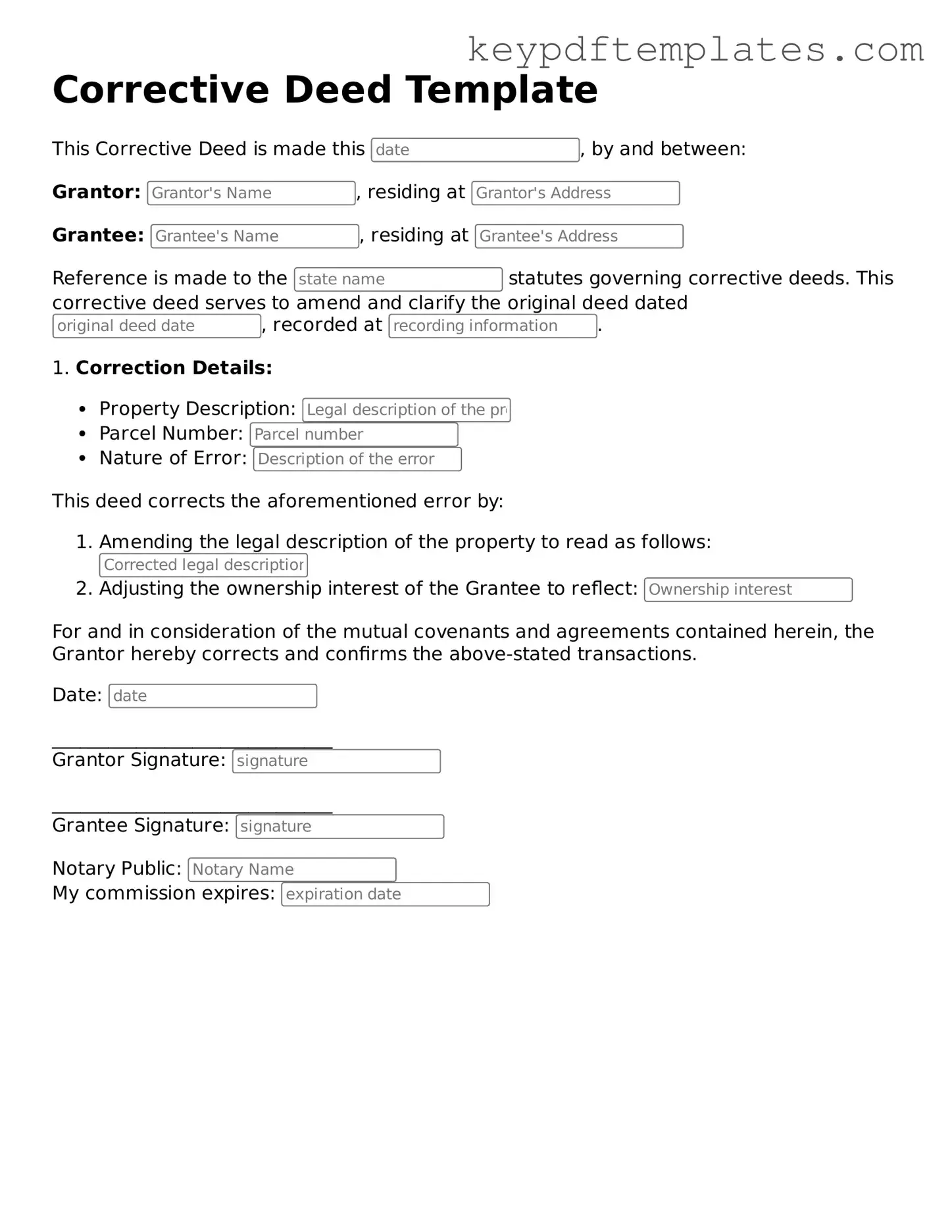

Printable Corrective Deed Template

Key takeaways

When it comes to filling out and using a Corrective Deed form, there are several important points to keep in mind. Here are some key takeaways that can help ensure the process goes smoothly:

- Understand the Purpose: A Corrective Deed is primarily used to correct errors in a previously recorded deed. This could include mistakes in names, property descriptions, or other critical details.

- Gather Necessary Information: Before completing the form, collect all relevant information from the original deed. This ensures accuracy when making corrections.

- Consult Local Laws: Different states may have specific requirements for filing a Corrective Deed. Familiarize yourself with local laws to avoid any potential issues.

- Signatures Matter: Ensure that all required parties sign the Corrective Deed. Missing signatures can invalidate the corrections made.

- File Promptly: Once completed, the Corrective Deed should be filed with the appropriate local government office as soon as possible to ensure the corrections are officially recognized.

By keeping these points in mind, individuals can navigate the process of using a Corrective Deed more effectively and ensure that their property records are accurate.

Similar forms

The Corrective Deed form is a legal document used to correct errors in a previously executed deed. Several other documents serve similar purposes in real estate and legal contexts. Here are nine documents that share similarities with the Corrective Deed:

- Quitclaim Deed: This document transfers interest in a property without guaranteeing that the title is clear. It is often used to remove a party’s interest in a property, similar to how a Corrective Deed rectifies errors.

- Warranty Deed: Unlike a Quitclaim Deed, a Warranty Deed guarantees that the grantor holds clear title to the property. Both documents serve to convey ownership, but the Warranty Deed provides more protection to the buyer.

- Transfer-on-Death Deed: This deed allows property owners to transfer real estate to beneficiaries upon death without probate, offering a straightforward way to simplify estate planning, as seen in the Transfer-on-Death Deed.

- Deed of Trust: This document secures a loan by transferring property title to a trustee until the debt is repaid. Like a Corrective Deed, it involves property interests and can be amended if errors arise.

- Affidavit of Title: This sworn statement confirms the ownership of a property and can clarify discrepancies. It functions similarly to a Corrective Deed by addressing issues related to title clarity.

- Grant Deed: This document transfers property ownership and implies that the title is clear. It is akin to a Corrective Deed in that it serves to convey property rights, but it does not correct existing errors.

- Title Insurance Policy: While not a deed, this document protects against losses from title defects. It can complement a Corrective Deed by providing assurance that any issues will be covered.

- Release of Lien: This document removes a lien from a property title, similar to how a Corrective Deed clears up title errors. Both serve to clarify ownership and ensure clear title.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. It can be used in conjunction with a Corrective Deed to ensure proper execution of corrections.

- Modification Agreement: This document alters the terms of an existing agreement, much like how a Corrective Deed modifies the original deed to rectify mistakes. Both are essential for maintaining accurate records.

Misconceptions

Misconceptions about the Corrective Deed form can lead to confusion and potential legal issues. Here are eight common misunderstandings:

- 1. A Corrective Deed is the same as a Quitclaim Deed. Many people believe these two forms serve identical purposes. However, a Corrective Deed specifically addresses errors in an existing deed, while a Quitclaim Deed transfers whatever interest the grantor has in the property without guaranteeing that interest is valid.

- 2. You can use a Corrective Deed for any type of error. Not all mistakes qualify for correction through this form. Generally, only clerical errors or minor discrepancies, such as misspelled names or incorrect legal descriptions, can be corrected. Significant changes or disputes over ownership may require different legal actions.

- 3. A Corrective Deed must be filed in the same office as the original deed. While it is a common practice to file the Corrective Deed with the same office where the original deed was recorded, this is not a strict requirement. The key is to ensure that the corrective action is properly documented and accessible.

- 4. The original grantor must sign the Corrective Deed. This is a misconception. In many cases, the current owner of the property, or the party who is correcting the deed, can sign the Corrective Deed, especially if the original grantor is unavailable.

- 5. A Corrective Deed can change the ownership of the property. This is incorrect. A Corrective Deed does not alter ownership rights; it merely clarifies or corrects the existing deed. To change ownership, a different type of deed must be executed.

- 6. You don’t need legal assistance to file a Corrective Deed. While some may attempt to file a Corrective Deed without legal help, it is advisable to consult an attorney. Legal professionals can ensure that the deed is completed correctly and that all necessary procedures are followed.

- 7. Filing a Corrective Deed is a lengthy process. Many assume that correcting a deed takes a significant amount of time. In reality, if the paperwork is completed accurately and all required information is provided, the process can be relatively quick.

- 8. A Corrective Deed is only necessary for residential properties. This is a misconception as well. Any type of property, whether residential, commercial, or agricultural, may require a Corrective Deed if there are errors that need addressing.

Understanding these misconceptions can help property owners navigate the complexities of real estate law more effectively. Clarity and accuracy in property documentation are essential for protecting one’s interests.

Other Corrective Deed Types:

Gift Deed Rules - Understanding local gifting laws ensures compliance and safeguards the transaction.

To ensure a smooth transfer of ownership, it is advisable to utilize resources that provide accurate templates for these legal documents, like the one available at quitclaimdeedtemplate.com, which carefully outlines the process and requirements for a Colorado Quitclaim Deed.

Trust Deed Sample - While the format may differ, the essential elements of a Deed of Trust remain consistent across jurisdictions.

PDF Details

| Fact Name | Details |

|---|---|

| Definition | A Corrective Deed is a legal document used to correct errors in a previously executed deed. |

| Purpose | Its primary purpose is to clarify or rectify mistakes such as misspellings or incorrect property descriptions. |

| Governing Law | The laws governing Corrective Deeds vary by state. For example, in California, it is governed by California Civil Code Section 1092. |

| Parties Involved | The parties involved typically include the original grantor and grantee, as well as any necessary witnesses or notaries. |

| Execution Requirements | Most states require the Corrective Deed to be signed by the grantor and notarized to be legally valid. |

| Recording | Once executed, the Corrective Deed must be recorded with the local county recorder's office to take effect. |

| Effect on Title | A Corrective Deed does not transfer title but clarifies the existing title as per the original deed. |

| Common Mistakes | Common errors corrected include incorrect legal descriptions, wrong names, or omitted signatures. |

| Limitations | A Corrective Deed cannot change the substantive terms of the original deed; it only corrects clerical errors. |

Documents used along the form

The Corrective Deed form is often used to rectify errors in previously executed deeds. When filing a Corrective Deed, several other forms and documents may be necessary to ensure that the corrections are legally recognized and properly recorded. Below is a list of related documents that are commonly associated with the Corrective Deed form.

- Original Deed: This document is the initial deed that contains the original terms of the property transfer. It serves as a reference point for the corrections made in the Corrective Deed.

- Affidavit of Correction: This sworn statement outlines the specific errors in the original deed and confirms the intention to correct them. It may provide additional context for the changes made.

- Title Search Report: A title search report provides a comprehensive overview of the property’s title history. It can help identify any potential issues that may arise from the corrections being made.

- Property Description Addendum: This document details the accurate legal description of the property. It is crucial for ensuring that the Corrective Deed reflects the correct boundaries and features of the property.

- Consent of Interested Parties: If there are multiple owners or parties with an interest in the property, their consent may be required. This document ensures that all parties agree to the corrections being made.

- Notarized Signatures: Signatures from all relevant parties must be notarized to validate the Corrective Deed. This step is essential for the document’s acceptance by the county recorder’s office.

- Recording Request Form: This form is often submitted along with the Corrective Deed to the local recording office. It requests that the Corrective Deed be officially recorded in the public records.

- Transfer-on-Death Deed: This form allows property owners to designate beneficiaries for their real estate, simplifying estate planning and avoiding probate. For more information, visit https://todform.com/blank-arizona-transfer-on-death-deed.

- Tax Certification: This document certifies that all property taxes have been paid. It may be required before the Corrective Deed can be recorded to avoid any liens on the property.

Each of these documents plays a vital role in the process of correcting a deed. Ensuring that all necessary forms are completed and submitted can help facilitate a smooth correction process and protect the interests of all parties involved.