Get Fl Dr 312 Form

Key takeaways

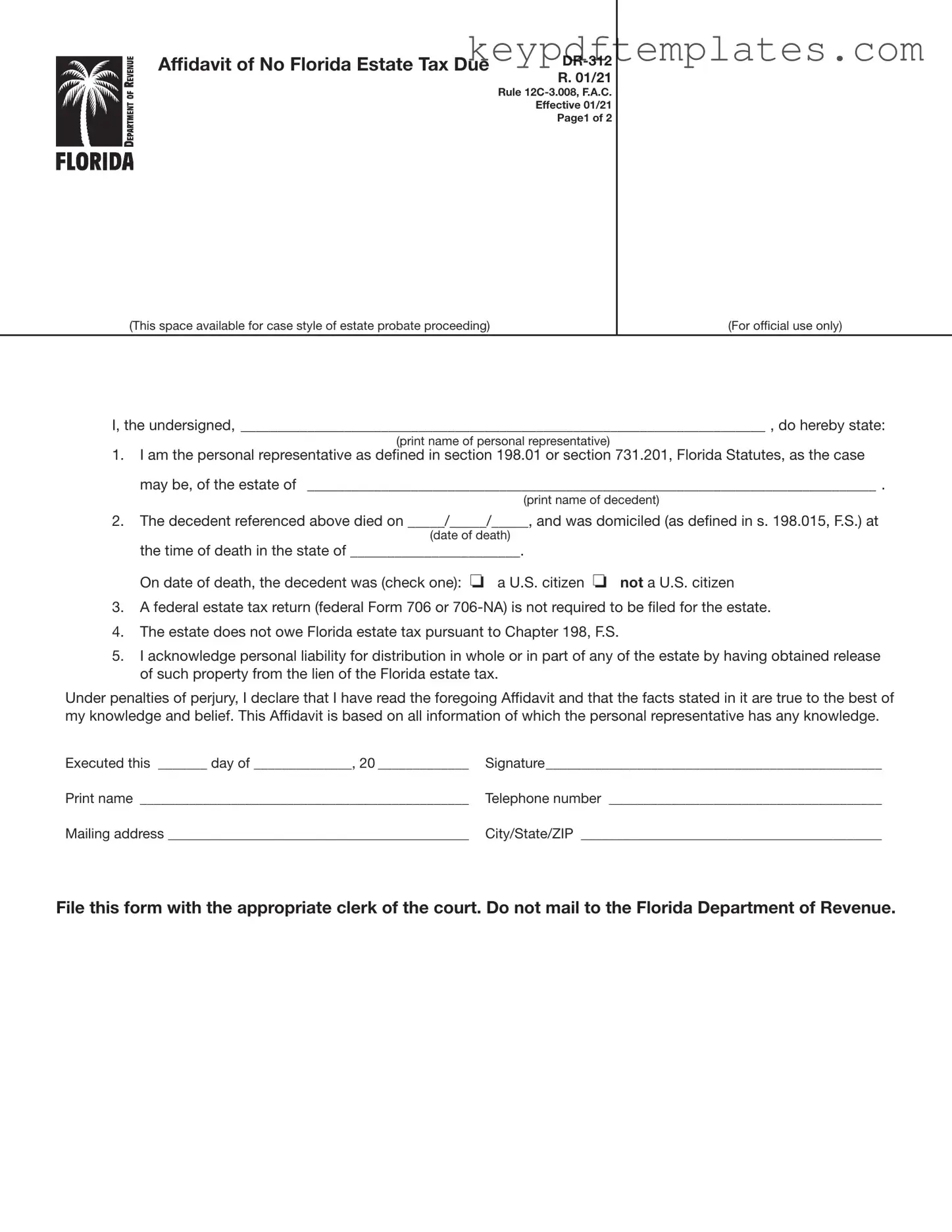

When it comes to filling out and using the Florida Form DR-312, there are several important points to keep in mind. This form, officially known as the Affidavit of No Florida Estate Tax Due, serves a specific purpose in the probate process.

- Who Should Use It: The form is intended for personal representatives of estates that do not owe Florida estate tax and do not require a federal estate tax return.

- Eligibility: You must confirm that no federal estate tax return (Form 706 or 706-NA) is required before using this form.

- Filing Location: Submit the completed form directly to the clerk of the circuit court in the county where the decedent owned property.

- Do Not Mail: Do not send this form to the Florida Department of Revenue; it should only be filed with the court.

- Personal Liability: As the personal representative, you acknowledge personal liability for any distributions made from the estate after obtaining a release from the estate tax lien.

- Definition of Personal Representative: The term includes anyone in actual or constructive possession of the decedent’s property, not just those formally appointed.

- Public Record: The form will be recorded in the public records of the county or counties where the decedent owned property, establishing evidence of nonliability for estate tax.

- Space for Clerk: Leave the 3-inch by 3-inch space at the top right corner of the form blank; it is reserved for the clerk’s use.

- Stay Informed: For any updates or changes regarding estate taxes, consider subscribing to email alerts from the Florida Department of Revenue.

By understanding these key takeaways, you can navigate the process of completing and filing the Form DR-312 more confidently. This ensures that you fulfill your responsibilities while adhering to Florida's estate tax regulations.

Similar forms

- Form DR-313: Affidavit of No Federal Estate Tax Due - This form serves a similar purpose as the DR-312, but specifically addresses federal estate tax obligations. It confirms that no federal estate tax is due, which can be crucial for the estate's administration.

- Form DR-314: Application for a Certificate of Discharge - This application allows personal representatives to request a discharge from estate tax liability. Like the DR-312, it helps clear any tax liens against the estate, facilitating the distribution of assets.

- Form DR-315: Affidavit of Personal Representative - This affidavit is used to affirm the appointment of a personal representative. It shares similarities with the DR-312 by verifying the authority of the representative to act on behalf of the estate.

- Hold Harmless Agreement: This document is essential for mitigating risks by ensuring that one party is not held liable for any injuries or damages that occur during an event. More information can be found at https://allfloridaforms.com.

- Form DR-316: Notice of Administration - This document notifies interested parties of the commencement of estate administration. While it serves a different function, it is part of the same administrative process and is often filed alongside the DR-312.

- Form DR-317: Petition for Summary Administration - This petition allows for a simplified process in small estates. It parallels the DR-312 in that both forms help streamline the estate settlement process when tax obligations are not an issue.

- Form DR-318: Waiver of Notice of Administration - This waiver allows interested parties to forgo receiving formal notice of the estate administration. It is similar to the DR-312 in that it can expedite the estate process by reducing formalities when there are no tax liabilities.

Misconceptions

Understanding the Florida Form DR-312, also known as the Affidavit of No Florida Estate Tax Due, is essential for personal representatives managing an estate. However, several misconceptions often arise regarding this form. Here’s a list of seven common misunderstandings:

- Form DR-312 is only for large estates. Many believe this form is only applicable for high-value estates. In reality, it can be used for any estate that does not owe Florida estate tax, regardless of its size.

- Filing Form DR-312 eliminates all tax obligations. This form only addresses Florida estate tax. If a federal estate tax return is required, the form cannot be used.

- Only attorneys can file Form DR-312. While legal advice is helpful, personal representatives can file this form themselves. They just need to ensure all information is accurate.

- Form DR-312 can be mailed to the Florida Department of Revenue. This is incorrect. The form must be filed directly with the clerk of the circuit court in the county where the decedent owned property.

- Once filed, Form DR-312 is permanent and cannot be changed. If there are changes in the estate or tax situation, the form can be amended or updated as needed.

- Form DR-312 guarantees the estate will never owe taxes. While it serves as evidence of nonliability for Florida estate tax at the time of filing, future changes in law or estate value could affect tax obligations.

- Form DR-312 is only for estates of U.S. citizens. This form can also be used for estates of non-U.S. citizens, as long as they meet the criteria for not owing Florida estate tax.

Being aware of these misconceptions can help personal representatives navigate the process more effectively and avoid potential pitfalls. Always consult with a tax professional or legal advisor for specific guidance tailored to your situation.

More PDF Templates

Form I-9 - This form helps validate an employee’s claims during background investigations.

When preparing to fill out the Texas form, it is essential to understand its importance and the specific requirements involved. This document not only facilitates smooth processing for various legal and administrative matters but also demands careful attention to detail. To streamline your experience and for additional resources, you can visit txtemplate.com/texas-pdf-template/ to gather all necessary information before you begin.

Generic Direct Deposit Form - Consult with the payor organization if there are any uncertainties about the process.

Trust Amendment Form Free - This document is crucial for those looking to adjust their estate plans effectively.

Form Specs

| Fact Name | Details |

|---|---|

| Form Title | Affidavit of No Florida Estate Tax Due (Form DR-312) |

| Effective Date | January 2021 |

| Governing Laws | Chapter 198, Florida Statutes and Rule 12C-3.008, Florida Administrative Code |

| Purpose | This form is used to declare that no Florida estate tax is due for the estate of a decedent. |

| Who Uses It? | Personal representatives of estates that do not owe Florida estate tax and are not required to file federal Form 706 or 706-NA. |

| Filing Location | The form must be filed with the clerk of the circuit court in the county where the decedent owned property. |

| Liability Acknowledgment | The personal representative acknowledges liability for distributions made from the estate after filing this affidavit. |

| Evidence of Nonliability | Form DR-312 serves as evidence that the estate is not liable for Florida estate tax and removes any tax lien. |

Documents used along the form

The FL DR 312 form, known as the Affidavit of No Florida Estate Tax Due, is an important document for estate administration in Florida. It is often accompanied by other forms and documents that help clarify various aspects of the estate and ensure compliance with state laws. Below is a list of related documents that may be used in conjunction with the FL DR 312 form.

- Federal Form 706: This is the United States Estate (and Generation-Skipping Transfer) Tax Return. It is required for estates that exceed a certain value threshold and must be filed with the IRS.

- Federal Form 706-NA: This form is similar to Form 706 but is specifically for the estates of nonresident aliens. It is used to report estate taxes owed on the estate of a decedent who was not a U.S. citizen.

- Death Certificate: This official document verifies the date and cause of death. It is often required for various legal and administrative processes following a person's passing.

- Will: The last will and testament outlines the decedent's wishes regarding the distribution of their assets. It is a critical document in the probate process.

- Letters of Administration: This document grants the personal representative the authority to manage the estate. It is issued by the probate court and is essential for handling estate matters.

- Inventory of Estate Assets: This list details all assets owned by the decedent at the time of death. It helps in assessing the total value of the estate for tax and distribution purposes.

- Notice to Creditors: This document informs creditors of the decedent's passing and provides them an opportunity to make claims against the estate for any debts owed.

- Texas Bill of Sale Form: When transferring ownership of personal property in Texas, refer to our comprehensive Texas bill of sale form to ensure all transactions are properly documented.

- Tax Waivers: These forms are sometimes required by the Florida Department of Revenue to confirm that no estate taxes are owed before property can be transferred to beneficiaries.

- Affidavit of Heirship: This document is used to establish the heirs of the decedent when there is no will. It can help facilitate the distribution of assets in accordance with state law.

Each of these documents plays a crucial role in the estate administration process. They ensure that all legal requirements are met and that the estate is managed according to the decedent's wishes and applicable laws. Understanding these forms can help streamline the probate process and reduce potential complications.