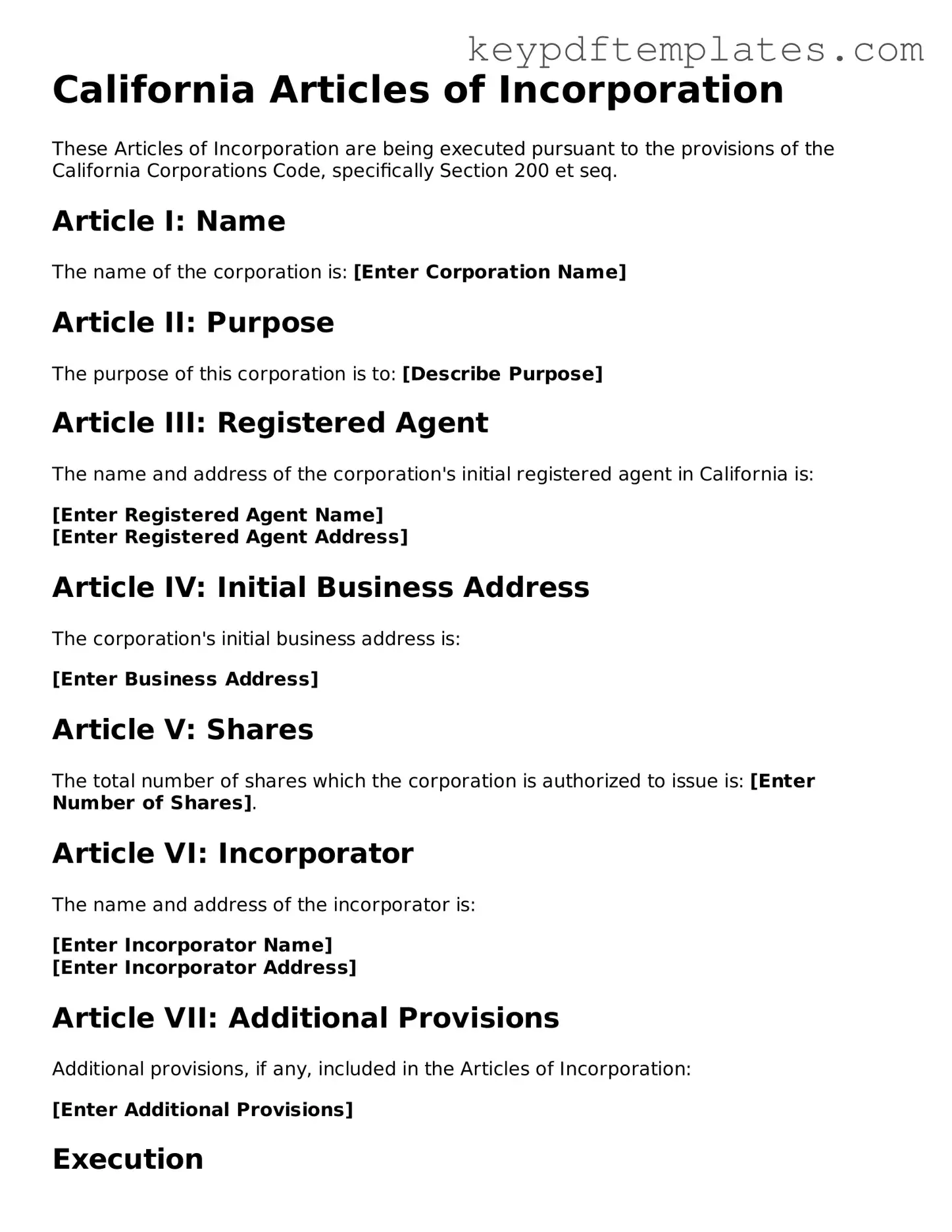

Legal Articles of Incorporation Document for the State of California

Key takeaways

When filling out and using the California Articles of Incorporation form, it’s essential to understand the process and requirements. Here are some key takeaways to keep in mind:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for creating a corporation in California. This document officially establishes your business as a legal entity.

- Choose the Right Name: Your corporation’s name must be unique and not already in use by another entity in California. It should also include a corporate designation such as "Corporation," "Incorporated," or an abbreviation like "Inc."

- Designate a Registered Agent: A registered agent is required for your corporation. This person or business will receive legal documents on behalf of your corporation. They must have a physical address in California.

- Specify the Purpose: Clearly outline the purpose of your corporation in the Articles. While you can use a general statement, being specific can help clarify your business activities.

- Include the Number of Shares: If your corporation will issue shares, indicate the total number of shares authorized to be issued. This is important for stock corporations.

- File with the Right Office: Submit your completed Articles of Incorporation to the California Secretary of State’s office. You can file online, by mail, or in person.

- Pay the Filing Fee: There is a filing fee associated with the Articles of Incorporation. Ensure you check the current fee schedule and include payment with your submission.

- Understand the Processing Time: After filing, processing times can vary. It’s wise to plan ahead, especially if you have specific timelines for launching your business.

- Keep Copies for Your Records: Once your Articles are approved, keep copies of the filed documents. These will be important for future business activities and legal compliance.

By following these key points, you can navigate the process of filing the Articles of Incorporation in California with greater ease and confidence.

Similar forms

- Bylaws: These are the rules that govern the internal management of a corporation. While the Articles of Incorporation establish the corporation's existence, the bylaws outline how it will operate, including the roles of officers and procedures for meetings.

- Operating Agreement: Similar to bylaws but used primarily by limited liability companies (LLCs), this document sets forth the management structure and operational procedures of the LLC, detailing member responsibilities and profit distribution.

- Power of Attorney Form: To ensure your decision-making preferences are respected, consider the comprehensive Power of Attorney form guidelines for both health care and financial matters.

- Certificate of Incorporation: Often used interchangeably with the Articles of Incorporation, this document serves the same purpose of formally establishing a corporation within a specific state, detailing basic information such as the company name and registered agent.

- Partnership Agreement: This document outlines the terms of a partnership, including the roles of each partner, profit-sharing arrangements, and procedures for resolving disputes. Like the Articles of Incorporation, it is foundational for the entity it governs.

- Business License: While not a governance document, a business license is required to operate legally within a jurisdiction. It is similar in that it signifies official recognition of the business's existence and compliance with local regulations.

- Shareholder Agreement: This document is particularly relevant for corporations with multiple shareholders. It details the rights and obligations of shareholders, akin to how the Articles of Incorporation outline the corporation's structure and purpose.

- Certificate of Good Standing: This document verifies that a corporation is authorized to do business and is compliant with state regulations. It is similar to the Articles of Incorporation in that it confirms the corporation's legal status.

- Annual Report: Corporations are often required to file annual reports to maintain their good standing. This document provides updated information about the corporation and is similar in that it reflects the ongoing compliance and operational status of the entity.

- Form 990: Nonprofit organizations must file this informational return with the IRS. Like the Articles of Incorporation, it is essential for establishing and maintaining the legal status of a nonprofit.

- Franchise Agreement: This agreement governs the relationship between a franchisor and a franchisee. It outlines rights and responsibilities, similar to how the Articles of Incorporation define the relationship between the corporation and its stakeholders.

Misconceptions

When considering the California Articles of Incorporation, several misconceptions can lead to confusion for those looking to establish a corporation. Here are five common misunderstandings:

- All Corporations Must Use the Same Form: Many believe that there is a one-size-fits-all form for Articles of Incorporation. In reality, the form can vary based on the type of corporation being established, such as a nonprofit or a professional corporation.

- Filing the Form is the Only Step: Some think that submitting the Articles of Incorporation is the end of the process. However, additional steps, such as obtaining necessary licenses and permits, are often required to fully establish a corporation.

- Anyone Can File the Articles: A common misconception is that any individual can file the Articles of Incorporation without restrictions. In California, the person filing must be an authorized representative of the corporation.

- Articles of Incorporation are Permanent: Many assume that once the Articles are filed, they remain unchanged forever. In truth, corporations may need to amend their Articles if there are changes in structure, purpose, or other significant factors.

- All Information is Public: Some believe that all details in the Articles of Incorporation are accessible to the public. While certain information is public, some details, like the names of initial directors, may not be disclosed depending on the corporation type.

Fill out Popular Articles of Incorporation Forms for Specific States

Articles of Incorporation Sunbiz - Proper drafting can prevent future legal complications.

The Illinois Bill of Sale form serves as a legal document that records the transfer of ownership of personal property from one party to another. This form is essential for both buyers and sellers, as it provides proof of the transaction and details about the item being sold. For those looking to simplify their transaction process, utilizing a Bill of Sale form can streamline the sales process and clarify the terms agreed upon by both parties.

Georgia Secretary of State Forms - Public accessibility of the Articles allows for transparency in corporate governance.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The California Articles of Incorporation form is used to create a corporation in California. It officially establishes the corporation as a legal entity. |

| Required Information | This form typically requires the corporation's name, address, purpose, and information about the initial directors and officers. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation. The fee amount can vary, so it is important to check the current fee schedule. |

| Governing Law | The Articles of Incorporation are governed by the California Corporations Code, specifically Sections 200-220. |

| Submission Method | The completed form can be submitted online, by mail, or in person to the California Secretary of State's office. |

Documents used along the form

When forming a corporation in California, the Articles of Incorporation is just the beginning. Several other documents are often required to ensure compliance with state regulations and to establish the corporation's operational framework. Below is a list of some essential forms and documents that complement the Articles of Incorporation.

- Bylaws: These are the internal rules that govern the corporation's operations. Bylaws outline how meetings are conducted, how decisions are made, and the roles and responsibilities of directors and officers.

- Statement of Information: This document provides the state with updated information about the corporation, including the names and addresses of its officers and directors. It must be filed within 90 days of incorporation and then every two years thereafter.

- Employer Identification Number (EIN): This is a unique number assigned by the IRS for tax purposes. It is necessary for opening a bank account, hiring employees, and filing tax returns.

- Initial Board of Directors Meeting Minutes: After incorporation, the first meeting of the board of directors should be documented. The minutes should include decisions made regarding the corporation's bylaws, the appointment of officers, and other foundational matters.

- Business Licenses and Permits: Depending on the nature of the business, various licenses and permits may be required at the local, state, or federal level. These ensure that the business operates legally within its industry.

- Trailer Bill of Sale: This document is essential for transferring ownership of a trailer in California, ensuring both parties acknowledge the sale details and protecting their interests during the transaction. For reference, you can visit Top Forms Online for the required form.

- Stock Certificates: If the corporation issues stock, stock certificates serve as proof of ownership. They must include specific information, such as the number of shares and the name of the shareholder.

- Shareholder Agreements: While not mandatory, these agreements outline the rights and obligations of shareholders. They can address issues such as the transfer of shares, voting rights, and how disputes will be resolved.

Understanding these documents is crucial for anyone looking to establish a corporation in California. Each plays a significant role in ensuring that the corporation operates smoothly and remains compliant with legal requirements. By preparing these documents thoughtfully, you lay a solid foundation for your business's future.