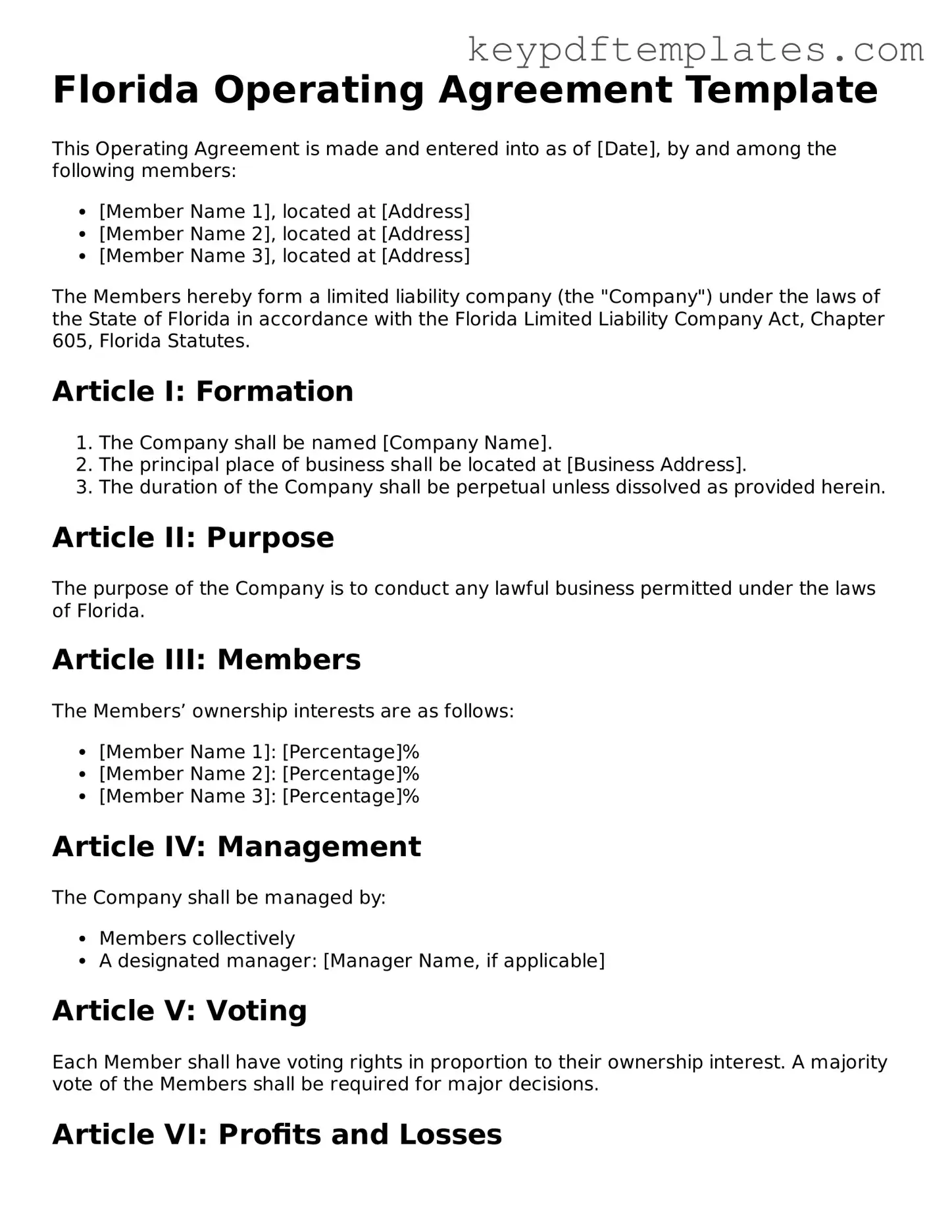

Legal Operating Agreement Document for the State of Florida

Key takeaways

When filling out and using the Florida Operating Agreement form, several key points should be kept in mind to ensure clarity and legal compliance. Here are some important takeaways:

- Understand the Purpose: The Operating Agreement outlines the management structure and operating procedures for your LLC. It serves as a foundational document that helps prevent misunderstandings among members.

- Identify Members: Clearly list all members of the LLC. This includes their names and addresses, which helps establish ownership and responsibility within the company.

- Define Roles and Responsibilities: Specify the roles of each member. This includes who will manage day-to-day operations and who will handle financial matters, ensuring everyone knows their duties.

- Establish Voting Rights: Detail how decisions will be made. Outline voting rights, including how many votes each member has and what constitutes a majority, to streamline the decision-making process.

- Address Profit Distribution: Clearly state how profits and losses will be distributed among members. This helps manage expectations and ensures fairness in financial matters.

- Include Amendment Procedures: Outline how the Operating Agreement can be amended in the future. This allows for flexibility as the business evolves and circumstances change.

- Consult Legal Advice: While it's possible to draft an Operating Agreement without legal assistance, consulting a lawyer can provide valuable insights and ensure compliance with Florida laws.

By following these key takeaways, you can create a comprehensive and effective Operating Agreement that supports the smooth operation of your LLC in Florida.

Similar forms

- Bylaws: Bylaws serve as the internal rules for a corporation. Like an Operating Agreement, they outline the management structure and operational procedures. Both documents help clarify the roles of members or shareholders and how decisions are made.

- Partnership Agreement: A Partnership Agreement is similar in that it defines the relationship between partners in a business. It addresses profit sharing, responsibilities, and decision-making, much like an Operating Agreement does for LLC members.

- Shareholder Agreement: This document is used by corporations to outline the rights and obligations of shareholders. Similar to an Operating Agreement, it governs how shares are managed and how decisions are made among shareholders.

- Transfer-on-Death Deed: This document allows property owners to designate a beneficiary for their real estate, facilitating a smooth transfer without the need for probate. For more information, you can visit txtemplate.com/transfer-on-death-deed-pdf-template/.

- Joint Venture Agreement: A Joint Venture Agreement outlines the terms of a partnership between two or more parties for a specific project. It shares similarities with an Operating Agreement in that it defines each party's contributions and how profits and losses are shared.

- LLC Membership Certificate: While not a governing document, an LLC Membership Certificate indicates ownership in an LLC. Like an Operating Agreement, it provides clarity on membership interests and rights within the company.

Misconceptions

Understanding the Florida Operating Agreement form is crucial for business owners. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

- All LLCs are required to have an Operating Agreement. While it is not mandatory for all LLCs in Florida to have one, it is highly recommended. An Operating Agreement helps define the management structure and operating procedures.

- The Operating Agreement is only necessary for large businesses. This is false. Even small LLCs benefit from having an Operating Agreement, as it clarifies roles and responsibilities among members.

- Once created, the Operating Agreement cannot be changed. This is a misconception. Members can amend the Operating Agreement as needed, provided they follow the procedures outlined within the document.

- Operating Agreements are only for multi-member LLCs. Single-member LLCs can also have an Operating Agreement. It serves to establish the owner's intentions and protect personal assets.

- The state provides a standard Operating Agreement template. Florida does not provide a specific template. Each Operating Agreement should be tailored to the unique needs of the LLC and its members.

- Having an Operating Agreement guarantees limited liability protection. While an Operating Agreement is important, it does not automatically protect members from personal liability. Proper business practices must also be followed.

- All members must sign the Operating Agreement for it to be valid. While it is best practice for all members to sign, the validity of the agreement can still hold if not all members sign, depending on the circumstances and state laws.

Addressing these misconceptions can lead to better understanding and management of your LLC in Florida. It is advisable to consult with a professional to ensure compliance and clarity in your Operating Agreement.

Fill out Popular Operating Agreement Forms for Specific States

How to File Operating Agreement Llc - This form is essential for ensuring compliance with state laws governing businesses.

In navigating the complexities of workers' compensation cases, it is crucial to have the proper documentation, such as the Georgia WC 102B form, which acts as a formal notice of representation. This form is not only vital for attorneys representing employers or insurers but also ensures transparent communication with the State Board of Workers' Compensation. For further details and to access the necessary forms, visit Georgia PDF.

PDF Details

| Fact Name | Details |

|---|---|

| Purpose | The Florida Operating Agreement outlines the management structure and operating procedures of a limited liability company (LLC). |

| Governing Law | This agreement is governed by Florida Statutes, Chapter 605, which covers LLCs in the state. |

| Members | All members of the LLC should sign the agreement to show their consent and understanding of the terms. |

| Flexibility | The Operating Agreement allows members to customize their management structure and profit distribution as they see fit. |

| Legal Protection | Having an Operating Agreement can help protect the members’ personal assets from business liabilities. |

| Not Required | While not legally required in Florida, it is highly recommended to have an Operating Agreement for clarity and protection. |

Documents used along the form

The Florida Operating Agreement is a crucial document for any limited liability company (LLC) operating in the state. It outlines the management structure, responsibilities, and operational procedures of the LLC. However, several other forms and documents complement the Operating Agreement, ensuring that the LLC is compliant with state laws and effectively managed. Below is a list of these essential documents.

- Articles of Organization: This document is filed with the Florida Division of Corporations to officially create the LLC. It includes basic information such as the LLC's name, address, and the names of its members.

- Member Consent Form: This form is used to document the agreement of members regarding significant decisions or actions taken by the LLC. It provides a written record of consent, which can be important for legal purposes.

- Operating Procedures Manual: This manual details the day-to-day operations of the LLC, including policies and procedures. It serves as a reference for members and employees, helping maintain consistency in operations.

- Meeting Minutes: A record of the discussions and decisions made during LLC meetings. Keeping accurate minutes is essential for transparency and can help resolve disputes or clarify decisions in the future.

- Membership Certificates: These certificates serve as proof of ownership for members of the LLC. They outline each member's percentage of ownership and can be useful for both internal and external purposes.

- Tax Identification Number (TIN) Application: This document is necessary for obtaining a TIN from the IRS, which is required for tax purposes. The TIN is essential for opening bank accounts and filing taxes.

- Trailer Bill of Sale: Essential for anyone selling or purchasing a trailer in Florida, this document ensures the ownership transfer is properly documented. For more information, visit https://allfloridaforms.com/.

- Bylaws: While not required, bylaws can be helpful in establishing additional rules governing the LLC's operations. They may cover aspects such as voting rights and procedures for member meetings.

- Annual Report: This document must be filed annually with the Florida Division of Corporations to maintain the LLC's active status. It includes updated information about the LLC and its members.

These documents play a vital role in the smooth operation and legal compliance of an LLC in Florida. Understanding their purpose and ensuring they are properly maintained can significantly benefit the members and the overall health of the business.