Legal Transfer-on-Death Deed Document for the State of California

Key takeaways

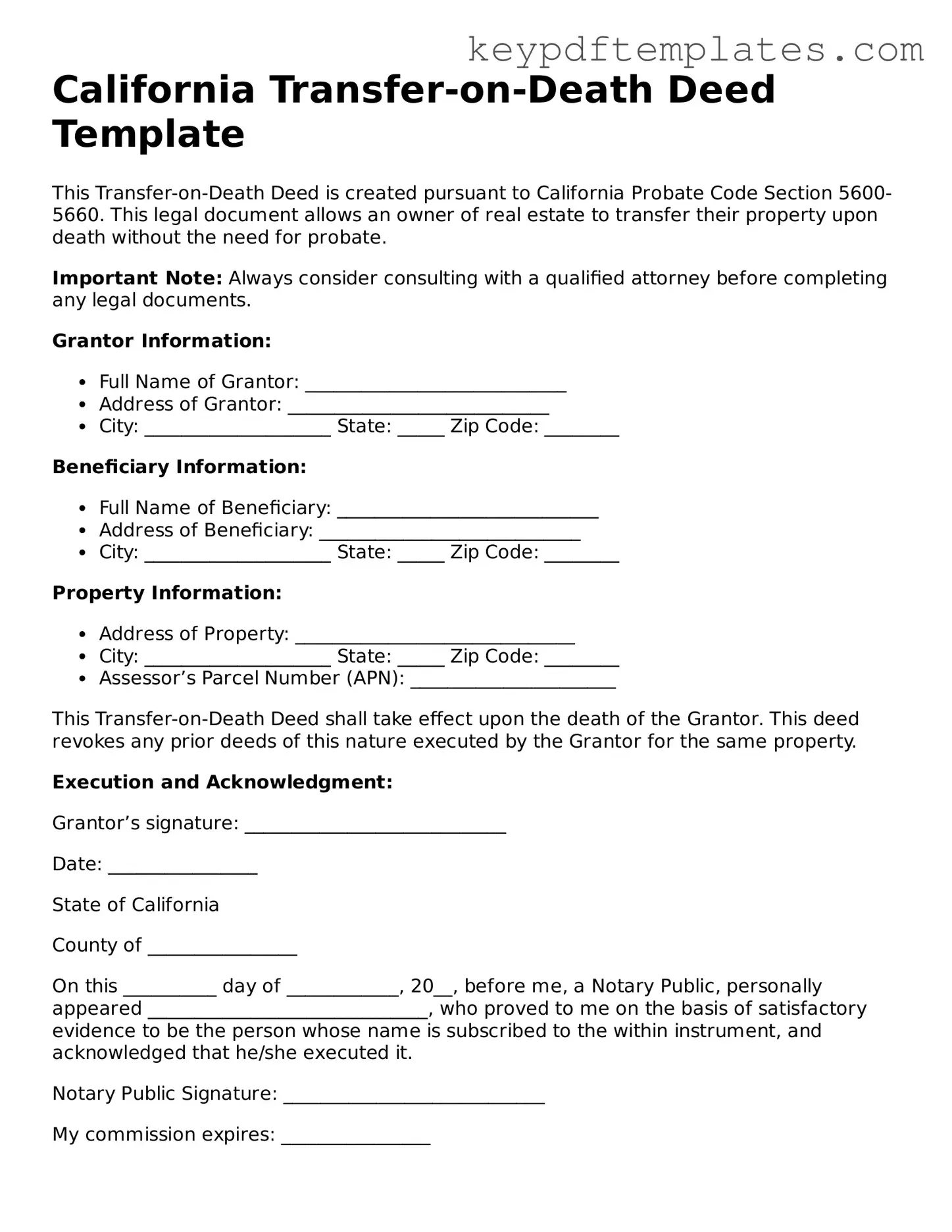

- Understand the Purpose: A Transfer-on-Death Deed allows property owners in California to transfer real estate to beneficiaries upon their death without going through probate.

- Eligibility Requirements: Only individuals, not entities, can create a Transfer-on-Death Deed. The property must be residential real estate and located in California.

- Complete the Form Accurately: Ensure that all required fields are filled out correctly. This includes the property description and the names of the beneficiaries.

- Sign in Front of a Notary: The deed must be signed by the property owner in the presence of a notary public to be valid.

- File the Deed: After signing, the deed must be recorded with the county recorder’s office where the property is located to take effect.

- Revocation is Possible: The property owner can revoke the Transfer-on-Death Deed at any time before their death by filing a revocation form with the county recorder.

- Consider Tax Implications: Beneficiaries may face tax consequences upon receiving the property. Consulting a tax professional can provide clarity on potential liabilities.

Similar forms

- Will: A will outlines how a person's assets should be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to specify beneficiaries, ensuring that their wishes are honored.

- Durable Power of Attorney: A Georgia Durable Power of Attorney form grants someone the authority to make financial and legal decisions on your behalf if you become incapacitated. This ensures your preferences are honored. To learn more, visit Georgia PDF.

- Living Trust: A living trust enables a person to place their assets into a trust during their lifetime. Similar to a Transfer-on-Death Deed, it allows for the direct transfer of assets to beneficiaries without going through probate.

- Beneficiary Designation Form: This form is often used for financial accounts and life insurance policies. It allows individuals to name beneficiaries who will receive assets upon their death, much like a Transfer-on-Death Deed does for real estate.

- Joint Tenancy with Right of Survivorship: In this arrangement, two or more people own property together. When one owner passes away, their share automatically transfers to the surviving owner, similar to how a Transfer-on-Death Deed operates.

- Payable-on-Death Account: This type of bank account allows the account holder to designate a beneficiary who will receive the funds upon their death. Like a Transfer-on-Death Deed, it provides a straightforward way to transfer assets without the need for probate.

Misconceptions

The California Transfer-on-Death Deed (TOD) form is a useful tool for estate planning, but several misconceptions surround it. Understanding these misconceptions can help individuals make informed decisions. Here are ten common misunderstandings:

-

It automatically transfers property upon death.

Many believe that the TOD deed transfers property immediately upon the owner's death. In reality, the transfer occurs only after the death of the property owner and after proper filing with the county.

-

It is the same as a will.

While both a TOD deed and a will deal with the transfer of property, they function differently. A will goes through probate, whereas a TOD deed allows for direct transfer without probate.

-

Only certain types of property can be transferred.

Some people think that only specific properties, like real estate, can be transferred using a TOD deed. However, the deed can apply to various types of real property, including single-family homes and vacant land.

-

It requires a lawyer to complete.

While legal advice can be beneficial, it is not mandatory to have a lawyer complete a TOD deed. Many individuals can fill out the form themselves if they understand the requirements.

-

It can be revoked only through a formal process.

People often think that revoking a TOD deed requires a complicated legal procedure. In fact, the owner can revoke the deed at any time by simply executing a new deed or a revocation form.

-

It affects the owner's ability to sell the property.

Some individuals worry that executing a TOD deed will restrict their ability to sell or mortgage the property. This is not true; the owner retains full control over the property during their lifetime.

-

It avoids all taxes.

Many assume that a TOD deed eliminates tax obligations entirely. While it can help avoid probate taxes, estate taxes may still apply depending on the value of the estate.

-

It is only for married couples.

Some think that TOD deeds are exclusively for married couples. In reality, anyone can use a TOD deed to transfer property to any individual or entity, regardless of marital status.

-

It is a permanent solution.

People often believe that once a TOD deed is executed, it cannot be changed. However, the owner can modify or revoke the deed at any time before their death.

-

It is recognized in all states.

Finally, some individuals think that the TOD deed is universally accepted across the United States. However, laws regarding transfer-on-death deeds vary by state, and it is essential to check local regulations.

Understanding these misconceptions can empower individuals to make better estate planning choices. It is always advisable to consult with a knowledgeable professional to clarify any uncertainties.

Fill out Popular Transfer-on-Death Deed Forms for Specific States

Transfer on Death Deed Florida Form - Real estate agents can assist property owners in executing a Transfer-on-Death Deed safely and legally.

To facilitate the completion of the Texas form, it's important to gather all required information and understand the specific requirements associated with your purpose. Whether you're filing for business registration or addressing personal legal matters, being prepared can streamline the process. For additional resources and templates, you can visit txtemplate.com/texas-pdf-template/.

PDF Details

| Fact Name | Description |

|---|---|

| What It Is | A California Transfer-on-Death Deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | This deed is governed by California Probate Code Sections 5600-5695. |

| Revocation | The property owner can revoke or change the deed at any time before their death, ensuring flexibility in estate planning. |

| Beneficiary Rights | Beneficiaries do not have any rights to the property until the owner's death, which protects the owner's control during their lifetime. |

Documents used along the form

The California Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive their property upon their passing. While this deed is a crucial document, several other forms and documents may be necessary to ensure a smooth transfer process. Below is a list of these documents, each serving a specific purpose in the estate planning and property transfer process.

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death, including any specific bequests to individuals or organizations.

- Durable Power of Attorney Form: To ensure your health and financial decisions are protected, consider the crucial Durable Power of Attorney document that empowers a trusted individual to act on your behalf.

- Living Trust: A legal entity that holds a person's assets during their lifetime and specifies how those assets should be managed and distributed after death, often avoiding probate.

- Grant Deed: This document is used to transfer ownership of real property. It provides evidence of the transfer and guarantees that the property is free of any undisclosed encumbrances.

- Affidavit of Death: A sworn statement confirming the death of an individual, which may be required to facilitate the transfer of property or assets.

- Property Tax Transfer Form: This form notifies the local tax assessor's office of a change in property ownership, which may affect property tax assessments.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for certain assets, such as bank accounts or retirement plans, outside of the will or trust.

- Power of Attorney: A legal document that allows an individual to designate someone else to make decisions on their behalf, particularly useful if they become incapacitated.

- Certificate of Title: This document proves ownership of a property and is essential for transferring title to a new owner.

- Notice of Death: This document may be filed with the county to formally notify the public of an individual's passing, which can be important for estate matters.

Understanding these documents can facilitate a smoother transition of property ownership and help ensure that your wishes are honored. Each form plays a vital role in the estate planning process, providing clarity and legal backing to your intentions.