Get Childcare Receipt Form

Key takeaways

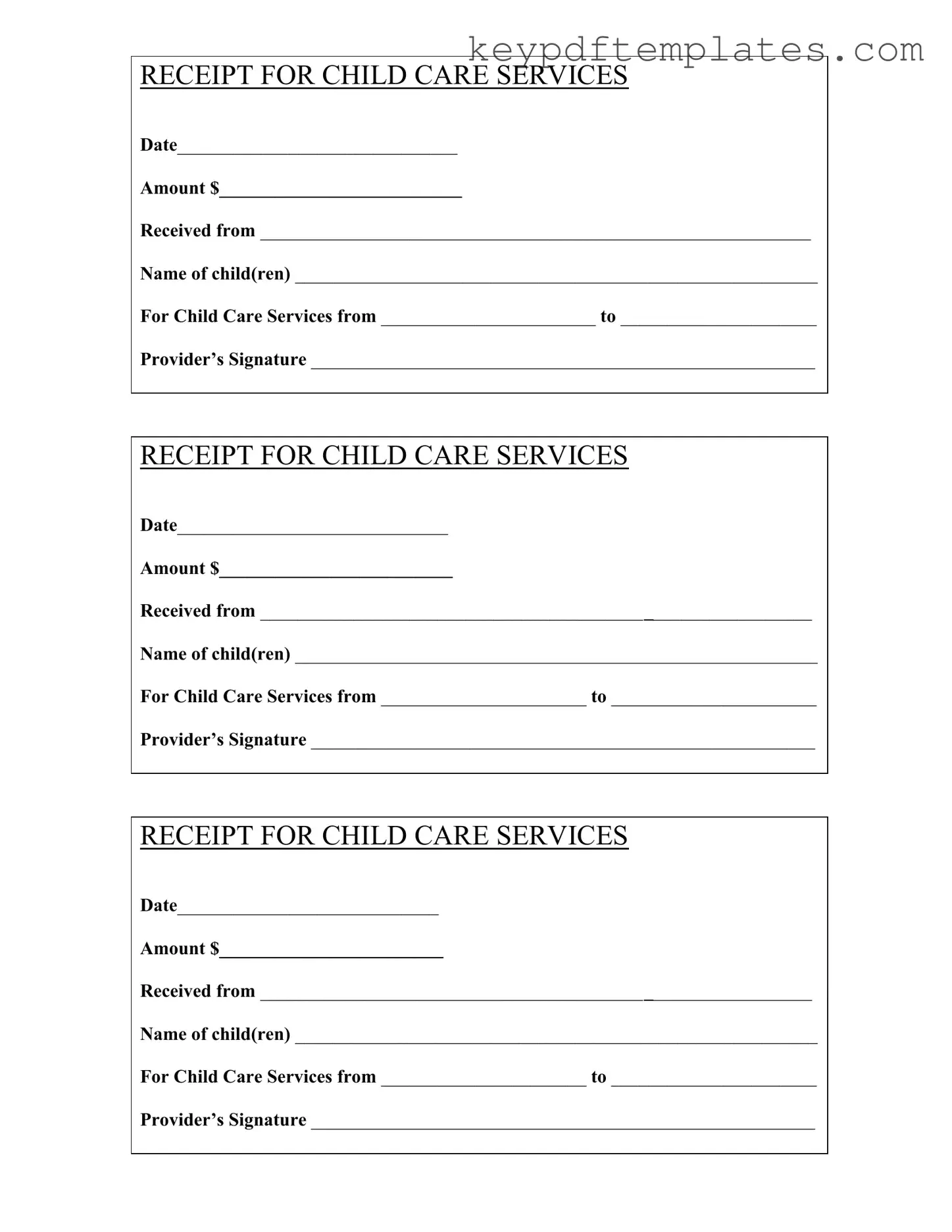

Filling out and using the Childcare Receipt form is an important task for both parents and childcare providers. Here are key takeaways to ensure accuracy and compliance.

- Complete all fields: Ensure that every section of the form is filled out, including the date, amount, and names of the children.

- Keep copies: Always retain a copy of the completed receipt for your records. This can be helpful for tax purposes or future reference.

- Use clear handwriting: Fill out the form legibly to avoid any misunderstandings regarding the details.

- Document services accurately: Clearly state the time period for which childcare services were provided. This helps in tracking payments and services rendered.

- Provider’s signature is essential: Ensure the childcare provider signs the receipt. This validates the transaction.

- Check for errors: Review the completed form for any mistakes before submission. Corrections should be made promptly.

- Be aware of tax implications: Keep in mind that childcare expenses may be tax-deductible. Receipts serve as proof of payment.

- Use the correct format: Follow the standard format provided in the form to avoid confusion and ensure consistency.

- Communicate with the provider: If there are any questions or concerns about the receipt, discuss them with the childcare provider directly.

Similar forms

Invoice: An invoice details the services provided, including dates and amounts owed. Like the Childcare Receipt form, it serves as proof of a transaction.

Payment Receipt: This document confirms that payment has been made. It includes similar information, such as the date, amount, and recipient, much like the Childcare Receipt.

Service Agreement: This outlines the terms of service between the provider and the client. It shares similarities with the Childcare Receipt in that it includes details about the child and the duration of care.

Tax Receipt: A tax receipt provides documentation for tax purposes. It often contains details about payments made for services, similar to the Childcare Receipt.

-

Vehicle Documentation: When replacing your vehicle's license plate or registration sticker, the txtemplate.com/texas-vtr-60-pdf-template offers a streamlined process for filling out the necessary Texas VTR-60 form, ensuring all details are accurately recorded for submission.

Contract for Services: This document formalizes the relationship between the caregiver and the parent. It includes specific information about the service period, much like the Childcare Receipt.

Payment Voucher: A payment voucher serves as a record of payment made for services rendered. It parallels the Childcare Receipt by documenting the transaction details.

Billing Statement: This provides a summary of charges and payments over a period. Similar to the Childcare Receipt, it includes dates and amounts related to services.

Childcare Enrollment Form: This form collects essential information about the child and services. It shares a focus on the child’s details, akin to the Childcare Receipt.

Payment Confirmation Email: An email confirming payment can serve as a digital receipt. It includes similar details about the transaction as found in the Childcare Receipt.

Misconceptions

Understanding the Childcare Receipt form is essential for parents and guardians utilizing childcare services. Here are ten common misconceptions about this form, along with clarifications.

- The form is only necessary for tax purposes. Many believe that the Childcare Receipt form is solely for tax deductions. In reality, it serves as proof of payment and can be useful for personal record-keeping as well.

- Only licensed providers can issue this receipt. Some think that only licensed childcare providers can provide a receipt. However, any individual or organization offering childcare services can issue this form as long as they provide the necessary details.

- All childcare payments must be documented on this form. It is a misconception that every payment made for childcare must be documented using this specific form. While it is a good practice, other forms of documentation may also suffice.

- The receipt must be issued immediately after payment. Some parents believe that the receipt must be given right after payment. While it is recommended to receive it promptly, there is no strict timeline for when the receipt should be issued.

- Only one receipt is needed for multiple children. Many think that a single receipt can cover multiple children. Each child should have their own receipt to ensure clarity and accurate record-keeping.

- The form does not require a signature. Some assume that a signature is not necessary on the receipt. In fact, the provider’s signature is crucial as it verifies the authenticity of the transaction.

- Digital copies of the receipt are not acceptable. There is a belief that only physical copies of the receipt are valid. However, digital versions are often acceptable, provided they contain all required information.

- The form can be altered after it is issued. Some individuals think it is permissible to change details on the receipt after it has been issued. This is incorrect; any alterations can invalidate the receipt.

- Parents do not need to keep these receipts. A common misconception is that parents can discard these receipts after use. In reality, keeping them for future reference, especially during tax season, is highly advisable.

- All childcare providers use the same receipt format. Many assume that there is a standardized format for the Childcare Receipt form. In fact, providers may have their own versions, as long as they include the necessary information.

By addressing these misconceptions, parents can better navigate the process of documenting childcare expenses and ensure they have the necessary information for their records.

More PDF Templates

Miscellaneous Information - The 1099-MISC must be filed by businesses that paid $600 or more during the tax year.

To facilitate your vehicle sale, ensure you utilize the proper documentation. This includes the crucial Motor Vehicle Bill of Sale documentation, which you can easily access by following this link: essential Motor Vehicle Bill of Sale template.

Asuiron - The Asurion F-017-08 MEN form is vital for warranty fulfillment.

Form Specs

| Fact Name | Description |

|---|---|

| Date of Service | The receipt must include the date on which the childcare services were provided. |

| Amount Charged | The total amount paid for the childcare services should be clearly stated on the receipt. |

| Received From | The name of the individual or entity that paid for the childcare services must be included. |

| Child(ren) Names | The receipt should specify the names of the child or children receiving care. |

| Service Period | The receipt must indicate the start and end dates of the childcare services provided. |

| Provider’s Signature | A signature from the childcare provider is required to validate the receipt. |

| State-Specific Requirements | Some states may have specific regulations governing the format and content of childcare receipts. |

| Tax Deductions | Parents may use these receipts to claim childcare expenses on their tax returns. |

| Record Keeping | Both providers and parents should keep copies of the receipts for their records. |

Documents used along the form

The Childcare Receipt form is a crucial document for parents and childcare providers, but it is often accompanied by other important forms and documents. These additional documents help streamline the childcare process, ensuring clarity and compliance for both parties. Below is a list of commonly used forms that often accompany the Childcare Receipt form.

- Child Enrollment Form: This form collects essential information about the child, including medical history, emergency contacts, and any special needs. It helps providers understand the child’s requirements and ensures their safety.

- Parent Agreement Form: This document outlines the terms of service between the provider and the parents. It typically includes payment terms, hours of operation, and policies regarding cancellations and late pickups.

- Power of Attorney for a Child: This document allows a parent or legal guardian to designate an individual to make decisions on behalf of their child, ensuring their needs are met in the parent's absence. For more details, visit https://allfloridaforms.com/.

- Payment Authorization Form: This form allows parents to authorize automatic payments for childcare services. It simplifies billing and ensures timely payments, reducing administrative burdens for providers.

- Tax Information Form: Parents may need to complete this form to provide necessary information for tax purposes. It often includes Social Security numbers and details about childcare expenses for tax deductions.

- Child Health Records: This document contains vaccination history and other health-related information. Providers require this to ensure compliance with health regulations and to safeguard the wellbeing of all children in their care.

- Incident Report Form: In the event of an accident or injury, this form documents what occurred. It is essential for maintaining transparency and for any necessary follow-up actions.

- Termination Notice: If either party decides to end the childcare arrangement, this form provides a formal way to communicate the decision. It outlines the last day of service and any final payments due.

Utilizing these forms alongside the Childcare Receipt form can enhance communication and ensure a smooth operation between parents and childcare providers. Each document serves a specific purpose, contributing to a transparent and organized childcare experience.