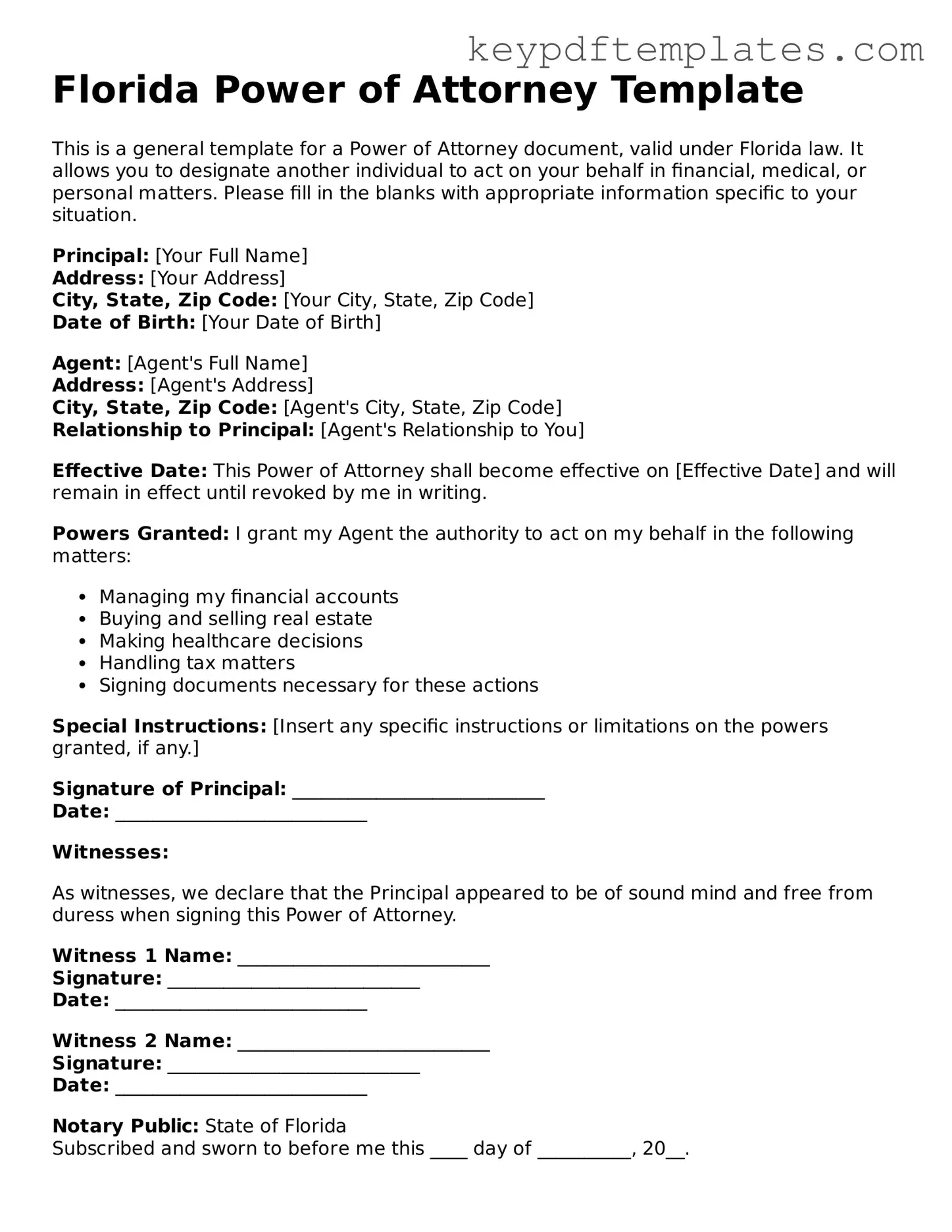

Legal Power of Attorney Document for the State of Florida

Key takeaways

Filling out and using a Power of Attorney form in Florida is an important step in planning for the future. Here are some key takeaways to keep in mind:

- Understand the Types: Florida recognizes different types of Power of Attorney, such as Durable, Springing, and Limited. Each serves a specific purpose, so choose the one that best fits your needs.

- Choose Your Agent Wisely: The person you designate as your agent should be trustworthy and capable of making decisions on your behalf. This could be a family member, friend, or a professional.

- Be Clear and Specific: When filling out the form, be as clear as possible about the powers you are granting. This helps avoid confusion and ensures your wishes are followed.

- Consider Legal Advice: While it’s possible to fill out the form on your own, consulting with a legal professional can provide peace of mind and ensure everything is done correctly.

Taking the time to understand these points can make the process smoother and help ensure that your wishes are honored when it matters most.

Similar forms

-

Living Will: A living will outlines your medical preferences in case you become unable to communicate them. Like a Power of Attorney, it allows someone to act on your behalf, but it specifically focuses on healthcare decisions rather than financial or legal matters.

-

Healthcare Proxy: This document designates a person to make healthcare decisions for you when you are incapacitated. Similar to a Power of Attorney, it empowers someone to act in your best interest, but it is limited to medical choices.

- Bill of Sale: This document serves as a record of the sale and transfer of ownership of personal property. You can access the Bill of Sale form to ensure both buyer and seller have a clear understanding of the transaction.

-

Durable Power of Attorney: A durable power of attorney remains effective even if you become incapacitated. This document is similar to a standard Power of Attorney but ensures that your designated agent retains authority during periods of mental or physical inability.

-

Financial Power of Attorney: This form specifically grants authority to manage financial matters. Like a general Power of Attorney, it allows someone to handle your financial affairs, but it is focused solely on financial transactions and decisions.

-

Trust Agreement: A trust agreement allows you to place assets in a trust for the benefit of others. While a Power of Attorney grants authority to act on your behalf, a trust agreement establishes a legal entity that manages your assets according to your wishes.

Misconceptions

Understanding the Florida Power of Attorney form is crucial for anyone considering its use. However, several misconceptions can lead to confusion. Here are six common misconceptions:

- It is only for elderly individuals. Many people believe that a Power of Attorney is only necessary for seniors. In reality, anyone can benefit from this document, especially if they anticipate being unable to make decisions due to illness or travel.

- It grants unlimited power to the agent. Some think that a Power of Attorney gives the agent unrestricted authority. In fact, the document can specify the powers granted, allowing individuals to limit the scope of authority as needed.

- It becomes effective only when the principal is incapacitated. Many assume that a Power of Attorney only activates upon incapacitation. However, it can be set up to be effective immediately or upon a specific event, depending on the principal's wishes.

- It is permanent and cannot be revoked. There is a belief that once a Power of Attorney is established, it cannot be changed. This is incorrect; the principal can revoke or change the document at any time as long as they are competent.

- All Power of Attorney forms are the same. Some individuals think that any Power of Attorney form will suffice. However, Florida has specific requirements, and using a form not compliant with state laws can lead to issues.

- It eliminates the need for a will. There is a misconception that having a Power of Attorney negates the necessity of a will. This is not true; a Power of Attorney deals with financial and health decisions, while a will addresses the distribution of assets after death.

Addressing these misconceptions is essential for ensuring that individuals make informed decisions regarding their legal and financial affairs. Proper understanding can help avoid potential pitfalls and ensure that the intended authority is granted effectively.

Fill out Popular Power of Attorney Forms for Specific States

Power of Attorney Forms California - Your agent must act in your best interest at all times.

For those looking to document their transaction accurately, the Texas Motorcycle Bill of Sale form is invaluable when transferring ownership; you can find the necessary template by visiting this helpful resource for the Motorcycle Bill of Sale.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Florida Power of Attorney is a legal document that allows one person to act on behalf of another in legal and financial matters. |

| Governing Law | The Florida Power of Attorney is governed by Chapter 709 of the Florida Statutes. |

| Types | There are different types of Power of Attorney forms in Florida, including durable, non-durable, and health care Power of Attorney. |

| Durability | A durable Power of Attorney remains in effect even if the principal becomes incapacitated, unless revoked. |

| Execution Requirements | The document must be signed by the principal in the presence of two witnesses and a notary public to be valid. |

Documents used along the form

A Power of Attorney (POA) in Florida is a crucial legal document that allows one person to act on behalf of another in various matters. While the POA itself is significant, it is often accompanied by other forms and documents that can enhance its effectiveness or address specific needs. Below is a list of commonly used documents alongside the Florida Power of Attorney form.

- Durable Power of Attorney: This variant remains in effect even if the principal becomes incapacitated. It is essential for long-term planning, ensuring that the designated agent can continue to make decisions when the principal is unable to do so.

- Healthcare Surrogate Designation: This document allows an individual to appoint someone to make medical decisions on their behalf if they are unable to communicate their wishes. It complements the POA by focusing specifically on health-related matters.

- Living Will: A living will outlines a person's preferences regarding medical treatment in situations where they cannot express their wishes. It provides guidance to healthcare providers and surrogates about end-of-life care.

- Georgia WC-14 Form: This essential document is used to notify the Georgia State Board of Workers' Compensation about workplace injuries. For more information on this form, visit Georgia PDF.

- Advance Directive: This is a broader term that encompasses both the healthcare surrogate designation and the living will. It serves as a comprehensive guide for healthcare decisions and can help avoid confusion during critical times.

- Financial Power of Attorney: This document specifically grants authority to an agent to manage financial matters. It can be tailored to cover various financial decisions, such as banking, investments, and property management.

- Revocation of Power of Attorney: If a principal decides to cancel a previously granted power of attorney, this document formally revokes the authority given to the agent, ensuring that the agent can no longer act on the principal's behalf.

- Affidavit of Acceptance: This document is used by the agent to formally accept their role and responsibilities under the power of attorney. It can provide clarity and assurance to all parties involved.

- Notice of Attorney-in-Fact: This document notifies third parties that an individual has appointed someone to act on their behalf. It can help prevent misunderstandings and ensure that the agent's authority is recognized.

Each of these documents plays a vital role in ensuring that a person's wishes are honored and that their affairs are managed appropriately. When considering a Power of Attorney, it is essential to understand the additional documents that may be necessary to create a comprehensive plan.