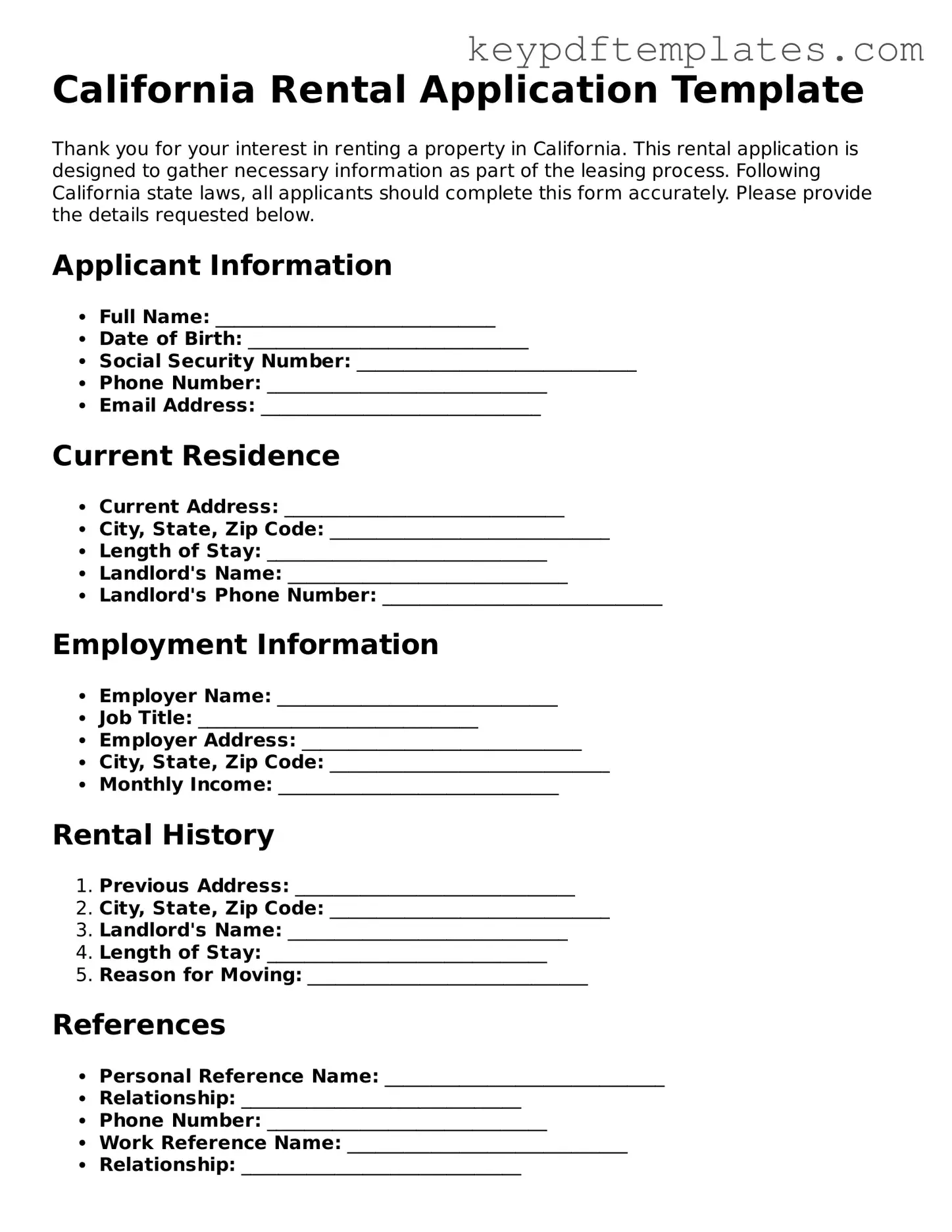

Legal Rental Application Document for the State of California

Key takeaways

When it comes to renting a property in California, filling out the rental application form is a crucial step. Here are some key takeaways to keep in mind:

- Be Honest and Accurate: Providing truthful information about your employment, income, and rental history is essential. Landlords often conduct background checks, and discrepancies can lead to application denial.

- Gather Necessary Documentation: Before filling out the application, collect important documents such as pay stubs, tax returns, and identification. Having these ready will streamline the process.

- Understand the Fees: Many landlords charge an application fee to cover the cost of background checks. Make sure to ask how much it is and whether it’s refundable if you don’t get the apartment.

- Check for Fair Housing Compliance: California law prohibits discrimination based on race, gender, or other protected categories. Be aware of your rights and ensure the landlord follows these regulations.

- Follow Up: After submitting your application, don’t hesitate to follow up with the landlord or property manager. A polite inquiry can show your interest and help you stand out among other applicants.

By keeping these points in mind, you can navigate the rental application process with confidence and increase your chances of securing your desired home.

Similar forms

- Lease Agreement: Like the rental application, a lease agreement outlines the terms and conditions of renting a property. Both documents require personal information and details about the tenant's financial stability.

- Background Check Authorization: This document allows landlords to verify a tenant's history. Similar to a rental application, it collects personal data, including Social Security numbers, to assess reliability.

- RV Bill of Sale: Similar to the Rental Application, an RV Bill of Sale records the sale and purchase of a recreational vehicle, detailing transaction specifics like sale price and buyer-seller information, making it crucial for anyone engaged in such transactions—learn more at https://txtemplate.com/rv-bill-of-sale-pdf-template/.

- Credit Report Consent: Just as a rental application may ask for permission to check a tenant's credit, this document is specifically focused on obtaining a credit report to evaluate financial responsibility.

- Employment Verification Form: This form confirms a tenant's employment status and income. It aligns with the rental application by requiring proof of financial capability to pay rent.

- Rental History Verification: This document seeks to confirm previous rental experiences. It complements the rental application by providing insight into a tenant's past behavior as a renter.

- Guarantor Agreement: If a tenant requires a guarantor, this agreement outlines the responsibilities of the guarantor. It is similar to a rental application in that it assesses the financial stability of both the tenant and the guarantor.

Misconceptions

When it comes to renting in California, many potential tenants encounter the rental application form. However, several misconceptions can lead to confusion and frustration. Here are four common misunderstandings about this important document:

- Misconception 1: The rental application is just a formality.

- Misconception 2: All rental applications are the same.

- Misconception 3: Your credit score is the only factor considered.

- Misconception 4: You can't negotiate the application fee.

Many people believe that the rental application is merely a formality and that it won't significantly impact their chances of securing a rental. In reality, this form is a critical tool for landlords to assess potential tenants. It provides essential information, such as rental history, credit scores, and income verification, which can greatly influence a landlord's decision.

Another common belief is that all rental applications follow a standard format. In fact, different landlords and property management companies may have unique requirements and questions on their applications. It's crucial to read each application carefully and provide the specific information requested.

While a credit score plays a significant role in the rental application process, it is not the sole factor that landlords consider. They often look at rental history, income stability, and references as well. A strong rental history can sometimes compensate for a lower credit score.

Many applicants assume that the application fee is non-negotiable. However, some landlords may be open to discussing this fee, especially if a prospective tenant has a strong rental history or is applying for multiple units. It's worth asking if there is any flexibility.

Understanding these misconceptions can empower potential tenants to navigate the rental application process more effectively. Being informed helps in presenting oneself as a desirable candidate to landlords.

Fill out Popular Rental Application Forms for Specific States

Rental Housing Application Form - Details required pet information, if applicable.

For landlords looking to terminate a lease agreement, it is essential to utilize the Florida Notice to Quit form correctly, which can be found at Florida PDF Forms, ensuring that all legal requirements are met while providing tenants adequate notice to vacate the property.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The California Rental Application form is used by landlords to screen potential tenants. |

| Required Information | Applicants must provide personal information, including name, contact details, and employment history. |

| Credit Check | Landlords often conduct a credit check, requiring applicants to consent to this process. |

| Application Fee | Landlords may charge an application fee, which cannot exceed $50 as per California law. |

| Fair Housing Laws | The application process must comply with the Fair Housing Act, prohibiting discrimination based on protected classes. |

| Income Verification | Applicants may need to provide proof of income, such as pay stubs or bank statements. |

| Rental History | Past rental history is typically required, including previous landlords' contact information. |

| Background Check | A background check may be conducted to assess criminal history and previous evictions. |

| Application Processing Time | Landlords are expected to process applications in a timely manner, usually within a few days. |

| Governing Laws | The California Civil Code, particularly sections 1950.5 and 1942.5, govern rental applications and tenant screening. |

Documents used along the form

When applying for a rental property in California, several forms and documents often accompany the California Rental Application. These documents help landlords assess potential tenants and ensure a smooth leasing process. Below is a list of common forms used in conjunction with the rental application.

- Credit Report Authorization: This form allows landlords to obtain a tenant's credit report, providing insight into their financial history and reliability in making timely payments.

- Trailer Bill of Sale: To ensure a smooth transfer of ownership, consider utilizing our essential trailer bill of sale documentation for accurate and legal transactions.

- Background Check Consent: A background check consent form permits landlords to conduct a criminal background check on the applicant, ensuring the safety and security of the property and community.

- Employment Verification Form: This document confirms the applicant's employment status, including income and job stability, which helps landlords evaluate their ability to pay rent.

- Rental History Verification: This form collects information about the applicant's previous rental experiences, including references from past landlords, to assess their behavior as a tenant.

- Pet Policy Agreement: If the property allows pets, this agreement outlines the rules and conditions regarding pet ownership, including any additional deposits or fees required.

- Security Deposit Receipt: After a tenant is approved, this receipt documents the amount paid for the security deposit, ensuring both parties have a record of the transaction.

These documents collectively provide a comprehensive overview of the applicant's qualifications and help landlords make informed decisions. Having these forms prepared can streamline the rental process and foster a positive landlord-tenant relationship.