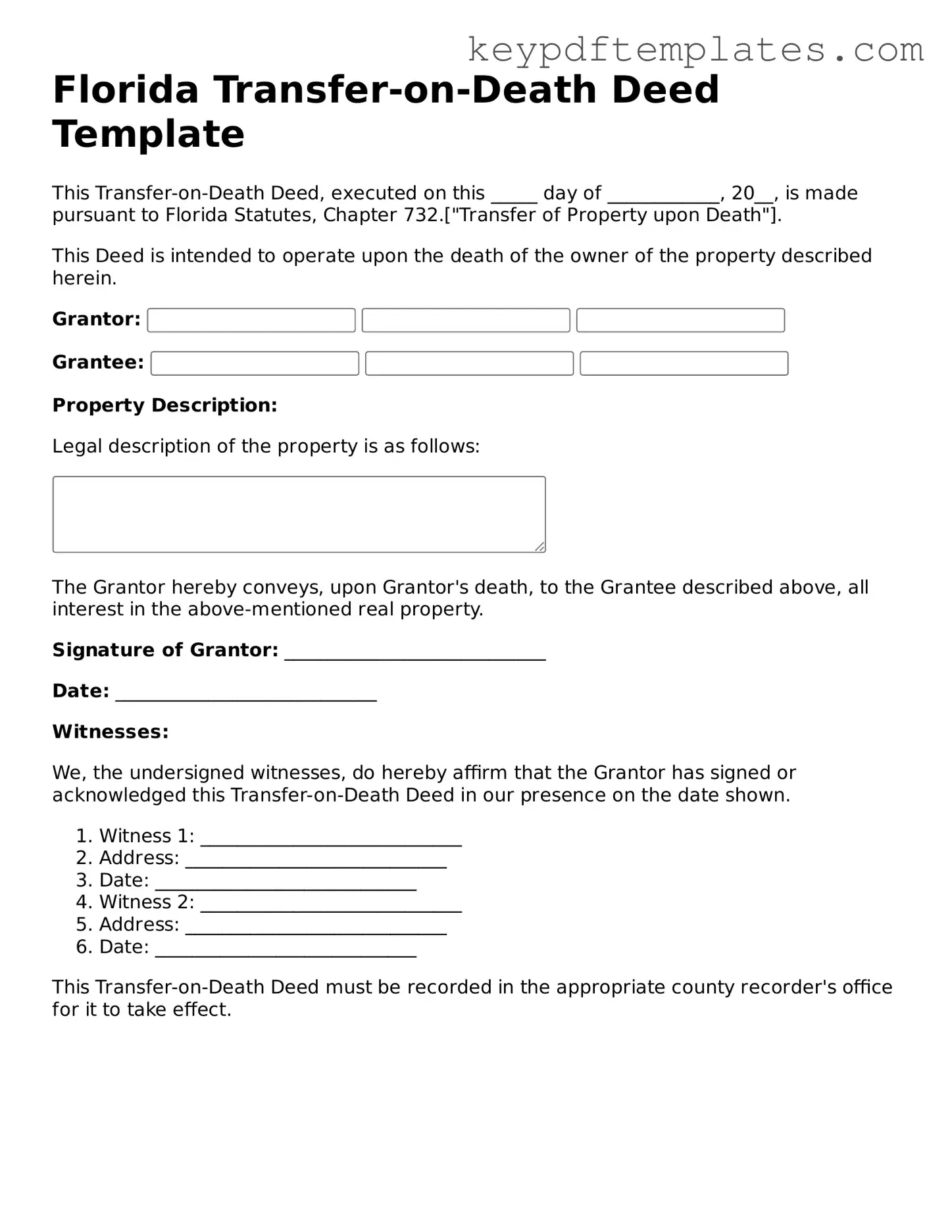

Legal Transfer-on-Death Deed Document for the State of Florida

Key takeaways

Filling out and using the Florida Transfer-on-Death Deed form can be a straightforward process when you understand its key aspects. Here are some important takeaways to keep in mind:

- Purpose of the Deed: This form allows property owners to transfer their real estate to a designated beneficiary upon their death, avoiding probate.

- Eligibility: The deed can be used for various types of real property, including residential homes and vacant land, as long as the owner is a Florida resident.

- Filling Out the Form: Accurate information is crucial. Ensure that the property description and beneficiary details are correct to prevent future disputes.

- Recording the Deed: After completing the form, it must be recorded with the county clerk's office where the property is located. This step is essential for the transfer to be valid.

- Revocation: The property owner can revoke or change the beneficiary at any time before their death by filing a new deed or a revocation form.

Understanding these points can help ensure that your intentions regarding property transfer are honored and that your loved ones are taken care of in the future.

Similar forms

The Transfer-on-Death Deed (TODD) form allows property owners to designate a beneficiary who will receive the property upon the owner’s death, bypassing probate. Several other legal documents serve similar purposes in estate planning and property transfer. Below are seven documents that share similarities with the Transfer-on-Death Deed:

- Will: A will outlines how a person's assets will be distributed after their death. Like a TODD, it can specify beneficiaries but typically requires probate, while a TODD does not.

- Living Trust: A living trust allows individuals to manage their assets during their lifetime and specify how they should be distributed after death. Both documents help avoid probate but differ in their management of assets before death.

- Beneficiary Designation Forms: Commonly used for financial accounts and insurance policies, these forms allow individuals to name beneficiaries directly. Similar to a TODD, they ensure that assets pass directly to the named individuals without going through probate.

- Motor Vehicle Bill of Sale: Essential for vehicle transactions, this document provides proof of ownership transfer and is critical to the sale process. For more details, visit https://vehiclebillofsaleform.com.

- Joint Tenancy Deed: This type of deed allows two or more individuals to own property together. Upon the death of one owner, the property automatically transfers to the surviving owner(s), akin to the TODD’s function of transferring property outside of probate.

- Payable-on-Death Accounts: These bank accounts allow the account holder to name a beneficiary who will receive the funds upon the holder's death. Like a TODD, these accounts bypass probate, facilitating a straightforward transfer of assets.

- Transfer-on-Death Registration for Securities: This document allows individuals to designate beneficiaries for stocks and bonds. Similar to a TODD, it ensures that the securities pass directly to the beneficiary upon death without probate interference.

- Life Estate Deed: A life estate deed grants an individual the right to use a property during their lifetime, with the property passing to a designated beneficiary afterward. While it provides a different type of ownership structure, it also facilitates a transfer of property outside of probate.

Misconceptions

Understanding the Florida Transfer-on-Death Deed can be challenging, especially with the various misconceptions that surround it. Here are ten common misunderstandings about this legal document:

- It automatically transfers all assets upon death. The Transfer-on-Death Deed specifically applies only to real estate. Other assets, such as bank accounts or personal property, are not included.

- It eliminates the need for a will. While this deed can simplify the transfer of property, it does not replace the need for a comprehensive will to address other aspects of an estate.

- It can be revoked at any time without notice. Although a Transfer-on-Death Deed can be revoked, it must be done formally through a new deed or a written revocation filed with the county.

- All heirs must agree to the deed. The property owner can designate beneficiaries without needing consent from other potential heirs.

- It is only for married couples. Any individual can create a Transfer-on-Death Deed, regardless of marital status, to designate beneficiaries for their property.

- Beneficiaries must pay taxes immediately. Taxes on the property may not be due until the property is sold or transferred, depending on the circumstances.

- It is a complicated legal process. While it may seem daunting, completing a Transfer-on-Death Deed is relatively straightforward and can often be done without legal assistance.

- It is effective without any formalities. The deed must be properly executed and recorded with the county to be valid. Failure to do so can render it ineffective.

- It can be used for properties in multiple states. The Transfer-on-Death Deed is specific to Florida law and may not be recognized in other states. Each state has its own rules regarding transfer-on-death provisions.

- Once executed, it cannot be changed. Property owners retain the right to change their mind and alter the deed as needed, provided they follow the proper procedures.

By clarifying these misconceptions, individuals can make more informed decisions regarding their estate planning in Florida.

Fill out Popular Transfer-on-Death Deed Forms for Specific States

How Much Does a Beneficiary Deed Cost - Choose your beneficiaries wisely to ensure your wishes are honored.

To navigate the complexities of vehicle transactions in Texas, it is essential to utilize the Statement of Fact Texas form, which can be efficiently accessed at https://txtemplate.com/statement-of-fact-texas-pdf-template/. This form ensures that all necessary details about the vehicle and transaction are accurately reported, safeguarding both the buyer and seller from potential legal issues.

Transfer on Death Deed Georgia Pdf - Provides a tool for individuals to leave behind a meaningful legacy to chosen beneficiaries.

PDF Details

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Florida to transfer real estate to beneficiaries upon their death without the need for probate. |

| Governing Law | The Florida Transfer-on-Death Deed is governed by Florida Statutes, specifically Section 732.4015. |

| Eligibility | Any individual who owns real property in Florida can create a Transfer-on-Death Deed, provided they are of sound mind. |

| Revocation | The deed can be revoked at any time by the property owner, allowing flexibility in estate planning. |

| Requirements | The deed must be signed by the property owner and witnessed by two individuals to be valid. |

| Filing | To be effective, the Transfer-on-Death Deed must be recorded with the county clerk's office where the property is located. |

Documents used along the form

When dealing with estate planning in Florida, a Transfer-on-Death Deed can be a valuable tool. However, several other forms and documents often accompany it to ensure a smooth process. Here’s a list of some common documents you might need.

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death. It can specify guardianship for minor children and appoint an executor to manage the estate.

- Durable Power of Attorney: This allows someone to make financial decisions on your behalf if you become incapacitated. It is crucial for managing your affairs when you cannot do so yourself.

- Healthcare Proxy: Also known as a medical power of attorney, this document lets you designate someone to make healthcare decisions for you if you are unable to communicate your wishes.

- Living Will: This outlines your preferences for medical treatment in situations where you are terminally ill or incapacitated. It provides guidance to your healthcare providers and loved ones.

- Affidavit of Heirship: This document helps establish the heirs of a deceased person, especially when there is no will. It can simplify the process of transferring property to heirs.

- Revocable Living Trust: This trust allows you to manage your assets during your lifetime and specify how they should be distributed after your death. It can help avoid probate.

- Operating Agreement: Essential for LLCs in Florida, this document outlines management structure and operational procedures to ensure compliance with state laws and smooth business operations. For more information, visit Florida PDF Forms.

- Quitclaim Deed: This document transfers ownership of property from one person to another without any warranties. It is often used to transfer property between family members.

- Property Tax Exemption Application: If you are transferring property, you may need to apply for tax exemptions. This document helps ensure you receive any applicable benefits.

Having these documents in place can provide clarity and peace of mind. They help ensure that your wishes are respected and can make the process easier for your loved ones during a difficult time.