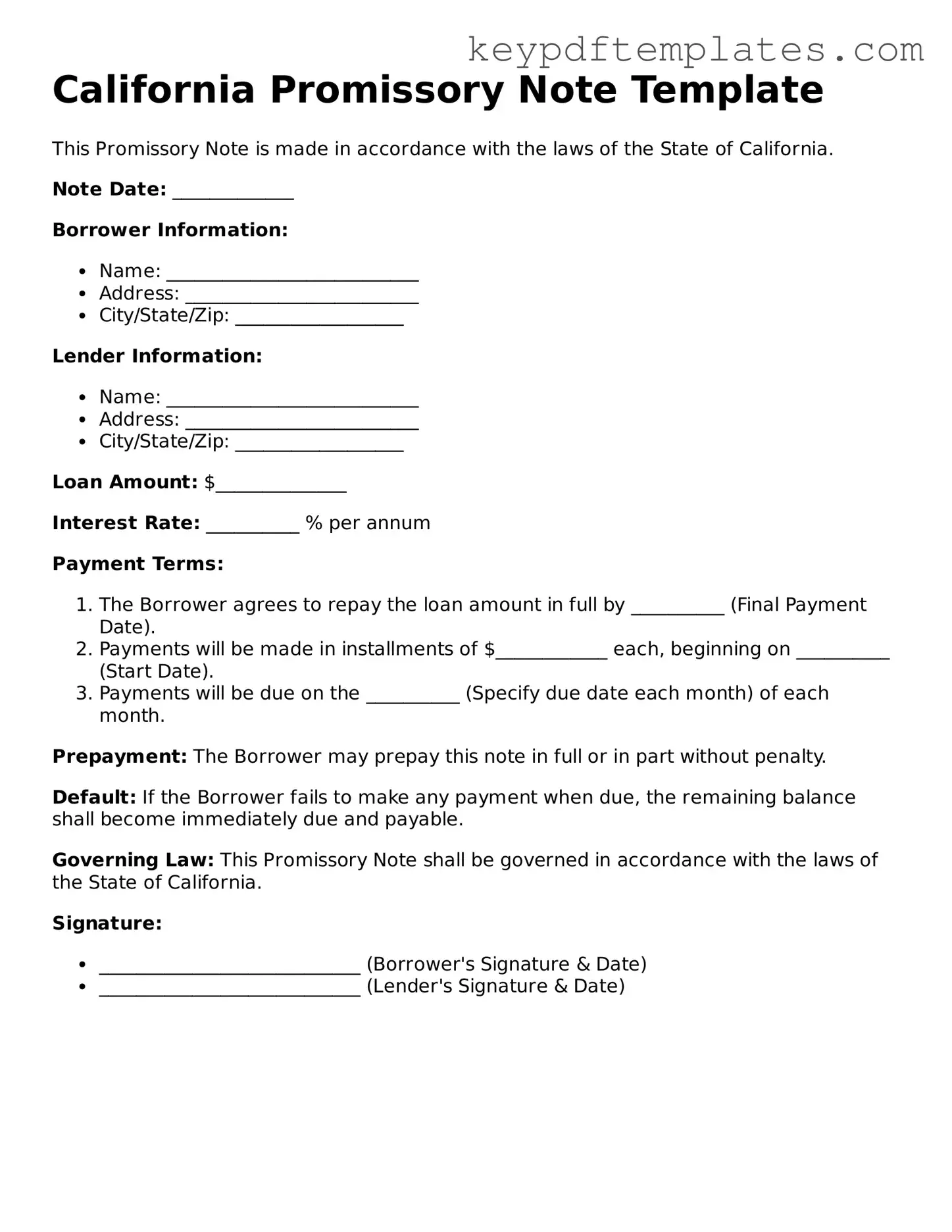

Legal Promissory Note Document for the State of California

Key takeaways

When dealing with a California Promissory Note, it’s essential to understand the key components and implications of this financial document. Here are some important takeaways to consider:

- Clear Terms: Ensure that the terms of the loan are clearly stated, including the principal amount, interest rate, repayment schedule, and any fees. This clarity helps prevent misunderstandings between the borrower and lender.

- Signatures Required: Both parties must sign the promissory note for it to be legally binding. Without signatures, the document lacks enforceability.

- State Compliance: The note must comply with California laws. Familiarize yourself with any specific requirements or regulations that may apply to promissory notes in the state.

- Record Keeping: Keep a copy of the signed promissory note for your records. This document serves as proof of the loan agreement and can be crucial in case of disputes.

Similar forms

A Promissory Note is a financial document that outlines a promise to pay a specific amount of money under agreed-upon terms. Several other documents share similarities with a Promissory Note. Here are four of them:

- Loan Agreement: This document outlines the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. Like a Promissory Note, it serves as a record of the borrower's commitment to repay the lender.

- Release of Liability Waiver: This document protects organizations and individuals from legal liability for injuries or damages that may occur during activities. By signing a Release of Liability Waiver, participants acknowledge the risks involved and agree not to hold the organizer accountable for any incidents.

- Mortgage: A mortgage is a specific type of loan used to purchase real estate. It includes the borrower's promise to repay the loan, similar to a Promissory Note. Both documents establish the borrower's obligation to repay the borrowed amount.

- Credit Agreement: This document details the terms of a credit line or credit card. It specifies the amount of credit extended and the repayment terms. Like a Promissory Note, it creates a binding agreement between the lender and borrower regarding repayment.

- Installment Agreement: This document outlines the terms for repaying a debt in installments over time. It shares similarities with a Promissory Note by detailing the payment schedule and the total amount owed, ensuring both parties understand their obligations.

Misconceptions

Understanding the California Promissory Note form is crucial for both lenders and borrowers. However, several misconceptions can lead to confusion. Here are nine common misconceptions about this important document:

- All Promissory Notes are the Same: Many people believe that all promissory notes are identical. In reality, the terms can vary significantly based on the agreement between the parties involved.

- Only Banks Can Issue Promissory Notes: Some assume that only financial institutions can create promissory notes. In fact, individuals can issue them as well.

- A Promissory Note Must Be Notarized: While notarization can add an extra layer of security, it is not a legal requirement for a promissory note to be valid in California.

- Promissory Notes Are Only for Large Loans: Many think that promissory notes are only necessary for significant sums of money. However, they can be used for any amount, regardless of size.

- Verbal Agreements are Sufficient: Some believe that a verbal agreement is enough. A written promissory note is always preferable as it provides clear evidence of the terms.

- Interest Rates Must Be Specified: While it is common to include interest rates, it is not mandatory. A promissory note can exist without specifying an interest rate.

- Promissory Notes Are Not Legally Binding: This misconception overlooks the fact that a properly executed promissory note is a legally enforceable contract.

- Only One Party Needs to Sign: It is often thought that only the borrower needs to sign the note. Both the borrower and lender should sign to ensure mutual agreement.

- They Are Only Used for Personal Loans: Many people think promissory notes are limited to personal loans. However, they are also used in business transactions and real estate financing.

By clarifying these misconceptions, individuals can navigate the use of California Promissory Notes more effectively and confidently.

Fill out Popular Promissory Note Forms for Specific States

Georgia Promissory Note - It gives borrowers flexibility in managing their repayment plan.

The process of buying or selling property in Texas can be simplified with the use of the Real Estate Purchase Agreement form, which details the essential terms and conditions involved in the transaction, providing clarity and protection for both parties engaged in the agreement.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specific amount of money at a designated time or on demand. |

| Governing Law | The California Civil Code governs promissory notes, specifically Sections 3300 to 3400. |

| Parties Involved | The note involves two main parties: the borrower (maker) and the lender (payee). |

| Interest Rate | California law allows for interest rates to be specified in the note, but they must comply with state usury laws. |

| Enforceability | A properly executed promissory note is legally enforceable in California courts, provided it meets all necessary legal requirements. |

Documents used along the form

A California Promissory Note is a legal document that outlines the terms of a loan between a lender and a borrower. It is important to understand that several other documents often accompany this form to ensure clarity and legal compliance. Below are some common forms and documents that may be used in conjunction with a California Promissory Note.

- Loan Agreement: This document details the terms and conditions of the loan, including the amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive contract between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets that back the loan. It outlines the rights of the lender in case of default by the borrower.

- Disclosure Statement: This document provides the borrower with important information about the loan, including fees, interest rates, and other costs associated with borrowing. It ensures transparency in the lending process.

- Chick Fil A Job Application: The Chick Fil A Job Application form is essential for potential employees, gathering necessary information for employment consideration at the renowned fast-food chain. For those interested in applying, learn more about the application process.

- Personal Guarantee: In some cases, a borrower may provide a personal guarantee, which is a promise to repay the loan personally if the business or entity defaults. This adds an extra layer of security for the lender.

- Amortization Schedule: This schedule breaks down each payment into principal and interest components. It helps borrowers understand how their payments will affect the loan balance over time.

- Default Notice: This document is issued if the borrower fails to meet the terms of the promissory note. It serves as a formal notification of default and may outline the lender's rights and next steps.

These documents collectively help to create a clear understanding between the parties involved in the loan transaction. Having all necessary forms in place can help prevent misunderstandings and provide legal protection for both the lender and borrower.