Legal Tractor Bill of Sale Document for the State of California

Key takeaways

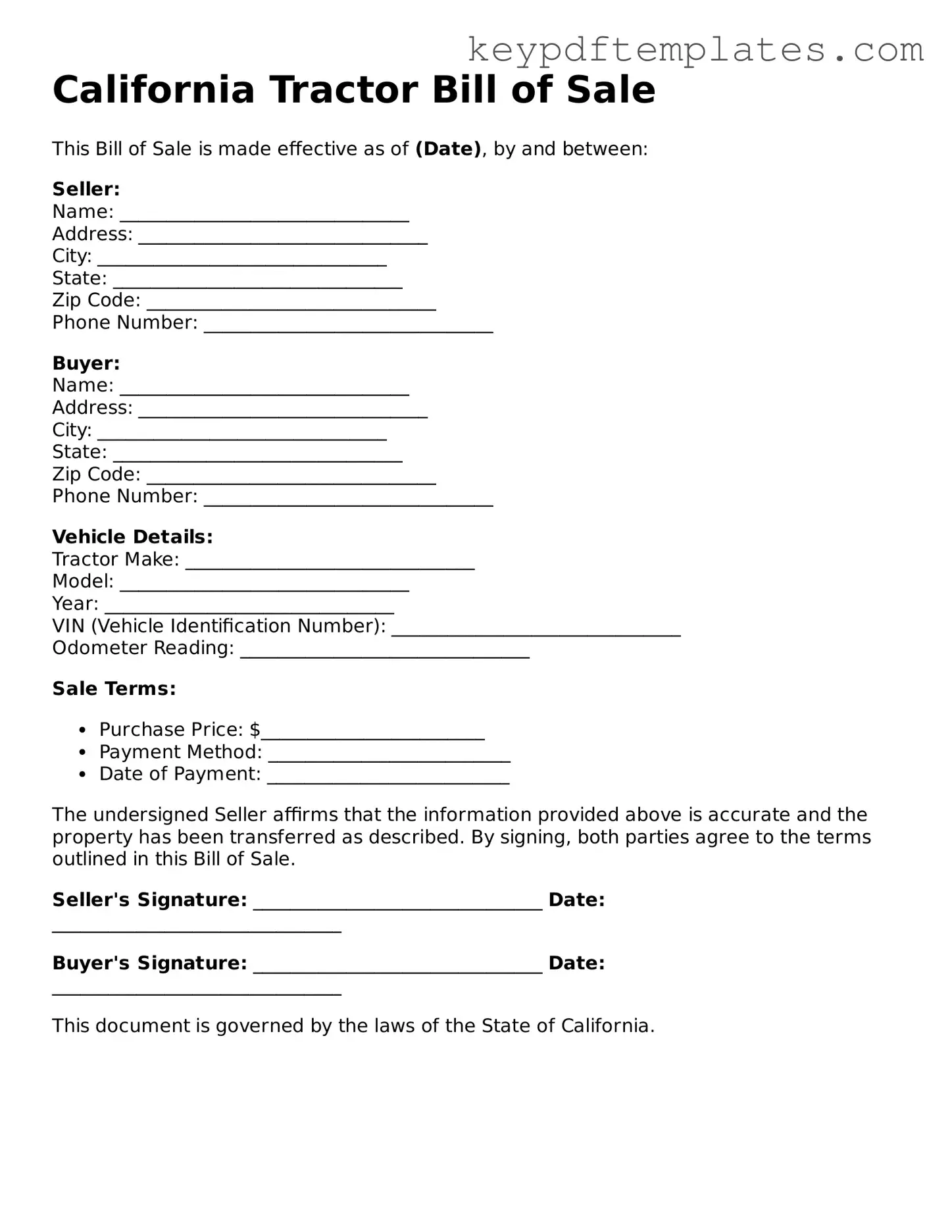

When filling out and using the California Tractor Bill of Sale form, there are several important points to keep in mind. This document serves as proof of the transaction between the seller and the buyer. Here are key takeaways to ensure a smooth process:

- Complete Information: Ensure that all fields are filled out accurately. This includes the names and addresses of both the seller and the buyer, as well as the tractor's details.

- Accurate Description: Provide a thorough description of the tractor. Include the make, model, year, and Vehicle Identification Number (VIN) to avoid any confusion later.

- Sale Price: Clearly state the sale price of the tractor. This is essential for both parties for record-keeping and tax purposes.

- Signatures Required: Both the seller and the buyer must sign the document. Without signatures, the bill of sale is not legally binding.

- Notarization: While not always required, having the bill of sale notarized adds an extra layer of authenticity and can be beneficial in case of disputes.

- Keep Copies: After completing the form, both parties should retain a copy for their records. This helps in case any issues arise in the future.

- Transfer of Ownership: Understand that the bill of sale is essential for transferring ownership. It may be required when registering the tractor with the Department of Motor Vehicles (DMV).

- Tax Implications: Be aware of any tax implications related to the sale. Both the buyer and seller may have obligations to report the transaction.

- Condition of the Tractor: It’s advisable to include a statement regarding the condition of the tractor. This can help protect both parties if there are any disputes after the sale.

- Consult a Professional: If there are any uncertainties about the process, consider consulting a legal professional. They can provide guidance tailored to your specific situation.

By following these key points, you can ensure that the process of filling out and using the California Tractor Bill of Sale form is clear and effective. Taking these steps will help protect both parties involved in the transaction.

Similar forms

- Vehicle Bill of Sale: This document serves a similar purpose by providing proof of the sale and transfer of ownership for a vehicle. It includes details such as the buyer, seller, vehicle identification number (VIN), and sale price.

- Boat Bill of Sale: Like the Tractor Bill of Sale, this form is used to transfer ownership of a boat. It outlines the specifics of the boat, including its make, model, and hull identification number, along with buyer and seller information.

- Motorcycle Bill of Sale: This document functions similarly by documenting the sale of a motorcycle. It captures essential details about the motorcycle and the parties involved, ensuring a clear record of the transaction.

- Equipment Bill of Sale: This form is used for the sale of various types of equipment, including agricultural machinery. It details the equipment being sold, the sale price, and the identities of the buyer and seller.

-

Texas Employment Verification: This form is essential for confirming employment status and earnings for employees or former employees in Texas, a critical step for those seeking state benefits. You can learn more about it at txtemplate.com/texas-employment-verification-pdf-template.

- Real Estate Purchase Agreement: While it involves property rather than vehicles or equipment, this document outlines the terms of a sale. It includes information about the property, sale price, and conditions, similar to the transfer of ownership seen in a Tractor Bill of Sale.

Misconceptions

The California Tractor Bill of Sale form is an important document for anyone buying or selling a tractor in the state. However, several misconceptions surround this form. Below are nine common misunderstandings.

- It's only necessary for new tractors. Many believe the form is only required for new purchases. In reality, it is essential for both new and used tractors to establish ownership and protect both parties.

- Only the seller needs to sign the form. Some think that only the seller's signature is required. However, both the buyer and the seller must sign the document to make it legally binding.

- The form is not needed if the transaction is informal. Many assume that informal agreements do not require documentation. In California, a bill of sale is crucial regardless of the formality of the transaction to ensure legal protection.

- It can be filled out after the sale. Some individuals believe they can complete the bill of sale after the transaction. It is best practice to fill it out at the time of sale to avoid disputes later.

- There is a specific format that must be followed. While there are guidelines for what information should be included, there is no strict format mandated by law. As long as it contains the necessary details, it can be customized.

- It is only for private sales. Some people think the bill of sale is only relevant for private transactions. However, it is also useful for sales between businesses and individuals.

- Once signed, the bill of sale cannot be changed. Many believe that any changes to the bill of sale after signing invalidate it. In fact, amendments can be made, but both parties must agree to and sign any changes.

- The form does not need to be notarized. Some individuals think notarization is required for the bill of sale to be valid. While notarization can add an extra layer of verification, it is not legally required in California.

- It is not necessary for tax purposes. Some assume that the bill of sale is irrelevant for tax obligations. In truth, it can serve as proof of purchase and may be needed for tax documentation and registration purposes.

Understanding these misconceptions can help ensure that both buyers and sellers navigate the sale of a tractor in California smoothly and legally.

Fill out Popular Tractor Bill of Sale Forms for Specific States

Bill of Sale for Tractor - May assist in determining a fair market value for the tractor.

Completing the Florida Residential Lease Agreement is essential for both landlords and tenants to ensure a clear understanding of their responsibilities. This legal document not only protects the rights of both parties but also establishes guidelines for the rental arrangement. For your convenience, you can easily access and utilize the necessary forms through Florida PDF Forms to facilitate a smooth leasing experience.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The California Tractor Bill of Sale form is used to document the sale of a tractor between a buyer and a seller. |

| Governing Law | This form is governed by the California Vehicle Code. |

| Identification | It includes essential details such as the tractor's make, model, year, and Vehicle Identification Number (VIN). |

| Buyer and Seller Information | The form requires the names and addresses of both the buyer and the seller. |

| Sales Price | The agreed-upon sales price must be clearly stated in the document. |

| Signatures | Both parties must sign the form to validate the transaction. |

| Record Keeping | It is advisable for both the buyer and seller to keep a copy of the signed bill of sale for their records. |

Documents used along the form

When purchasing or selling a tractor in California, having the right documentation is crucial for a smooth transaction. Alongside the California Tractor Bill of Sale form, several other forms and documents can help clarify ownership and ensure compliance with state regulations. Here’s a list of important documents you might encounter in this process.

- Title Transfer Document: This document officially transfers ownership from the seller to the buyer. It includes details like the vehicle identification number (VIN) and the names of both parties.

- Odometer Disclosure Statement: Required by federal law, this form records the tractor's mileage at the time of sale. It helps prevent fraud by ensuring that the buyer knows the actual usage of the vehicle.

- Vehicle Registration Application: After purchasing a tractor, the new owner must register it with the California Department of Motor Vehicles (DMV). This application includes personal information and details about the vehicle.

- Smog Certification: Depending on the tractor's age and type, a smog certification may be necessary to prove that the vehicle meets California's emissions standards.

- Insurance Documentation: Proof of insurance is often required before registering a tractor. This document shows that the buyer has adequate coverage for the vehicle.

- Power of Attorney: If the buyer or seller cannot be present during the transaction, a power of attorney allows someone else to sign documents on their behalf, facilitating the sale process.

- FR-44 Florida Form: For those seeking to comprehend insurance requirements in Florida, it's essential to be aware of the https://allfloridaforms.com, which provides guidance on the mandatory FR-44 form for vehicle liability insurance.

- Sales Tax Payment Receipt: In California, sales tax applies to vehicle purchases. Keeping a receipt of this payment is important for both parties to confirm that the tax obligation has been fulfilled.

Having these documents ready can simplify the buying or selling process and protect both parties involved. Always ensure that everything is filled out correctly and keep copies for your records. This attention to detail can save you from future complications and provide peace of mind throughout the transaction.