Get Cash Drawer Count Sheet Form

Key takeaways

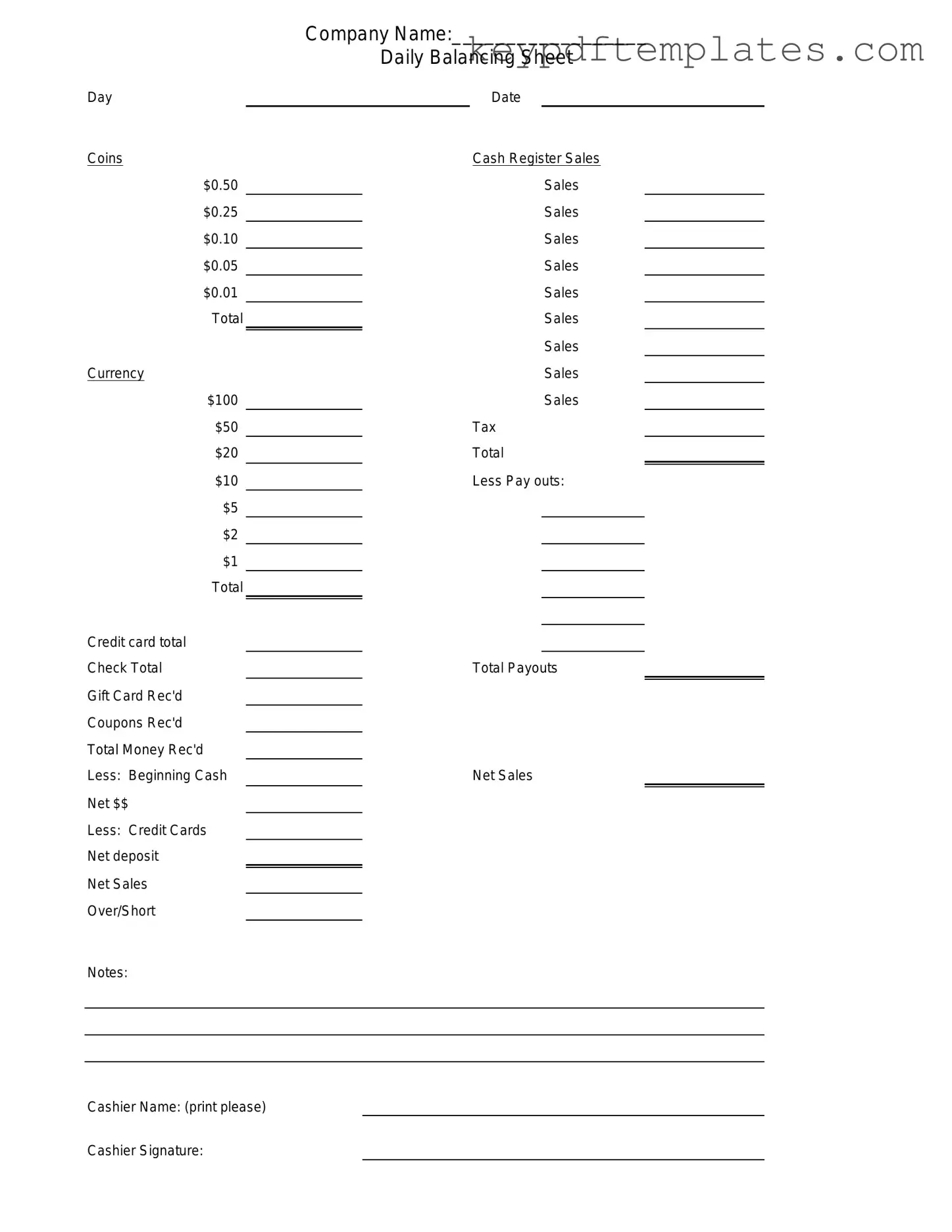

When it comes to using the Cash Drawer Count Sheet form, there are several important points to keep in mind. This form is essential for tracking cash flow and ensuring accuracy in your financial operations.

- Accuracy is crucial. Always double-check the amounts recorded on the form to avoid discrepancies that could lead to financial issues.

- Consistency matters. Use the form regularly to establish a routine. This helps in identifying patterns and potential problems with cash handling.

- Documentation is key. Retain completed forms for future reference. This can be invaluable for audits or resolving disputes.

- Training is important. Ensure that all staff members who handle cash are trained on how to fill out the form correctly. This promotes accountability.

- Review regularly. Periodically assess the information collected through the Cash Drawer Count Sheet. This can help identify trends and improve cash management practices.

By following these key takeaways, you can enhance your cash handling processes and maintain better financial oversight.

Similar forms

- Daily Sales Report: This document summarizes total sales for a specific period, similar to how the Cash Drawer Count Sheet records cash transactions.

- Petty Cash Log: Both documents track cash flow, with the Petty Cash Log detailing smaller expenses and the Cash Drawer Count Sheet focusing on sales revenue.

- Bank Deposit Slip: This slip records cash deposits made to the bank, paralleling the Cash Drawer Count Sheet's function of accounting for cash on hand.

- Transaction Receipt: Receipts provide proof of individual sales transactions, while the Cash Drawer Count Sheet aggregates these transactions into a total count.

- Inventory Count Sheet: Both documents involve counting items, but the Inventory Count Sheet tracks products, while the Cash Drawer Count Sheet focuses on cash.

- Expense Report: This report documents expenditures, similar to how the Cash Drawer Count Sheet tracks income from sales.

- Credit Card Transaction Log: This log records credit transactions, akin to how the Cash Drawer Count Sheet captures cash transactions.

- Last Will and Testament Form: To secure your final wishes, utilize the essential Last Will and Testament document preparation to ensure your legacy is respected and carried out.

- End-of-Day Summary: This summary provides an overview of daily financial activities, much like the Cash Drawer Count Sheet consolidates cash counts at the end of the day.

Misconceptions

Understanding the Cash Drawer Count Sheet form is essential for accurate cash management. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- It’s only for cash transactions. Many believe that the Cash Drawer Count Sheet is only relevant for cash sales. In reality, it also tracks credit and debit transactions, providing a complete view of drawer activity.

- It needs to be filled out daily. Some think that this form must be completed every day. While frequent use is beneficial, it’s not a strict requirement. The frequency depends on the business's cash handling practices.

- It’s only for accounting purposes. This form is often viewed solely as an accounting tool. However, it also helps in managing cash flow and identifying discrepancies quickly.

- It can be filled out after closing. Some people assume that they can complete the form after closing the cash drawer. Ideally, it should be filled out during cash handling to ensure accuracy.

- It’s not necessary for small businesses. Small business owners may think they can skip this form due to their size. Yet, maintaining accurate records is crucial for any business, regardless of size.

- Only managers need to understand it. There’s a belief that only managers should be familiar with the Cash Drawer Count Sheet. In truth, all employees involved in cash handling should know how to use it effectively.

- It’s a one-time form. Some individuals think that once the form is filled out, it is no longer needed. In fact, it should be reviewed regularly to track trends and address issues.

- It’s complicated to use. Many people perceive the form as overly complex. In reality, it’s designed to be straightforward, making it accessible for anyone who handles cash.

By addressing these misconceptions, businesses can enhance their cash management practices and ensure accurate financial reporting.

More PDF Templates

Facial Consent Form Template - By signing, you accept the terms of the facial procedure.

The Chick Fil A Job Application form serves as the first step for prospective employees to express their interest in joining the renowned fast-food chain. This document gathers essential personal, educational, and professional information required for employment consideration. To learn more about the application process, you can access the document that provides further details on how to apply. It's a crucial bridge connecting job seekers with potential employment opportunities at Chick Fil A.

Sfa Age Range - The data collected can inform future curriculum design.

Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to record the cash on hand in a business's cash drawer at the end of a shift or business day. |

| Components | This form typically includes sections for recording the starting cash balance, cash sales, cash received, cash paid out, and the ending cash balance. |

| Importance | Accurate completion of the Cash Drawer Count Sheet helps prevent discrepancies and ensures accountability in cash handling. |

| Frequency of Use | Businesses should complete this form daily or at the end of each shift to maintain accurate financial records. |

| Legal Compliance | While not a federal requirement, maintaining accurate cash records can help businesses comply with state tax laws and regulations. |

| Record Keeping | It is advisable for businesses to retain completed Cash Drawer Count Sheets for a specific period, often in accordance with state laws regarding financial record-keeping. |

Documents used along the form

The Cash Drawer Count Sheet is an important document used to track cash transactions and ensure accurate accounting. Several other forms and documents are often used alongside it to maintain financial accuracy and accountability. Here’s a list of related documents that can help streamline cash management processes.

- Daily Sales Report: This document summarizes total sales for the day, including cash, credit, and other payment methods. It helps compare sales with cash counted in the drawer.

- Cash Deposit Slip: Used when cash is taken from the drawer and deposited into the bank. It details the amount and date of the deposit.

- Cash Register Tape: A printed record from the cash register that shows all transactions made during a specific period. This tape is useful for verifying cash counts.

- Expense Report: A document that lists all business expenses incurred during a specific time. It helps track cash outflows and reconcile with cash drawer counts.

- Operating Agreement: This important document defines the internal governance of an LLC, detailing roles, responsibilities, and operational procedures. For more information, visit https://allfloridaforms.com/.

- Refund Request Form: This form is used to document customer refunds. It ensures that cash is accurately accounted for when returning money to customers.

- Petty Cash Log: A record of small cash transactions for minor expenses. It helps manage and track cash used outside of the main cash drawer.

- Bank Reconciliation Statement: A document that compares the company’s cash records with bank statements. It helps identify discrepancies and ensures accurate financial reporting.

- End-of-Day Summary: A comprehensive report that includes total cash, sales, and any discrepancies. This summary is essential for closing out the cash drawer each day.

Using these documents in conjunction with the Cash Drawer Count Sheet can enhance financial management and accountability. Each document serves a specific purpose, contributing to a clear understanding of cash flow and financial health.