Legal Loan Agreement Document for the State of California

Key takeaways

Filling out and using the California Loan Agreement form requires attention to detail and an understanding of its components. Here are some key takeaways to keep in mind:

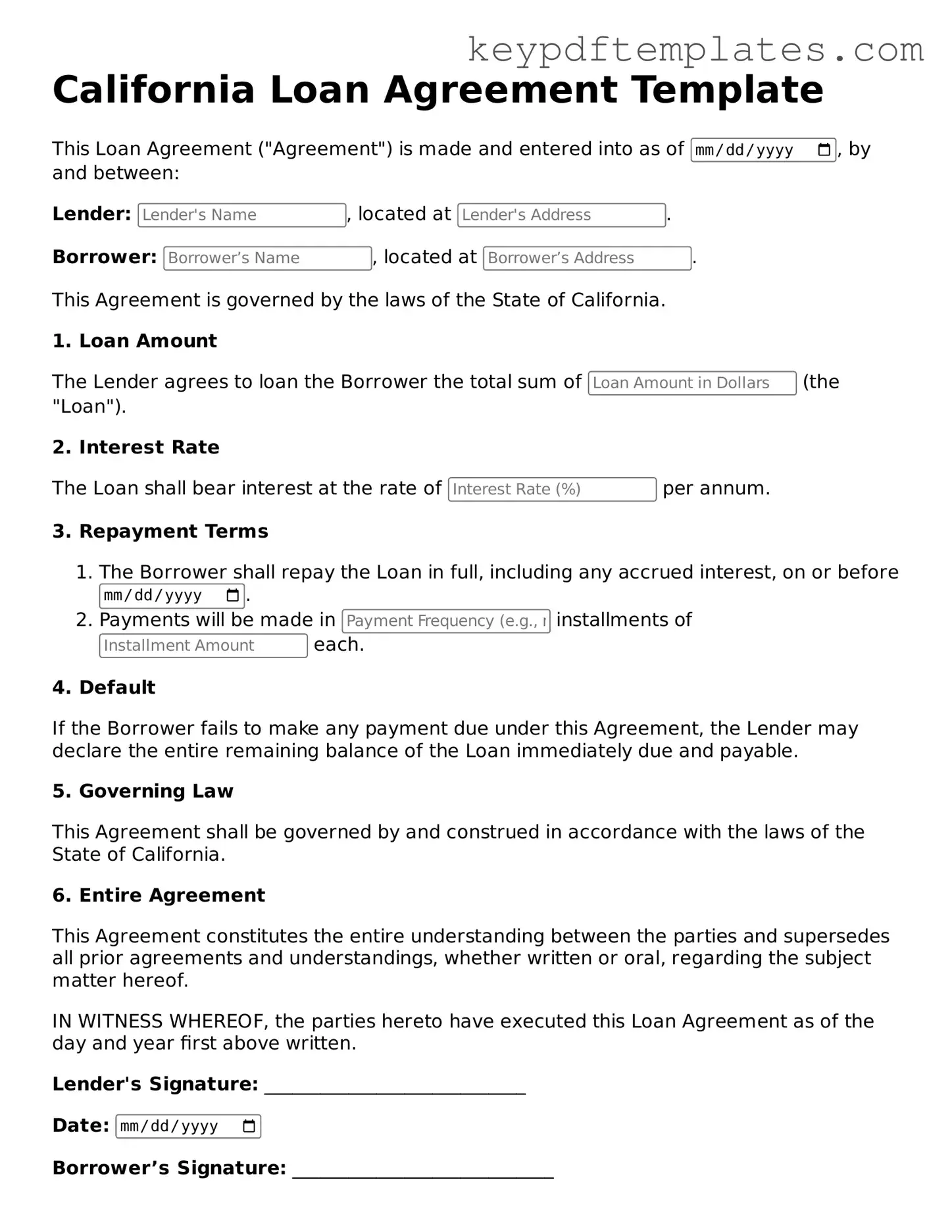

- The form must clearly identify the parties involved, including the lender and borrower, along with their contact information.

- Specify the loan amount and the interest rate. This information is crucial for both parties to understand their financial obligations.

- Include the loan term, which defines how long the borrower has to repay the loan. This can vary widely depending on the agreement.

- Detail the payment schedule, including due dates and the method of payment. Clear terms help avoid misunderstandings.

- Incorporate default terms to outline the consequences if the borrower fails to make payments. This section protects the lender’s interests.

- Both parties should sign the agreement in the presence of a witness or notary. This adds an extra layer of authenticity and can be important in legal disputes.

- Keep a copy of the signed agreement for both parties. Having documentation is essential for future reference.

- Consider consulting a legal professional before finalizing the agreement. This ensures that the terms comply with California laws and protect both parties adequately.

Similar forms

Promissory Note: This document outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. Like a Loan Agreement, it details the repayment schedule, interest rate, and consequences of default.

Mortgage Agreement: A Mortgage Agreement secures a loan with property as collateral. It shares similarities with a Loan Agreement in that both documents define the terms of borrowing and outline the lender's rights if the borrower defaults.

- Trailer Bill of Sale: This essential document ensures the legal transfer of ownership for a trailer, detailing crucial information such as the trailer's identification number and sale price. For more information and to access the form, visit Florida PDF Forms.

Lease Agreement: While primarily for renting property, a Lease Agreement can include terms for financing improvements or equipment. Both agreements stipulate payment terms and responsibilities of the parties involved.

Security Agreement: This document provides a lender with a security interest in personal property. Similar to a Loan Agreement, it specifies the obligations of the borrower and the rights of the lender in case of default.

Credit Agreement: This document outlines the terms under which a borrower can access credit. Like a Loan Agreement, it includes details on interest rates, repayment terms, and potential fees.

Forbearance Agreement: This agreement allows a borrower to temporarily pause or reduce payments due to financial hardship. It resembles a Loan Agreement in its structure and the need for mutual consent on modified terms.

Personal Loan Agreement: This type of agreement is specifically for personal loans between individuals. It contains terms similar to those in a Loan Agreement, including repayment schedules and interest rates.

Business Loan Agreement: Tailored for business financing, this document includes terms related to business loans. It shares the same essential components as a Loan Agreement, such as payment terms and conditions for default.

Installment Agreement: This agreement allows borrowers to pay off a debt in installments over time. It mirrors the Loan Agreement by detailing the repayment schedule and any interest that may apply.

Debt Settlement Agreement: This document outlines an agreement between a debtor and creditor to settle a debt for less than the full amount owed. It includes terms similar to a Loan Agreement regarding payment obligations and timelines.

Misconceptions

Understanding the California Loan Agreement form is essential for both lenders and borrowers. However, several misconceptions can lead to confusion. Below are four common misconceptions explained.

-

All loan agreements are the same.

Many people believe that all loan agreements follow a standard template. In reality, each agreement can vary significantly based on the specific terms negotiated between the parties involved.

-

The California Loan Agreement form is only for large loans.

Some assume that this form is only applicable for substantial amounts. However, it can be used for loans of various sizes, accommodating both small personal loans and larger financial transactions.

-

Signing the form means the loan is guaranteed.

It is a common misconception that signing the agreement guarantees loan approval. In truth, approval is contingent on various factors, including creditworthiness and the lender's policies.

-

Once signed, the terms cannot be changed.

Many believe that the terms of the loan are set in stone once the agreement is signed. In fact, borrowers and lenders can negotiate changes to the terms, provided both parties agree.

Being aware of these misconceptions can help individuals navigate the loan process more effectively and make informed decisions.

Fill out Popular Loan Agreement Forms for Specific States

Loan Agreement Template Georgia - A clear timeline for the loan disbursement is often included.

The Florida Horse Bill of Sale form is a legal document that serves as proof of the sale and transfer of ownership of a horse. This form is essential for both buyers and sellers, as it outlines important details about the horse, including its description and the terms of the sale. By using this form, individuals can ensure a clear and enforceable agreement, protecting their interests in the transaction. For more information, you can visit https://allfloridaforms.com/.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The California Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by California state laws, particularly the California Civil Code. |

| Parties Involved | The form identifies the lender and borrower, ensuring both parties are clearly defined. |

| Loan Amount | The specific amount of money being loaned is explicitly stated in the agreement. |

| Interest Rate | The form details the interest rate applicable to the loan, which must comply with California's usury laws. |

| Repayment Terms | It outlines the repayment schedule, including due dates and the total duration of the loan. |

| Default Clauses | Provisions regarding what happens in the event of default are included to protect the lender. |

| Signatures | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

| Amendments | The form may include a clause on how amendments to the agreement can be made, typically requiring written consent from both parties. |

| Dispute Resolution | It may provide options for resolving disputes, such as mediation or arbitration, to avoid lengthy court battles. |

Documents used along the form

When entering into a loan agreement in California, several additional forms and documents may be necessary to ensure clarity and compliance with legal requirements. These documents help define the terms of the loan, protect the interests of both parties, and provide a clear framework for the transaction.

- Promissory Note: This document outlines the borrower's promise to repay the loan amount, including details about interest rates, repayment schedule, and any penalties for late payments.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what assets are being used as security and the rights of the lender in case of default.

- Disclosure Statement: This document provides important information about the loan, such as the total cost of borrowing, interest rates, and any fees associated with the loan. It ensures transparency for the borrower.

- Loan Application: The borrower typically submits this form to request the loan. It includes personal and financial information that helps the lender assess the borrower's creditworthiness.

- Loan Closing Statement: At the end of the loan process, this statement summarizes the final terms of the loan, including any fees paid at closing, and serves as a record of the transaction.

- Texas Form: This essential document is needed for various legal and administrative tasks in Texas. It's necessary for activities like business registration and personal legal matters. For further details, visit txtemplate.com/texas-pdf-template.

- Personal Guarantee: In some cases, a personal guarantee may be required, where an individual agrees to be personally responsible for the loan if the borrowing entity defaults.

Understanding these documents can help both lenders and borrowers navigate the loan process more effectively. Each form plays a crucial role in ensuring that the terms of the loan are clear and that both parties are protected throughout the transaction.