Get California Affidavit of Death of a Trustee Form

Key takeaways

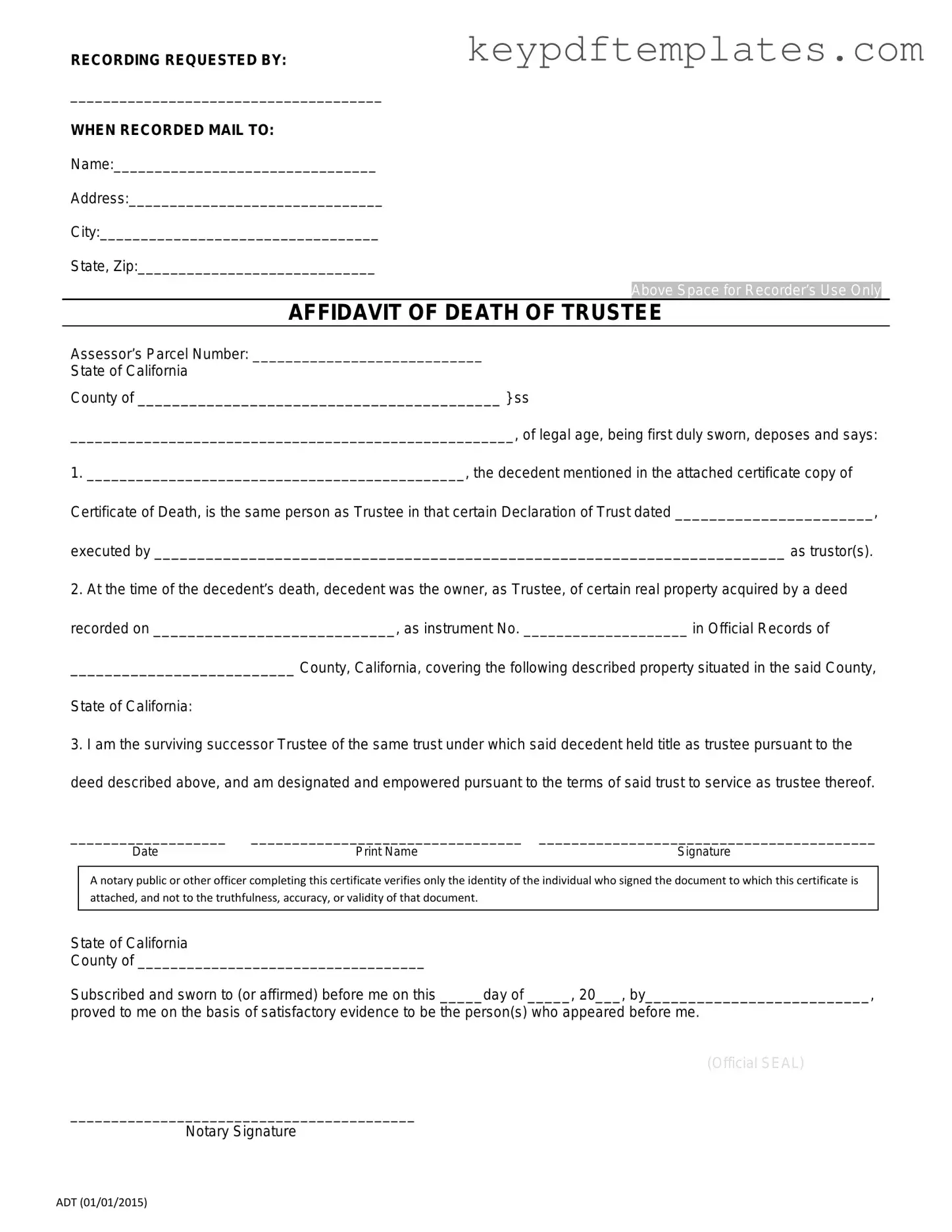

The California Affidavit of Death of a Trustee form is an important document for managing trust affairs after the passing of a trustee. Here are some key takeaways to keep in mind when filling out and using this form:

- The form serves as a legal declaration confirming the death of a trustee.

- It is typically used to transfer the trustee's responsibilities to a successor trustee.

- Ensure that the form is completed accurately to avoid delays in the trust administration process.

- Obtain a certified copy of the trustee's death certificate, as this is often required for the form.

- Include the name of the trust and the date it was created for clarity.

- Both the successor trustee and a witness may need to sign the affidavit.

- Filing the affidavit with the appropriate county recorder’s office is essential for public record.

- Review the trust document to confirm the procedure for appointing a successor trustee.

- Consulting with a legal professional can provide guidance tailored to specific situations.

- Keep copies of the completed affidavit and related documents for your records.

Understanding these points can simplify the process and ensure that the trust is managed according to the deceased trustee's wishes.

Similar forms

- Affidavit of Death: This document serves to confirm the passing of an individual. It is often used in various legal contexts, similar to the Affidavit of Death of a Trustee, to provide proof of death for estate matters.

- Death Certificate: A formal record issued by a government authority, the death certificate is essential for legal processes. It provides official proof of death, just like the affidavit, but is a government-issued document.

- Will: A will outlines how a person's assets should be distributed after their death. While the affidavit focuses on the trustee's death, the will may specify the new trustee or how the trust should be managed going forward.

- Power of Attorney for a Child: This legal document empowers a parent or guardian to delegate decision-making responsibilities to another individual, ensuring that their child's needs are prioritized during emergencies or relocations. To learn more about this essential form, visit Florida PDF Forms.

- Trustee Resignation Form: This document is used when a trustee voluntarily steps down from their role. Similar to the affidavit, it officially records a change in trusteeship but does not necessarily involve death.

- Letter of Administration: This document is issued by a court when appointing an administrator for an estate. It functions similarly to the affidavit by confirming who has the authority to manage the deceased's estate.

- Petition for Probate: This legal request initiates the probate process after someone dies. Like the affidavit, it deals with the deceased's estate but focuses on the court's role in managing the estate's distribution.

Misconceptions

The California Affidavit of Death of a Trustee form is an important legal document, yet several misconceptions surround it. Understanding these misconceptions can help clarify its purpose and use.

- Misconception 1: The form is only needed if the trust is contested.

- Misconception 2: Only the successor trustee can file the affidavit.

- Misconception 3: The affidavit must be filed with the court.

- Misconception 4: The affidavit is a replacement for a will.

This is not true. The affidavit is used to formally acknowledge the death of a trustee, regardless of whether there are disputes about the trust. It serves to update the trust's administration and ensure that the successor trustee can take over their duties smoothly.

While the successor trustee typically files the affidavit, any interested party can do so. This includes beneficiaries or other trustees who may need to act on behalf of the trust.

This is a common misunderstanding. The affidavit does not need to be filed in court; instead, it is usually presented to financial institutions, real estate offices, or other entities where the trust holds assets. This helps facilitate the transfer of control to the new trustee.

This is incorrect. The affidavit of death of a trustee addresses the specific role of a trustee within a trust. It does not replace or serve as a will, which is a separate document that outlines how a person's assets should be distributed after their death.

More PDF Templates

Form 6059B Customs Declaration - It ensures that travelers understand their obligations when entering the U.S.

Alabama Sports Physical Form 2022 - It is essential for protecting both the athlete and the school's interests.

For those looking to navigate the process of gifting property, utilizing a form such as the simple Affidavit of Gift template can streamline the documentation and ensure clarity in your intentions.

Roof Guarantee - This Roofing Warranty Certificate is your key to long-lasting coverage.

Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The California Affidavit of Death of a Trustee form is used to officially document the death of a trustee in a trust. |

| Governing Law | This form is governed by California Probate Code Sections 15640 and 15642. |

| Who Can Use It | Any successor trustee or beneficiary of the trust can complete this form. |

| Filing Requirement | It is not mandatory to file this affidavit with the court, but it may be required by financial institutions. |

| Information Needed | The form requires details such as the deceased trustee's name, date of death, and the trust's name. |

| Signatures | The affidavit must be signed by the successor trustee or a beneficiary. |

| Effect on Trust | Once filed, it allows the successor trustee to manage the trust without delay. |

| Additional Documentation | A certified copy of the trustee's death certificate may need to be attached to the affidavit. |

Documents used along the form

The California Affidavit of Death of a Trustee is a crucial document used in the process of transferring trust property after the death of a trustee. To ensure a smooth transition and proper administration of the trust, several other forms and documents are often utilized alongside this affidavit. Here’s a list of some commonly associated documents:

- Trust Agreement: This document outlines the terms of the trust, including the roles and responsibilities of the trustee and the beneficiaries. It serves as the foundational document for the trust's operation.

- Death Certificate: A certified copy of the deceased trustee's death certificate is typically required to prove the trustee's passing and is often attached to the affidavit.

- Statement of Fact Texas Form: This form is essential in vehicle transactions in Texas. For detailed information, visit https://txtemplate.com/statement-of-fact-texas-pdf-template.

- Notice to Beneficiaries: This document informs all beneficiaries about the trustee's death and the subsequent changes in trust management. It ensures transparency and keeps beneficiaries informed.

- Certificate of Trust: This document can be used to provide evidence of the trust's existence and the authority of the successor trustee without disclosing the entire trust agreement.

- Successor Trustee Acceptance: A written acceptance by the successor trustee confirms their agreement to assume the responsibilities of managing the trust, ensuring clarity in the transition process.

- Beneficiary Designation Forms: These forms may be necessary to update or confirm the beneficiaries of certain assets held within the trust, ensuring that distributions are made according to the trust's terms.

- Property Deeds: If the trust holds real estate, updated property deeds may need to be executed to reflect the change in trusteeship and ensure proper title transfer.

These documents play an essential role in the effective administration of a trust after the death of a trustee. Having them prepared and organized can facilitate a smoother transition and help avoid potential disputes among beneficiaries.