Get Cash Receipt Form

Key takeaways

When dealing with a Cash Receipt form, understanding its purpose and proper usage is crucial. Here are some key takeaways to keep in mind:

- Purpose of the Form: The Cash Receipt form is used to document the receipt of cash payments. It serves as proof of payment for both the payer and the recipient.

- Accurate Information: Ensure that all fields are filled out accurately. This includes the date, amount received, and the name of the payer. Inaccuracies can lead to confusion or disputes later.

- Signature Requirement: A signature from the person receiving the cash is often required. This adds an additional layer of verification and accountability.

- Record Keeping: Keep a copy of the Cash Receipt for your records. This is important for tracking payments and for accounting purposes.

- Distribution: Provide a copy of the receipt to the payer. This serves as their proof of payment and helps maintain transparency.

- Use of the Form: The form can be used in various situations, such as sales transactions, service payments, or donations. Understanding the context of its use is essential.

- Legal Considerations: Retaining these forms may be necessary for legal compliance, especially for businesses. They can be important during audits or financial reviews.

By following these guidelines, you can effectively manage cash transactions and maintain clear records. This will help ensure smooth financial operations and build trust with your clients or customers.

Similar forms

The Cash Receipt form is a crucial document used to record incoming payments. It shares similarities with several other financial documents. Below is a list of six documents that are similar to the Cash Receipt form, along with explanations of how they are alike:

- Invoice: An invoice requests payment for goods or services provided. Like the Cash Receipt, it includes details about the transaction, such as the amount due and payment terms.

- Payment Voucher: This document authorizes a payment. Similar to the Cash Receipt, it tracks the payment process and ensures that funds are disbursed correctly.

- Deposit Slip: A deposit slip is used to record money being deposited into a bank account. It serves a similar purpose to the Cash Receipt by documenting the receipt of funds.

- Sales Receipt: A sales receipt confirms a purchase and includes details about the transaction. Both documents serve as proof of payment and can be used for record-keeping.

- Credit Memo: A credit memo is issued to reduce the amount owed by a customer. It relates to the Cash Receipt as it also tracks financial transactions, but in the context of adjustments to previous sales.

- Operating Agreement: The Florida Operating Agreement form is essential for LLCs, specifying the management structure and responsibilities of members. It plays a crucial role in defining financial arrangements and expectations, preventing misunderstandings, and promoting smooth operations, much like a Cash Receipt's importance in transaction documentation. For more information, visit https://allfloridaforms.com/.

- Accounts Receivable Ledger: This ledger tracks amounts owed to a business. It is similar to the Cash Receipt form in that it records financial transactions and helps maintain accurate financial records.

Misconceptions

Understanding the Cash Receipt form is essential for effective financial management. However, there are several misconceptions that can lead to confusion. Here are six common myths about the Cash Receipt form, along with explanations to clarify the truth.

-

Myth 1: The Cash Receipt form is only used for cash transactions.

This is not true. While the form is primarily associated with cash transactions, it can also be used for other payment methods, such as checks or credit card payments. The key is that it serves as a record of any payment received.

-

Myth 2: The Cash Receipt form is not necessary for small businesses.

Every business, regardless of size, should maintain accurate records of transactions. The Cash Receipt form helps ensure transparency and accountability, making it crucial even for small businesses.

-

Myth 3: The Cash Receipt form is only for internal use.

This misconception overlooks the fact that the form can also serve as proof of payment for customers. It provides a clear record that can be useful for both parties in case of disputes or inquiries.

-

Myth 4: Once a Cash Receipt form is filled out, it cannot be changed.

While it is important to maintain the integrity of financial records, corrections can be made if necessary. It’s advisable to document any changes clearly to avoid confusion.

-

Myth 5: The Cash Receipt form is only needed at the time of the transaction.

In reality, the form should be retained for record-keeping purposes long after the transaction has occurred. This helps in financial audits and tax preparations.

-

Myth 6: You don’t need to keep a copy of the Cash Receipt form.

Keeping a copy is essential. It provides a backup in case the original is lost or damaged and is crucial for maintaining accurate financial records.

By dispelling these misconceptions, individuals and businesses can better understand the importance of the Cash Receipt form in their financial processes.

More PDF Templates

What Is Joint Tenancy in California - Completing the affidavit ensures that the deceased’s interest in the property is legally acknowledged.

For those who find themselves needing to replace their vehicle's license plate(s) or registration sticker, the Texas VTR-60 form serves as a vital resource; you can easily access it by visiting https://txtemplate.com/texas-vtr-60-pdf-template/, ensuring you have all the required information to complete the process smoothly.

California Correction Deed - The affidavit is an important record that supplements original legal documents.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document the receipt of cash payments, ensuring accurate record-keeping for businesses and organizations. |

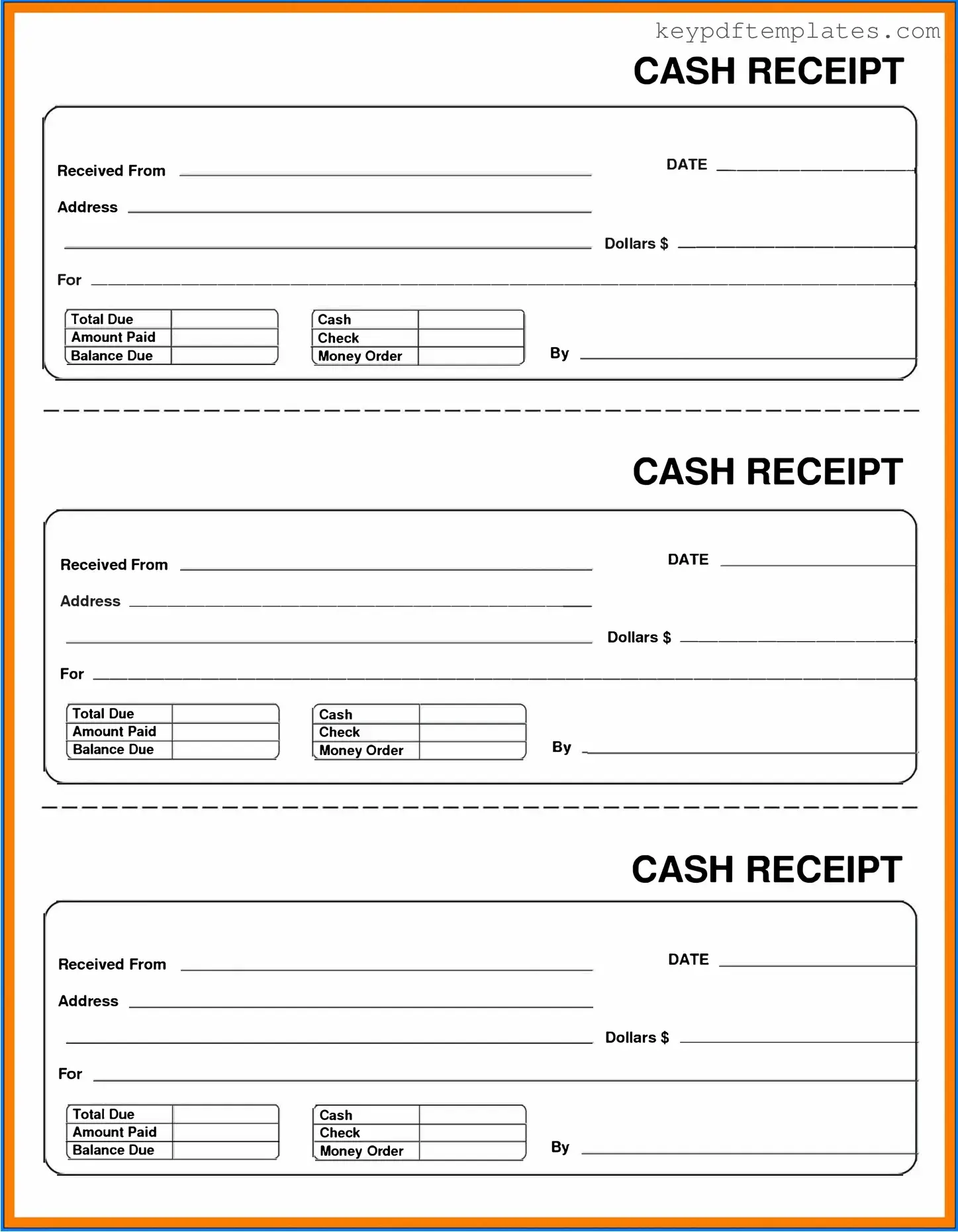

| Components | This form typically includes details such as the date of the transaction, amount received, payer's information, and the purpose of the payment. |

| Legal Requirements | In many states, businesses must retain cash receipt records for a specified period, often governed by state tax laws and regulations. |

| Importance | Maintaining accurate cash receipts is crucial for financial audits, tax filings, and overall financial management. |

Documents used along the form

When managing financial transactions, several forms and documents complement the Cash Receipt form to ensure accurate record-keeping and accountability. Each of these documents serves a specific purpose, providing a comprehensive view of financial activities. Below are some commonly used forms that often accompany the Cash Receipt form.

- Invoice: An invoice is a document issued by a seller to a buyer. It outlines the products or services provided, the amount due, and payment terms. Invoices help track sales and ensure that payments are received in a timely manner.

- Payment Voucher: A payment voucher is a document that authorizes a payment to be made. It typically includes details such as the payee, amount, and purpose of the payment. This form is essential for internal controls and helps maintain a clear audit trail.

- Georgia SOP Form: This form is crucial for understanding the procedures for inmate visitation and its impact on maintaining relationships. For more information, refer to the Georgia PDF.

- Deposit Slip: A deposit slip is used when depositing cash or checks into a bank account. It provides the bank with information about the amount being deposited and serves as a record for both the depositor and the bank.

- Receipt Acknowledgment: A receipt acknowledgment is a document signed by the recipient to confirm that they have received payment or goods. This serves as proof of the transaction and can be vital in case of disputes.

By utilizing these documents alongside the Cash Receipt form, individuals and organizations can enhance their financial management practices, ensuring transparency and accuracy in their transactions.