Legal Quitclaim Deed Document for the State of California

Key takeaways

Understanding the California Quitclaim Deed form is essential for anyone involved in property transfers. Here are some key takeaways to keep in mind:

- Purpose: A Quitclaim Deed is primarily used to transfer ownership of real property without any warranties. This means the grantor is not guaranteeing that the title is clear.

- Who Uses It: This form is often utilized among family members, friends, or in situations where the parties know each other well, as it allows for a simple transfer of property rights.

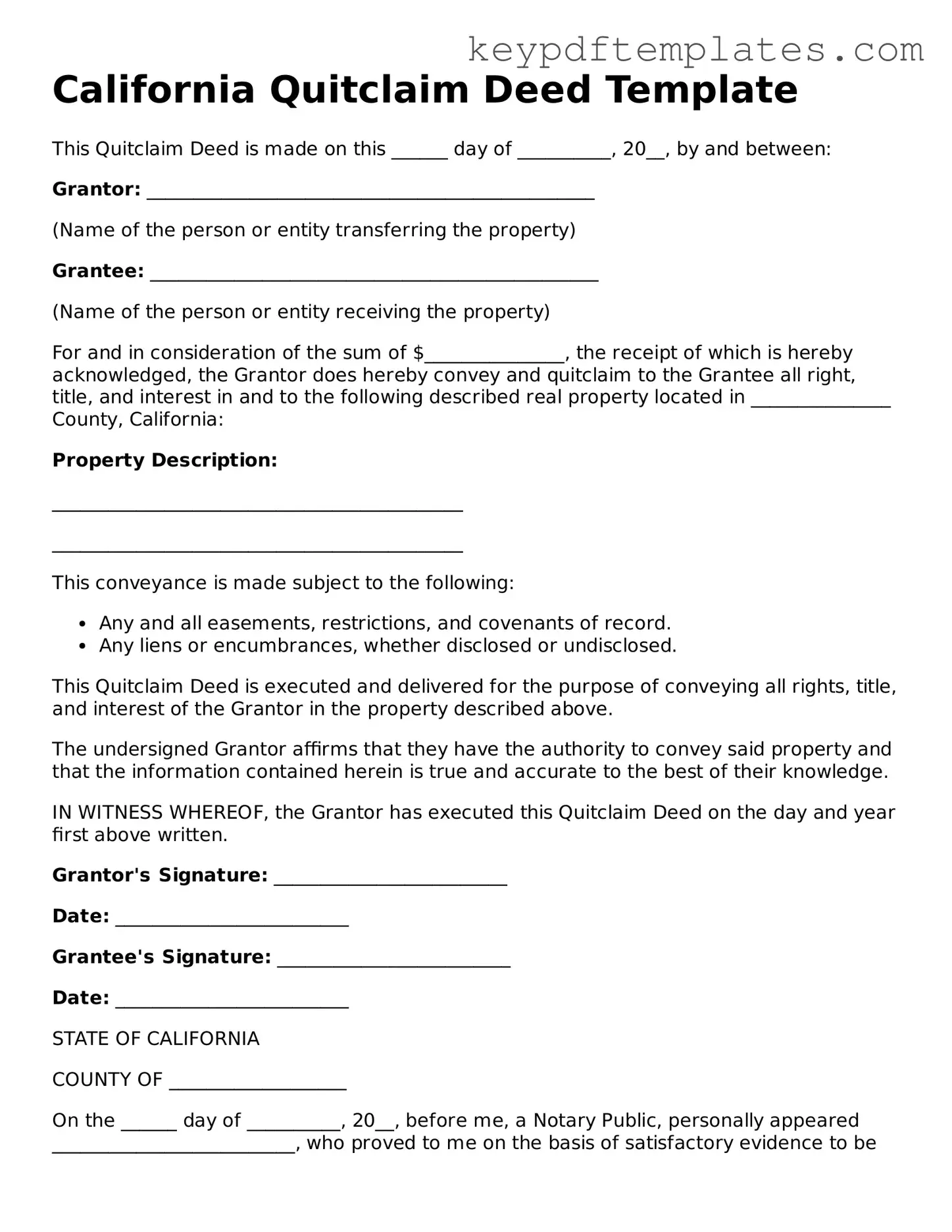

- Filling Out the Form: Ensure that all required fields are completed accurately, including the names of the grantor and grantee, the property description, and the date of the transfer.

- Property Description: The property must be described clearly. This usually includes the address and legal description, which can be found on the property's title or tax records.

- Signatures: The deed must be signed by the grantor. In California, the signature must be notarized to be legally binding.

- Recording the Deed: After filling out and signing the Quitclaim Deed, it should be recorded with the county recorder's office where the property is located. This step is crucial for public notice.

- Tax Implications: Be aware that transferring property may have tax implications. Consult with a tax professional to understand any potential consequences.

- Limitations: A Quitclaim Deed does not remove any liens or debts associated with the property. If there are outstanding obligations, the grantee may still be responsible.

- Legal Advice: While the form is straightforward, seeking legal advice can be beneficial, especially in complex situations or when significant assets are involved.

By keeping these points in mind, you can navigate the process of using a California Quitclaim Deed more effectively. Always approach property transfers with care and consideration for all parties involved.

Similar forms

- Warranty Deed: This document guarantees that the grantor holds clear title to the property and has the right to transfer it. Unlike a quitclaim deed, it provides legal protection against claims from third parties.

- Grant Deed: Similar to a warranty deed, a grant deed conveys property ownership but typically includes fewer guarantees. It assures that the property has not been sold to anyone else and that there are no undisclosed encumbrances.

- Deed of Trust: This document secures a loan by transferring property title to a trustee until the loan is paid off. While it serves a different purpose, it involves the transfer of property rights, similar to a quitclaim deed.

- Chick Fil A Job Application: This form is essential for candidates wishing to join the fast-food chain, gathering vital information necessary for employment consideration. For those interested, you can view and download the form.

- Lease Agreement: While primarily a rental contract, a lease agreement grants the tenant certain rights to the property. Both documents involve the transfer of rights, although a lease is temporary and does not transfer ownership.

- Assignment of Lease: This document allows a tenant to transfer their lease rights to another party. Like a quitclaim deed, it involves the transfer of interests in property, but it does not convey ownership.

- Affidavit of Title: This sworn statement confirms that the seller has clear title to the property. While it does not transfer ownership, it provides assurance similar to that found in a warranty deed.

- Power of Attorney: This legal document allows one person to act on behalf of another in legal matters, including property transactions. It can facilitate the transfer of property rights, akin to a quitclaim deed.

- Property Settlement Agreement: Often used in divorce proceedings, this agreement outlines the division of property. It involves the transfer of property rights, similar to a quitclaim deed, but is typically part of a larger legal settlement.

- Bill of Sale: While primarily used for personal property, a bill of sale transfers ownership from one party to another. It shares the concept of transferring rights, although it typically does not pertain to real estate.

- Real Estate Purchase Agreement: This contract outlines the terms of a property sale. It sets the stage for a future deed transfer, including quitclaim deeds, by establishing the buyer's rights to the property.

Misconceptions

Many people have misunderstandings about the California Quitclaim Deed form. Here are nine common misconceptions:

-

A Quitclaim Deed transfers ownership of property.

This is true, but it only transfers whatever interest the grantor has in the property. If the grantor has no ownership, the recipient receives nothing.

-

A Quitclaim Deed guarantees clear title.

This is a misconception. A Quitclaim Deed does not guarantee that the title is free of liens or other claims. It simply transfers the interest held by the grantor.

-

You need an attorney to complete a Quitclaim Deed.

While it’s advisable to consult with a professional, it is not legally required to have an attorney to fill out or file a Quitclaim Deed.

-

A Quitclaim Deed is only for married couples.

This is false. Anyone can use a Quitclaim Deed to transfer property, regardless of their marital status.

-

A Quitclaim Deed can be used to change names on a title.

This is possible, but it only works if the person is transferring their interest to themselves under a different name. It does not change the ownership structure.

-

Once a Quitclaim Deed is signed, it cannot be revoked.

This is incorrect. A Quitclaim Deed can be revoked or challenged in court, depending on the circumstances.

-

A Quitclaim Deed is the same as a Warranty Deed.

This is a misconception. A Warranty Deed provides more protection to the buyer, ensuring that the title is clear, while a Quitclaim Deed offers no such assurances.

-

Quitclaim Deeds are only for transferring property between family members.

This is not true. Quitclaim Deeds can be used for any transfer of property, whether between family members or unrelated parties.

-

Filing a Quitclaim Deed is a complicated process.

While there are steps to follow, the process is generally straightforward. Many people can complete it without difficulty.

Fill out Popular Quitclaim Deed Forms for Specific States

Georgia Quit Claim Deed - Quitclaim deeds are not suitable for all transactions; they work best in trusted relationships.

When engaging in the sale of a motor vehicle, it is crucial to properly complete the Florida Motor Vehicle Bill of Sale form, as this document serves as legal proof of the transaction. By filling out this form, both the seller and the buyer can clarify important details regarding the vehicle and the sale process. To ensure you have the correct documentation, you can access the necessary form at allfloridaforms.com/, which can facilitate a smooth transition of ownership and help protect the interests of both parties involved in the transaction.

Quit Claim Deed Florida - The form's effectiveness depends on proper execution and recording.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Quitclaim Deed is a legal document used to transfer ownership of real property from one person to another without any warranties. |

| Governing Law | California Civil Code Sections 1091-1098 govern the use of Quitclaim Deeds in California. |

| No Warranty | This deed offers no guarantees about the property’s title. The grantor simply transfers their interest, if any. |

| Common Uses | Quitclaim Deeds are often used in divorce settlements, transferring property between family members, or clearing up title issues. |

| Filing Requirements | The deed must be signed by the grantor and notarized before it can be recorded with the county recorder's office. |

| Tax Implications | Transferring property via a Quitclaim Deed may have tax implications, including potential reassessment of property taxes. |

| Revocation | Once a Quitclaim Deed is executed and recorded, it cannot be revoked unless all parties agree to it. |

| Consideration | Consideration (something of value exchanged) is not required for a Quitclaim Deed to be valid, but it is often included. |

| Legal Advice | While it is not required, seeking legal advice is recommended before executing a Quitclaim Deed to ensure all parties understand their rights. |

| State-Specific Form | California has its own specific form for Quitclaim Deeds, which should be used to ensure compliance with state laws. |

Documents used along the form

When transferring property in California, the Quitclaim Deed is a common document used. However, several other forms and documents often accompany it to ensure the process is smooth and legally sound. Below is a list of these important documents.

- Grant Deed: This document is used to transfer ownership of real property and provides a guarantee that the property has not been sold to anyone else. Unlike a Quitclaim Deed, it offers more protection to the buyer.

- Preliminary Change of Ownership Report: This form is required by the county assessor’s office when property changes hands. It helps assess property taxes based on the new ownership.

- Title Insurance Policy: This document protects the buyer from any future claims against the property. It ensures that the title is clear and that there are no hidden issues that could affect ownership.

- Property Transfer Disclosure Statement (PTDS): Sellers must provide this document to buyers, detailing any known issues with the property. It is crucial for transparency and helps buyers make informed decisions.

- Vehicle Bill of Sale: This form is crucial for documenting the transfer of ownership of a vehicle, and can be found here: Vehicle Bill of Sale, ensuring both parties have proof of the transaction.

- Affidavit of Death: If the property is being transferred due to the death of the owner, this document serves as proof of death and helps facilitate the transfer without going through probate.

Understanding these documents is essential for anyone involved in property transactions. Each serves a unique purpose, ensuring that the transfer of ownership is legally valid and that all parties are protected.