Get California Death of a Joint Tenant Affidavit Form

Key takeaways

When dealing with the California Death of a Joint Tenant Affidavit form, keep these key takeaways in mind:

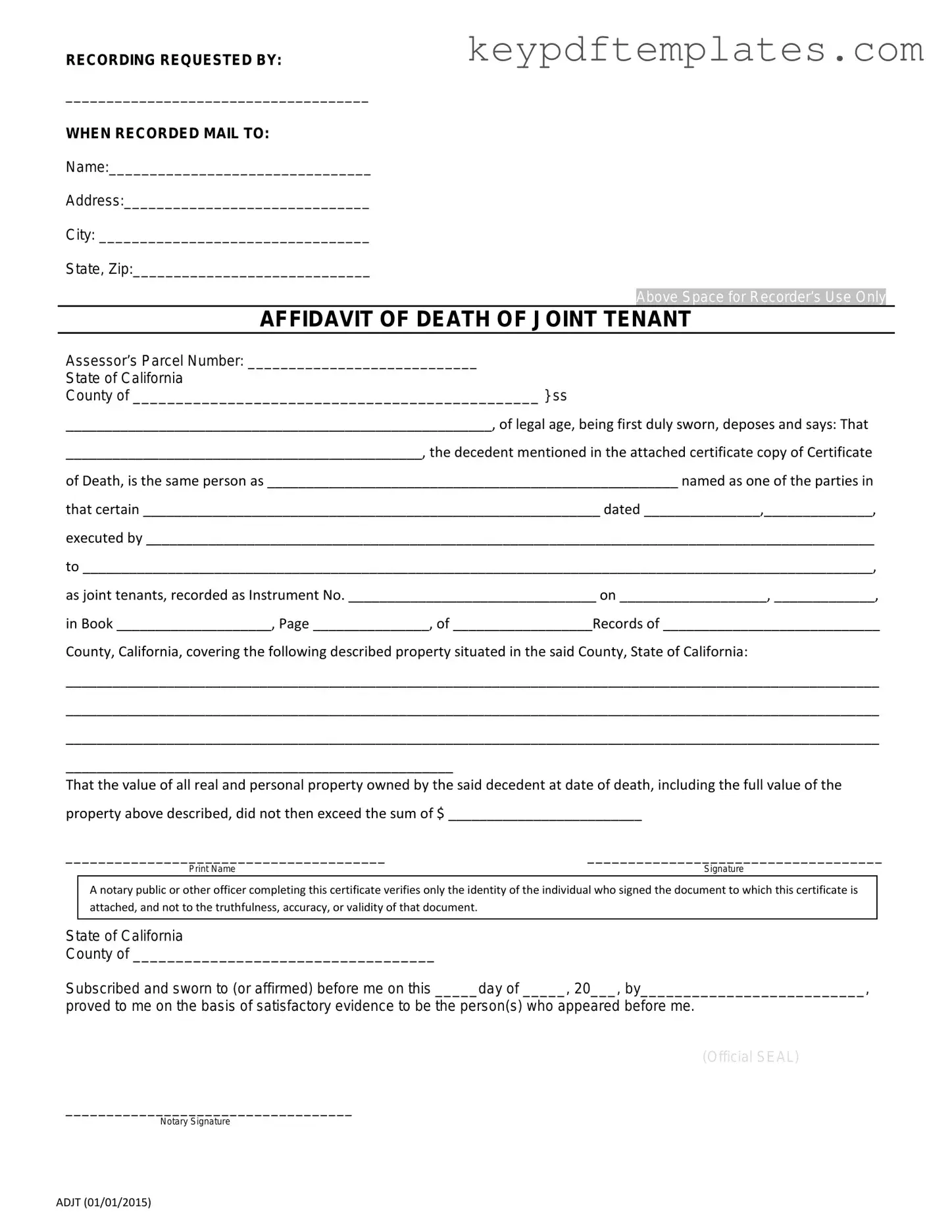

- The affidavit is used to transfer ownership of property when one joint tenant passes away.

- Complete the form accurately, providing necessary details such as the deceased tenant's name, date of death, and property information.

- Sign the affidavit in front of a notary public to ensure its validity.

- File the completed affidavit with the county recorder’s office to officially update property ownership records.

Similar forms

- Affidavit of Death: This document serves a similar purpose by confirming the death of an individual. It is often used to update property titles and ensure that ownership is transferred smoothly to the surviving heirs or joint tenants.

- Grant Deed: A Grant Deed transfers ownership of real property from one party to another. Like the California Death of a Joint Tenant Affidavit, it is essential for formalizing changes in property ownership, particularly after the death of a joint tenant.

- Probate Petition: This legal document initiates the probate process after someone passes away. It addresses the distribution of the deceased's assets, similar to how the California Death of a Joint Tenant Affidavit facilitates the transfer of property rights to surviving tenants.

- Texas Vehicle Purchase Agreement: This legal document outlines the terms of a vehicle sale in Texas, serving as a binding contract for both parties involved. Be sure to read more about the form for further details.

- Living Trust Document: A Living Trust outlines how a person's assets should be managed during their lifetime and distributed after their death. It functions similarly by providing a clear plan for asset distribution, ensuring that the wishes of the deceased are honored.

Misconceptions

When dealing with property ownership and joint tenancy in California, misunderstandings can arise regarding the Death of a Joint Tenant Affidavit form. Here are nine common misconceptions, clarified for better understanding:

- Only the surviving joint tenant can file the affidavit. Many believe that only the surviving tenant has the right to file this affidavit. In reality, any interested party, including heirs, may assist in the process.

- The affidavit is only necessary for real estate. Some think this form applies solely to real property. However, it can also pertain to other jointly held assets, such as bank accounts.

- The affidavit can be filed anytime after the tenant's death. A common misconception is that there’s no deadline. In fact, it’s best to file the affidavit as soon as possible to avoid complications.

- All joint tenants must be present to file the affidavit. Many assume that all joint tenants must sign the affidavit. This is not the case; only the surviving tenant needs to sign it.

- The affidavit automatically transfers ownership. Some people think filing the affidavit guarantees an automatic transfer of ownership. While it facilitates the process, additional steps may be necessary.

- Legal representation is required to file the affidavit. Many believe that hiring an attorney is mandatory. In truth, individuals can file the affidavit on their own if they feel comfortable doing so.

- The affidavit is the same as a will. There’s a misconception that this affidavit serves the same purpose as a will. It does not; it specifically addresses the transfer of ownership upon a joint tenant’s death.

- There is no fee to file the affidavit. Some assume that filing the affidavit is free. However, there may be filing fees depending on the county where it is submitted.

- Filing the affidavit resolves all estate issues. Lastly, many think that this affidavit resolves all estate-related matters. It only addresses the transfer of jointly held property and does not cover other estate issues.

Understanding these misconceptions can help individuals navigate the process more effectively and ensure that their interests are protected.

More PDF Templates

Signs of a Miscarriage Coming - This form facilitates arrangements for private funeral services if desired by the mother.

The Florida Power of Attorney for a Child form is a legal document that allows a parent or guardian to designate another individual to make decisions on behalf of their child. This arrangement can be essential for various situations, such as temporary relocations or emergencies. To ensure that your child's needs are met, consider filling out the form by clicking the button below or visiting Florida PDF Forms for more information.

Parent Consent Form - It establishes the authority of the adult traveling with the minor.

Navpers 1336 3 - The completion of this form is mandatory for processing any request.

Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The California Death of a Joint Tenant Affidavit is used to transfer property ownership when one joint tenant passes away. |

| Governing Law | This form is governed by California Probate Code Sections 5600-5605. |

| Eligibility | Only joint tenants who are named on the title can use this affidavit to transfer ownership. |

| Signature Requirement | The surviving joint tenant must sign the affidavit to validate the transfer of ownership. |

| Documentation | A certified copy of the deceased joint tenant's death certificate must accompany the affidavit. |

| Filing Location | The completed affidavit should be filed with the county recorder's office where the property is located. |

| Effect on Property Title | Once filed, the property title will reflect the surviving joint tenant as the sole owner. |

| Legal Advice | It is advisable to consult an attorney to ensure compliance with all legal requirements when using this form. |

Documents used along the form

When dealing with the passing of a joint tenant in California, various forms and documents come into play. Each of these documents serves a specific purpose in ensuring that the transfer of property rights is handled correctly and efficiently. Below is a list of commonly used forms that accompany the California Death of a Joint Tenant Affidavit.

- Grant Deed: This document is used to transfer ownership of real property from one party to another. In the context of a joint tenancy, it can be used to establish the new ownership structure after one tenant has passed away.

- Certificate of Death: This official document confirms the death of the joint tenant. It is often required to validate the claims made in the Death of a Joint Tenant Affidavit.

- Affidavit of Death of Joint Tenant: Similar to the California Death of a Joint Tenant Affidavit, this document is used to declare the death of a joint tenant and may be required by some institutions to release assets.

- Will: If the deceased tenant left a will, it may outline how their share of the property should be handled. This document can provide clarity on the deceased’s intentions.

- Trust Documents: If the property was held in a trust, the trust documents will dictate how the property is to be managed or transferred upon the death of a joint tenant.

- Durable Power of Attorney: This form allows an individual to appoint someone to manage their financial and legal decisions, even if they become incapacitated. For more details, visit https://allfloridaforms.com/.

- Title Search Report: This report verifies the current ownership of the property and any liens or encumbrances that may affect the transfer of ownership.

- Property Tax Records: These records provide information on the property’s tax status, which can be crucial when transferring ownership and ensuring that taxes are up to date.

- Notice of Death: This document may be filed with the county to officially notify the public and relevant authorities of the joint tenant’s passing.

- Change of Ownership Statement: This form is often required by the county assessor’s office to update property records following a change in ownership due to death.

- Beneficiary Deed: In some cases, a beneficiary deed may be used to designate who will inherit the property upon the death of a joint tenant, simplifying the transfer process.

Understanding these documents and their purposes can greatly ease the process of managing property after the death of a joint tenant. Each form plays a vital role in ensuring that the transfer of ownership is conducted smoothly and legally, protecting the interests of all parties involved.