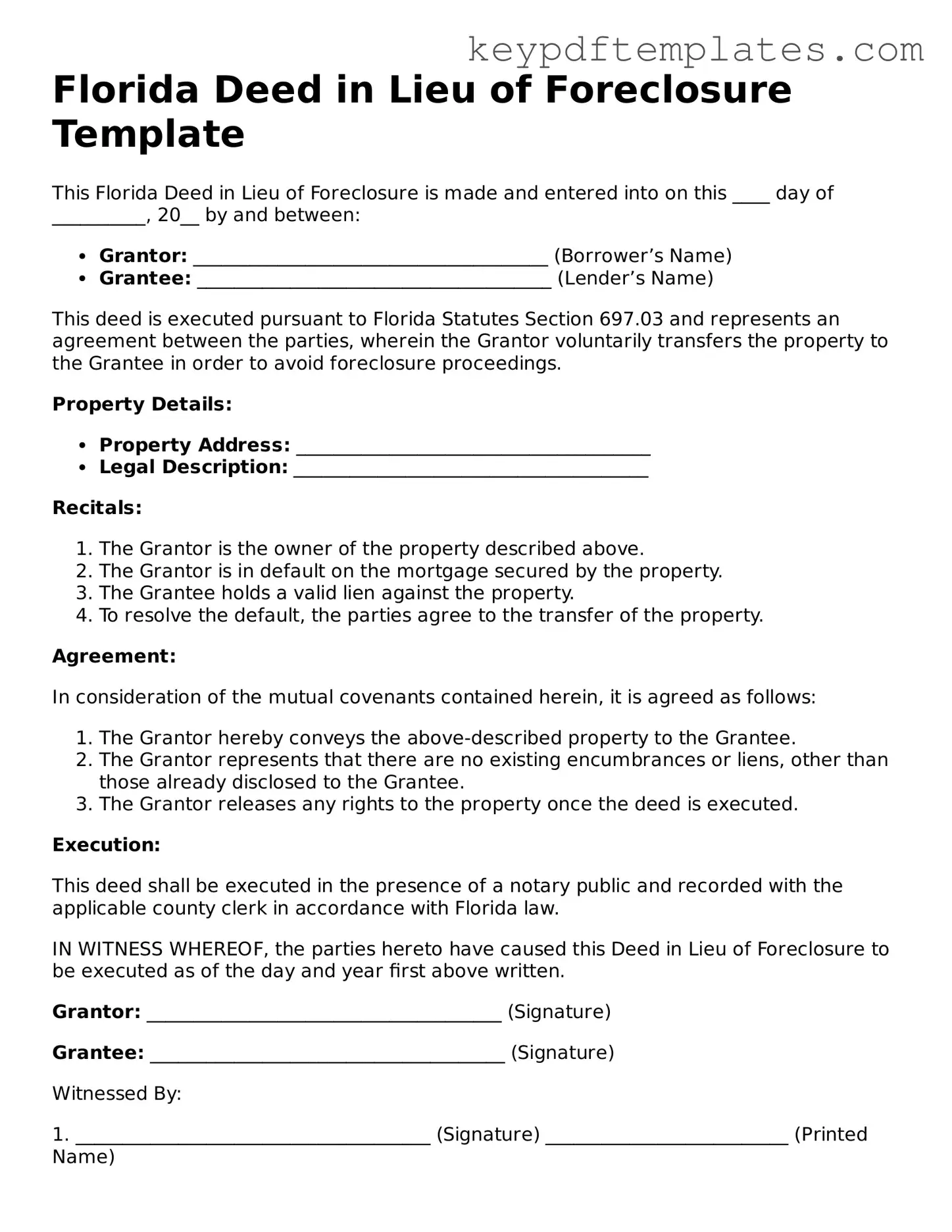

Legal Deed in Lieu of Foreclosure Document for the State of Florida

Key takeaways

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer their property to the lender to avoid foreclosure proceedings.

- Eligibility Requirements: Ensure that you meet the lender's criteria for this option, which often includes being behind on mortgage payments.

- Consult with Professionals: It's advisable to seek guidance from a real estate attorney or a housing counselor to understand the implications fully.

- Prepare Necessary Documentation: Gather all required documents, such as the mortgage agreement and any financial statements, before filling out the form.

- Complete the Form Accurately: Fill out the Deed in Lieu of Foreclosure form carefully. Any mistakes could delay the process.

- Review Tax Implications: Be aware that transferring your property in this manner could have tax consequences. Consult a tax professional for advice.

- Get Confirmation: After submitting the form, ensure you receive written confirmation from the lender that the deed has been accepted.

Similar forms

- Loan Modification Agreement: This document alters the terms of your existing mortgage. It can lower your interest rate or extend your repayment period, making it easier to manage your payments and avoid foreclosure.

- Short Sale Agreement: In a short sale, the lender agrees to accept less than the total amount owed on the mortgage. This allows the homeowner to sell the property and settle the debt, preventing foreclosure.

- Forebearance Agreement: This document allows you to temporarily pause or reduce your mortgage payments. It provides relief during financial hardship, giving you time to get back on your feet without losing your home.

- Bankruptcy Filing: Filing for bankruptcy can stop foreclosure proceedings. It reorganizes your debts, allowing you to keep your home while you work through financial difficulties.

- Statement of Fact Texas Form: This form is essential for vehicle transactions and is critical to ensure accurate reporting of vehicle details such as the year, make, VIN, and other important transaction information. To learn more about this document, visit https://txtemplate.com/statement-of-fact-texas-pdf-template/.

- Release of Mortgage: This document formally releases the lender's claim on the property. It is often used when a mortgage is paid off or settled, indicating that you no longer owe the lender.

Misconceptions

When it comes to the Florida Deed in Lieu of Foreclosure, many people hold misconceptions that can lead to confusion or poor decision-making. Here are six common myths, along with clarifications to help you understand this important legal tool.

- It eliminates all debt associated with the property. Many believe that signing a deed in lieu of foreclosure wipes out all debts. However, while it can relieve you of the mortgage obligation, it may not eliminate other debts tied to the property, such as unpaid property taxes or liens.

- It guarantees a quick resolution. Some homeowners think that a deed in lieu will expedite the process of leaving their home. In reality, the lender must review the request, which can take time. A deed in lieu is not an instant solution.

- It is the same as a foreclosure. A deed in lieu is often confused with foreclosure, but they are different. A foreclosure is a legal process initiated by the lender to reclaim the property, while a deed in lieu is a voluntary transfer of property back to the lender.

- It has no impact on credit scores. Many people assume that a deed in lieu has no effect on their credit. In truth, it can still negatively impact your credit score, though generally less severely than a foreclosure.

- It is only for homeowners in dire financial situations. While many who opt for a deed in lieu are facing financial hardship, it is not exclusively for those in crisis. Homeowners who want to avoid the lengthy foreclosure process may also choose this option.

- Once signed, the lender cannot pursue further action. Some believe that signing a deed in lieu protects them from any future claims by the lender. However, if there are outstanding debts or if the lender does not agree to a full release, they may still pursue further action.

Understanding these misconceptions can help homeowners make informed decisions about their options when facing financial difficulties. Always consider seeking professional advice tailored to your specific situation.

Fill out Popular Deed in Lieu of Foreclosure Forms for Specific States

Georgia Foreclosure - This arrangement allows for a voluntary transfer rather than an involuntary foreclosure.

The Florida Power of Attorney for a Child form is a legal document that allows a parent or guardian to designate another individual to make decisions on behalf of their child. This arrangement can be essential for various situations, such as temporary relocations or emergencies. To ensure that your child's needs are met, consider filling out the form by clicking the button below or visiting Florida PDF Forms for more information.

PDF Details

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers the title of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | This process is governed by Florida Statutes, specifically Section 701.02 regarding deeds and conveyances. |

| Eligibility | Homeowners facing financial difficulties and unable to keep up with mortgage payments may qualify for this option. |

| Advantages | A deed in lieu can help borrowers avoid the lengthy and costly foreclosure process, potentially reducing the impact on their credit score. |

| Disadvantages | Borrowers may still face tax implications and may not be eligible for future loans for a certain period after the deed is executed. |

| Process | The borrower must contact the lender, negotiate terms, and complete the necessary paperwork to finalize the transfer of property ownership. |

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure. Along with this form, several other documents may be necessary to complete the process. Below is a list of commonly used forms and documents that often accompany the Deed in Lieu of Foreclosure in Florida.

- Loan Modification Agreement: This document outlines any changes made to the original loan terms, including interest rates and payment schedules, which may have been negotiated before opting for a deed in lieu.

- Release of Liability: This form releases the borrower from any further obligations related to the mortgage after the deed transfer, protecting them from future claims for the debt.

- Property Condition Disclosure: The borrower may need to provide a disclosure detailing the condition of the property, including any known defects or issues, to inform the lender before the transfer.

- Title Search Report: This report confirms the current ownership of the property and reveals any liens or encumbrances that may affect the transaction.

- Notice of Default: This document formally notifies the borrower of their default status on the mortgage, which can serve as a precursor to the deed in lieu process.

- Affidavit of Title: The borrower may need to sign an affidavit affirming they hold clear title to the property and that there are no undisclosed claims against it.

- Settlement Statement: This document outlines the financial aspects of the transaction, including any costs or fees associated with the deed in lieu process.

- Power of Attorney: In some cases, the borrower may grant power of attorney to another individual to act on their behalf during the transaction.

- Durable Power of Attorney: This legal document allows an individual to designate an agent to manage their financial and legal matters, even if they become incapacitated. More information can be found at allfloridaforms.com.

- Consent to Transfer: This form may be required by the lender to formally acknowledge and consent to the transfer of property ownership.

Each of these documents plays a crucial role in ensuring that the deed in lieu process is conducted smoothly and legally. It is essential to understand the purpose of each document to avoid complications and protect all parties involved.