Get Cg 20 10 07 04 Liability Endorsement Form

Key takeaways

When filling out the CG 20 10 07 04 Liability Endorsement form, it is essential to keep several key points in mind. These takeaways will help ensure that the process is smooth and effective.

- Identify Additional Insureds Clearly: Make sure to list the names of all additional insured persons or organizations in the designated schedule. Accurate identification is crucial for coverage.

- Understand Coverage Limitations: The insurance provided to additional insureds is limited to the extent required by law or specified in a contract. Be aware that this coverage cannot exceed what is mandated.

- Recognize Exclusions: Note that coverage does not apply to injuries or damages that occur after the completion of work related to the project. This includes any materials or equipment used.

- Review Insurance Limits: The maximum amount payable for additional insureds is determined by the contract or the policy limits, whichever is lower. Ensure you are familiar with these limits to avoid surprises.

By keeping these points in mind, you can navigate the complexities of the CG 20 10 07 04 Liability Endorsement form with confidence.

Similar forms

CG 20 10 12 19 Additional Insured Endorsement: Similar to the CG 20 10 07 04, this form also adds additional insured parties to a general liability policy. It specifies the conditions under which these parties are covered, focusing on ongoing operations.

CG 20 37 10 01 Additional Insured - Owners, Lessees or Contractors: This endorsement extends coverage to additional insureds for liability arising from the work performed by the named insured. It emphasizes the contractor's responsibility and the extent of coverage.

CG 20 33 10 01 Additional Insured - Owners, Lessees or Contractors - Completed Operations: This document provides coverage for additional insureds specifically for completed operations, contrasting with the ongoing operations focus of the CG 20 10 07 04.

CG 20 11 07 04 Additional Insured - Managers or Lessors of Premises: This endorsement covers managers or lessors of premises, ensuring they are protected against liabilities arising from the use of the premises by the named insured.

CG 20 20 07 04 Additional Insured - Designated Person or Organization: Similar in nature, this endorsement allows for the designation of specific persons or organizations as additional insureds, focusing on the contractual obligations of the named insured.

CG 21 44 07 04 Additional Insured - Vendors: This form extends coverage to vendors of the named insured, protecting them against liability claims that may arise from the products sold or distributed by the insured.

CG 24 04 10 01 Additional Insured - State or Political Subdivision: This endorsement is designed for state or political subdivisions, providing them coverage as additional insureds for liabilities arising out of the insured's operations.

CG 24 07 04 Additional Insured - Grantor of Franchise: This document adds coverage for grantors of franchises, ensuring they are protected from liabilities related to the franchisee's operations.

Georgia WC-100 Form: This form is essential for initiating mediation in workers' compensation claims and can be accessed by filling it out from the Georgia PDF.

CG 20 10 04 13 Additional Insured - Designated Construction Project: This endorsement is tailored for construction projects, providing coverage to additional insureds specifically for liabilities arising during construction activities.

CG 20 10 07 04 Additional Insured - Joint Ventures: This document extends coverage to joint ventures, ensuring that all parties involved in a joint venture are protected against potential liabilities.

Misconceptions

Understanding the Cg 20 10 07 04 Liability Endorsement form can be complex. Here are ten common misconceptions about this endorsement, along with clarifications to help you navigate its provisions.

- All parties are automatically covered. Many believe that simply naming an additional insured guarantees coverage. However, coverage only applies to the specific activities and locations outlined in the endorsement.

- Coverage is unlimited. Some think that the endorsement provides limitless coverage. In reality, the insurance limits are capped by what is required in the contract or the policy limits, whichever is lower.

- It covers all types of liability. There is a misconception that this endorsement covers all liabilities. It specifically addresses "bodily injury," "property damage," and "personal and advertising injury," and does not extend beyond these categories.

- Work performed after completion is still covered. Many assume that coverage continues after the work is done. However, the endorsement states that coverage does not apply once all work has been completed.

- It applies regardless of contractual obligations. Some believe that the endorsement provides coverage irrespective of any contracts. The endorsement's coverage is limited to what is required by contracts or agreements.

- All subcontractors are automatically covered. There is a common belief that subcontractors are included under this endorsement. Coverage only extends to the named additional insureds and their specific operations.

- It covers damages caused by other contractors. Many think that if another contractor causes damage, the endorsement will cover it. This is not true; coverage is limited to the acts or omissions of the insured or those acting on their behalf.

- The endorsement increases policy limits. Some individuals assume that adding this endorsement increases their overall coverage limits. In fact, it does not enhance the existing limits of insurance.

- Coverage is the same as primary insurance. Some believe that the coverage provided is equivalent to primary insurance. Instead, it acts as an additional layer, contingent on the terms outlined in the endorsement.

- All operations are covered without restrictions. Many think that any operation related to the additional insured is covered. The endorsement specifies that coverage is only for ongoing operations at designated locations.

By understanding these misconceptions, you can better navigate the complexities of the Cg 20 10 07 04 Liability Endorsement form and ensure that you have the appropriate coverage for your needs.

More PDF Templates

Completed Immunization Records - The structure of the form is designed for easy completion.

When considering a Power of Attorney, it is crucial to understand its implications and the responsibilities it entails for both the principal and the agent. For further information and resources, you can visit allfloridaforms.com/, which provides comprehensive guidance on creating and utilizing this important legal document.

Employer's Quarterly Federal Tax Return - Employers should be aware of changes in tax laws that may affect their 941 filings.

Odometer Statement Texas - Any modifications to the stated mileage must be clearly noted on the form to prevent misrepresentation.

Form Specs

| Fact Name | Fact Description |

|---|---|

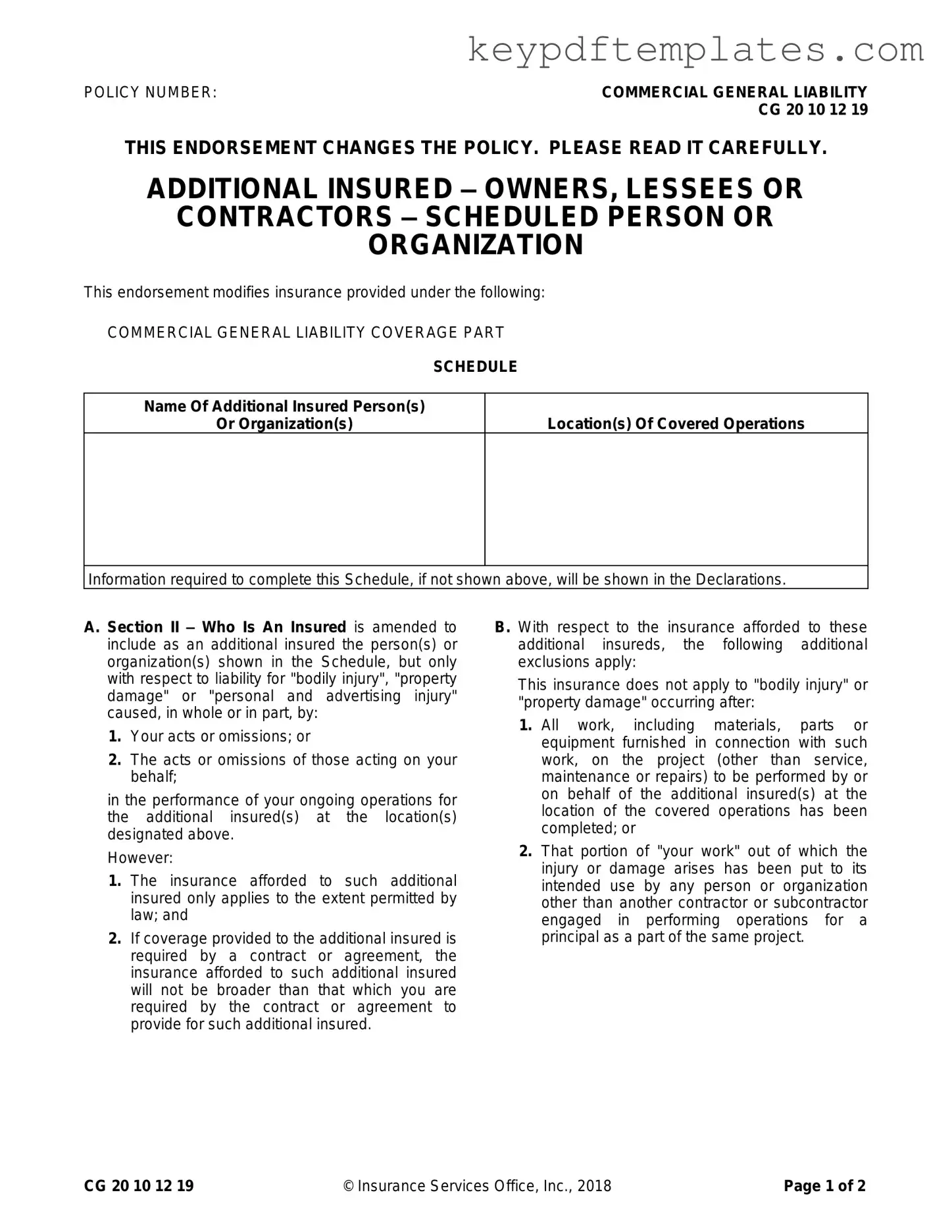

| Policy Number | The endorsement is identified by the policy number CG 20 10 12 19. |

| Purpose | This endorsement adds additional insureds to a commercial general liability policy. |

| Coverage Part | It modifies the insurance provided under the Commercial General Liability Coverage Part. |

| Additional Insureds | It includes persons or organizations specified in a schedule for liability coverage. |

| Scope of Coverage | The coverage applies to bodily injury, property damage, or personal injury caused by your acts or omissions. |

| Limitations | The insurance only applies to the extent permitted by law and does not exceed contract requirements. |

| Exclusions | Coverage does not apply after all work related to the project has been completed. |

| Contractual Limits | The maximum amount payable for additional insureds is limited to the contract amount or available insurance limits, whichever is less. |

| Governing Law | This endorsement is governed by the laws of the state in which the policy is issued. |

Documents used along the form

The CG 20 10 07 04 Liability Endorsement form is an important document in the realm of commercial general liability insurance. It serves to add additional insured parties to a policy, ensuring that they are covered for specific liabilities arising from the insured's operations. Alongside this form, several other documents are often utilized to provide a comprehensive understanding of the insurance coverage and obligations involved. Below is a list of these documents, each with a brief description.

- Commercial General Liability (CGL) Policy: This is the main insurance policy that provides coverage for bodily injury, property damage, and personal injury claims. It outlines the general terms and conditions of coverage.

- Certificate of Insurance (COI): A document that verifies the existence of an insurance policy and details the coverage limits, effective dates, and the parties insured. It is often required by clients or partners.

- Additional Insured Endorsement: This form extends coverage to other parties, ensuring they are protected against claims arising from the actions of the primary insured. It specifies the conditions and limitations of this coverage.

- Contractual Agreement: A legal document that outlines the terms of the relationship between parties, including the responsibilities and liabilities of each. It often stipulates insurance requirements.

- Indemnity Agreement: This document outlines the obligations of one party to compensate another for certain damages or losses. It often accompanies contracts where liability is shared or transferred.

- Claims Reporting Form: A form used to report incidents that may lead to a claim. It captures essential details about the event and initiates the claims process.

- Motor Vehicle Power of Attorney: For those managing vehicle-related tasks, the comprehensive Motor Vehicle Power of Attorney form guide simplifies the process of authorizing representation in vehicle transactions.

- Exclusions List: This document details specific situations or conditions that are not covered by the insurance policy. Understanding exclusions is crucial for both the insured and additional insured parties.

These documents collectively enhance the understanding of coverage, responsibilities, and liabilities in commercial insurance. Familiarity with each can help ensure that all parties involved are adequately protected and informed throughout the insurance process.