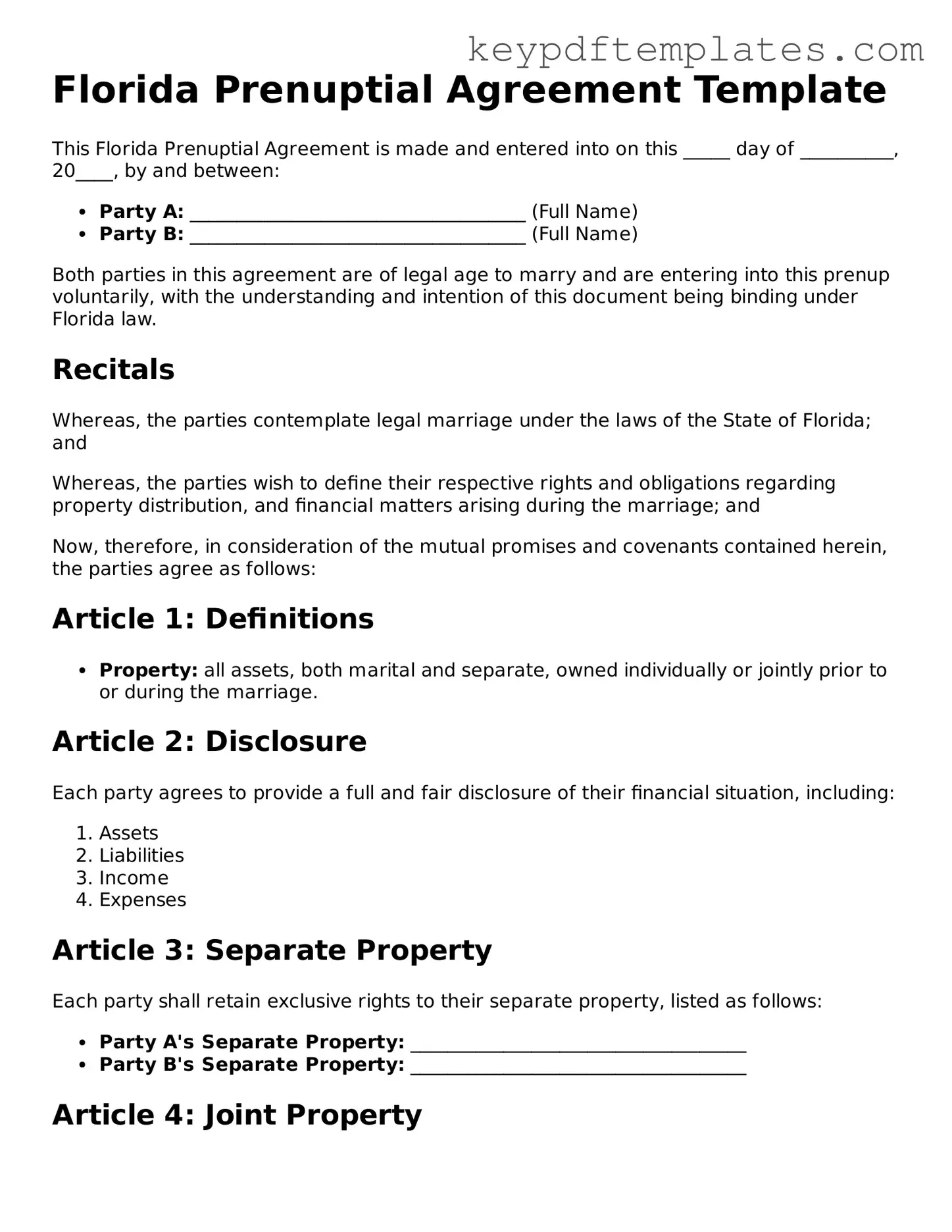

Legal Prenuptial Agreement Document for the State of Florida

Key takeaways

Filling out and using a Florida Prenuptial Agreement form can be a straightforward process, but it is essential to understand its implications. Here are some key takeaways to consider:

- Clarity is Crucial: Clearly outline each party's assets and liabilities. This transparency can prevent misunderstandings later on.

- Full Disclosure: Both parties must provide complete financial information. Hiding assets can render the agreement invalid.

- Legal Guidance: Consulting with a lawyer is advisable. They can help ensure that the agreement complies with Florida law and protects both parties' interests.

- Timing Matters: Complete the agreement well in advance of the wedding. Last-minute agreements can raise questions about coercion or pressure.

Similar forms

-

Postnuptial Agreement: Similar to a prenuptial agreement, a postnuptial agreement is created after a couple is married. It outlines the division of assets and responsibilities in the event of divorce or separation, serving to protect both parties’ interests.

-

Separation Agreement: This document is used when a couple decides to live apart. It details the terms of the separation, including asset division, child custody, and support obligations, ensuring clarity and mutual understanding.

-

Divorce Settlement Agreement: In the context of divorce, this agreement finalizes the terms of the dissolution of marriage. It covers property division, alimony, and child support, similar to how a prenuptial agreement addresses these issues before marriage.

-

Durable Power of Attorney: A Georgia Durable Power of Attorney form is a legal document that allows you to designate someone to make financial and legal decisions on your behalf if you become unable to do so. This form remains effective even if you become incapacitated, ensuring your wishes are followed. To get started on securing your future, fill out the form by clicking the button below. For more information, visit Georgia PDF.

-

Living Together Agreement: For couples who choose to cohabit without marriage, this agreement outlines the rights and responsibilities of each partner. It can include provisions for property ownership and financial obligations, similar to a prenuptial agreement’s focus on asset management.

Misconceptions

- Misconception 1: Prenuptial agreements are only for the wealthy.

- Misconception 2: A prenuptial agreement means you expect the marriage to fail.

- Misconception 3: Prenuptial agreements are not enforceable in court.

- Misconception 4: Prenuptial agreements are only about money.

- Misconception 5: Once signed, a prenuptial agreement cannot be changed.

This is a common belief, but prenuptial agreements can benefit couples of all financial backgrounds. They can help clarify financial responsibilities and protect individual assets, regardless of wealth.

Many people think that having a prenup indicates a lack of faith in the marriage. In reality, it can serve as a proactive measure to ensure both parties are on the same page about finances, fostering open communication.

While it’s true that certain conditions must be met for a prenup to be enforceable, many are upheld in court when they are drafted properly. Consulting with a legal expert can help ensure compliance with state laws.

While financial matters are a primary focus, prenuptial agreements can address other issues, such as property rights and responsibilities during the marriage. They can also outline how debts will be handled.

Couples can modify a prenup if both parties agree. Life circumstances change, and it’s possible to revisit and update the agreement to reflect new situations or understandings.

Fill out Popular Prenuptial Agreement Forms for Specific States

California Prenup Contract - This form can help define expectations for financial transparency in marriage.

To ensure your financial and medical decisions are handled as per your wishes, consider using a comprehensive Durable Power of Attorney form. This document empowers a trusted individual to act on your behalf, safeguarding your interests should you become unable to make decisions yourself.

Georgia Prenup Contract - A prenuptial agreement can protect individual property and debts brought into the marriage.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement in Florida is a legal contract between two individuals before they marry, outlining the division of assets and responsibilities in the event of divorce or death. |

| Governing Law | Florida Statutes, Chapter 61, governs prenuptial agreements, ensuring they comply with state laws regarding marital property. |

| Enforceability | For a prenuptial agreement to be enforceable in Florida, it must be in writing and signed by both parties. Oral agreements are not valid. |

| Disclosure Requirement | Both parties must provide a fair and reasonable disclosure of their financial situations. Lack of transparency can lead to the agreement being challenged. |

| Amendment Process | A prenuptial agreement can be amended or revoked at any time, but this must be done in writing and signed by both parties to be valid. |

Documents used along the form

A Florida Prenuptial Agreement is a significant legal document that outlines the financial arrangements between two individuals before they marry. To ensure that all aspects of the couple's financial rights and obligations are clearly defined, several other forms and documents are often used in conjunction with this agreement. Below are five commonly associated documents that can complement a Prenuptial Agreement.

- Financial Disclosure Statement: This document requires both parties to provide a detailed account of their assets, liabilities, income, and expenses. It promotes transparency and ensures that both individuals are fully aware of each other's financial situations before entering into the marriage.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after the marriage has taken place. It can address changes in circumstances or financial situations that may arise after the wedding, ensuring that both parties' interests are still protected.

- Trailer Bill of Sale: This essential document facilitates the transfer of ownership for a trailer from one party to another, ensuring all details are accurately recorded, such as make, model, and identification number. To complete the necessary form, visit Florida PDF Forms.

- Marital Settlement Agreement: Often used in divorce proceedings, this document outlines how the couple will divide their assets and responsibilities. While not directly related to a prenuptial agreement, it serves as a reference point for how assets were handled during the marriage.

- Will: A will outlines how a person's assets will be distributed upon their death. Having a will in conjunction with a prenuptial agreement can clarify intentions regarding asset distribution and ensure that both parties' wishes are respected.

- Power of Attorney: This document allows one person to make financial or medical decisions on behalf of another in case they become incapacitated. Establishing a power of attorney can provide peace of mind and ensure that both parties are prepared for unexpected situations.

Utilizing these documents alongside a Florida Prenuptial Agreement can create a comprehensive framework for managing financial and legal matters both before and during a marriage. This preparation can help couples navigate their financial future with greater clarity and security.