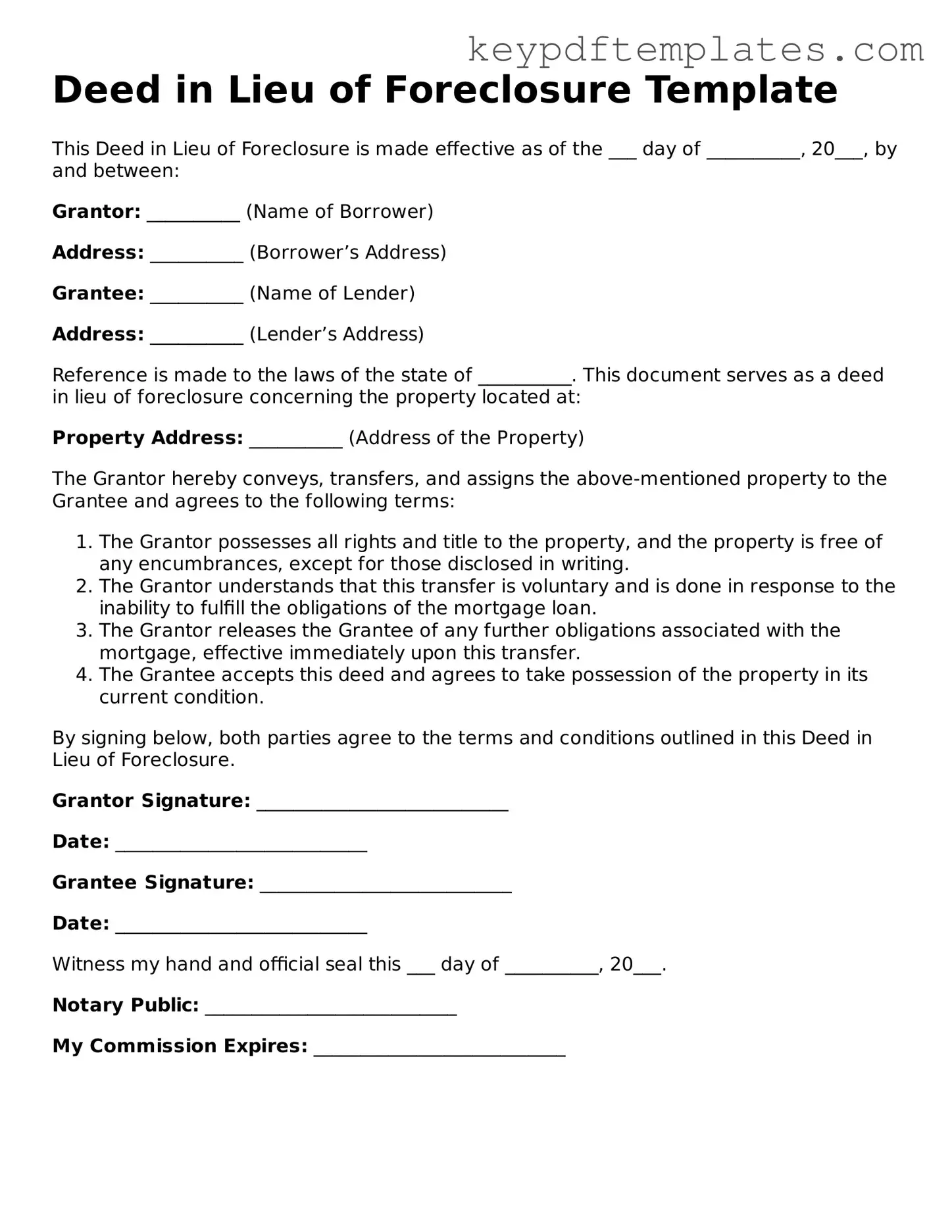

Printable Deed in Lieu of Foreclosure Template

Deed in Lieu of Foreclosure - Tailored for State

Key takeaways

When considering the Deed in Lieu of Foreclosure, it is essential to understand its implications and process. Here are key takeaways to keep in mind:

- Understanding Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure.

- Eligibility Criteria: Not all homeowners qualify. Lenders typically require proof of financial hardship and a lack of other viable options.

- Property Condition: The property must be in good condition. Lenders may conduct an inspection before accepting the deed.

- Release of Liability: This agreement may release the homeowner from future mortgage obligations, but it's crucial to confirm this with the lender.

- Impact on Credit: While it can be less damaging than foreclosure, a Deed in Lieu of Foreclosure will still negatively impact credit scores.

- Tax Implications: Homeowners should consult a tax professional, as there may be tax consequences related to debt forgiveness.

- Documentation Required: Homeowners must provide necessary documentation, including financial statements and proof of hardship.

- Legal Assistance: Seeking legal advice can help navigate the complexities of the process and ensure all rights are protected.

- Finalizing the Process: Once the deed is executed, it must be recorded with the county to officially transfer ownership.

Understanding these key points can help homeowners make informed decisions regarding a Deed in Lieu of Foreclosure.

Similar forms

- Short Sale Agreement: A short sale occurs when a homeowner sells their property for less than the amount owed on the mortgage. Similar to a deed in lieu of foreclosure, it allows the homeowner to avoid foreclosure by transferring the property to a buyer, with the lender agreeing to accept the sale proceeds as full satisfaction of the debt.

-

Bill of Sale for Trailers: This document is essential for documenting the sale of a trailer, providing all necessary information about the vehicle. To properly complete the transaction, use the Florida PDF Forms for the Trailer Bill of Sale.

- Loan Modification Agreement: This document modifies the terms of an existing mortgage to make it more affordable for the homeowner. Like a deed in lieu of foreclosure, it aims to prevent foreclosure by allowing the borrower to keep their home while adjusting the payment terms to fit their financial situation.

- Forbearance Agreement: In this agreement, the lender allows the borrower to temporarily pause or reduce mortgage payments. This can help the homeowner avoid foreclosure, similar to a deed in lieu of foreclosure, by providing time to improve their financial situation before taking further action.

- Bankruptcy Filing: Filing for bankruptcy can help individuals reorganize their debts or liquidate assets. While it is a different legal process, it can serve a similar purpose by providing a way to prevent foreclosure, allowing the homeowner time to address their financial obligations.

- Property Transfer Agreement: This document allows a homeowner to transfer ownership of the property to another party, often to settle debts or obligations. Like a deed in lieu of foreclosure, it involves transferring property ownership to relieve the homeowner of mortgage obligations.

Misconceptions

Understanding the Deed in Lieu of Foreclosure can be challenging, and there are several misconceptions that often arise. Here are five common misunderstandings about this legal process:

- It eliminates all debt obligations. Many people believe that signing a Deed in Lieu of Foreclosure means they are completely free from all debts. However, this is not always the case. While it can relieve a borrower from the mortgage debt, it may not cover other obligations, such as second mortgages or personal loans.

- It is a quick and easy solution. Some individuals think that a Deed in Lieu of Foreclosure is a simple fix to avoid foreclosure. In reality, the process can be lengthy and may require negotiations with the lender. It is essential to understand that each situation is unique and can vary significantly in complexity.

- It has no impact on credit scores. Another misconception is that a Deed in Lieu of Foreclosure does not affect credit ratings. In truth, this action can have a negative impact on a borrower’s credit score, similar to a foreclosure. The extent of the impact can depend on various factors, including the individual’s credit history.

- It is only available to those facing foreclosure. Many believe that a Deed in Lieu of Foreclosure is an option only for those who are already in the foreclosure process. However, it can be a viable alternative for homeowners who are struggling with mortgage payments but have not yet reached that stage.

- All lenders accept Deeds in Lieu of Foreclosure. Some borrowers assume that all lenders will agree to a Deed in Lieu of Foreclosure. Unfortunately, this is not always true. Lenders have different policies and may refuse this option based on their specific criteria or the circumstances surrounding the loan.

By clarifying these misconceptions, individuals can make more informed decisions regarding their options when facing financial difficulties related to their homes.

Other Deed in Lieu of Foreclosure Types:

Trust Deed Sample - In some jurisdictions, a Deed of Trust can be a more flexible alternative to traditional mortgages.

The Texas form is not only essential for legal and administrative tasks but also provides guidance on where to access templates and resources. For those looking to streamline the process, utilizing available tools can be beneficial, and you can find a useful template at https://txtemplate.com/texas-pdf-template. Taking the time to prepare before submission will ensure a smoother experience.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal agreement where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure proceedings. |

| Purpose | This process helps homeowners avoid the lengthy and costly foreclosure process, allowing for a more amicable resolution. |

| Eligibility | Homeowners typically need to demonstrate financial hardship and an inability to keep up with mortgage payments to qualify. |

| State-Specific Forms | Each state may have its own specific deed in lieu of foreclosure form. For example, in California, the governing law is outlined in the California Civil Code. |

| Credit Impact | While a deed in lieu of foreclosure is less damaging than a foreclosure, it can still negatively impact the homeowner's credit score. |

| Tax Implications | Homeowners may face tax consequences, as the IRS may consider the forgiven debt as taxable income. |

| Negotiation | Homeowners can negotiate terms with their lender, including potential relocation assistance or debt forgiveness. |

| Documentation | Proper documentation is crucial. Homeowners must provide financial statements and other relevant information to their lender. |

| Legal Advice | Seeking legal counsel is advisable to ensure that all rights and options are understood before proceeding with a deed in lieu of foreclosure. |

| Alternative Options | Homeowners should consider alternatives such as loan modification or short sale before opting for a deed in lieu of foreclosure. |

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender to avoid the foreclosure process. When completing this transaction, several other forms and documents may be required to ensure a smooth process. Below is a list of commonly associated documents.

- Loan Modification Agreement: This document outlines the new terms of the loan, including interest rates and payment schedules, which may be adjusted to help the borrower avoid foreclosure.

- Property Condition Disclosure: A form that provides information about the condition of the property. This disclosure helps the lender assess any potential issues before accepting the deed.

- Release of Liability: This document releases the borrower from any further obligation on the mortgage after the deed is transferred. It ensures that the borrower is not held responsible for any remaining debt.

- Quitclaim Deed: A legal document used to transfer ownership of the property without any warranties. It is often used in conjunction with a deed in lieu to formally convey the property to the lender.

- Durable Power of Attorney Form: For ensuring your financial and medical decisions are managed even in unforeseen circumstances, consider our important Durable Power of Attorney resources to guide you through the process.

- Affidavit of Title: A sworn statement confirming the borrower's ownership of the property and that there are no outstanding liens or claims against it, ensuring clear title for the lender.

- Settlement Statement: This document itemizes all the costs and credits associated with the transaction, providing a clear financial overview for both parties involved.

- Notice of Default: A formal notification from the lender to the borrower indicating that they have defaulted on their mortgage. This document is often part of the foreclosure process and may be referenced during the deed in lieu transaction.

Understanding these additional documents can help homeowners navigate the deed in lieu of foreclosure process more effectively. Each document serves a specific purpose and plays a crucial role in ensuring that both the borrower and lender are protected throughout the transaction.