Get Citibank Direct Deposit Form

Key takeaways

When filling out the Citibank Direct Deposit form, there are several important points to keep in mind. Here are some key takeaways to ensure a smooth process:

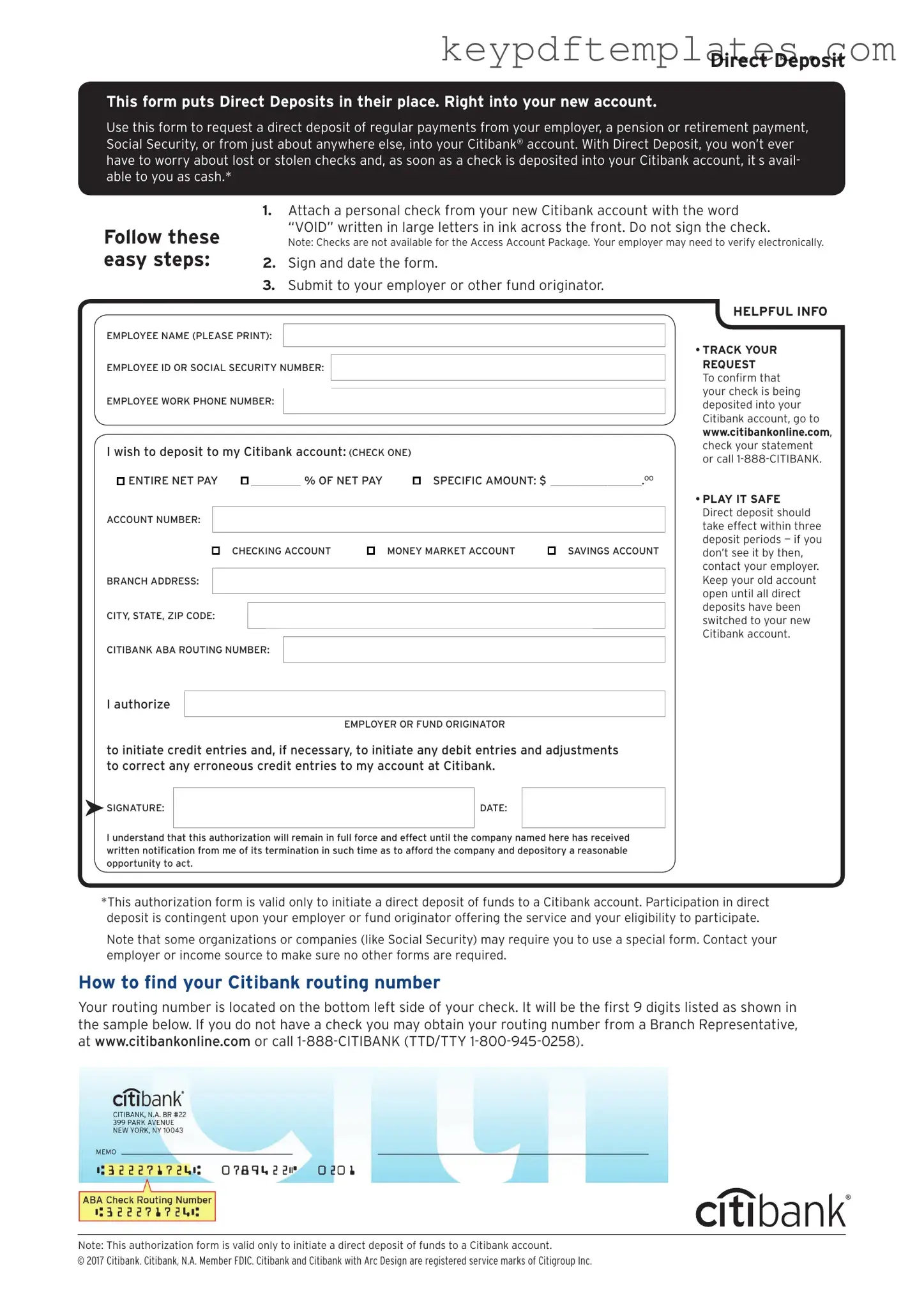

- Accurate Information: Double-check all personal details, including your name, address, and account number. Errors can delay your deposit.

- Routing Number: Make sure to use the correct routing number for your Citibank account. This number is essential for directing your funds to the right place.

- Signature Required: Your signature is necessary to authorize the direct deposit. Without it, your request will not be processed.

- Notify Your Employer: After completing the form, submit it to your employer's payroll department. They need this information to set up your direct deposit.

By keeping these points in mind, you can ensure that your direct deposit setup goes smoothly and that your funds arrive on time.

Similar forms

- W-4 Form: This document is used by employees to indicate their tax withholding preferences. Like the Direct Deposit form, it requires personal information and is submitted to an employer for processing.

- Bank Account Application: Similar to the Direct Deposit form, this application gathers personal and financial information to set up an account. Both documents require accurate details to ensure proper processing.

- Paycheck Authorization Form: This form authorizes an employer to deposit wages directly into an employee's bank account. It serves a similar purpose as the Direct Deposit form in facilitating direct payments.

- Georgia WC 102B Form: Essential for attorneys representing employers or insurers, this form acts as a notice of representation in workers' compensation cases. For more information, visit Georgia PDF.

- Social Security Administration Direct Deposit Form: This form allows individuals to set up direct deposit for Social Security benefits. It shares the same intent of ensuring timely and secure payments to a bank account.

- State Unemployment Benefits Direct Deposit Form: Similar in function, this form allows individuals to receive unemployment benefits directly into their bank accounts, streamlining the payment process.

- Retirement Account Contribution Form: This document is used to set up direct deposits for contributions to retirement accounts. It requires personal information and banking details, much like the Direct Deposit form.

Misconceptions

Understanding the Citibank Direct Deposit form can be challenging due to various misconceptions. Here are nine common misunderstandings and clarifications:

- Direct deposit is only for payroll. Many believe that direct deposit is limited to salary payments. However, it can also be used for government benefits, tax refunds, and other types of income.

- You need a Citibank account to use the form. While the form is designed for Citibank accounts, it can be used to set up direct deposits to any bank account, as long as you provide the correct routing and account numbers.

- Direct deposit is instant. Some people think that once they submit the form, the funds will arrive immediately. In reality, it may take one or two pay cycles for direct deposits to start.

- Once set up, direct deposit cannot be changed. This is not true. You can update or change your direct deposit information at any time by submitting a new form.

- Direct deposits are only for employees. Many assume that only employees can receive direct deposits. In fact, freelancers and contractors can also set up direct deposits for payments.

- Direct deposits are not secure. Some worry about the safety of direct deposits. However, they are generally considered more secure than paper checks, which can be lost or stolen.

- All employers offer direct deposit. Not all employers provide this option. It’s essential to check with your employer to see if they support direct deposit.

- You can’t use a joint account for direct deposit. This is a misconception. You can use a joint account for direct deposits as long as both account holders agree to it.

- Direct deposits are only for U.S. residents. While most direct deposits are for U.S. accounts, some international payments can also be set up through direct deposit, depending on the payer's policies.

By understanding these misconceptions, you can navigate the Citibank Direct Deposit form with greater confidence.

More PDF Templates

Fake Utility Bill Generator - Report any incorrect meter readings that affect billing.

Form Fillable Character Sheet 5e - Equipment shows essential items your character carries for adventures.

For an efficient transaction, it’s important to have the right documentation. You can find a helpful resource by reviewing this essential Motorcycle Bill of Sale template at the Texas documents website.

How to Make Report Security Guard - The form is designed for clarity to facilitate easy information retrieval.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Citibank Direct Deposit form is used to authorize the direct deposit of funds into a Citibank account. |

| Required Information | To complete the form, individuals must provide their bank account number, routing number, and personal identification details. |

| State-Specific Forms | Some states may require specific forms or additional documentation, governed by state banking laws. |

| Submission Process | The completed form should be submitted to the employer or the entity responsible for processing the direct deposit. |

Documents used along the form

When setting up direct deposit with Citibank, you may encounter several other forms and documents that can facilitate the process. Each of these documents serves a specific purpose, ensuring that your banking information is accurate and secure. Below is a list of common forms and documents that are often used alongside the Citibank Direct Deposit form.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. It helps determine the amount of federal income tax to withhold from your paycheck.

- Bank Account Verification Letter: A letter from your bank confirming your account details. This document is often required to ensure that the direct deposit is set up correctly.

- Employment Verification Form: This form confirms your employment status and is sometimes required by the bank to process your direct deposit request.

- Pay Stub: A recent pay stub may be requested to verify your income and employment details, ensuring that the correct amount is deposited into your account.

- Direct Deposit Authorization Form: A specific form that grants your employer permission to deposit your paycheck directly into your bank account. This is often provided by the employer.

- Routing and Account Number Documentation: Documentation that includes your bank's routing number and your account number, necessary for setting up direct deposit.

- State Tax Withholding Form: Depending on your state, this form allows you to specify state tax withholding preferences, which may be required for direct deposit processing.

- Bill of Sale Form: A crucial document for the transfer of ownership of personal property in New York, ensuring both parties have a clear record of the transaction. For more details, refer to NY PDF Forms.

- Change of Direct Deposit Information Form: If you need to update your banking information, this form allows you to change the details of your existing direct deposit account.

These documents play a crucial role in ensuring that your direct deposit is processed smoothly and accurately. Having them ready can help streamline the setup process and prevent any delays in receiving your funds.