Printable Deed Template

Deed - Tailored for State

Key takeaways

When dealing with a Deed form, understanding the essentials can make a significant difference in the process. Here are some key takeaways to keep in mind:

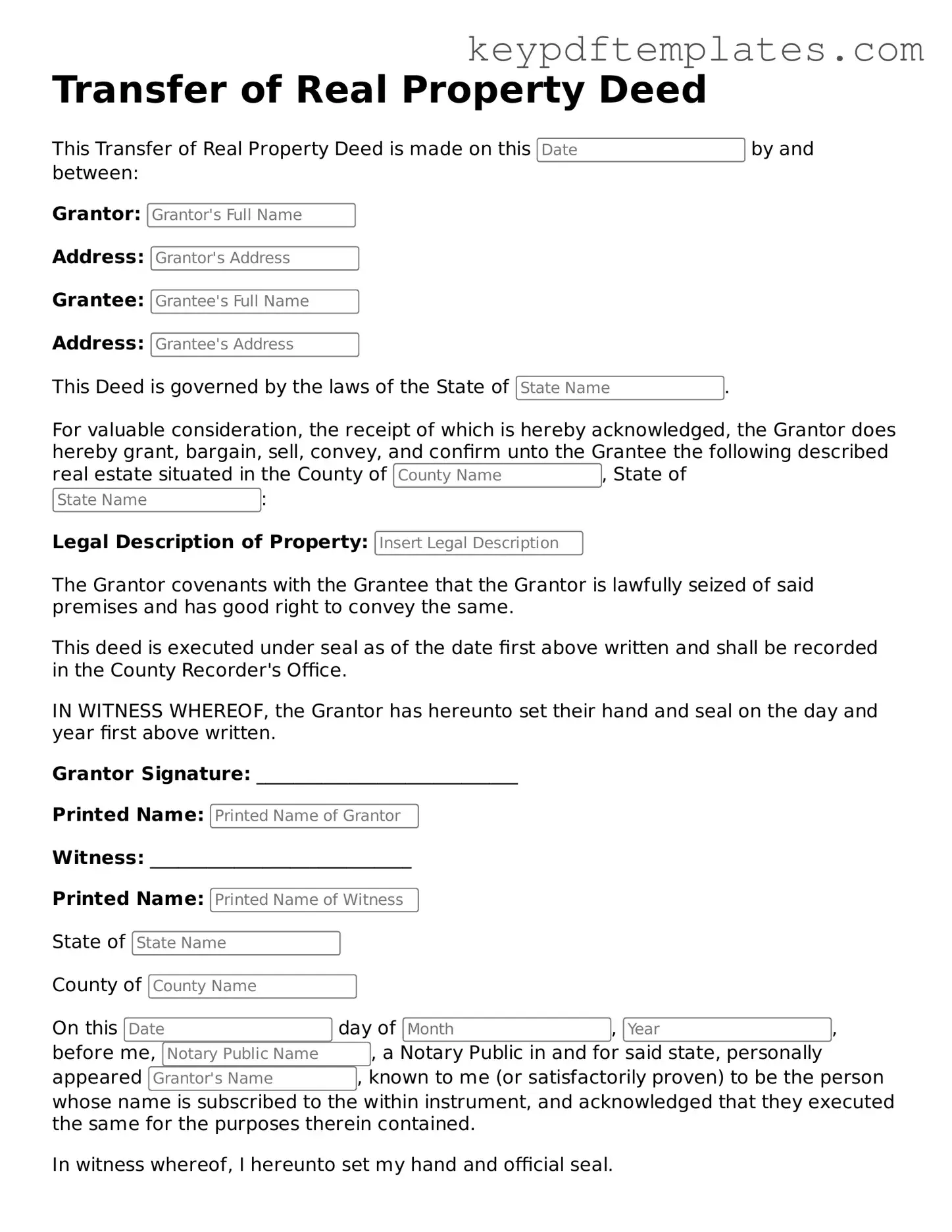

- Know the Purpose: A Deed is a legal document that conveys ownership of property. Familiarize yourself with its function to ensure proper usage.

- Identify the Parties: Clearly state the names and addresses of both the grantor (seller) and grantee (buyer). Accuracy here is crucial.

- Describe the Property: Provide a detailed description of the property being transferred. This should include the address and any relevant legal descriptions.

- Signatures Matter: Ensure that all parties sign the Deed. Without signatures, the document holds no legal weight.

- Consider Notarization: While not always required, having the Deed notarized can add an extra layer of authenticity and help prevent disputes.

- Record the Deed: After execution, the Deed should be recorded with the appropriate county office. This step protects the interests of the new owner.

- Consult Professionals: If you have questions or concerns, don’t hesitate to seek advice from a real estate attorney or a contract specialist. Their expertise can guide you through the process.

By keeping these points in mind, you can navigate the complexities of filling out and using a Deed form with confidence. Proper attention to detail can save time and prevent future complications.

Similar forms

The Deed form is a legal document used to transfer ownership of property. It has similarities with several other documents. Here are eight documents that share characteristics with the Deed form:

- Bill of Sale: This document transfers ownership of personal property, similar to how a Deed transfers real property. Both serve as proof of ownership.

- Lease Agreement: A Lease outlines the terms of renting property. Like a Deed, it involves property rights, though it does not transfer ownership.

- Title Transfer Document: This document is used specifically for vehicles. It serves a similar purpose as a Deed by transferring ownership from one party to another.

- Texas Employment Verification Form: This essential form is used by employers to confirm an employee's employment status and is critical for individuals applying for state benefits. For more information, visit https://txtemplate.com/texas-employment-verification-pdf-template.

- Trust Agreement: This outlines the management of assets held in trust. It can include real property, much like a Deed, which details property ownership.

- Mortgage Agreement: This document secures a loan with real property. It is linked to a Deed, as both involve property rights and ownership considerations.

- Quitclaim Deed: A specific type of Deed, it transfers any interest the grantor has in the property without guaranteeing that interest. It highlights the concept of transferring property rights.

- Property Settlement Agreement: Often used in divorce, this document divides property between parties. Like a Deed, it deals with the ownership of real estate.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions, similar to how a Deed facilitates the transfer of property rights.

Misconceptions

Understanding the Deed form is essential for anyone involved in property transactions. However, several misconceptions can lead to confusion. Here are seven common misunderstandings about Deed forms:

-

All Deeds are the same.

This is not true. Different types of Deeds serve various purposes, such as Warranty Deeds, Quitclaim Deeds, and Grant Deeds. Each has distinct legal implications and protections.

-

A Deed is only needed for selling property.

Many people believe that Deeds are only necessary during sales. However, they are also required for transferring property ownership, even as gifts or through inheritance.

-

Once a Deed is signed, it cannot be changed.

This is a misconception. While a Deed is a legal document, it can be amended or revoked under certain circumstances, provided the proper legal procedures are followed.

-

Notarization is optional for Deeds.

In many states, notarization is a requirement for a Deed to be legally binding. Failing to have a Deed notarized can lead to issues in the transfer of property.

-

Deeds do not need to be recorded.

Recording a Deed with the appropriate government office is crucial. This step provides public notice of ownership and protects against future claims on the property.

-

Only lawyers can prepare Deeds.

While it's advisable to seek legal advice, individuals can prepare Deeds themselves, provided they understand the requirements and follow the correct format.

-

A Deed guarantees clear title to the property.

This is a common misunderstanding. A Deed transfers ownership but does not guarantee that the title is free from liens or other claims. Title insurance is often recommended for added protection.

By clearing up these misconceptions, individuals can approach property transactions with greater confidence and understanding.

Common Forms

What Is an Affidavit of Affixture - Filing the affidavit can assist in maintaining compliance with homeowner association rules.

Vehicle Accident Release of Liability Form - Clarifies the extent of damages covered for the signing party.

In order to facilitate a clear understanding of responsibilities, it is essential for both landlords and tenants to utilize a proper leasing framework, such as the Florida PDF Forms that provides a comprehensive Residential Lease Agreement. This document not only clarifies terms but also instills confidence in both parties as they embark on their rental journey.

Roof Estimate Template - Please share details about your property’s age and condition.

PDF Details

| Fact Name | Details |

|---|---|

| Definition | A deed is a legal document that conveys ownership of property from one party to another. |

| Types of Deeds | Common types include warranty deeds, quitclaim deeds, and special purpose deeds. |

| Governing Law | Each state has its own laws governing deeds; for example, in California, the California Civil Code applies. |

| Signature Requirement | Most states require the signature of the grantor (the person transferring the property) for the deed to be valid. |

| Recording | Deeds should be recorded in the county where the property is located to provide public notice of ownership. |

| Legal Description | A precise legal description of the property must be included in the deed to ensure clarity in ownership. |

Documents used along the form

When completing a property transfer, several forms and documents may accompany the Deed form. Each document serves a specific purpose and ensures a smooth transaction. Below is a list of commonly used documents.

- Title Search Report: This document provides a history of the property's ownership and any liens or encumbrances. It confirms that the seller has the right to transfer ownership.

- Bill of Sale: A Bill of Sale is used to document the transfer of personal property associated with the real estate. This includes items like appliances or fixtures that are included in the sale.

- Closing Statement: This document outlines all financial aspects of the transaction. It details the purchase price, closing costs, and any adjustments made at closing.

- Durable Power of Attorney: This essential document allows you to appoint someone to manage your financial and legal affairs if you become incapacitated. For more information, please visit Georgia PDF.

- Affidavit of Title: This sworn statement by the seller confirms that they hold clear title to the property and discloses any known issues that may affect ownership.

- Property Disclosure Statement: This document requires the seller to disclose known defects or issues with the property. It protects the buyer by ensuring they are aware of any potential problems before the sale is finalized.

Understanding these documents is crucial for both buyers and sellers. They help clarify the terms of the transaction and protect the interests of all parties involved.