Legal Loan Agreement Document for the State of Florida

Key takeaways

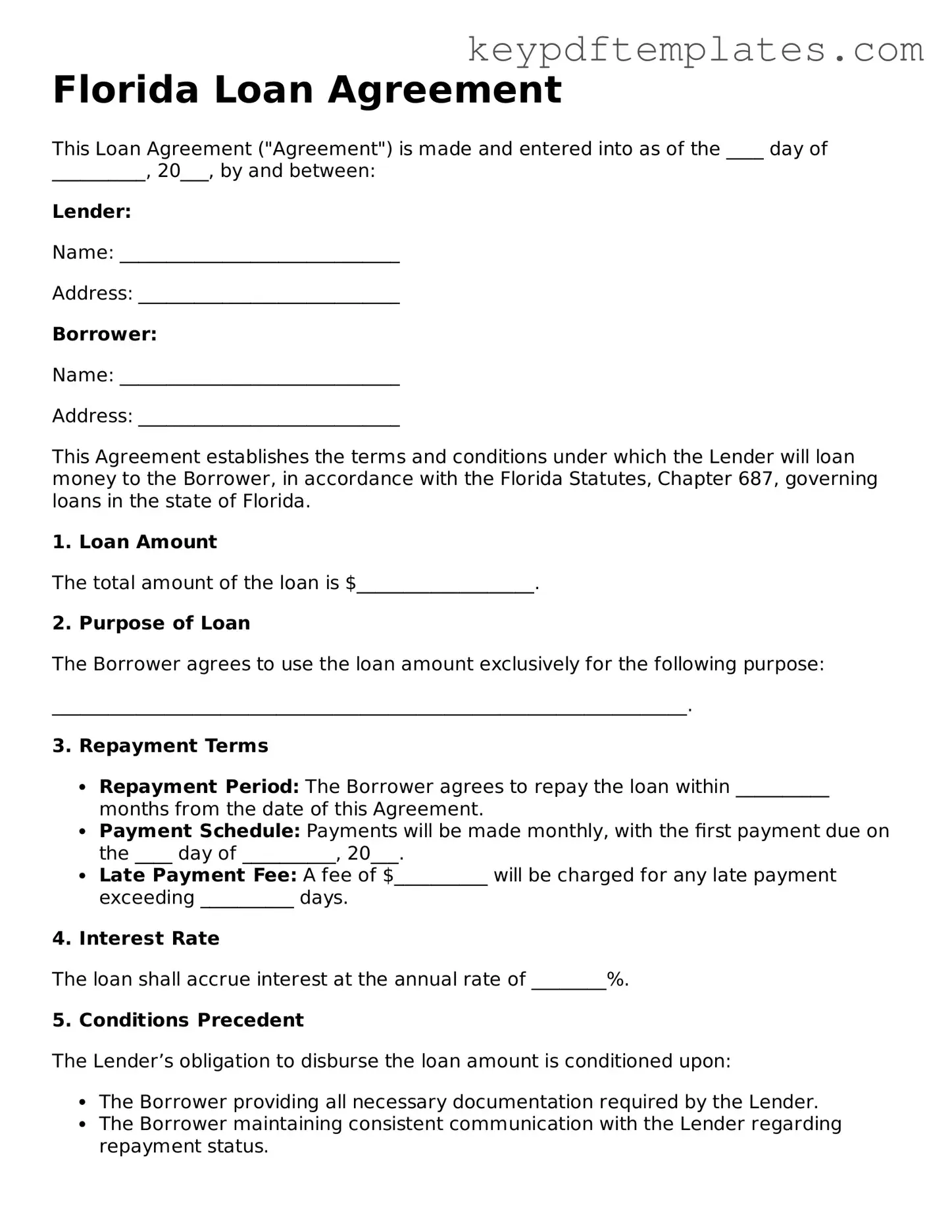

When navigating the Florida Loan Agreement form, it’s essential to understand its components and implications. Here are some key takeaways to consider:

- Understand the Purpose: The Florida Loan Agreement outlines the terms between the lender and borrower, ensuring clarity on repayment and obligations.

- Identify the Parties: Clearly state the names and addresses of both the lender and borrower. This establishes who is involved in the agreement.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This figure is crucial for both parties to avoid misunderstandings.

- Detail the Interest Rate: Include the interest rate applicable to the loan. This should be expressed as an annual percentage to ensure transparency.

- Outline Repayment Terms: Clearly define how and when the borrower will repay the loan. This might include monthly payments, due dates, and any grace periods.

- Include Default Terms: Specify what happens if the borrower fails to repay on time. Knowing the consequences helps both parties understand their responsibilities.

- Consider Legal Requirements: Ensure that the agreement complies with Florida state laws, including any necessary disclosures or regulations.

- Review Before Signing: Both parties should thoroughly review the agreement before signing. This ensures mutual understanding and agreement on all terms.

By keeping these points in mind, both lenders and borrowers can create a solid foundation for their financial relationship, fostering trust and accountability.

Similar forms

-

Promissory Note: This document is a written promise from the borrower to repay a specific amount of money to the lender. Like a Loan Agreement, it outlines the terms of the loan, including interest rates and repayment schedules. However, a Promissory Note is typically simpler and focuses primarily on the borrower's commitment to repay the loan.

-

Mortgage Agreement: When a loan is secured by real estate, a Mortgage Agreement comes into play. This document details the terms of the loan while also establishing the lender's rights to the property if the borrower defaults. Similar to a Loan Agreement, it includes information about the loan amount, interest rates, and repayment terms, but it adds an additional layer of security for the lender.

-

Credit Agreement: A Credit Agreement is used when a borrower is granted a line of credit rather than a lump-sum loan. This document outlines the terms under which credit can be accessed, including interest rates and repayment obligations. While it shares similarities with a Loan Agreement, it allows for more flexibility in borrowing and repayment.

Durable Power of Attorney: This legal document designates a person to make financial and legal decisions on your behalf if you become unable to do so. In Georgia, you can find the necessary form through Georgia PDF, ensuring your wishes are followed even in incapacitation.

-

Loan Modification Agreement: When a borrower needs to change the terms of an existing loan, a Loan Modification Agreement is created. This document modifies the original Loan Agreement, often to adjust interest rates or extend repayment periods. Like the Loan Agreement, it requires mutual consent from both parties, ensuring that the new terms are clearly defined.

Misconceptions

Many people have misunderstandings about the Florida Loan Agreement form. Here are seven common misconceptions, along with clarifications.

-

The form is only for personal loans.

This is not true. The Florida Loan Agreement can be used for various types of loans, including business and commercial loans.

-

All loan agreements must be notarized.

While notarization can add a layer of security, it is not a legal requirement for all loan agreements in Florida.

-

Once signed, the terms cannot be changed.

Loan terms can be modified if both parties agree to the changes. A new agreement or an amendment can be created.

-

The lender can charge any interest rate.

Florida has laws that limit the maximum interest rate lenders can charge. Exceeding these limits can lead to legal issues.

-

Loan agreements are only enforceable in court.

While court enforcement is one option, many agreements include alternative dispute resolution methods, such as mediation or arbitration.

-

The borrower has no rights once the loan is taken.

Borrowers retain certain rights, such as the right to receive clear information about the loan and the right to dispute unfair practices.

-

All loan agreements are the same.

Each loan agreement can be tailored to fit the specific needs of the parties involved. Terms can vary widely based on the situation.

Fill out Popular Loan Agreement Forms for Specific States

Loan Agreement Template Georgia - A Loan Agreement may require the borrower to provide collateral.

To effectively manage your financial and medical decisions during incapacitation, utilizing a comprehensive Durable Power of Attorney form is vital. For additional insights on this legal document, explore our guide on the essential Durable Power of Attorney process.

California Promissory Note Template - Clearly outline the purpose of the loan in this form.

PDF Details

| Fact Name | Details |

|---|---|

| Purpose | The Florida Loan Agreement form is used to outline the terms of a loan between a lender and a borrower in the state of Florida. |

| Governing Law | This agreement is governed by the laws of the State of Florida, specifically under Florida Statutes Chapter 687. |

| Parties Involved | The form requires the names and addresses of both the lender and the borrower, ensuring clarity in the agreement. |

| Loan Amount | The specific amount being borrowed must be clearly stated, providing transparency for both parties. |

| Interest Rate | The agreement should specify the interest rate applicable to the loan, which can be fixed or variable. |

| Repayment Terms | Details about how and when the borrower will repay the loan are crucial and should be included in the form. |

Documents used along the form

When entering into a loan agreement in Florida, several additional forms and documents may be necessary to ensure clarity and compliance with state regulations. Each document serves a specific purpose in the loan process, contributing to a comprehensive understanding of the terms and conditions agreed upon by the parties involved.

- Promissory Note: This document outlines the borrower's promise to repay the loan amount under specified terms, including interest rates, payment schedules, and consequences for default. It serves as a legal acknowledgment of the debt.

- Texas Form: This essential document is necessary for various legal and administrative processes in Texas. For more information, visit https://txtemplate.com/texas-pdf-template.

- Security Agreement: If the loan is secured by collateral, this agreement details the assets pledged by the borrower. It specifies the rights of the lender in the event of default and the procedures for reclaiming the collateral.

- Loan Disclosure Statement: Required by federal law, this statement provides borrowers with essential information about the loan, including the total cost, annual percentage rate (APR), and any fees associated with the loan. Transparency is the primary goal of this document.

- Personal Guarantee: In cases where a business is borrowing, a personal guarantee may be required from the business owner. This document holds the individual personally responsible for the debt if the business fails to repay the loan.

- Amortization Schedule: This document details the repayment plan for the loan, breaking down each payment into principal and interest components. It helps borrowers understand how their payments will affect the outstanding balance over time.

- Loan Closing Statement: This document summarizes the final terms of the loan, including all costs and fees. It is provided at the closing of the loan transaction, ensuring that both parties agree to the final terms before funds are disbursed.

These documents collectively facilitate a clear understanding of the loan terms and protect the interests of both the borrower and lender. Proper attention to these forms can help prevent misunderstandings and disputes in the future.