Legal Deed Document for the State of California

Key takeaways

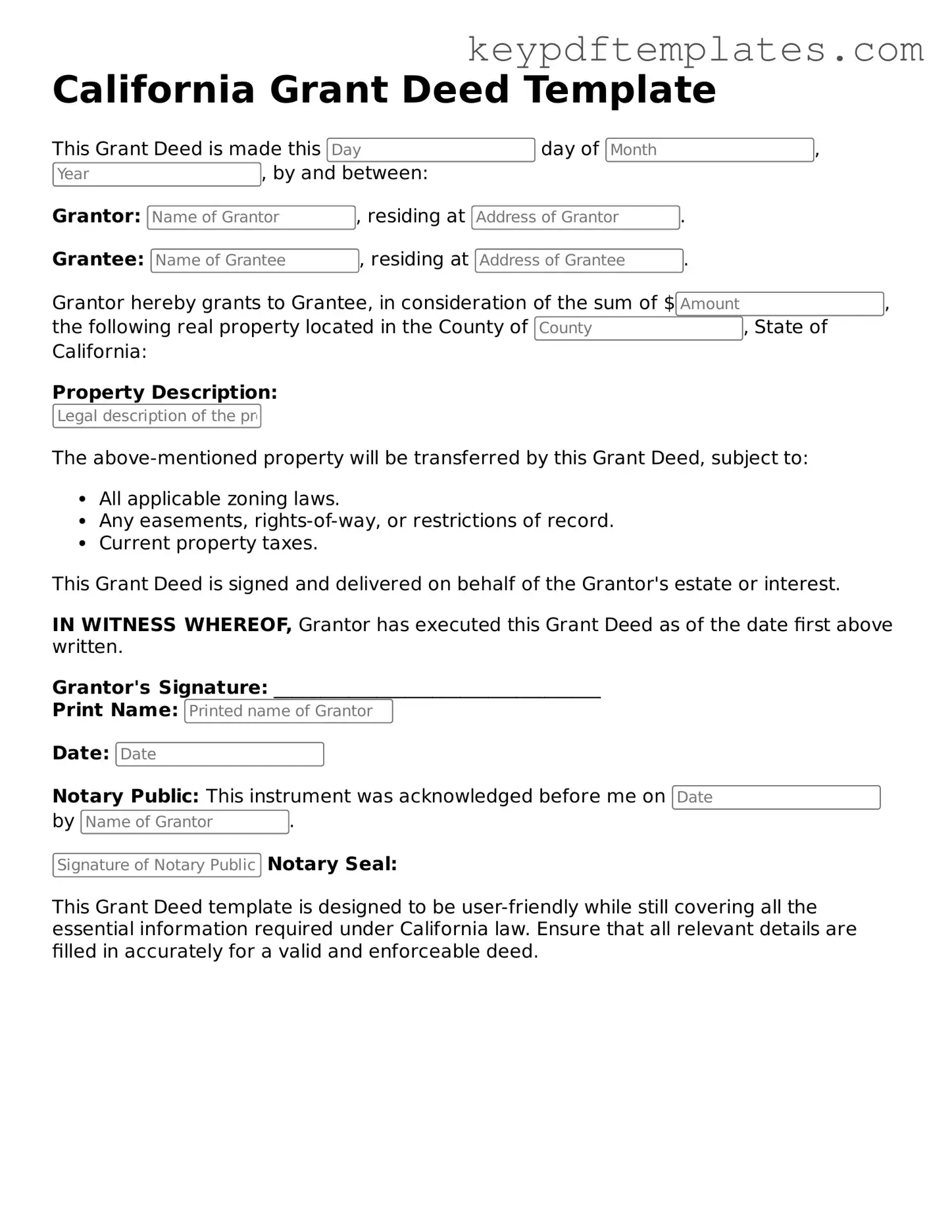

Filling out and using the California Deed form requires attention to detail and an understanding of the necessary components. Here are some key takeaways to consider:

- The California Deed form must clearly identify the grantor (the person transferring the property) and the grantee (the person receiving the property).

- It is essential to include a legal description of the property. This description should accurately reflect the boundaries and features of the property being transferred.

- The form should be signed by the grantor in the presence of a notary public. This step is crucial for the deed to be legally valid.

- After signing, the deed must be recorded with the county recorder's office where the property is located. This process provides public notice of the property transfer.

- Ensure that all information is accurate and complete before submission. Errors can lead to delays or complications in the transfer process.

- Consider including any necessary exemptions or special clauses that may apply to the transfer of the property.

- Be aware of any applicable transfer taxes that may need to be paid at the time of recording the deed.

- Keep a copy of the completed and recorded deed for your records. This document serves as proof of ownership and can be important for future transactions.

Similar forms

- Title Transfer Document: This document serves to transfer ownership of property from one party to another, similar to a deed, which formally conveys property rights.

- Quitclaim Deed: A quitclaim deed transfers any interest the grantor has in a property without guaranteeing that the title is clear, much like a deed, but with less legal protection.

- Last Will and Testament Form: For those looking to outline their estate wishes, our comprehensive Last Will and Testament form guide ensures clarity and legal compliance.

- Warranty Deed: A warranty deed provides a guarantee that the title is clear and free of liens, similar to a deed but with added assurances for the buyer.

- Lease Agreement: This document outlines the terms under which one party rents property from another, much like a deed, as it establishes rights and responsibilities regarding property use.

- Bill of Sale: A bill of sale transfers ownership of personal property, functioning similarly to a deed by formalizing the transfer of ownership.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, similar to a deed in that it can grant rights over property.

- Trust Agreement: A trust agreement outlines how assets are managed for beneficiaries, similar to a deed in that it can dictate the use and control of property.

- Mortgage Document: This document secures a loan with the property as collateral, similar to a deed as it involves property rights and ownership responsibilities.

Misconceptions

Understanding the California Deed form can be challenging, especially with the various misconceptions that surround it. Here are five common misunderstandings that individuals often have:

-

All Deeds Are the Same: Many people believe that all deed forms are interchangeable. However, California has specific types of deeds, such as grant deeds, quitclaim deeds, and warranty deeds, each serving different purposes and offering varying levels of protection.

-

A Deed Automatically Transfers Ownership: It’s a common belief that signing a deed automatically transfers ownership of property. While the deed is a crucial document, it must be properly recorded with the county to be legally recognized as a transfer of ownership.

-

Only a Lawyer Can Prepare a Deed: Some assume that only a licensed attorney can prepare a deed. In California, individuals can prepare their own deeds, provided they follow the legal requirements. However, consulting a professional can help avoid mistakes.

-

Once a Deed is Recorded, It Cannot Be Changed: People often think that once a deed is recorded, it is set in stone. In reality, deeds can be amended or corrected under certain circumstances, allowing for adjustments to be made if errors are discovered.

-

All Deeds Require Notarization: It is a misconception that every deed must be notarized to be valid. In California, while notarization is recommended for certain types of deeds, it is not a strict requirement for all. However, notarization can help ensure the document's acceptance by the county.

By addressing these misconceptions, individuals can better navigate the process of preparing and executing a California Deed form, ensuring a smoother transaction and clearer understanding of property ownership.

Fill out Popular Deed Forms for Specific States

Quit Claim Deed Ga - A deed can also denote any rights or easements associated with the property.

Understanding the significance of a well-drafted Release of Liability document is crucial in ensuring both safety and legal protection during events or activities that carry inherent risks. This form serves to clearly outline the responsibilities of all parties involved, minimizing potential disputes that may arise after an incident.

Florida Deed Form - Age and marital status of the granter may be relevant details.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A California Deed is a legal document used to transfer property ownership in California. |

| Types of Deeds | Common types include Grant Deed, Quitclaim Deed, and Warranty Deed. |

| Governing Law | California Civil Code Sections 880.010 - 883.050 govern deed forms and property transfers. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property). |

| Notarization | Notarization is required for the deed to be legally binding and enforceable. |

| Recording | The deed should be recorded with the county recorder’s office to provide public notice of the transfer. |

| Property Description | A legal description of the property must be included in the deed for it to be valid. |

| Tax Implications | Transfer taxes may apply, depending on the county and the value of the property being transferred. |

Documents used along the form

When transferring property ownership in California, several forms and documents often accompany the Deed form to ensure a smooth and legally compliant transaction. Below is a list of these documents, each serving a specific purpose in the property transfer process.

- Grant Deed: This document is used to transfer real property from one party to another. It guarantees that the property has not been sold to anyone else and that the seller holds the title free of any encumbrances.

- Quitclaim Deed: A quitclaim deed transfers any interest the grantor has in a property without making any guarantees about the title. It is often used between family members or in divorce settlements.

- Preliminary Change of Ownership Report: This form is required by California law when a property changes ownership. It provides information to the county assessor's office for tax purposes.

- Title Insurance Policy: This document protects the buyer and lender against any claims or issues with the property title that may arise after the purchase. It ensures that the title is clear and marketable.

- Georgia Divorce Form: This legal document is essential for initiating the divorce process in Georgia and can be completed by referring to the Georgia PDF.

- Property Transfer Tax Statement: This statement is used to report any transfer taxes due when a property changes hands. It is submitted to the county tax assessor's office along with the deed.

- Affidavit of Death: If the property is being transferred due to the death of the owner, this affidavit serves as proof of death and can help facilitate the transfer process.

- Closing Statement: Also known as a settlement statement, this document outlines all the financial details of the transaction, including costs, fees, and the final sale price.

Understanding these documents is essential for anyone involved in property transactions in California. Each plays a crucial role in ensuring that the transfer is legally sound and that all parties are protected throughout the process.