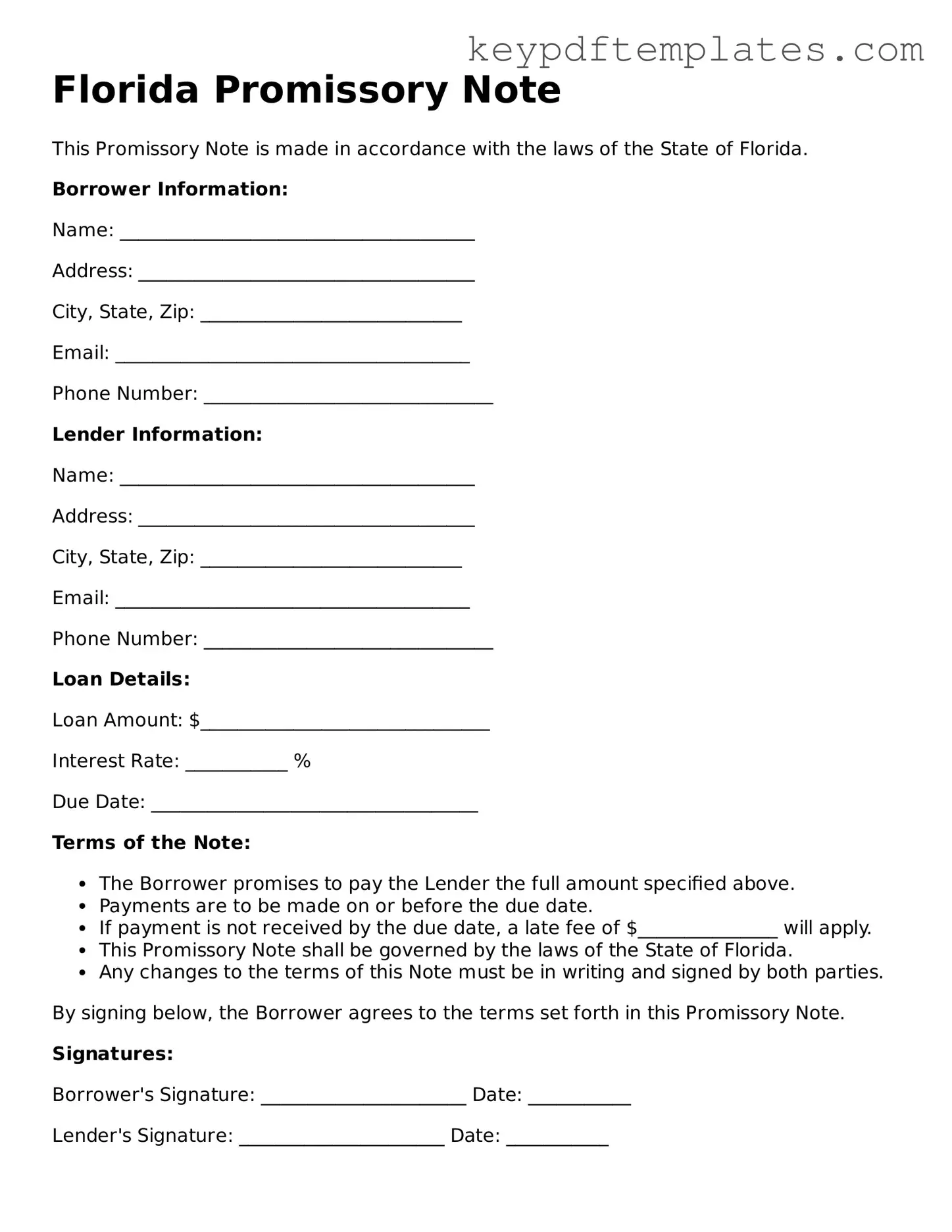

Legal Promissory Note Document for the State of Florida

Key takeaways

When filling out and using the Florida Promissory Note form, keep these key points in mind:

- Clear Identification: Clearly identify all parties involved. This includes the lender and borrower, along with their addresses.

- Loan Amount: Specify the exact amount being borrowed. This ensures both parties understand the financial commitment.

- Interest Rate: Include the interest rate, if applicable. This detail is crucial for understanding the total repayment amount.

- Payment Terms: Outline the payment schedule. Specify how often payments are due and the method of payment.

By following these guidelines, you can ensure that the promissory note is clear and enforceable.

Similar forms

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. However, it is typically more detailed and may include additional clauses regarding default and collateral.

- Mortgage: A mortgage is a specific type of loan agreement secured by real property. It involves a promissory note, but also includes a security agreement that gives the lender a claim on the property if the borrower fails to repay.

- Lease Agreement: A lease agreement shares similarities with a promissory note in that it establishes a payment obligation. It details the terms under which one party pays to use another party's property, often including monthly payments and duration.

- Personal Guarantee: A personal guarantee is a document in which an individual agrees to be responsible for a loan or debt if the primary borrower defaults. This is similar to a promissory note in that it creates a personal obligation to pay.

- Credit Agreement: A credit agreement outlines the terms of a credit facility between a lender and borrower. Like a promissory note, it specifies repayment terms and interest rates, but it may also include covenants and conditions for borrowing.

- Installment Agreement: An installment agreement allows a borrower to repay a debt over time through scheduled payments. It is similar to a promissory note in that it establishes a clear repayment plan and payment amounts.

- Hold Harmless Agreement: To ensure protection from potential liabilities, you can fill out a Texas Hold Harmless Agreement form for various activities that require liability waivers between parties.

- Debt Settlement Agreement: A debt settlement agreement is a contract between a debtor and creditor that outlines the terms for settling a debt for less than the full amount owed. It creates an obligation similar to a promissory note but focuses on resolving existing debt rather than establishing new terms.

Misconceptions

Understanding the Florida Promissory Note form is crucial for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion and potential issues. Here are nine common misconceptions:

- All Promissory Notes are the Same: Many believe that all promissory notes function identically. In reality, the terms and conditions can vary significantly based on the state laws and the specific agreement between the parties.

- A Promissory Note is a Contract: While a promissory note is a legally binding document, it is not a contract in the traditional sense. It primarily serves as a promise to pay rather than detailing the entire agreement between the parties.

- Only Written Promissory Notes are Valid: Some think that verbal agreements cannot be enforced. However, a verbal promise can be legally binding, although proving its existence can be challenging.

- Interest Rates Must Be Included: It is a common misconception that all promissory notes must include an interest rate. While many do, it is not a requirement, and a note can be interest-free.

- Promissory Notes are Only for Large Loans: People often assume that promissory notes are only necessary for significant amounts of money. In truth, they can be used for any loan amount, regardless of size.

- They Do Not Require Signatures: Some believe that a promissory note can be valid without signatures. In fact, signatures from both parties are essential to establish agreement and enforceability.

- Once Signed, They Cannot Be Changed: Many think that a signed promissory note is set in stone. Amendments can be made, but both parties must agree to the changes and document them properly.

- They Are Only Used in Personal Loans: There is a misconception that promissory notes are only applicable in personal lending situations. In reality, they are also frequently used in business transactions and real estate deals.

- Florida's Laws Do Not Affect Promissory Notes: Some believe that federal laws govern all promissory notes. However, state laws, including Florida's, play a significant role in how these documents are structured and enforced.

By addressing these misconceptions, individuals can better navigate the complexities of promissory notes and ensure that their agreements are clear and enforceable.

Fill out Popular Promissory Note Forms for Specific States

Georgia Promissory Note - The agreement can state penalties for missed payments explicitly.

For individuals seeking to establish a solid plan for their future, understanding the importance of a General Power of Attorney form in Georgia is crucial. This document not only designates someone to manage your financial and legal decisions but also provides peace of mind knowing that your wishes will be honored. To learn more about how to create this important legal tool, you can visit Georgia PDF.

Promissory Note California - The borrower’s signature confirms their commitment to repay the specified amount.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money at a designated time or on demand. |

| Governing Law | Florida Statutes, Chapter 673 governs negotiable instruments, including promissory notes. |

| Parties Involved | The note involves at least two parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The interest rate can be fixed or variable, as agreed upon by both parties in the note. |

| Signature Requirement | The note must be signed by the maker to be legally enforceable. |

| Default Consequences | If the maker defaults, the payee may pursue legal action to recover the owed amount. |

Documents used along the form

When engaging in a lending transaction in Florida, a Promissory Note is a crucial document. However, it is often accompanied by several other forms and documents that help clarify the terms of the loan and protect the interests of both parties. Here’s a list of commonly used documents that complement the Florida Promissory Note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the amount borrowed, interest rates, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this document specifies what assets are being used as security. It details the rights of the lender in case of default and ensures clarity on what can be seized if the borrower fails to repay.

- Mortgage or Deed of Trust: In cases where real estate is involved, this document secures the loan against the property. It provides the lender with a legal claim to the property until the debt is fully repaid.

- Personal Guarantee: This document is often used when a business borrows money. It holds an individual personally responsible for the debt, providing additional security for the lender.

- Disclosure Statement: Required by law, this document informs the borrower of the total cost of the loan, including interest rates and any fees. It promotes transparency and helps borrowers make informed decisions.

- Amortization Schedule: This document breaks down each payment over the life of the loan, showing how much goes towards principal and interest. It helps borrowers understand their payment obligations clearly.

- Non-disclosure Agreement: This agreement is crucial for protecting sensitive information shared during financial transactions. To learn more about the importance of NDAs, visit allfloridaforms.com.

- Default Notice: Should a borrower miss a payment, this document formally notifies them of the default. It typically outlines the consequences and next steps, providing a record of communication.

- Loan Payoff Statement: When the loan is paid off, this document confirms that the borrower has fulfilled their obligations. It releases any claims the lender had on the borrower's assets.

Understanding these documents is essential for anyone involved in a lending transaction in Florida. Each one plays a specific role in safeguarding the interests of both parties and ensuring a smooth process. Always consult a legal professional when drafting or signing these documents to ensure compliance with state laws and regulations.