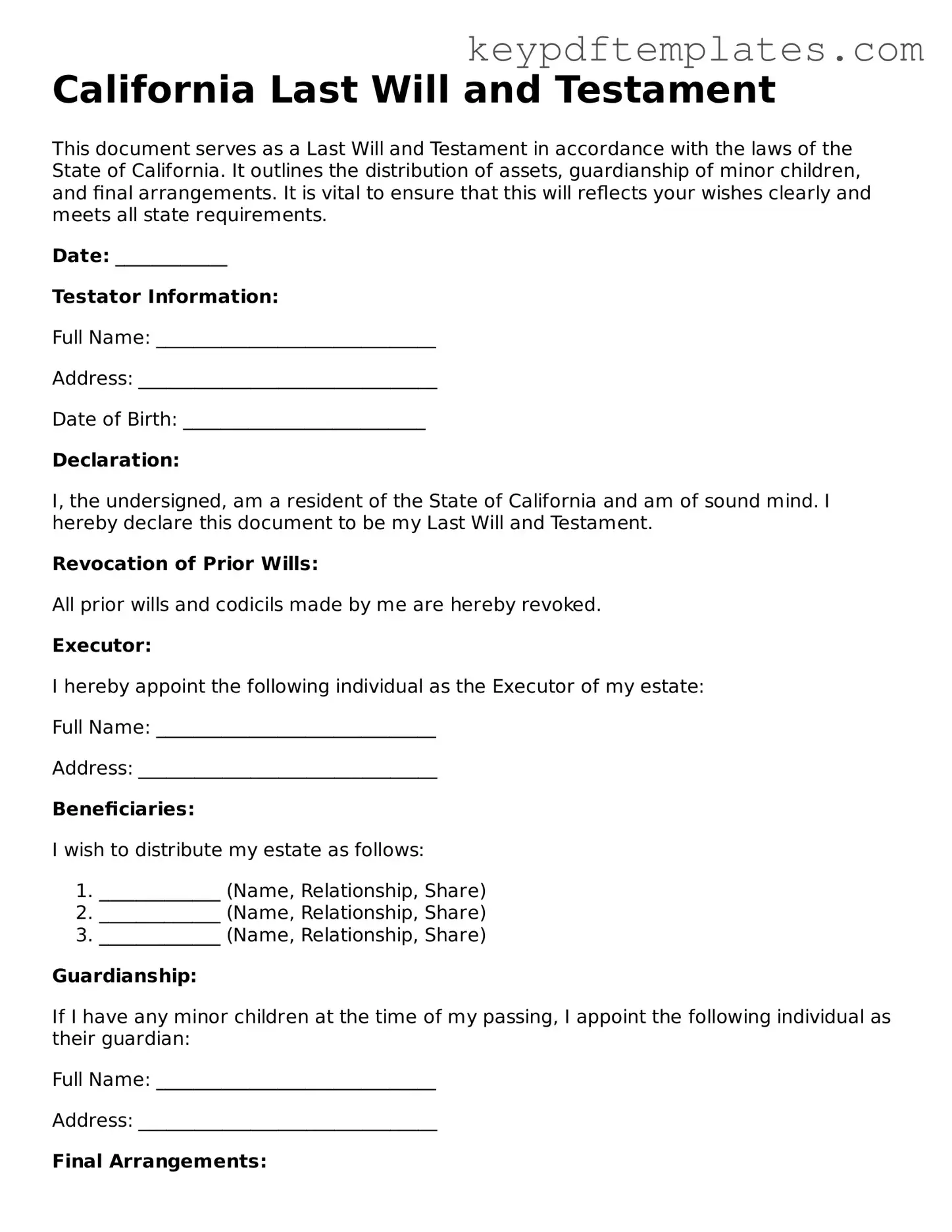

Legal Last Will and Testament Document for the State of California

Key takeaways

When filling out and using the California Last Will and Testament form, consider the following key takeaways:

- Understand the Requirements: Ensure you meet the legal requirements to create a valid will in California. You must be at least 18 years old and of sound mind.

- Be Clear and Specific: Clearly outline your wishes regarding the distribution of your assets. Use specific language to avoid confusion.

- Choose an Executor: Appoint a trustworthy executor who will carry out your wishes. This person should be willing to take on the responsibility.

- Sign and Date the Document: Your will must be signed and dated in the presence of at least two witnesses. They should also sign the document.

- Keep It Safe: Store your will in a secure place, and inform your executor and close family members where it can be found. Regularly review and update it as necessary.

Following these guidelines will help ensure that your wishes are respected and that the process is as smooth as possible for your loved ones.

Similar forms

- Living Will: A living will outlines a person's preferences regarding medical treatment in situations where they cannot communicate their wishes. Like a Last Will and Testament, it reflects an individual's intentions, but it focuses on healthcare decisions rather than asset distribution.

- Power of Attorney: This document allows someone to make financial or legal decisions on behalf of another person. Similar to a Last Will and Testament, it involves the delegation of authority, but it is effective during the individual's lifetime, rather than after death.

- Trust Document: A trust document establishes a legal entity to hold and manage assets for beneficiaries. Like a will, it specifies how assets should be distributed, but it can provide more control and flexibility during and after the grantor's lifetime.

- Advance Healthcare Directive: This document combines a living will and a durable power of attorney for healthcare. It provides instructions for medical care and designates someone to make healthcare decisions. Both documents ensure that a person's wishes are honored when they are unable to communicate.

- Goods Transfer Receipt: This document provides a formal record of the transfer of goods from one party to another. It is essential for ensuring that both parties acknowledge the exchange of ownership and can be referenced in case of disputes. For a comprehensive understanding, refer to the Goods Transfer Receipt.

- Codicil: A codicil is an amendment or addition to an existing will. It allows individuals to make changes without drafting a new will, similar to how a Last Will and Testament can be updated to reflect changing circumstances.

- Letter of Instruction: This informal document provides guidance to loved ones about personal wishes, funeral arrangements, or asset distribution. While it is not legally binding like a will, it serves a similar purpose by conveying an individual's preferences.

- Beneficiary Designation: This document specifies who will receive assets from accounts like life insurance or retirement plans upon death. Similar to a will, it directs the distribution of assets but operates outside the probate process.

- Estate Plan: An estate plan encompasses various legal documents, including a will, trusts, and powers of attorney. Like a Last Will and Testament, it aims to manage and distribute a person's assets according to their wishes, but it takes a broader approach to overall financial and healthcare planning.

Misconceptions

When it comes to creating a Last Will and Testament in California, several misconceptions can lead to confusion. Understanding these common misunderstandings can help you navigate the process more effectively. Here are six misconceptions to clarify:

- A will must be notarized to be valid. Many people believe that notarization is required for a will to be legally binding. In California, a will can be valid without being notarized, as long as it is signed by the testator and witnessed by two individuals.

- Only wealthy individuals need a will. This misconception can prevent many from creating a will. Regardless of your financial situation, having a will is important for ensuring that your wishes are honored and your loved ones are taken care of after your passing.

- Handwritten wills are not valid. Some think that only typed wills are acceptable. In California, handwritten wills, known as holographic wills, can be valid if they are signed by the testator and the material provisions are in their handwriting.

- Once a will is created, it cannot be changed. This is not true. A will can be modified or revoked at any time, as long as the testator is mentally competent. This flexibility allows individuals to adapt their wills to reflect changes in their lives.

- Having a will avoids probate altogether. While a will is a crucial part of estate planning, it does not completely bypass the probate process. A will must go through probate to ensure that debts are settled and assets are distributed according to the testator's wishes.

- All assets will be distributed according to the will. Some people think that a will governs all assets. However, certain assets, such as those held in a trust or with designated beneficiaries, may not be included in the will and will pass outside of probate.

By dispelling these misconceptions, individuals can make informed decisions about their estate planning needs and ensure that their wishes are clearly articulated and legally recognized.

Fill out Popular Last Will and Testament Forms for Specific States

Template for a Will - Ensures that specific personal items are distributed according to personal preferences.

For those navigating the complexities of legal agreements, it's important to familiarize oneself with the Power of Attorney form, which plays a crucial role in ensuring that one's wishes are respected. By designating an agent, as discussed in the https://allfloridaforms.com, individuals can provide clear directives on how their financial and healthcare decisions should be handled during times when they are unable to make those choices themselves.

Simple Will Template Georgia - A statement that safeguards your family's future by clarifying inheritance matters.

PDF Details

| Fact Name | Description |

|---|---|

| Legal Age Requirement | In California, individuals must be at least 18 years old to create a valid Last Will and Testament. |

| Written Document | The will must be in writing. Oral wills are not recognized in California. |

| Signature Requirement | The testator must sign the will, or someone else may sign it in their presence and at their request. |

| Witnesses | California law requires at least two witnesses to sign the will, who must be present at the same time. |

| Governing Law | The California Probate Code, specifically Sections 6100-6320, governs the creation and execution of wills. |

Documents used along the form

In California, the Last Will and Testament is a crucial document for outlining an individual's wishes regarding the distribution of their assets after death. However, several other forms and documents may accompany this will to ensure a comprehensive estate plan. Below is a list of these important documents.

- Living Trust: A legal entity that holds an individual's assets during their lifetime and specifies how they should be distributed after death, often avoiding probate.

- Durable Power of Attorney: This document designates an individual to make financial or legal decisions on behalf of someone else if they become incapacitated.

- Doctors Excuse Note: A Doctor's Excuse Note serves as essential documentation for justifying absences due to health issues. It's particularly important in professional and educational settings. For convenience, you can download an editable document to create your own Doctor's Excuse Note.

- Advance Healthcare Directive: Also known as a living will, this document outlines a person's healthcare preferences and appoints someone to make medical decisions if they are unable to do so.

- Beneficiary Designations: Forms used to specify who will receive certain assets, such as life insurance policies or retirement accounts, directly, bypassing the will.

- Declaration of Trust: A document that provides details about the management and distribution of assets held in a trust, clarifying the responsibilities of the trustee.

- Codicil: An amendment to an existing will that allows for changes or updates without the need to create an entirely new document.

- Affidavit of Heirship: A legal document that establishes the heirs of a deceased person, often used to facilitate the transfer of property when no will exists.

- Estate Tax Return: A tax form that may need to be filed to report the value of the estate and pay any taxes owed to the federal or state government.

- Letter of Instruction: A non-legal document that provides guidance to the executor or family members regarding personal wishes, funeral arrangements, and asset distribution.

- Will Contest Document: A legal document filed to challenge the validity of a will, often initiated by those who believe they have a claim to the deceased's estate.

These documents work in conjunction with the Last Will and Testament to create a thorough estate plan. Each serves a specific purpose, ensuring that an individual's wishes are honored and that their loved ones are taken care of after their passing.