Legal Real Estate Purchase Agreement Document for the State of California

Key takeaways

When engaging in a real estate transaction in California, understanding the Real Estate Purchase Agreement (RPA) form is crucial. This document serves as a foundation for the sale and purchase of property. Here are some key takeaways to consider:

- Accuracy is Essential: Ensure that all information provided in the RPA is accurate. This includes details about the property, the buyer, and the seller. Mistakes can lead to misunderstandings or legal complications.

- Contingencies Matter: The RPA allows for various contingencies, such as financing or inspection conditions. Clearly outline these contingencies to protect both parties and provide an opportunity to withdraw from the agreement if necessary.

- Review Deadlines: Pay close attention to deadlines specified in the RPA. Timely responses and actions are critical to keeping the transaction on track. Missing a deadline can jeopardize the agreement.

- Seek Professional Guidance: It is advisable to consult with a real estate professional or attorney when filling out the RPA. Their expertise can help navigate the complexities of the agreement and ensure that your interests are adequately represented.

Similar forms

Lease Agreement: Similar to a Real Estate Purchase Agreement, a lease agreement outlines the terms under which one party agrees to rent property owned by another. Both documents specify the parties involved, property details, and terms of use, but a lease is temporary while a purchase agreement is for ownership.

Option to Purchase Agreement: This document gives a tenant the right to purchase the property at a later date. Like the purchase agreement, it details the property and terms, but it does not transfer ownership until the option is exercised.

Purchase and Sale Agreement: Often used interchangeably with the Real Estate Purchase Agreement, this document also outlines the terms for buying and selling property. Both documents cover price, contingencies, and closing details.

Joint Venture Agreement: This agreement outlines the terms between two or more parties collaborating on a real estate investment. Similar to a purchase agreement, it details the roles, contributions, and profit-sharing arrangements.

Real Estate Investment Trust (REIT) Agreement: This document governs the operation of a REIT, which allows multiple investors to pool funds for real estate investments. Like a purchase agreement, it includes details on ownership and distribution of profits, but it is more focused on collective investment.

Property Management Agreement: This document outlines the relationship between a property owner and a management company. Both agreements specify duties and responsibilities, but a management agreement focuses on property oversight rather than transfer of ownership.

Real Estate Disclosure Statement: This document provides information about the condition of a property before purchase. Similar to a purchase agreement, it aims to protect both parties by ensuring transparency regarding property issues.

Title Insurance Policy: While primarily a financial product, it protects against losses from defects in title. It complements a purchase agreement by ensuring that the buyer has clear ownership, which is a crucial aspect of the purchase process.

Home Inspection Report: This document details the condition of a property after inspection. It is similar to a purchase agreement in that it can influence the terms of the sale, especially if repairs are needed before closing.

- Hold Harmless Agreement: To protect against potential liabilities, utilize the necessary Hold Harmless Agreement form that outlines obligations and protections for involved parties.

Closing Statement: This document summarizes the final transaction details during closing. Like the purchase agreement, it outlines financial obligations and the distribution of funds, but it is focused on the final steps of the sale process.

Misconceptions

Understanding the California Real Estate Purchase Agreement (REPA) is essential for anyone involved in a property transaction. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

- It is a legally binding contract from the moment it is signed. Many people believe that simply signing the agreement makes it legally binding. In reality, it becomes binding only when all parties have signed and any necessary contingencies have been met.

- All agreements must be in writing. While the REPA is a written document, some may think that verbal agreements are entirely invalid. However, certain verbal agreements can be enforceable, though they are harder to prove.

- The form is the same for every transaction. Some assume that the REPA is a one-size-fits-all document. In fact, each agreement can be customized to reflect the specific terms and conditions of the transaction.

- It covers all aspects of the sale. Many believe that the REPA addresses every detail related to the property sale. However, it primarily focuses on the sale terms and may not include all relevant disclosures or conditions that should be documented elsewhere.

- Once signed, it cannot be changed. Some people think that any changes to the agreement after signing are impossible. In truth, amendments can be made if all parties agree to the changes and document them appropriately.

Addressing these misconceptions can help ensure a smoother transaction and better understanding of the real estate process in California.

Fill out Popular Real Estate Purchase Agreement Forms for Specific States

Contract for Purchase - It typically specifies the method of payment, whether cash, loan, or other means.

The Texas Resale Certificate 01 339 form is vital for businesses in Texas that buy goods for resale, allowing for tax-free purchases on items designated for resale, leasing, or rental. It is critical for businesses to understand how to fill out this form correctly to ensure compliance with tax laws and prevent any charges related to tax evasion. For further details, businesses can refer to the official document available at https://txtemplate.com/texas-resale-certificate-01-339-pdf-template/.

PDF Details

| Fact Name | Description |

|---|---|

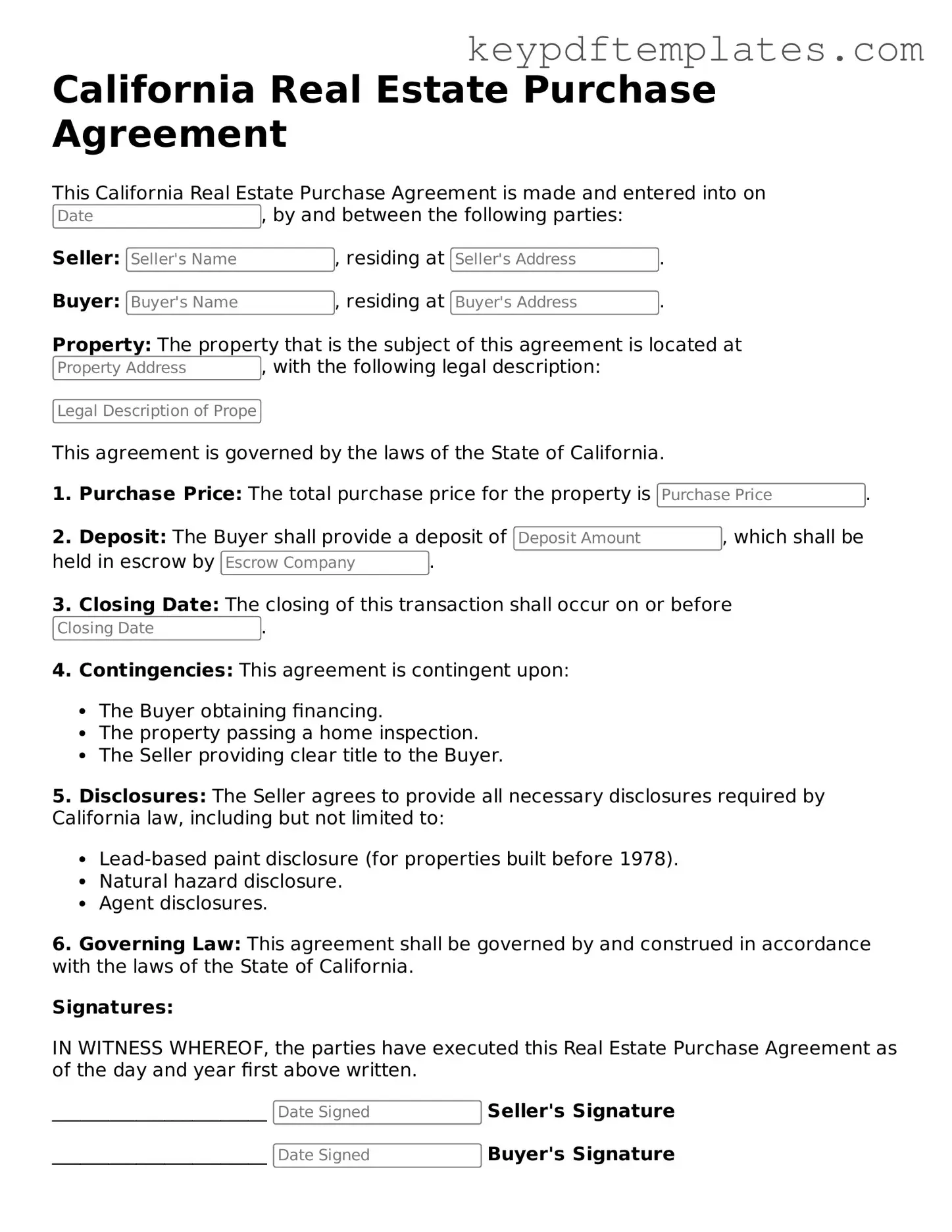

| Governing Law | The California Real Estate Purchase Agreement is governed by the California Civil Code, particularly sections related to real estate transactions. |

| Standardized Form | This agreement is a standardized form used throughout California, ensuring consistency in real estate transactions. |

| Parties Involved | The form typically identifies the buyer and seller, outlining their roles and responsibilities in the transaction. |

| Property Description | A detailed description of the property being sold is included, covering aspects such as the address, parcel number, and any fixtures included in the sale. |

| Purchase Price | The agreement specifies the purchase price of the property, along with any earnest money deposit required from the buyer. |

| Contingencies | Buyers can include contingencies, such as financing or inspection contingencies, which must be satisfied for the sale to proceed. |

| Disclosure Requirements | California law mandates that sellers provide specific disclosures about the property, which must be acknowledged in the agreement. |

Documents used along the form

When engaging in a real estate transaction in California, several important documents accompany the California Real Estate Purchase Agreement. Each of these documents serves a unique purpose, ensuring that both buyers and sellers are protected and informed throughout the process. Here’s a list of commonly used forms and documents:

- Disclosure Statements: These documents inform buyers about the property's condition and any known issues, such as lead paint, mold, or pest infestations. Sellers are required to disclose certain information to promote transparency.

- Pre-Approval Letter: A letter from a lender indicating that a buyer is pre-approved for a mortgage. This document shows sellers that the buyer is serious and financially capable of purchasing the property.

- Counter Offer: If the seller does not accept the initial offer, they may present a counter offer. This document outlines the seller’s terms and conditions, allowing negotiations to continue.

- General Power of Attorney: This form is vital for granting someone the authority to manage your financial and legal decisions when you are unable to do so. For more information, you can visit Georgia PDF.

- Escrow Instructions: This document outlines the terms and conditions of the escrow process. It details how funds and documents will be handled until the transaction is completed.

- Title Report: A title report provides information about the property's ownership history and any liens or encumbrances. It ensures that the buyer receives clear title to the property upon purchase.

- Closing Statement: Also known as a HUD-1 statement, this document itemizes all the closing costs associated with the transaction. It provides a detailed breakdown of what each party will pay at closing.

- Home Inspection Report: After an inspection, this report details the condition of the home, including any repairs that may be needed. Buyers often use this information to negotiate repairs or price adjustments.

- Property Insurance Binder: This document serves as proof of insurance coverage for the property being purchased. It is often required by lenders before closing to protect their investment.

Understanding these documents is crucial for anyone involved in a real estate transaction. They help clarify responsibilities and protect the interests of all parties. By familiarizing yourself with these forms, you can navigate the home-buying or selling process with greater confidence and ease.