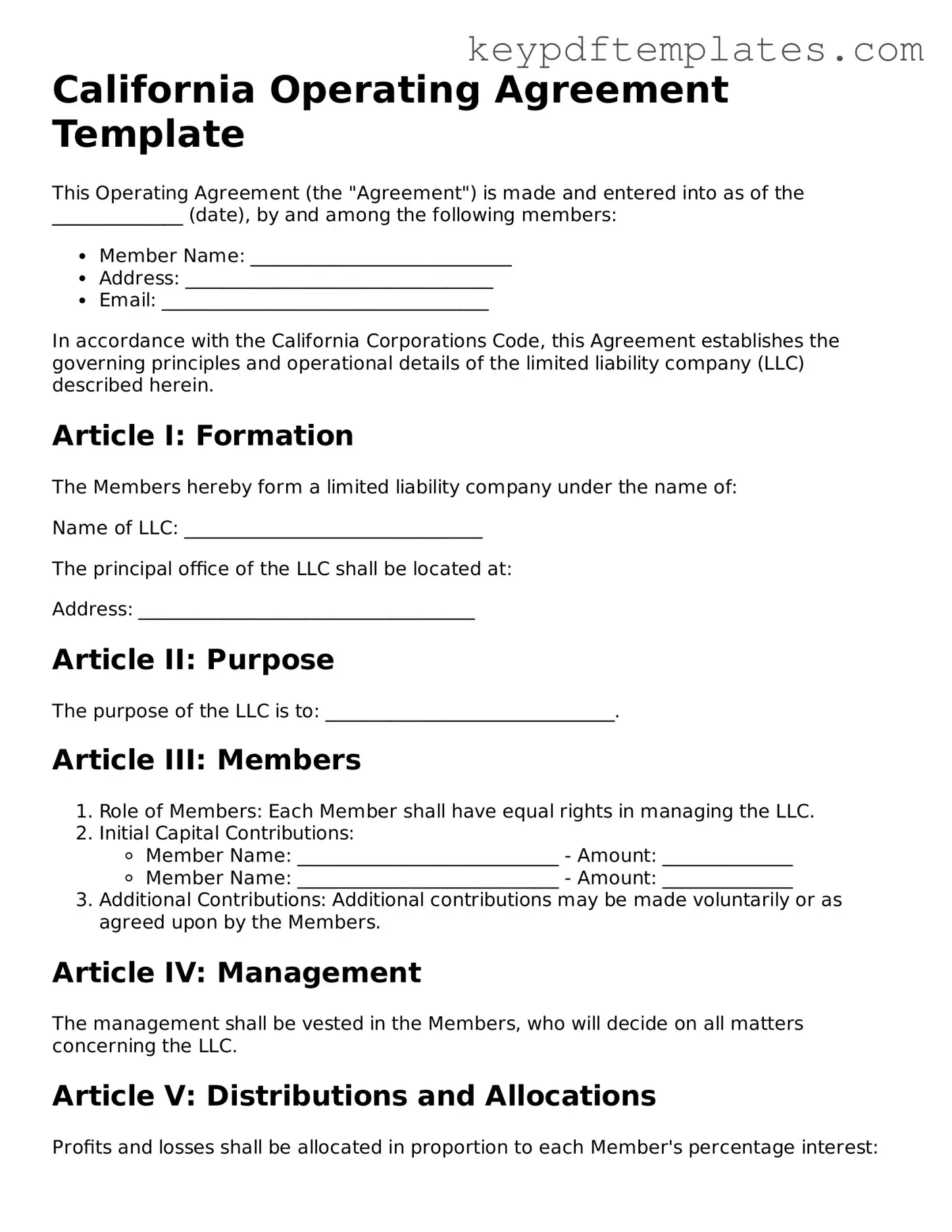

Legal Operating Agreement Document for the State of California

Key takeaways

When filling out and utilizing the California Operating Agreement form, it is important to keep the following key takeaways in mind:

- Clarity of Purpose: Clearly define the purpose and objectives of the business within the agreement. This helps all members understand their roles and responsibilities.

- Member Contributions: Document the contributions of each member, whether financial, material, or service-based. This establishes expectations and accountability.

- Decision-Making Processes: Outline how decisions will be made, including voting rights and procedures. This ensures that all members have a voice in the management of the business.

- Dispute Resolution: Include a method for resolving disputes among members. This can help maintain harmony and prevent potential conflicts from escalating.

Similar forms

- Partnership Agreement: Like an Operating Agreement, a Partnership Agreement outlines the roles, responsibilities, and financial arrangements among partners. Both documents serve to clarify how decisions are made and how profits and losses are shared, ensuring that all parties are on the same page.

- Bylaws: Bylaws govern the internal management of a corporation, similar to how an Operating Agreement governs an LLC. Both documents detail the structure of the organization, including procedures for meetings, voting rights, and the roles of members or directors.

- Shareholder Agreement: This document is akin to an Operating Agreement but is specific to corporations. It outlines the rights and obligations of shareholders, including how shares can be transferred and how disputes are resolved, mirroring the way an Operating Agreement addresses member interactions and ownership stakes.

- Motorcycle Bill of Sale: To properly document your motorcycle transactions, refer to our essential motorcycle bill of sale form guide for important legal clarity and protection.

- Joint Venture Agreement: A Joint Venture Agreement outlines the terms of collaboration between two or more parties for a specific project. Like an Operating Agreement, it specifies the contributions, responsibilities, and profit-sharing arrangements of each party involved, ensuring clarity and mutual understanding.

- Employment Agreement: While primarily focused on the employer-employee relationship, an Employment Agreement shares similarities with an Operating Agreement in that it delineates roles and responsibilities. Both documents aim to establish clear expectations and protect the interests of the parties involved.

Misconceptions

Many people have misconceptions about the California Operating Agreement form. Understanding these misconceptions can help clarify the importance and function of this document. Here are nine common misunderstandings:

-

It's only necessary for large businesses.

Many believe that only large corporations need an operating agreement. In reality, any LLC, regardless of size, benefits from having this document to outline management structure and operational procedures.

-

It's a one-size-fits-all document.

Some think that a standard template will suffice for all LLCs. However, each business has unique needs and circumstances that should be reflected in a tailored operating agreement.

-

It is not legally required in California.

While California does not mandate an operating agreement, having one is highly recommended. It provides clarity and can prevent disputes among members.

-

Members can’t change it once it’s signed.

Many assume that once the operating agreement is signed, it cannot be altered. In fact, members can amend the agreement as needed, provided they follow the procedures outlined within it.

-

It only covers financial matters.

Some individuals think the operating agreement is solely about finances. In truth, it also addresses management roles, voting rights, and procedures for adding or removing members.

-

All members must be equal in decision-making.

People often believe that all members have equal say in decisions. However, the operating agreement can specify different voting rights based on ownership percentages or roles within the company.

-

It is unnecessary if there is a partnership agreement.

Some think that having a partnership agreement eliminates the need for an operating agreement. However, an operating agreement specifically addresses the structure and operations of an LLC, which may differ from a partnership.

-

Verbal agreements are sufficient.

Many believe that a verbal agreement among members is enough. However, having a written operating agreement is crucial for legal protection and clarity.

-

It’s only for internal use.

Some think that the operating agreement is only relevant to members. In reality, it may also be required by banks or investors when seeking financing or partnerships.

Clarifying these misconceptions can help business owners make informed decisions about their LLC's operating agreement. Understanding its purpose and the benefits it offers is essential for effective business management.

Fill out Popular Operating Agreement Forms for Specific States

How to File Operating Agreement Llc - The form encourages a proactive approach to potential business challenges.

For more information on the Georgia WC-14 form and its requirements, you can visit the Georgia PDF website, where you will find helpful resources to assist you in the process of filing your claim accurately.

PDF Details

| Fact Name | Details |

|---|---|

| Purpose | The California Operating Agreement outlines the management structure and operating procedures for a Limited Liability Company (LLC). |

| Governing Law | The agreement is governed by the California Corporations Code, specifically sections related to LLCs. |

| Member Rights | It defines the rights and responsibilities of the members, including voting rights and profit distribution. |

| Customization | The form allows for customization to fit the specific needs of the LLC and its members. |

| Filing Requirement | While the Operating Agreement is not filed with the state, it is recommended for internal use and to clarify member roles. |

| Dispute Resolution | The agreement may include provisions for resolving disputes among members, often through mediation or arbitration. |

| Amendments | Members can amend the Operating Agreement as needed, typically requiring a vote or written consent. |

| Tax Treatment | The agreement can specify how the LLC will be taxed, which may affect member tax liabilities. |

| Effective Date | The Operating Agreement can specify its effective date, which may be upon signing or a later date. |

Documents used along the form

When forming a Limited Liability Company (LLC) in California, several documents may accompany the California Operating Agreement. Each of these documents serves a specific purpose in the establishment and operation of the LLC.

- Articles of Organization: This document is filed with the California Secretary of State to officially create the LLC. It includes basic information such as the LLC's name, address, and the name of the registered agent.

- Member Information: A document that outlines the details of each member involved in the LLC, including their ownership percentages and roles within the company.

- New York ATV Bill of Sale: This document is essential for recording the sale and transfer of ownership of an all-terrain vehicle in New York. For more information, you can visit NY PDF Forms.

- Initial Statement of Information: This form must be filed within 90 days of the LLC's formation. It provides updated information about the LLC, including addresses, management structure, and the names of members or managers.

- Bylaws: Although not required for LLCs, bylaws can be created to establish the internal rules and procedures for the management and operation of the company. They can help clarify roles and responsibilities among members.

- Membership Certificates: These are issued to members to represent their ownership interest in the LLC. While not legally required, they can serve as a formal acknowledgment of membership.

These documents collectively contribute to the proper formation and governance of an LLC in California. Having them in place can help ensure smooth operations and clarify the roles of all parties involved.