Printable Deed of Trust Template

Key takeaways

Understanding the Deed of Trust form is crucial for anyone involved in real estate transactions. Here are some key takeaways to consider:

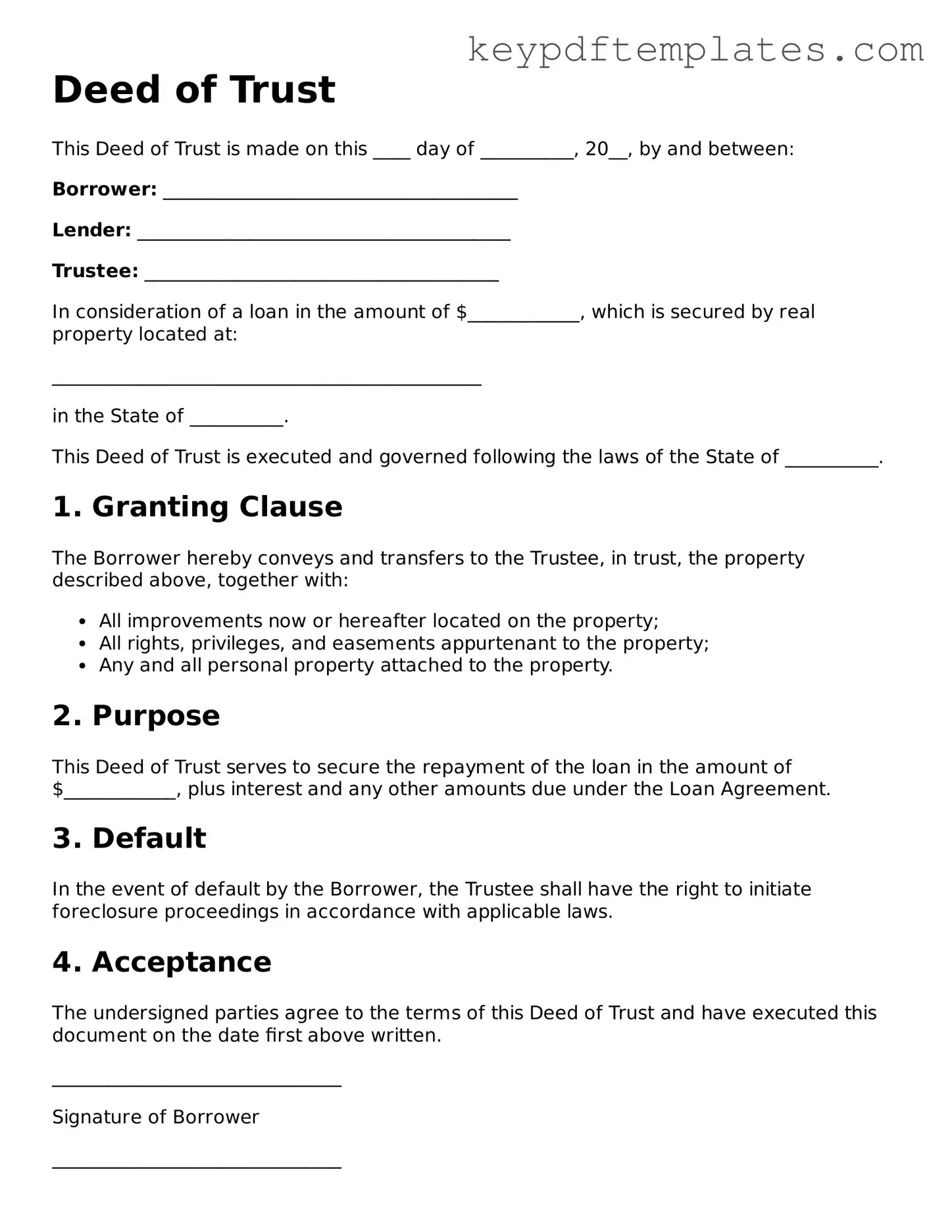

- Parties Involved: The Deed of Trust involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee. Each party has specific roles and responsibilities.

- Purpose: This document secures a loan by placing a lien on the property. If the borrower defaults, the trustee can initiate foreclosure proceedings on behalf of the lender.

- Filling Out the Form: Accuracy is essential when filling out the Deed of Trust. Ensure that all names, addresses, and property descriptions are correct to avoid legal complications.

- Recording the Deed: After completion, the Deed of Trust must be recorded in the appropriate county office. This step provides public notice of the lender's interest in the property.

- Legal Implications: Failure to adhere to the terms outlined in the Deed of Trust can lead to serious consequences, including foreclosure. Understanding these implications is vital for all parties involved.

Similar forms

- Mortgage: Like a Deed of Trust, a mortgage secures a loan with real property. Both documents create a lien on the property, ensuring the lender can reclaim the property if the borrower defaults on the loan.

- Promissory Note: This document outlines the borrower's promise to repay the loan. While a Deed of Trust secures the loan, the promissory note specifies the terms of repayment.

- Loan Agreement: Similar to a promissory note, a loan agreement details the terms of the loan. It includes interest rates, payment schedules, and other conditions, functioning alongside the Deed of Trust.

- Security Agreement: This document also secures a loan but may apply to personal property rather than real estate. Both agreements ensure the lender has a claim to the collateral in case of default.

- Assignment of Mortgage: This document transfers the rights of the original lender to another party. It is similar to a Deed of Trust in that it involves the transfer of interests in a secured loan.

- Subordination Agreement: This document allows a new loan to take priority over an existing one. It relates to the Deed of Trust by determining the order of claims against the property.

- Quitclaim Deed: A quitclaim deed transfers ownership of property without warranties. While it serves a different purpose, it can be related to the transfer of interests outlined in a Deed of Trust.

- Title Insurance Policy: This document protects against losses from defects in the title. While it does not secure a loan, it is often associated with transactions involving a Deed of Trust.

- Affidavit of Title: This sworn statement confirms the seller's ownership and the absence of liens. It complements a Deed of Trust by ensuring clear title before the loan is secured.

Georgia Deed Form: Essential for transferring property ownership in Georgia, the Georgia Deed form ensures clarity and compliance in real estate transactions. For more information and to access the form, visit georgiapdf.com.

- Escrow Agreement: This document outlines the terms under which funds or property are held by a third party. It often works in conjunction with a Deed of Trust during real estate transactions.

Misconceptions

Understanding the Deed of Trust form can be challenging due to various misconceptions. Here are eight common misunderstandings, along with clarifications to help clear up any confusion.

-

Misconception 1: A Deed of Trust is the same as a mortgage.

While both serve to secure a loan, a Deed of Trust involves three parties: the borrower, the lender, and a trustee. A mortgage typically involves only two parties: the borrower and the lender.

-

Misconception 2: A Deed of Trust is only used for residential properties.

This is not true. Deeds of Trust can be used for both residential and commercial properties, providing security for various types of loans.

-

Misconception 3: Once signed, the Deed of Trust cannot be changed.

While it is true that a Deed of Trust is a legal document, it can be amended or refinanced if both parties agree to the changes.

-

Misconception 4: The trustee has ownership of the property.

The trustee holds the title temporarily to ensure the loan is repaid. They do not have ownership rights over the property unless the borrower defaults.

-

Misconception 5: A Deed of Trust guarantees loan approval.

A Deed of Trust secures the loan but does not guarantee that the borrower will be approved for the loan itself. Approval depends on the lender’s criteria.

-

Misconception 6: You cannot sell a property with a Deed of Trust.

Property can still be sold, but the existing Deed of Trust must be addressed, either by paying off the loan or transferring it to the new owner.

-

Misconception 7: All states use Deeds of Trust in the same way.

Deeds of Trust are subject to state laws, which can vary significantly. It’s important to understand the specific regulations in your state.

-

Misconception 8: A Deed of Trust is only beneficial for lenders.

Borrowers also benefit from a Deed of Trust as it can provide a more streamlined foreclosure process compared to traditional mortgages.

Other Deed of Trust Types:

What Is a Deed in Lieu - In certain cases, the borrower may negotiate relocation assistance or other incentives from the lender.

A Texas Quitclaim Deed form is a legal document used to transfer interest in real property from one person to another without any warranties of title. This means that the seller, known as the grantor, does not guarantee they hold clear title to the property. For more information, you can refer to the Quit Claim Deed, which is a common tool for transactions among family members or to quickly change names on a property title.

Transfer on Death Deed California - Some states have specific requirements for the execution of Transfer-on-Death Deeds, so local consultation may be necessary.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Deed of Trust is a legal document that secures a loan by transferring the title of a property to a trustee until the loan is paid off. |

| Parties Involved | It involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee. |

| Governing Law | Each state has its own laws governing Deeds of Trust. For example, in California, it is governed by California Civil Code Section 2920. |

| Foreclosure Process | In a Deed of Trust, the foreclosure process is typically non-judicial, allowing for a faster resolution compared to traditional mortgages. |

| Benefits | Using a Deed of Trust can provide benefits such as quicker foreclosure and fewer legal complications in case of default. |

| Revocation | A Deed of Trust can be revoked or reconveyed once the loan is fully paid, returning the title to the borrower. |

Documents used along the form

A Deed of Trust is a crucial document in real estate transactions, particularly when securing a loan. Alongside this form, several other documents are commonly utilized to ensure that the transaction proceeds smoothly and legally. Below is a list of these documents, each serving a specific purpose in the process.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It details the loan amount, interest rate, repayment schedule, and consequences of default.

- Loan Application: A formal request for a loan, this document includes personal and financial information about the borrower, helping lenders assess creditworthiness.

- Title Insurance Policy: This insurance protects the lender and borrower from potential disputes over property ownership. It ensures that the title is clear and free of liens or claims.

- Closing Disclosure: Provided to the borrower three days before closing, this document outlines the final terms of the loan, including costs and fees associated with the transaction.

- Property Appraisal: An assessment of the property's value, this document is often required by lenders to ensure the property is worth the loan amount being requested.

- Inspection Report: This report details the condition of the property, identifying any issues that may need to be addressed before the sale can proceed.

- Borrower’s Affidavit: A sworn statement by the borrower affirming their identity and confirming that all information provided during the loan application process is accurate.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, often used when the borrower cannot be present at closing.

- Alabama Transfer-on-Death Deed: This form allows property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. To properly utilize this form and ensure your property passes directly to your loved ones, you can access and download the document.

- Mortgage Statement: A summary of the mortgage loan, detailing the remaining balance, payment history, and any fees or charges that may apply.

These documents collectively support the integrity of the transaction, ensuring that all parties involved are protected and informed. Understanding each document's role can help streamline the process and mitigate potential issues during the closing of a real estate transaction.