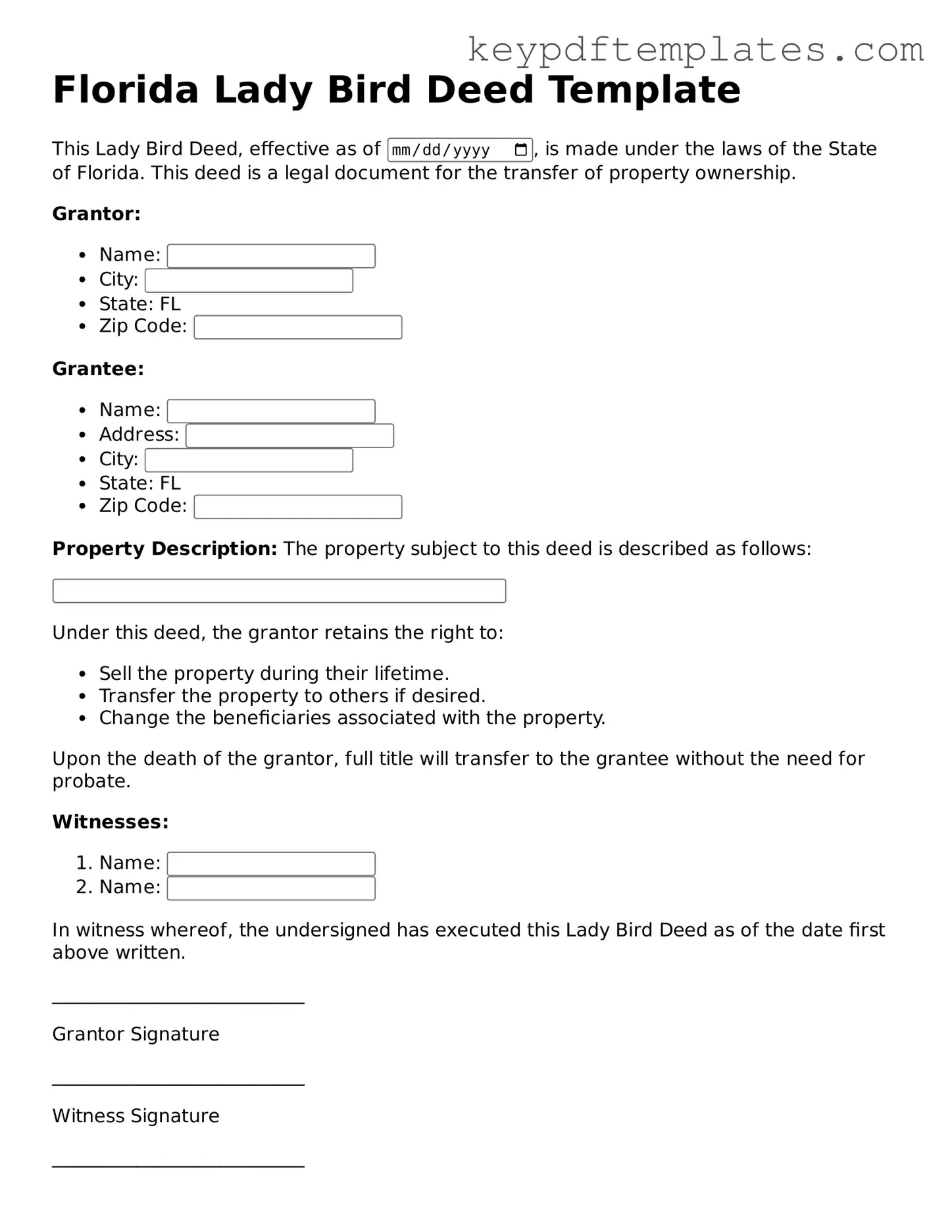

Legal Lady Bird Deed Document for the State of Florida

Key takeaways

The Florida Lady Bird Deed is a unique estate planning tool that can simplify the transfer of property while providing certain benefits. Here are some key takeaways to consider when filling out and using this form:

- Ownership Rights: The Lady Bird Deed allows the property owner to retain full control over the property during their lifetime, including the right to sell or modify it without needing consent from the beneficiaries.

- Avoiding Probate: By using a Lady Bird Deed, property can pass directly to the designated beneficiaries upon the owner's death, avoiding the lengthy and often costly probate process.

- Tax Benefits: The property retains its tax basis, which can be beneficial for the beneficiaries, as they may not face significant tax implications when they inherit the property.

- Medicaid Planning: This deed can be advantageous for those considering Medicaid eligibility, as it may help protect the property from being counted as an asset for qualification purposes.

- Flexibility: The deed can be revoked or changed at any time before the owner’s death, allowing for adjustments based on changing circumstances or preferences.

- Legal Requirements: It is essential to ensure that the deed is properly executed, recorded, and complies with Florida laws to be effective. Consulting with a qualified professional is recommended.

Understanding these aspects can help ensure that the Lady Bird Deed serves its intended purpose effectively and aligns with your estate planning goals.

Similar forms

- Transfer on Death Deed (TODD): Similar to a Lady Bird Deed, a TODD allows property owners to designate beneficiaries who will receive the property upon the owner's death, avoiding probate.

- Life Estate Deed: This document creates a life estate, allowing the owner to retain control of the property during their lifetime while designating a remainder beneficiary who will receive the property after the owner's death.

- Joint Tenancy Deed: In a joint tenancy arrangement, two or more individuals own the property together, with rights of survivorship. When one owner dies, their share automatically transfers to the surviving owner(s).

- Revocable Living Trust: This legal arrangement allows individuals to place their assets into a trust during their lifetime. The trust can be altered or revoked, and upon death, the assets pass directly to the beneficiaries, bypassing probate.

- Will: A will outlines how a person's assets will be distributed after their death. While it does not avoid probate, it serves as a legal document to express the individual's wishes regarding their property.

- Beneficiary Designation: Certain assets, like retirement accounts and life insurance policies, allow owners to name beneficiaries. These assets transfer directly to the designated individuals upon the owner's death, similar to the Lady Bird Deed.

- Quitclaim Deed: This type of deed transfers a person's interest in a property to another without any guarantees. It can be used in estate planning to transfer property to heirs, though it does not have the same probate-avoiding features as a Lady Bird Deed.

- Vehicle Documentation: To ensure proper registration and compliance with Texas laws, individuals must fill out necessary forms such as the Texas VTR-60 form, which can be found at txtemplate.com/texas-vtr-60-pdf-template.

- Community Property with Right of Survivorship: This form of ownership applies in certain states and allows spouses to own property together. Upon the death of one spouse, the property automatically transfers to the surviving spouse, avoiding probate.

Misconceptions

The Florida Lady Bird Deed is a useful estate planning tool, but several misconceptions surround its use and implications. Here are seven common misunderstandings:

-

It only benefits the property owner.

While the property owner does gain advantages, such as retaining control during their lifetime, the beneficiaries also benefit from avoiding probate upon the owner's death.

-

It is the same as a traditional deed.

A Lady Bird Deed includes specific provisions that allow the owner to retain more rights than a traditional deed, such as the ability to sell or mortgage the property without the consent of beneficiaries.

-

It eliminates all estate taxes.

While it may help avoid probate, it does not eliminate estate taxes. The property will still be part of the owner's estate for tax purposes.

-

It is only for married couples.

Individuals, as well as couples, can utilize a Lady Bird Deed. It is not limited to any specific relationship status.

-

It cannot be revoked or changed.

The property owner retains the right to revoke or modify the deed at any time during their lifetime, making it a flexible option.

-

It is only applicable to residential properties.

While commonly used for homes, a Lady Bird Deed can also be applied to other types of real estate, including commercial properties.

-

All states recognize the Lady Bird Deed.

This deed is specific to Florida and may not be recognized or have the same legal implications in other states.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | The Florida Lady Bird Deed is a legal document that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by Florida Statutes, specifically Section 732.4015, which outlines the requirements and effects of such transfers. |

| Benefits | One major advantage of the Lady Bird Deed is that it helps avoid probate, allowing for a smoother transfer of property upon the owner's death. |

| Revocability | Unlike other forms of property transfer, the Lady Bird Deed can be revoked or amended at any time by the property owner, providing flexibility. |

Documents used along the form

When dealing with a Florida Lady Bird Deed, several other documents may be necessary to ensure a smooth process. Each of these forms plays a role in estate planning and property management. Below is a list of commonly used documents that complement the Lady Bird Deed.

- Last Will and Testament: This document outlines how a person wishes their assets to be distributed after their death. It can work alongside a Lady Bird Deed to clarify intentions regarding other properties or assets.

- Georgia SOP Form: Vital for outlining inmate visitation procedures within Georgia's correctional facilities, understanding this form is crucial for maintaining relationships; to learn more, visit Georgia PDF.

- Durable Power of Attorney: This form allows someone to make financial or legal decisions on behalf of another person if they become incapacitated. It’s important for managing property effectively.

- Health Care Proxy: This document designates someone to make medical decisions for a person if they are unable to do so themselves. It ensures that health care wishes are respected.

- Living Will: A living will outlines a person's preferences for medical treatment in situations where they cannot communicate their wishes. It complements the health care proxy.

- Trust Agreement: This document establishes a trust to manage assets during a person’s lifetime and after their death. It can provide additional control over how assets are distributed.

- Property Deed: A property deed transfers ownership of real estate. It’s crucial to have this document if the property is being transferred to a new owner.

- Affidavit of Heirship: This document can help establish who the heirs are when someone passes away without a will. It can simplify the transfer of property in certain situations.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, like life insurance or retirement accounts, upon a person’s death. They can be vital for comprehensive estate planning.

Understanding these documents can help clarify the estate planning process. Each one serves a unique purpose and can work together with the Lady Bird Deed to achieve your goals.