuring a smooth transaction and protecting the interests of both the buyer and the seller.