Get Florida Commercial Contract Form

Key takeaways

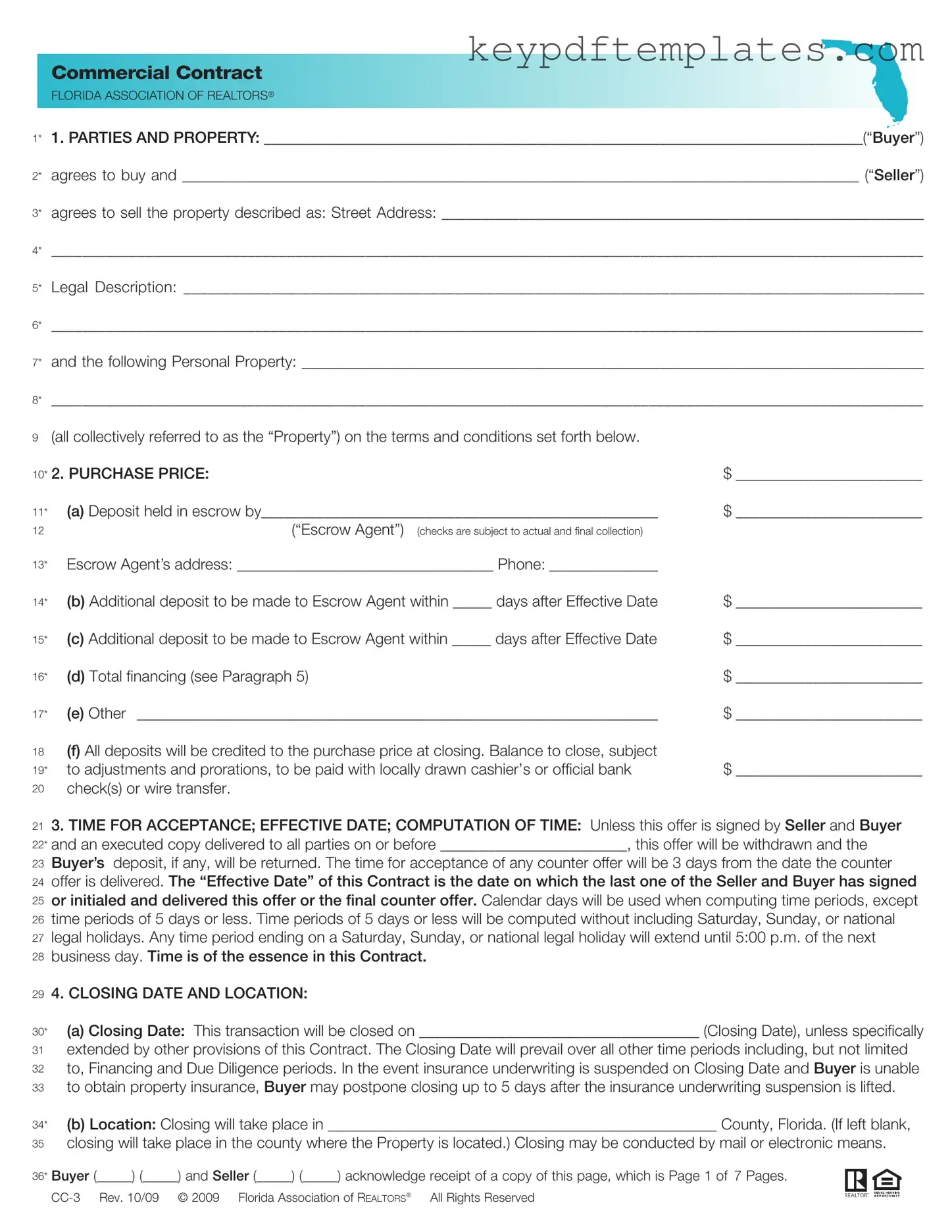

Ensure accurate identification of all parties involved in the transaction. Clearly state the names of both the Buyer and Seller at the beginning of the contract.

Detail the property description thoroughly. Include both the street address and legal description to avoid any confusion regarding the property being sold.

Specify the purchase price and payment structure. Include details about deposits, financing, and how the total amount will be settled at closing.

Understand the closing timeline. The contract outlines critical dates, including the closing date and time for acceptance, which are essential for both parties to adhere to.

Review the property condition clause. The contract allows for inspections and outlines the buyer's rights regarding the property's condition, including any "as is" acceptance or due diligence periods.

Similar forms

- Residential Purchase Agreement: Similar to the Florida Commercial Contract, this document outlines the terms of a residential property sale, including buyer and seller details, purchase price, and closing conditions. Both agreements emphasize the importance of clear terms and timelines for acceptance and closing.

- Lease Agreement: This document governs the rental of property, detailing the rights and responsibilities of both landlords and tenants. Like the commercial contract, it specifies terms such as duration, payment amounts, and conditions for termination.

- Option to Purchase Agreement: This agreement gives a potential buyer the right to purchase a property within a specified time frame. Similar to the commercial contract, it includes terms regarding the purchase price and conditions that must be met for the sale to proceed.

- Joint Venture Agreement: In real estate, this document outlines the partnership between parties to develop or manage a property. Like the commercial contract, it details the roles of each party, financial contributions, and profit-sharing arrangements.

- Real Estate Listing Agreement: This document is used between property owners and real estate agents to outline the terms of the sale. Similar to the commercial contract, it includes details about the property, commission rates, and obligations of the agent and seller.

- Operating Agreement: Essential for LLCs in Florida, this document details the management structure and operational procedures. To learn more about this form, visit Florida PDF Forms.

- Commercial Lease Agreement: This document is specifically for leasing commercial properties. It shares similarities with the Florida Commercial Contract in that it includes terms for rent, duration, and maintenance responsibilities, ensuring both parties understand their obligations.

Misconceptions

1. The Florida Commercial Contract form is only for large businesses. This form is suitable for a variety of commercial transactions, regardless of the size of the business. Small businesses and individual investors can also utilize it effectively.

2. The contract guarantees financing. Many believe that signing this contract ensures financing will be secured. However, the buyer must still apply for financing and meet the lender's criteria.

3. All deposits are non-refundable. Some assume that once a deposit is made, it cannot be retrieved. In reality, deposits can be returned under certain conditions, such as failure to obtain financing.

4. The seller must fix all property issues before closing. Buyers often think that sellers are obligated to repair any defects. However, the contract typically allows the seller to sell the property "as is," meaning buyers accept the property in its current condition.

5. The closing date is flexible and can be changed easily. Many people think the closing date can be adjusted without consequence. In fact, the closing date is a critical term that must be adhered to unless explicitly extended in the contract.

6. Buyers can ignore due diligence. Some buyers believe they can skip the due diligence period. This period is crucial for assessing the property’s condition and suitability for intended use, and neglecting it can lead to unforeseen issues.

7. The contract is automatically enforceable. It is a common misconception that signing the contract automatically enforces all terms. In reality, both parties must comply with the conditions outlined in the contract for it to be enforceable.

8. Legal representation is not necessary. Some individuals feel they can navigate the contract without legal help. However, consulting with an attorney can provide valuable insights and ensure all legal obligations are met.

More PDF Templates

Navpers 1336 3 - The use of this form can facilitate various official Navy requests.

Da 7666 - The form promotes effective personnel communication.

For anyone looking to facilitate a sale, the simple Trailer Bill of Sale guide serves as a vital resource, detailing the necessary elements required to complete the ownership transfer of a trailer effectively.

Sfa Age Range - It bolsters the ability to adapt teaching to meet diverse needs.

Form Specs

| Fact Name | Fact Description |

|---|---|

| Governing Law | This contract is governed by Florida law. |

| Parties Involved | The contract identifies the Buyer and Seller, who agree to the sale of the property. |

| Property Description | The contract requires detailed information about the property, including the street address and legal description. |

| Purchase Price | The total purchase price must be specified, along with any deposits and payment methods. |

| Effective Date | The Effective Date is the date when both parties have signed the contract. |

| Closing Date | The contract specifies a closing date, which may be extended under certain conditions. |

| Title Conveyance | The Seller must convey marketable title to the Buyer, free of liens and encumbrances. |

| Default Provisions | In case of default, the Buyer or Seller has specific remedies, including the option for deposit refunds or specific performance. |

| Inspection Rights | The Buyer has the right to inspect the property and conduct due diligence within a specified period. |

Documents used along the form

The Florida Commercial Contract form is a crucial document in real estate transactions. However, it is often accompanied by other forms and documents that help facilitate the process. Below is a list of commonly used documents that complement the Florida Commercial Contract.

- Escrow Agreement: This document outlines the terms under which an escrow agent holds funds or property until specific conditions are met. It protects both the buyer and seller during the transaction.

- Title Insurance Commitment: This document provides assurance that the title to the property is clear of any liens or encumbrances. It also details the conditions under which a title insurance policy will be issued.

- Lease Agreement: If the property is currently leased, this document outlines the terms of the lease, including rent, duration, and responsibilities of both the landlord and tenant.

- Property Disclosure Statement: This statement provides buyers with information about the condition of the property, including any known defects or issues that could affect its value or use.

- Vehicle Purchase Agreement: This legal document outlines the terms of the sale and purchase of a vehicle in Texas, ensuring both parties are aware of their rights and responsibilities. For further details or to get started, you can download the form.

- Due Diligence Checklist: This document helps the buyer assess the property’s suitability for their intended use. It includes items to investigate, such as zoning laws, environmental concerns, and financial obligations.

- Closing Statement: This document itemizes all the financial transactions involved in the closing process, including purchase price, closing costs, and any adjustments for taxes or fees.

- Estoppel Certificate: This document is signed by tenants and confirms the terms of their lease, including the rent amount and any outstanding obligations. It protects the buyer from unexpected claims by tenants after the sale.

- Survey Report: This document provides a detailed map of the property, showing boundaries, structures, and any easements or encroachments. It is essential for confirming the property’s dimensions and legal description.

These documents work together with the Florida Commercial Contract to ensure a smooth transaction. Each plays a vital role in protecting the interests of both buyers and sellers, facilitating a clear understanding of rights and obligations throughout the process.