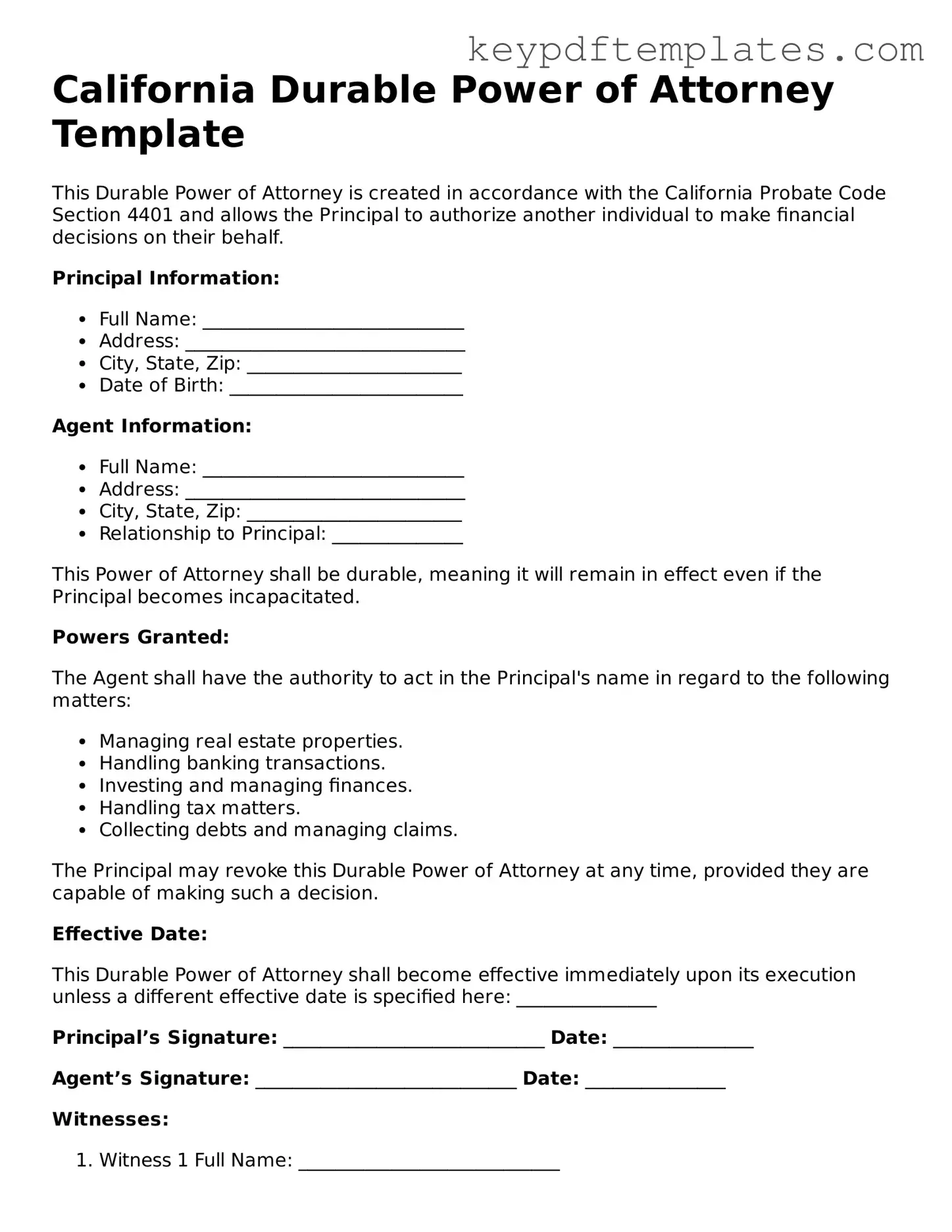

Legal Durable Power of Attorney Document for the State of California

Key takeaways

Filling out and using the California Durable Power of Attorney form is an important step in planning for the future. Here are some key takeaways to keep in mind:

- Understand the Purpose: This document allows you to appoint someone to make financial and legal decisions on your behalf if you become unable to do so.

- Choose Your Agent Wisely: Select a trusted individual who understands your values and will act in your best interest.

- Be Specific: Clearly outline the powers you are granting. You can give broad authority or limit it to specific tasks.

- Sign and Date: Make sure to sign and date the document in front of a notary public or two witnesses, as required by California law.

- Keep Copies: After completing the form, keep a copy for yourself and provide copies to your agent and any relevant institutions.

- Review Regularly: Life changes. Review your Durable Power of Attorney periodically to ensure it still reflects your wishes.

Similar forms

- General Power of Attorney: This document allows an individual to appoint someone to manage their financial affairs, similar to a Durable Power of Attorney, but it becomes invalid if the person becomes incapacitated.

- Healthcare Power of Attorney: This form designates someone to make medical decisions on behalf of an individual if they are unable to do so. Like a Durable Power of Attorney, it grants authority to act in specific situations.

- Living Will: A Living Will outlines an individual's wishes regarding medical treatment in end-of-life situations. While it does not appoint an agent, it complements the Healthcare Power of Attorney by providing guidance.

- Revocable Trust: This legal arrangement allows a person to place their assets in a trust for management during their lifetime and distribution after death. It shares similarities in terms of asset management and control.

- Texas Operating Agreement: To ensure proper governance of your LLC, utilize the essential Texas Operating Agreement guidelines for clear management structure and operational procedures.

- Financial Power of Attorney: This document specifically allows an agent to handle financial matters. It is similar to a Durable Power of Attorney but may not be effective if the principal becomes incapacitated unless stated otherwise.

- Advance Directive: An Advance Directive combines a Living Will and Healthcare Power of Attorney. It outlines healthcare preferences and appoints an agent, similar to the Durable Power of Attorney’s scope.

- Will: A Will outlines how a person’s assets should be distributed after death. While it does not grant authority during life, it serves a similar purpose in terms of asset management and intentions.

- Guardianship Documents: These documents establish a legal guardian for an individual who cannot care for themselves. They share a similar goal of protecting an individual's interests, particularly in cases of incapacity.

Misconceptions

Understanding the California Durable Power of Attorney (DPOA) is crucial for anyone considering this important legal document. However, several misconceptions can cloud people's understanding. Here’s a list of common misunderstandings about the DPOA form in California:

- Misconception 1: A Durable Power of Attorney is only for financial matters.

- Misconception 2: The DPOA becomes effective only when I become incapacitated.

- Misconception 3: I can only appoint one agent.

- Misconception 4: My agent can do anything they want with my assets.

- Misconception 5: A DPOA is permanent and cannot be revoked.

- Misconception 6: I don’t need a DPOA if I have a will.

- Misconception 7: The DPOA is a one-size-fits-all document.

Many believe that a DPOA only covers financial decisions. In reality, it can also grant authority for healthcare decisions, depending on how it is drafted. This means you can specify who makes medical choices for you if you are unable to do so.

While a DPOA is designed to remain in effect if you become incapacitated, it can also be effective immediately upon signing. This allows your agent to act on your behalf right away if you choose.

Some people think they can only choose a single agent. However, California law allows you to appoint multiple agents. You can also designate alternate agents in case your primary choice is unable or unwilling to serve.

Your agent has a fiduciary duty to act in your best interest. They cannot use your assets for personal gain unless you explicitly allow it in the DPOA document. This helps protect your interests.

Many people assume that once a DPOA is signed, it cannot be changed or revoked. In fact, you can revoke or modify your DPOA at any time as long as you are mentally competent. Just be sure to notify your agent and any relevant institutions.

Some believe that having a will is sufficient for managing their affairs. However, a will only takes effect after death, while a DPOA allows someone to manage your affairs while you are still alive but unable to do so yourself.

It’s a common misconception that a DPOA template can be used without any modifications. In reality, each DPOA should be tailored to reflect your specific needs and preferences. Consulting with a legal professional can help ensure it meets your requirements.

Fill out Popular Durable Power of Attorney Forms for Specific States

Durable Power Printable Power of Attorney Form - By completing this document, you are taking an important step to secure your future and wellbeing.

The Texas Motor Vehicle Power of Attorney form allows an individual to grant another person the authority to manage their motor vehicle-related transactions, such as signing titles or registration applications. This form is particularly useful for those who may be unable to handle these matters personally, ensuring that their vehicle-related needs are addressed seamlessly. To simplify this process, one can utilize the Motor Vehicle Power of Attorney form, which helps empower vehicle owners to delegate tasks with confidence.

What Does a Durable Power of Attorney Allow You to Do - This form can also be revoked at any time, provided you are still mentally competent to do so.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A California Durable Power of Attorney allows a person to appoint someone else to make financial and legal decisions on their behalf. |

| Durability | This type of power of attorney remains effective even if the principal becomes incapacitated. |

| Governing Law | The California Probate Code, specifically sections 4000-4545, governs durable power of attorney forms. |

| Principal | The individual who creates the power of attorney is known as the principal. |

| Agent | The person appointed to act on behalf of the principal is called the agent or attorney-in-fact. |

| Revocation | The principal can revoke the durable power of attorney at any time, as long as they are competent. |

| Witnesses and Notarization | California law requires the signature of the principal to be witnessed by two individuals or notarized. |

Documents used along the form

When creating a California Durable Power of Attorney, it is often beneficial to consider additional forms and documents that can enhance your estate planning strategy. These documents can provide clarity, ensure your wishes are followed, and protect your interests in various situations. Below are some commonly used forms alongside the Durable Power of Attorney.

- Advance Healthcare Directive: This document allows you to specify your healthcare preferences in case you become unable to communicate your wishes. It can designate a healthcare agent and outline treatment preferences, ensuring that your medical decisions are made according to your desires.

- Will: A will outlines how your assets should be distributed after your death. It can also name guardians for minor children and specify funeral arrangements, providing peace of mind for you and your loved ones.

- Hold Harmless Agreement: This document protects one party from liability for damages or injuries during an activity or event. For more information on the Georgia Hold Harmless Agreement, visit Georgia PDF.

- Revocable Living Trust: This trust allows you to manage your assets during your lifetime and can facilitate a smoother transfer of those assets upon your death, avoiding probate. It provides flexibility and can help maintain privacy regarding your estate.

- Healthcare Proxy: Similar to an Advance Healthcare Directive, a healthcare proxy specifically designates someone to make medical decisions on your behalf if you are incapacitated. This ensures that your healthcare preferences are respected.

- Financial Power of Attorney: This document grants someone authority to manage your financial affairs. While a Durable Power of Attorney can cover financial matters, this specific form can be tailored to address particular financial transactions or decisions.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for various accounts, such as life insurance policies or retirement accounts. They ensure that your assets are transferred directly to your chosen beneficiaries, bypassing probate.

Incorporating these documents into your estate planning can provide a comprehensive approach to managing your affairs. By addressing various aspects of your life and ensuring that your wishes are clearly articulated, you can protect your interests and provide guidance for your loved ones during difficult times.