Printable Closing Date Extension Addendum Form Template

Key takeaways

When dealing with the Closing Date Extension Addendum Form, several important considerations can help ensure a smooth process. Here are key takeaways to keep in mind:

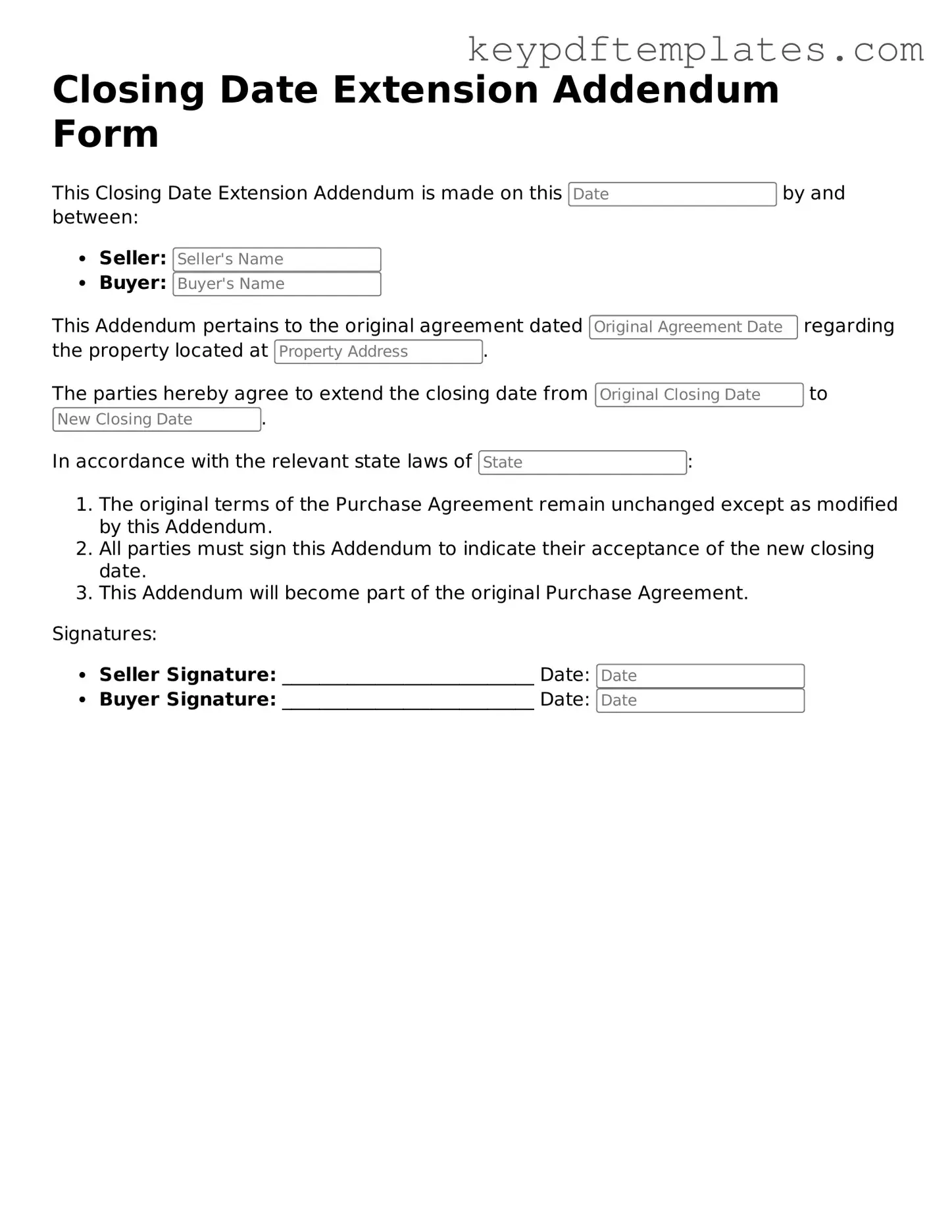

- The form is used to officially extend the closing date of a real estate transaction.

- Both the buyer and seller must agree to the extension and sign the addendum.

- It is essential to specify the new closing date clearly to avoid confusion.

- Include any reasons for the extension to provide context and clarity.

- Review any related contracts to ensure consistency with the extension terms.

- Keep a copy of the signed addendum for your records and for any future reference.

- Be aware of any implications the extension may have on financing or other contractual obligations.

Using the Closing Date Extension Addendum Form correctly can help prevent misunderstandings and ensure that all parties are on the same page regarding the new timeline for closing the transaction.

Similar forms

- Amendment Agreement: This document modifies specific terms of an existing contract, similar to how the Closing Date Extension Addendum adjusts the timeline of a closing date.

- Extension Agreement: This document provides an extension to the original agreement's deadlines, just as the Closing Date Extension Addendum allows for additional time before closing.

- Non-disclosure Agreement: This important legal form establishes terms to protect sensitive information shared between parties, ensuring confidentiality. For more information, visit Florida PDF Forms.

- Letter of Intent: This document outlines the preliminary understanding between parties, akin to the Closing Date Extension Addendum which clarifies the new closing date expectations.

- Release of Liability: This document frees one party from future claims, similar to how the Closing Date Extension Addendum may include terms that protect parties from penalties related to the delay.

Misconceptions

Understanding the Closing Date Extension Addendum Form is crucial for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Here are ten common misconceptions about this form:

- It is only used for residential properties. Many believe this addendum applies solely to residential transactions. In reality, it can be used for both residential and commercial properties.

- It automatically extends the closing date. Some think that signing this form guarantees an extension. The extension is only valid if both parties agree and sign the addendum.

- There are no consequences for extending the closing date. This is misleading. Extending the closing date can have financial implications, including potential penalties or additional costs.

- It can be used at any time without restrictions. This is not accurate. The timing of when to request an extension can be critical and may be subject to the terms of the original contract.

- Only the buyer can request an extension. This is a common misunderstanding. Either party, buyer or seller, can request an extension if circumstances warrant it.

- The form is only needed for significant delays. Some believe that minor delays do not require an addendum. However, any change in the closing date should be documented to avoid disputes.

- Once signed, the closing date is permanently changed. This is incorrect. The addendum can specify a new date, but further changes may require additional agreements.

- The addendum is a standard form with no room for customization. While there is a standard format, parties can modify the terms to suit their specific needs, as long as both agree.

- It is a legally binding document without any conditions. This misconception overlooks that the addendum's enforceability depends on the mutual consent of both parties and adherence to the original contract terms.

- Using the addendum means the original contract is void. This is false. The addendum supplements the original contract and does not invalidate it.

By addressing these misconceptions, individuals can navigate the closing process more effectively and ensure smoother transactions.

Common Forms

Employer's Quarterly Federal Tax Return - Employers should regularly review their payroll records to prepare for the 941.

To facilitate the proper ownership transfer of personal property, it is recommended to utilize a General Bill of Sale form. This essential document ensures clarity and legality in transactions involving various items, from vehicles to electronics and even smaller possessions like furniture. For those seeking to create their own bill of sale, you can access a comprehensive guide and the pdf download, which provides a convenient template for your needs.

Ms Word Chart - Resistance to change in dates may impact the accuracy of the record.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The Closing Date Extension Addendum Form is used to extend the closing date of a real estate transaction. |

| Parties Involved | The form typically involves the buyer and the seller of the property. |

| Governing Law | The form is governed by state-specific laws, which may vary by jurisdiction. |

| Execution | Both parties must sign the addendum for it to be legally binding. |

| Timeframe | The extension period specified in the form can vary, depending on the agreement between the parties. |

| Impact on Other Terms | The extension may affect other terms of the original purchase agreement, including contingencies. |

| Notification | Parties should notify relevant stakeholders, such as lenders and agents, of the extension. |

| State-Specific Forms | Some states may have their own versions of the form, requiring adherence to local regulations. |

Documents used along the form

When dealing with real estate transactions, several documents often accompany the Closing Date Extension Addendum Form. Each of these documents plays a crucial role in ensuring that all parties involved understand their rights and responsibilities. Here’s a brief overview of some commonly used forms that you might encounter.

- Purchase Agreement: This is the initial contract between the buyer and seller outlining the terms of the sale, including the purchase price and closing date.

- Disclosure Statements: These documents provide essential information about the property, such as its condition and any known issues, helping buyers make informed decisions.

- Title Report: This report details the legal ownership of the property and any liens or encumbrances that may affect the transaction.

- Loan Commitment Letter: Issued by the lender, this letter confirms that the buyer has been approved for a loan, detailing the terms and conditions of the financing.

- Closing Statement: Also known as a HUD-1 or ALTA statement, this document outlines all financial transactions related to the sale, including fees and adjustments.

- Home Inspection Report: Conducted by a qualified inspector, this report assesses the condition of the property and can influence negotiations regarding repairs or price adjustments.

- Vehicle Release of Liability: This document is essential for transferring ownership of a vehicle, providing legal protection for the seller against future claims related to the vehicle. For more information, visit https://toptemplates.info/release-of-liability/vehicle-release-of-liability/.

- Escrow Agreement: This document outlines the terms under which an escrow agent will hold funds and documents until the closing conditions are met.

Understanding these documents can significantly enhance your experience in a real estate transaction. Each form serves a specific purpose, and together they create a comprehensive framework that helps facilitate a smooth closing process.