Get Employee Advance Form

Key takeaways

When filling out and using the Employee Advance form, it's essential to keep several key points in mind to ensure a smooth process. Below are important takeaways to consider:

- Complete all required fields: Ensure that every mandatory section of the form is filled out accurately to avoid delays.

- Provide a clear purpose: Clearly state the reason for the advance. This helps in the approval process.

- Attach supporting documents: Include any necessary receipts or documentation that justify the advance request.

- Review the policy: Familiarize yourself with the company's advance policy to understand eligibility and limits.

- Submit on time: Timely submission of the form is crucial. Late requests may not be processed promptly.

- Keep a copy: Always retain a copy of the submitted form for your records. This can be helpful for future reference.

- Follow up: If you do not receive a response within the expected timeframe, follow up with the appropriate department.

- Understand repayment terms: Be aware of how and when the advance will be repaid to avoid confusion later.

- Seek assistance if needed: If you have questions about the form or the process, don’t hesitate to ask your supervisor or HR.

By keeping these takeaways in mind, you can navigate the Employee Advance form process more effectively.

Similar forms

- Expense Reimbursement Form: Both documents are used by employees to request funds from their employer. The Expense Reimbursement Form specifically covers costs incurred while performing job duties, while the Employee Advance form requests money in advance of expenses.

- Payroll Advance Request: Similar to the Employee Advance form, this document allows employees to request a portion of their upcoming paycheck before the scheduled payday. It provides a way for employees to access funds quickly.

- Travel Authorization Form: This form is used to gain approval for travel-related expenses. Like the Employee Advance form, it often involves requesting funds to cover travel costs in advance.

- Petty Cash Request: Employees can use this document to request small amounts of cash for minor expenses. Both forms facilitate the process of obtaining funds for business-related purposes.

- Residential Lease Agreement: The California Residential Lease Agreement is crucial in renting properties, detailing rent amounts, security deposits, and responsibilities. For comprehensive insights, read more about the document.

- Loan Application Form: Employees may use this form to request a loan from their employer. Similar to the Employee Advance form, it involves an application process to receive funds, though loans typically require repayment over time.

- Cash Advance Request: This document is specifically for requesting cash for immediate needs. Like the Employee Advance form, it allows employees to access funds before they are officially earned.

- Budget Proposal Form: Employees may use this document to outline expected expenses for a project. Similar to the Employee Advance form, it involves a request for funds, though it is often more detailed and project-focused.

- Vendor Payment Request: This form is used to initiate payments to vendors for services or products. Like the Employee Advance form, it involves a request for disbursement of funds from the company.

- Reimbursement Agreement: This document outlines the terms under which employees can be reimbursed for expenses. It shares similarities with the Employee Advance form in that both involve the handling of funds for work-related expenses.

- Scholarship Application Form: Employees seeking educational assistance may use this form to apply for funds. Similar to the Employee Advance form, it involves a request for financial support, though it is typically tied to educational purposes.

Misconceptions

Misconceptions about the Employee Advance form can lead to confusion and delays. Here are nine common misunderstandings:

- Only managers can request advances. This is false. Any eligible employee can submit a request for an advance.

- Advances are only for emergencies. While many use them for urgent needs, advances can be requested for various reasons, such as travel or unexpected expenses.

- All requests are automatically approved. This is not true. Each request is reviewed based on company policy and the employee's situation.

- There is no limit to the amount I can request. In reality, there are set limits based on company guidelines and individual circumstances.

- The form is only required for cash advances. This misconception overlooks that the form is also necessary for advances against future earnings.

- I can submit the form after the expense has occurred. This is incorrect. Requests should be made prior to incurring the expense.

- Once I submit the form, I cannot make changes. Actually, changes can be made before the request is processed. Communication with HR is key.

- Advances must be repaid immediately. Repayment terms vary. Employees can typically repay through payroll deductions over time.

- There is no record of my advance. This is misleading. All advances are documented and tracked by the payroll department.

Understanding these points can help ensure a smoother process when requesting an Employee Advance.

More PDF Templates

Form 1099 Nec - Order official forms directly from the IRS to ensure compliance and accuracy.

Triple Aaa International License - Access driving permissions in other countries with this form.

For those looking to safeguard their rights and ensure their decisions are respected, utilizing the Florida Power of Attorney form can be essential, and you can obtain the necessary documents through Florida PDF Forms to streamline the process.

Electrical Load Calculations - Critical for maintaining energy efficiency in large developments.

Form Specs

| Fact Name | Description |

|---|---|

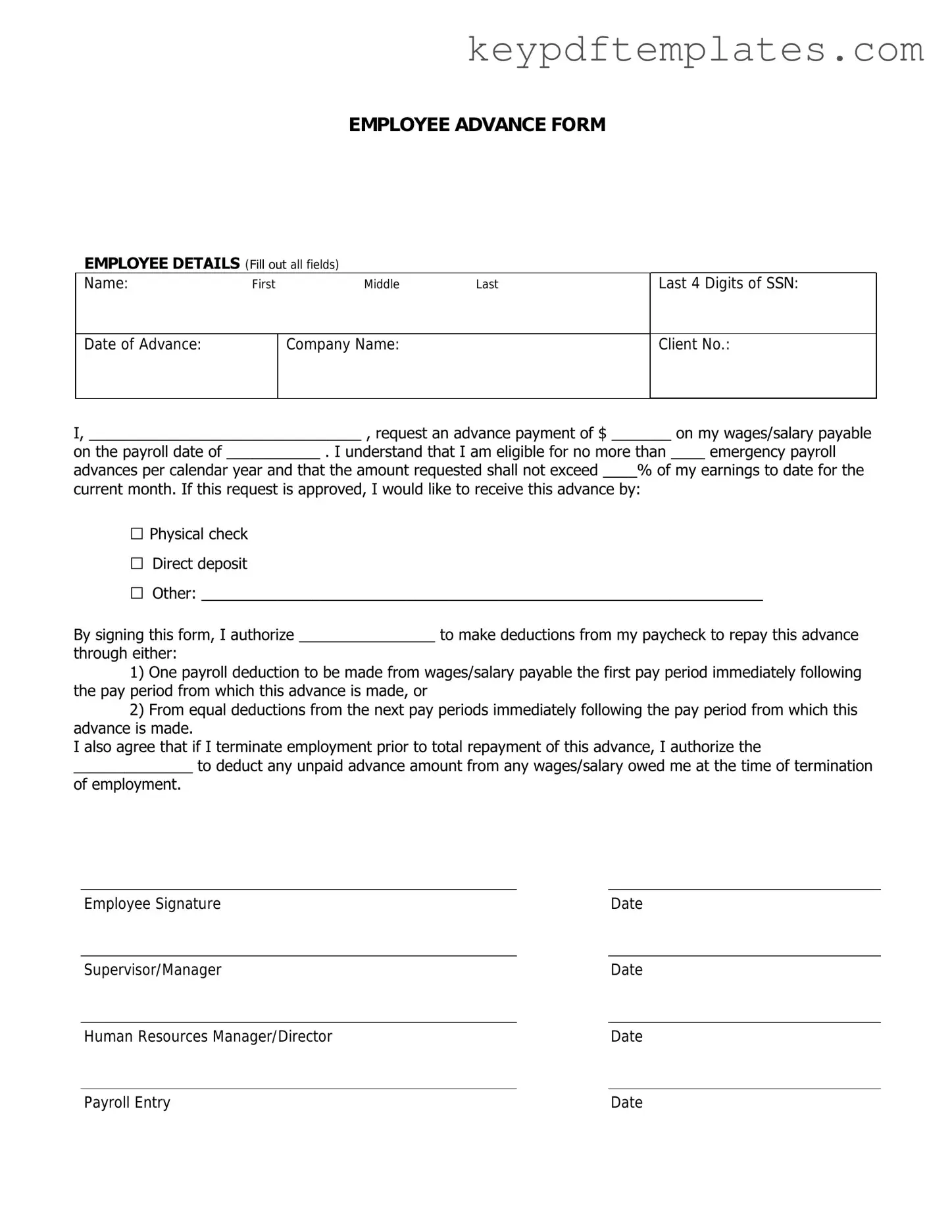

| Definition | The Employee Advance form is a document used by employers to provide financial advances to employees for business-related expenses. |

| Purpose | This form helps streamline the process of requesting and approving advances, ensuring clarity and accountability. |

| Eligibility | Typically, only full-time employees with a demonstrated need for an advance can use this form. |

| Repayment Terms | The form outlines how and when the employee must repay the advance, which is usually deducted from future paychecks. |

| State-Specific Requirements | Some states may have specific laws governing advances, such as California's wage deduction laws. |

| Documentation | Employees must often provide receipts or documentation for the expenses covered by the advance. |

| Approval Process | Managers or HR personnel typically review and approve the request before funds are disbursed. |

| Tax Implications | Advances may have tax implications, and employees should consult with a tax professional regarding potential impacts. |

| Record Keeping | Employers must keep records of all advances issued and repayments made for auditing purposes. |

Documents used along the form

When requesting an advance on expenses, employees often need to complete several related forms and documents to ensure proper processing and accountability. Here are some commonly used documents that may accompany the Employee Advance form:

- Expense Report: This document outlines the specific expenses for which the advance is being requested. It includes details such as dates, amounts, and descriptions of each expense, helping to clarify how the funds will be used.

- Approval Memo: This memo is typically required to obtain managerial or departmental approval for the advance. It serves as a formal request for authorization, ensuring that the advance aligns with company policies.

- Repayment Agreement: In cases where the advance is expected to be repaid, a repayment agreement may be necessary. This document specifies the terms of repayment, including the timeline and method, protecting both the employee and the employer.

- Insurance Document: For those in certain professions, such as plumbing, having an insurance documentation form is vital. For instance, the Texas Certificate of Insurance form must be submitted by Master Plumbers to the Texas State Board of Plumbing Examiners. This includes essential details for compliance. More information can be found at txtemplate.com/texas-certificate-insurance-pdf-template/.

- Budget Justification: If the advance is for a project or specific event, a budget justification may be required. This document explains why the advance is needed and how it fits into the overall budget, providing context for the request.

By understanding these accompanying documents, employees can streamline the process of requesting an advance, ensuring all necessary information is provided for a smooth approval. Proper documentation not only facilitates quicker processing but also helps maintain transparency and accountability within the organization.