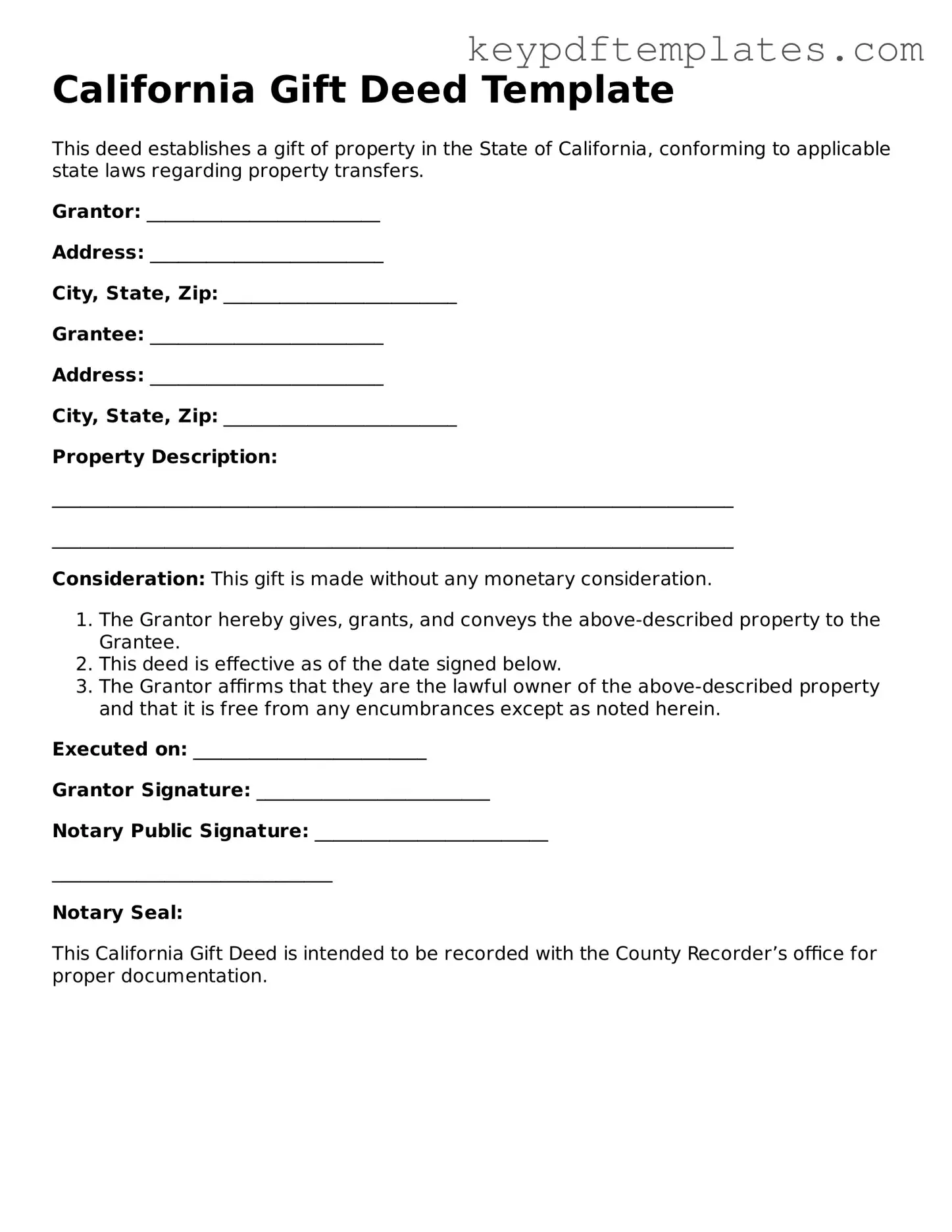

Legal Gift Deed Document for the State of California

Key takeaways

Filling out and using the California Gift Deed form can be a straightforward process if you keep a few key points in mind. Here are some essential takeaways to consider:

- Understand the Purpose: A Gift Deed is used to transfer property ownership without any exchange of money. It’s a way to give real estate to someone else as a gift.

- Complete Information: Ensure that all required fields are filled out accurately. This includes the names of the giver (donor) and receiver (grantee), property description, and the date.

- Consider Tax Implications: Gifting property may have tax consequences for both the giver and receiver. It’s wise to consult a tax professional to understand potential gift tax obligations.

- Signatures Matter: The Gift Deed must be signed by the donor. If the donor is married, the spouse may also need to sign to relinquish any interest in the property.

- Notarization Required: A notary public must witness the signing of the Gift Deed. This step helps to validate the document and ensure its legal standing.

- Recording the Deed: After signing, the Gift Deed should be recorded with the county recorder’s office where the property is located. This step makes the transfer official and protects the grantee’s ownership rights.

- Keep Copies: Always retain copies of the signed and recorded Gift Deed for your records. This documentation can be important for future reference or legal matters.

Similar forms

Quitclaim Deed: This document transfers ownership of property without any warranties. It is often used between family members or in divorce settlements.

Warranty Deed: Unlike a gift deed, this document guarantees that the grantor holds clear title to the property and has the right to transfer it.

Transfer on Death Deed: This deed allows a property owner to designate beneficiaries who will receive the property upon their death, similar to a gift deed but effective after death.

- Florida Quitclaim Deed: A Florida PDF Forms is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees about the property’s title, often utilized in informal transactions.

Bill of Sale: This document transfers ownership of personal property, like vehicles or furniture, rather than real estate, but both serve to transfer ownership.

Lease Agreement: While this document does not transfer ownership, it grants temporary rights to use a property, which can be seen as a form of gifting usage rights.

Power of Attorney: This document allows one person to act on another’s behalf, which can include transferring property, similar to gifting property through a representative.

Deed of Trust: This document secures a loan with real estate, creating an obligation that can resemble a gift if the loan is forgiven.

Real Estate Sales Contract: This contract outlines the terms of a sale, which can be similar to a gift deed in that it transfers property, albeit typically for consideration.

Misconceptions

There are several misconceptions about the California Gift Deed form. Understanding these can help clarify its purpose and use.

- Gift Deeds are only for large gifts. Many believe that Gift Deeds are only necessary for substantial transfers of property. In reality, they can be used for any size gift, regardless of value.

- Gift Deeds require a lawyer. While having legal assistance can be beneficial, it is not a requirement to create a valid Gift Deed. Individuals can complete the form on their own if they understand the process.

- Gift Deeds are only for family members. Some think that Gift Deeds can only be used to transfer property between family members. However, they can be used between friends or any two parties willing to make a gift.

- Once a Gift Deed is signed, it cannot be revoked. This is not true. A donor can revoke a Gift Deed before the transfer is completed, as long as they follow the proper legal procedures.

- Gift Deeds avoid all taxes. While Gift Deeds can help avoid certain taxes, they do not eliminate all tax implications. Gift tax may still apply depending on the value of the gift and other factors.

- All property can be gifted using a Gift Deed. Not all types of property can be transferred with a Gift Deed. For example, some assets like certain business interests may require different legal documentation.

- A Gift Deed automatically transfers ownership. Ownership is not automatically transferred upon signing. The deed must be recorded with the county to finalize the transfer of ownership.

Understanding these misconceptions can help individuals navigate the process of using a Gift Deed in California more effectively.

Fill out Popular Gift Deed Forms for Specific States

Transfer Deed - Creating a Gift Deed is a proactive way to express generosity, while also protecting the donor's interests.

The Texas Certificate of Insurance (COI) form is a critical requirement for Master Plumbers to maintain compliance with state regulations while providing assurance of adequate insurance coverage. By submitting the form, plumbers demonstrate their ability to operate safely and effectively in various specialized plumbing fields. For more detailed information on obtaining this form, you can visit txtemplate.com/texas-certificate-insurance-pdf-template/.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The California Gift Deed is governed by California Civil Code Section 11911. |

| Requirements | The deed must be in writing, signed by the donor, and must clearly identify the property and the recipient. |

| Consideration | No monetary consideration is required for a gift deed, distinguishing it from other types of property transfers. |

| Tax Implications | Gift deeds may have tax implications, including potential gift tax liabilities for the donor. |

| Recording | To protect the interests of the recipient, the gift deed should be recorded with the county recorder's office where the property is located. |

| Revocation | Once executed and delivered, a gift deed is generally irrevocable, meaning the donor cannot take back the gift. |

| Legal Advice | It is advisable to seek legal counsel when preparing a gift deed to ensure compliance with all legal requirements and to understand the implications. |

Documents used along the form

When completing a California Gift Deed, several other forms and documents may be necessary to ensure a smooth transfer of property. These documents help clarify the intent of the gift, provide necessary disclosures, and ensure compliance with state regulations. Below is a list of commonly used forms that accompany the Gift Deed.

- Preliminary Change of Ownership Report: This form must be filed with the county assessor's office when a property changes ownership. It provides important information about the transaction and helps determine property taxes.

- Grant Deed: While a Gift Deed is specifically for transferring property as a gift, a Grant Deed is often used for other types of transfers. It serves as a legal document that conveys ownership and includes warranties regarding the title.

- Property Tax Exemption Claim Form: This document is used to claim an exemption from property taxes for certain transfers, including those made as gifts. It must be submitted to the local tax authority to benefit from potential tax savings.

- Affidavit of Value: This form may be required to declare the value of the property being gifted. It provides transparency and helps establish the fair market value for tax purposes.

- Florida Lottery DOL 129 Form: This essential application is required for retailers looking to sell lottery tickets in Florida. It helps obtain the necessary permits and includes detailed information about the business owners and regulatory compliance. For further details, you can visit allfloridaforms.com/.

- Title Insurance Policy: Although not always mandatory, obtaining title insurance can protect the new owner against any future claims or disputes regarding the property’s title. This document is important for safeguarding the investment.

In summary, these forms and documents work together with the California Gift Deed to facilitate a clear and legally sound transfer of property. Understanding their roles can simplify the process and help avoid potential issues down the line.