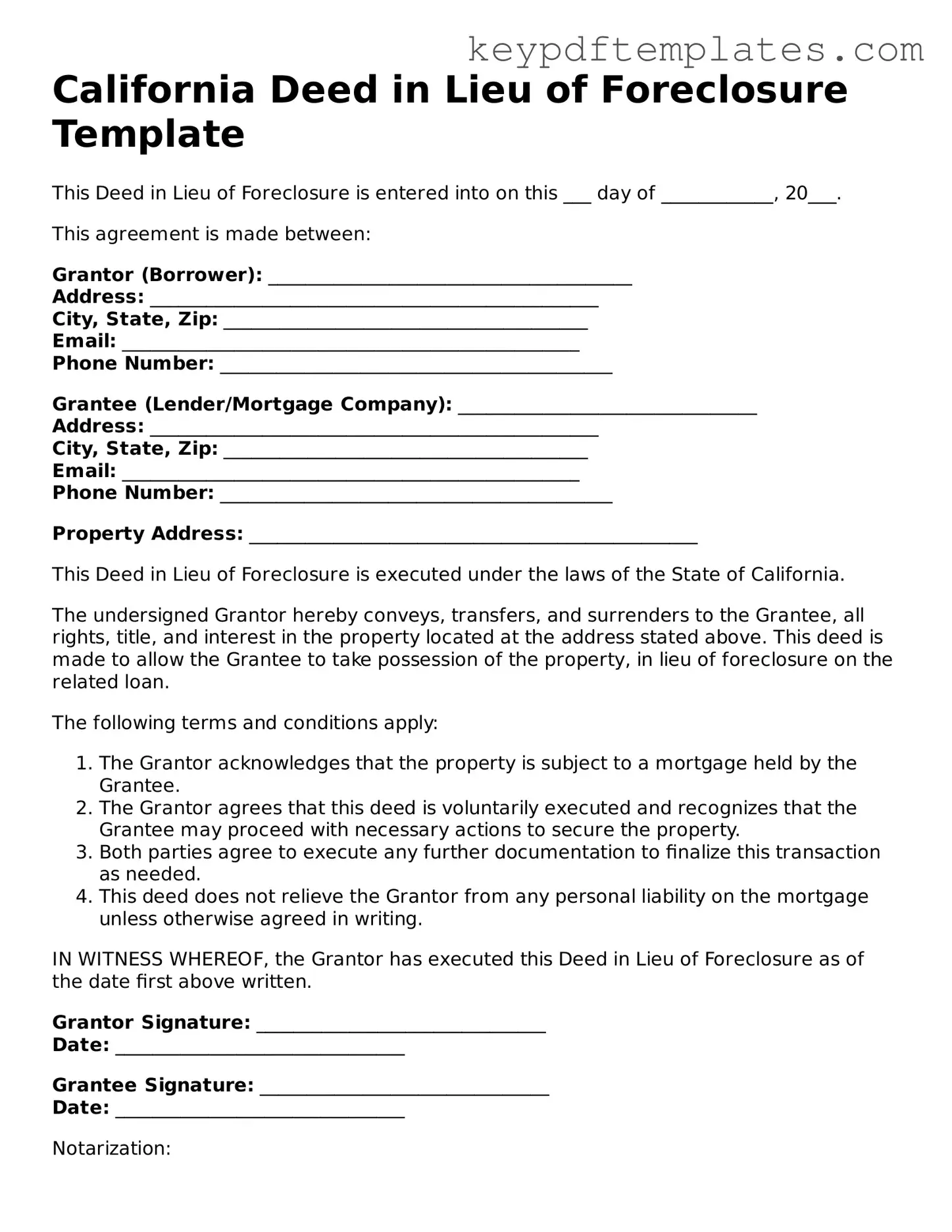

Legal Deed in Lieu of Foreclosure Document for the State of California

Key takeaways

Filling out and using the California Deed in Lieu of Foreclosure form is a significant step for homeowners facing financial difficulties. Here are some key takeaways to consider:

- Voluntary Transfer: A deed in lieu of foreclosure is a voluntary transfer of property from the homeowner to the lender. This can help avoid the lengthy foreclosure process.

- Eligibility Requirements: Not all homeowners qualify for this option. Lenders typically require proof of financial hardship and an inability to keep up with mortgage payments.

- Clear Title: Before submitting the deed, ensure that the property title is clear of other liens. This will facilitate a smoother transaction.

- Legal Implications: Understand that signing a deed in lieu may not absolve the homeowner from all financial obligations. It is crucial to clarify any remaining debts with the lender.

- Consultation Recommended: It is advisable to consult with a legal or financial professional before proceeding. They can provide guidance tailored to individual circumstances.

Similar forms

- Short Sale Agreement: This document allows a homeowner to sell their property for less than what is owed on the mortgage. Similar to a deed in lieu of foreclosure, it helps avoid the lengthy foreclosure process and can minimize damage to the homeowner's credit score.

- Loan Modification Agreement: In this agreement, the lender agrees to change the terms of the mortgage to make it more affordable for the borrower. Like a deed in lieu, it aims to help the homeowner avoid foreclosure by providing a more manageable payment plan.

- Forbearance Agreement: This document is a temporary arrangement where the lender allows the borrower to pause or reduce mortgage payments for a specific period. Both options seek to prevent foreclosure by providing immediate relief to the homeowner.

- Repayment Plan: A repayment plan outlines how a borrower will pay back missed mortgage payments over time. It is similar to a deed in lieu because it aims to help the homeowner keep their property while catching up on payments.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide the homeowner with a chance to reorganize their debts. This option, like a deed in lieu, can offer a way out of financial distress, although it has more significant long-term consequences.

- Property Settlement Agreement: This document is often used in divorce cases where one party is awarded the property. Similar to a deed in lieu, it can facilitate a transfer of ownership to avoid foreclosure if the property is no longer financially manageable for one party.

- Durable Power of Attorney: This legal document allows an individual to appoint another person to make decisions on their behalf, ensuring financial and legal matters are handled according to their wishes. For more information, visit https://allfloridaforms.com/.

- Quitclaim Deed: A quitclaim deed allows a property owner to transfer their interest in the property to another person. While it does not directly prevent foreclosure, it can be used in conjunction with other options to relieve the financial burden on the original owner.

Misconceptions

Understanding the California Deed in Lieu of Foreclosure can be challenging. Here are nine common misconceptions that many people have about this process.

-

It cancels all debts related to the mortgage.

A deed in lieu of foreclosure does not automatically eliminate all debts. It only transfers ownership of the property back to the lender. Homeowners may still be responsible for other debts or obligations.

-

It is the same as a foreclosure.

While both processes involve the lender taking possession of the property, a deed in lieu is typically less damaging to a homeowner's credit score than a foreclosure.

-

Homeowners must be behind on payments to qualify.

Although many homeowners seeking a deed in lieu are struggling, it is possible to initiate this process even if payments are current. Lenders often consider the homeowner's financial situation.

-

The lender must accept the deed in lieu.

Acceptance is not guaranteed. Lenders have specific criteria and may refuse the deed if they believe it is not in their best interest.

-

All types of loans qualify for a deed in lieu.

Not all loans are eligible. Government-backed loans, such as FHA or VA loans, may have different requirements and restrictions.

-

Homeowners can stay in the property after the transfer.

Once the deed is transferred, homeowners typically must vacate the property. The lender will set a timeline for this process.

-

A deed in lieu means the homeowner will not face tax consequences.

Homeowners may still face tax implications from the cancellation of debt. Consulting a tax professional is advisable to understand potential liabilities.

-

It is a quick process.

The process can take time. Homeowners should be prepared for negotiations and potential delays as the lender reviews the situation.

-

All lenders have the same policies regarding deeds in lieu.

Each lender may have different policies and procedures. Homeowners should inquire directly with their lender to understand specific requirements.

By clarifying these misconceptions, homeowners can make more informed decisions regarding their options in difficult financial situations.

Fill out Popular Deed in Lieu of Foreclosure Forms for Specific States

Sample Deed in Lieu of Foreclosure - It requires careful assessment and agreement on any remaining debt after the transfer.

When engaging in vehicle transactions in Texas, it is crucial to provide accurate information through the Statement of Fact Texas form, as it serves as a formal declaration of essential vehicle details. By utilizing this form, you enhance the legality of your transactions and ensure compliance with state regulations. For further assistance, you can refer to the resource available at https://txtemplate.com/statement-of-fact-texas-pdf-template/, which offers guidance on completing this important document.

Georgia Foreclosure - This deed can offer peace of mind for borrowers seeking a non-confrontational exit strategy.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | The process is governed by California Civil Code Section 1475 et seq. |

| Voluntary Action | The borrower must willingly agree to give up the property; it is not forced by the lender. |

| Benefits | This option can help borrowers avoid the lengthy and stressful foreclosure process. |

| Credit Impact | A deed in lieu may have a less severe impact on a borrower's credit score compared to a foreclosure. |

| Deficiency Judgments | In California, lenders may not pursue deficiency judgments after a deed in lieu is executed. |

| Eligibility | Borrowers must demonstrate financial hardship and be unable to continue making mortgage payments. |

| Property Condition | The property must be in good condition, as lenders typically require it to be free of significant damage. |

| Tax Implications | Borrowers should consult a tax professional, as there may be tax consequences related to forgiven debt. |

| Documentation | A formal agreement must be drafted, outlining the terms of the deed in lieu, to protect both parties. |

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer their property back to the lender to avoid foreclosure. This process can be complex, and several other forms and documents are often involved to ensure a smooth transaction. Below is a list of commonly used documents that accompany the California Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines the new terms of the loan if the lender agrees to modify the existing loan instead of proceeding with foreclosure. It may include changes to the interest rate, payment schedule, or loan balance.

- Notice of Default: This is a formal notice that indicates the borrower has failed to meet the mortgage obligations. It is typically the first step in the foreclosure process and alerts the borrower of their default status.

- Quitclaim Deed: This document is used to transfer the property title from the homeowner to the lender. It releases the homeowner's interest in the property but does not guarantee that the lender will take ownership.

- Power of Attorney for a Child: This form allows a parent or guardian to designate another individual to make decisions on behalf of their child during temporary relocations or emergencies. To ensure that your child's needs are met, consider filling out the form by clicking the button below: Florida PDF Forms.

- Release of Liability: This form releases the homeowner from any further obligations under the mortgage after the property has been transferred to the lender. It is crucial for protecting the homeowner from future claims related to the mortgage.

- Property Inspection Report: This report provides an assessment of the property’s condition. Lenders often require this document to evaluate the property’s value and any potential repairs needed before accepting the deed in lieu.

Understanding these documents can help homeowners navigate the process of a Deed in Lieu of Foreclosure more effectively. Each document plays a specific role in protecting the interests of both the homeowner and the lender, ensuring that the transaction is handled properly and legally.