Printable Employee Loan Agreement Template

Key takeaways

When filling out and using the Employee Loan Agreement form, it's important to keep several key points in mind. Here are some essential takeaways:

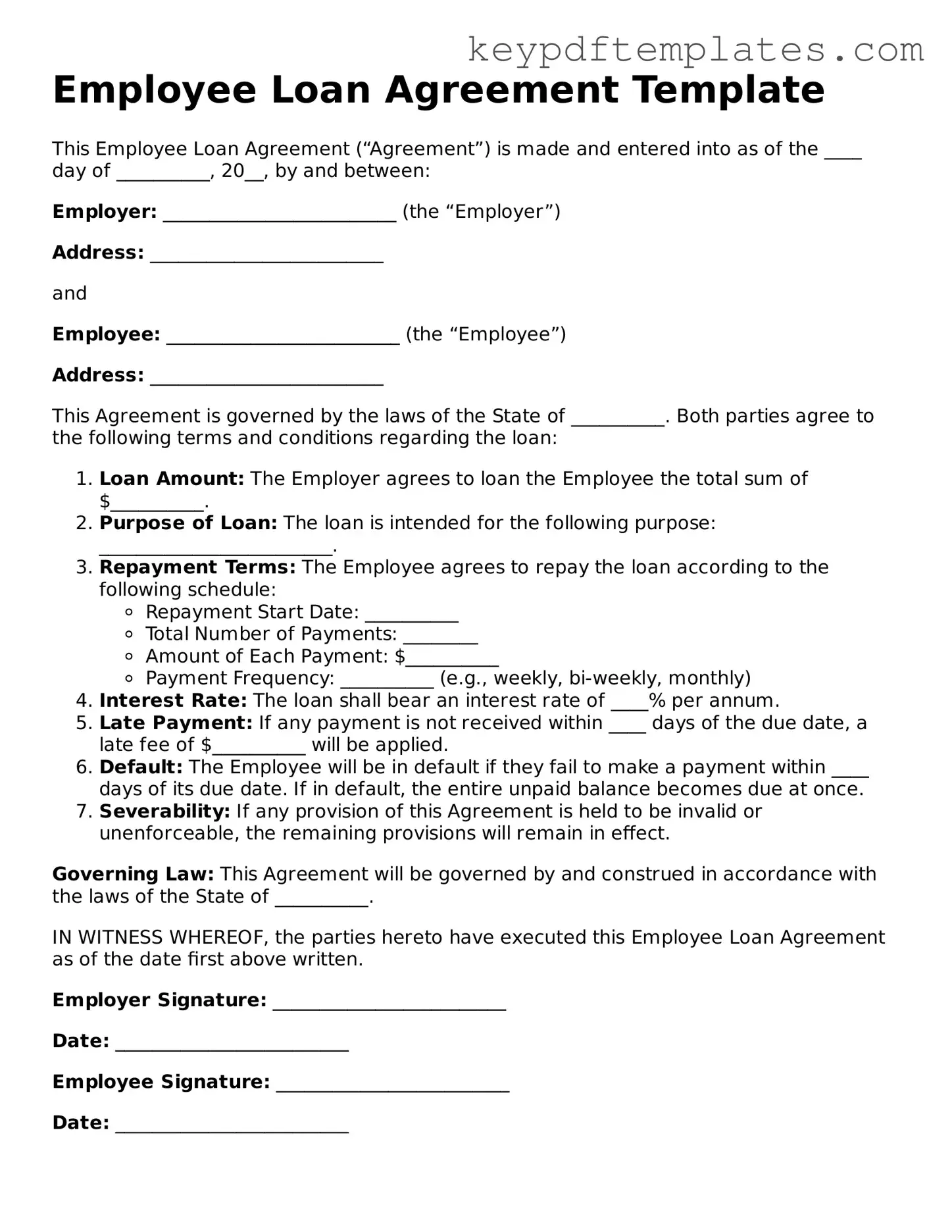

- Clear Terms: Ensure that the terms of the loan, including the amount, interest rate, and repayment schedule, are clearly defined.

- Borrower Information: Provide accurate information about the employee borrowing the funds, including their full name and position within the company.

- Loan Purpose: Specify the purpose of the loan. This helps in understanding the context and necessity of the borrowing.

- Signatures Required: Both the employee and an authorized representative of the company must sign the agreement to make it legally binding.

- Repayment Details: Outline the repayment terms, including when payments are due and the method of payment accepted.

- Default Consequences: Clearly state the consequences of failing to repay the loan, which may include deductions from future paychecks.

- Keep Records: Maintain a copy of the signed agreement for both the employee's and the employer's records. This helps in tracking the loan and ensuring compliance.

By following these guidelines, both employees and employers can navigate the loan process more smoothly.

Similar forms

-

Promissory Note: This document outlines a borrower's promise to repay a loan under specific terms. Like the Employee Loan Agreement, it includes details such as the loan amount, interest rate, and repayment schedule. Both documents serve to formalize the borrowing arrangement between parties.

-

Loan Application: A loan application is submitted by an individual seeking funds. It collects personal and financial information, similar to how an Employee Loan Agreement may require details about the employee's employment status and financial standing to assess eligibility.

-

Repayment Plan: This document outlines how and when a borrower will repay a loan. It shares similarities with the Employee Loan Agreement in that both specify the terms of repayment, including amounts and deadlines, ensuring clarity for both the lender and borrower.

-

Security Agreement: A security agreement provides collateral for a loan, detailing the assets that secure the debt. Like the Employee Loan Agreement, it protects the lender's interests and outlines the obligations of the borrower, ensuring both parties understand their rights and responsibilities.

- Florida Loan Agreement: This document is essential for outlining the lending terms and conditions between parties, and can be accessed through All Florida Forms.

-

Loan Disclosure Statement: This document informs borrowers about the terms and conditions of a loan. It is similar to the Employee Loan Agreement in that both provide essential information about the loan, including fees, interest rates, and repayment terms, helping borrowers make informed decisions.

Misconceptions

The Employee Loan Agreement form often raises questions and misconceptions. Here are eight common misunderstandings about this form, along with clarifications to help clear up any confusion.

-

Misconception 1: The agreement is only for large loans.

This is incorrect. Employee loan agreements can be used for loans of any size, whether small or large, depending on the company’s policy.

-

Misconception 2: Employees cannot negotiate the terms of the loan.

In reality, employees may discuss and negotiate terms such as repayment schedules and interest rates before finalizing the agreement.

-

Misconception 3: The loan must be repaid immediately.

Most agreements outline a specific repayment period, allowing employees to repay the loan over time, rather than requiring immediate repayment.

-

Misconception 4: The agreement is not legally binding.

On the contrary, once signed, the Employee Loan Agreement is a legally binding document that outlines the responsibilities of both the employee and the employer.

-

Misconception 5: Interest rates are always high.

Interest rates can vary widely based on company policy and market conditions. Some employers may offer loans at little to no interest.

-

Misconception 6: Only full-time employees can apply for loans.

Part-time employees may also be eligible, depending on the employer's policies regarding loans.

-

Misconception 7: The agreement is only for personal loans.

Employee loans can be used for various purposes, including education, home repairs, or medical expenses, not just personal needs.

-

Misconception 8: Employees lose their job if they default on the loan.

While defaulting on a loan can have consequences, termination is not an automatic outcome. Employers typically have procedures in place to address such situations.

Understanding these misconceptions can help employees navigate the Employee Loan Agreement process more effectively.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | An Employee Loan Agreement is a formal document outlining the terms under which an employer lends money to an employee. |

| Purpose | This agreement serves to protect both the employer and the employee by clearly stating the loan's terms, repayment schedule, and interest rates. |

| Loan Amount | The specific amount of money being loaned to the employee must be clearly stated in the agreement. |

| Repayment Terms | The agreement should outline how and when the employee will repay the loan, including installment amounts and due dates. |

| Interest Rates | If applicable, the interest rate on the loan must be disclosed, ensuring compliance with state laws regarding usury. |

| Governing Law | The agreement should specify which state laws govern the terms of the loan, which may vary by state. |

| Default Clauses | It is important to include terms that define what constitutes a default and the consequences that follow. |

| Confidentiality | The agreement may include a confidentiality clause to protect the financial details of the loan from being disclosed. |

| Signatures | Both the employer and employee must sign the agreement to make it legally binding. |

Documents used along the form

When entering into an Employee Loan Agreement, several other forms and documents may be necessary to ensure clarity and compliance. These documents help outline the terms of the loan, the responsibilities of both parties, and any legal implications. Below is a list of commonly used forms that complement the Employee Loan Agreement.

- Loan Application Form: This form gathers essential information about the employee requesting the loan, including personal details, employment status, and the purpose of the loan.

- Promissory Note: A legal document in which the employee promises to repay the loan under specified terms. It includes details such as the loan amount, interest rate, and repayment schedule.

- Repayment Schedule: This document outlines the timeline for loan repayment, detailing due dates and amounts owed at each interval.

- Authorization for Payroll Deduction: A form allowing the employer to deduct loan payments directly from the employee's paycheck, ensuring timely repayment.

- California Loan Agreement Form: For those requiring a formalized lending process, the comprehensive California loan agreement document ensures all terms are clear and legally binding.

- Loan Disclosure Statement: This statement provides the employee with all relevant information about the loan, including fees, interest rates, and total repayment amounts.

- Employee Acknowledgment Form: A form confirming that the employee understands the terms of the loan and agrees to abide by them.

- Financial Hardship Statement: This document may be used if the employee faces difficulties in repaying the loan, allowing them to request adjustments to the repayment terms.

- Termination of Loan Agreement: A document that outlines the process and terms for terminating the loan agreement, including any outstanding obligations.

- Legal Compliance Checklist: A checklist to ensure that all necessary legal requirements are met when issuing the loan, protecting both the employer and employee.

These forms and documents play a crucial role in managing employee loans effectively. By utilizing them, both employers and employees can maintain transparency and foster a positive working relationship.