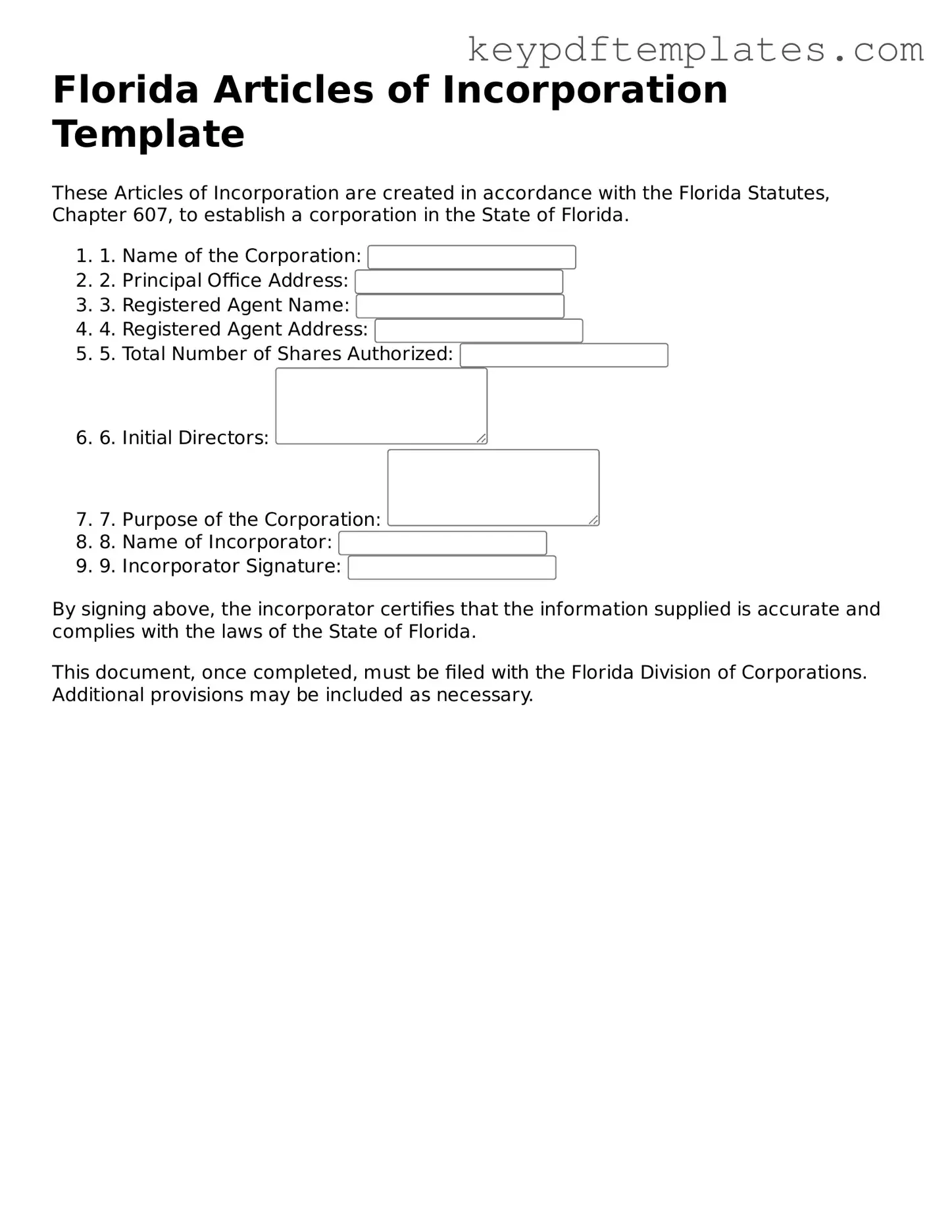

Legal Articles of Incorporation Document for the State of Florida

Key takeaways

Filling out and utilizing the Florida Articles of Incorporation form is a crucial step in establishing a corporation in the state. Here are nine key takeaways to consider:

- Identify the Corporation Type: Determine whether you are forming a for-profit or not-for-profit corporation, as this will influence the information required on the form.

- Provide a Name: The corporation's name must be unique and comply with Florida naming regulations. It should include a designation such as “Corporation” or “Inc.”

- Designate a Registered Agent: A registered agent must be appointed to receive legal documents on behalf of the corporation. This can be an individual or a business entity authorized to do business in Florida.

- Include the Principal Office Address: The form requires the physical address of the corporation's principal office. This cannot be a P.O. Box.

- State the Purpose: Clearly outline the purpose of the corporation. While general business purposes are acceptable, specific purposes may require additional detail.

- List Incorporators: The names and addresses of the incorporators must be included. Incorporators are individuals responsible for filing the Articles of Incorporation.

- Specify the Number of Shares: If the corporation will issue stock, indicate the total number of shares authorized and their par value, if applicable.

- Filing Fees: Be aware of the required filing fees. Payment must accompany the submission of the Articles of Incorporation to the Florida Division of Corporations.

- Review and Submit: Before submitting, review the completed form for accuracy. Errors can delay the incorporation process.

Understanding these key aspects can streamline the process of forming a corporation in Florida and ensure compliance with state requirements.

Similar forms

- Bylaws: These are the internal rules that govern the management of a corporation. While the Articles of Incorporation establish the existence of the corporation, the bylaws outline how it will operate on a day-to-day basis.

- Bill of Sale: For transferring ownership of personal property, the Bill of Sale form is crucial as it provides proof of purchase and essential details of the transaction.

- Certificate of Incorporation: This document is often used interchangeably with Articles of Incorporation. It serves the same purpose of formally creating a corporation and typically includes similar information about the business structure.

- Operating Agreement: For limited liability companies (LLCs), this document outlines the management structure and operating procedures. It is similar to bylaws but tailored for LLCs instead of corporations.

- Partnership Agreement: This document details the terms of a partnership. Like the Articles of Incorporation, it establishes the framework for how the partnership will function, including roles and responsibilities.

- Business License: This is a permit issued by a government agency allowing a business to operate legally. While it does not establish the business structure, it is a necessary document for compliance and operation.

- Employer Identification Number (EIN): This is a unique number assigned by the IRS for tax purposes. It is essential for corporations and similar entities, much like the Articles of Incorporation, as it identifies the business for tax filings.

- Annual Report: This document is filed yearly to provide updated information about the corporation. It is similar to the Articles of Incorporation in that it keeps the state informed about the business’s status and operations.

- Shareholder Agreement: This document outlines the rights and obligations of shareholders in a corporation. It complements the Articles of Incorporation by detailing how decisions are made and how shares are handled.

Misconceptions

Understanding the Florida Articles of Incorporation form is crucial for anyone looking to establish a business in the state. However, several misconceptions often cloud the process. Here are six common misunderstandings:

- All businesses must file Articles of Incorporation. Many believe that every type of business entity must file this document. In reality, only corporations need to submit Articles of Incorporation. Sole proprietorships and partnerships do not require this form.

- Filing Articles of Incorporation guarantees business success. While submitting the form is an essential step in starting a corporation, it does not ensure that the business will succeed. Success depends on various factors, including market research, business planning, and effective management.

- Once filed, Articles of Incorporation cannot be changed. Some people think that the information provided in the Articles of Incorporation is set in stone. However, amendments can be made to update or change details as the business evolves.

- All information in the Articles of Incorporation is public. Although certain details are accessible to the public, not all information is disclosed. For example, the names of the shareholders may remain confidential in some cases.

- Filing is a one-time requirement. Many assume that once the Articles of Incorporation are filed, no further action is needed. In fact, corporations must comply with ongoing requirements, such as annual reports and maintaining good standing with the state.

- Legal assistance is unnecessary for filing. Some entrepreneurs believe they can navigate the filing process alone. However, seeking legal guidance can help ensure that all requirements are met and that the form is completed correctly, reducing the risk of delays or rejections.

Being aware of these misconceptions can help streamline the incorporation process and set a solid foundation for your business in Florida.

Fill out Popular Articles of Incorporation Forms for Specific States

Georgia Secretary of State Forms - Properly filed Articles can enhance the corporation's credibility with customers and vendors.

Having a well-structured Employee Handbook can significantly enhance workplace clarity, ensuring that employees are well-informed about organizational policies and culture. Additionally, for those seeking to review or create a comprehensive guide, the Employee's Manual serves as an excellent resource, facilitating a smoother onboarding process and helping to align expectations between the company and its workforce.

PDF Details

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Articles of Incorporation are governed by Chapter 607 of the Florida Statutes. |

| Purpose | This form is used to legally create a corporation in the state of Florida. |

| Filing Requirement | Filing the Articles of Incorporation with the Florida Division of Corporations is mandatory for incorporation. |

| Information Required | Key information includes the corporation's name, principal office address, and registered agent details. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Incorporator | At least one incorporator is required to sign the Articles of Incorporation. |

| Filing Fee | The standard filing fee for the Articles of Incorporation in Florida is $70. |

| Processing Time | Typically, processing takes about 3 to 5 business days, but expedited services are available for an additional fee. |

| Amendments | If changes are needed after filing, amendments can be made through a separate form submitted to the state. |

Documents used along the form

When forming a corporation in Florida, the Articles of Incorporation is a crucial document. However, several other forms and documents often accompany this filing to ensure compliance with state laws and facilitate smooth business operations. Below is a list of commonly used documents that may be required or beneficial during the incorporation process.

- Bylaws: These are the internal rules governing the management and operation of the corporation. Bylaws outline the responsibilities of directors and officers, meeting procedures, and voting rights.

- Initial Report: In some cases, corporations must file an initial report shortly after incorporation. This document provides basic information about the business, including its address and the names of its officers and directors.

- Employer Identification Number (EIN) Application: This form, often referred to as Form SS-4, is submitted to the IRS to obtain an EIN, which is essential for tax purposes and hiring employees.

- Registered Agent Designation: This document identifies the registered agent for the corporation, who is responsible for receiving legal documents and official notices on behalf of the company.

- Business License Application: Depending on the type of business and location, a separate application may be required to obtain the necessary licenses or permits to operate legally.

- Operating Agreement: While not always required, this document outlines the management structure and operational procedures for limited liability companies (LLCs) and can clarify member roles and responsibilities.

- Stock Certificates: If the corporation issues stock, stock certificates serve as proof of ownership for shareholders. These documents may need to be created and distributed after incorporation.

- Annual Report: Corporations in Florida must file an annual report to maintain their active status. This document updates the state on the corporation’s information, such as addresses and officers.

- Georgia WC-3 Form: Essential for notifying of any disputes regarding worker's compensation claims, the Georgia WC-3 form must be filed with the State Board of Workers' Compensation. For more details, you can refer to Georgia PDF.

- Resolution to Open Bank Account: A corporate resolution may be required by banks to authorize specific individuals to open and manage the corporation's bank accounts.

- Statement of Purpose: This document outlines the specific business activities the corporation will engage in, providing clarity on its objectives and goals.

These documents, while not all mandatory, play significant roles in establishing and maintaining a corporation in Florida. Each serves a unique purpose, contributing to the legal and operational framework necessary for a successful business endeavor.